Table Of Contents

Examples

Let us look at some American Depositary Shares examples to understand them better.

Example #1

Let us consider a hypothetical first.

Walsh owns a furniture company in Berlin. The business already has an extensive reach; for upscaling, Walsh lists his company on the Frankfurt Stock Exchange. Deutsche Börse AG operates the Frankfurt Stock Exchange.

The IPO becomes a huge success, and within two years, his company becomes a multinational conglomerate. Walsh's company now has a global reputation and strong brand recognition.

He observes that his company is more adored in the US market; he wants American investors to invest in his company as well. But, turning American investors to Frankfurt Stock Exchange is challenging due to the complexity of procedures.

Thus, Walsh moves forward by creating ADS for his company. He issues shares in US stock exchanges via ADRs. After completing ADR procedures, Walsh releases an IPO on the New York Stock Exchange (NYSE). This makes it very convenient for US citizens to buy shares. The firm primarily benefits from the added publicity.

Example #2

Now, let us look at a real-world example.

Didi Global Inc. is a Chinese ride-hailing company. In June 2021, Didi raised $4.4 billion in its US IPO. The company sold ADS worth $ 316.8 million—considerably higher than their expectations ($ 288 million) at $14 per share. As a result, the ADS valuation of the company was around $73 billion.

This was the Chinese company's most significant US sale after Alibaba’s massive $25 billion fundraising in 2014. The company was formed by Cheng Wei (a former employee of Alibaba), who also serves as the CEO. Didi president Liu Qing worked with Goldman Sachs for 12 years.

Example #3

In June 2021, Kanzhun Limited released an initial public offering (IPO) of 48,000,000 Kanzhun American Depositary Shares. This leading recruitment firm from China released shares at US$19.00 per ADS.

The total IPO amounted to $912 million. Goldman Sachs LLC, Morgan Stanley & Co. LLC, and UBS Securities LLC are the representatives of Kanzhun IPO underwriters.

Kanzuhn is a network where job vacancies are advertised in China. In addition, the firm employs a dedicated mobile app called ‘BOSS Zhipin.’

Frequently Asked Questions (FAQs)

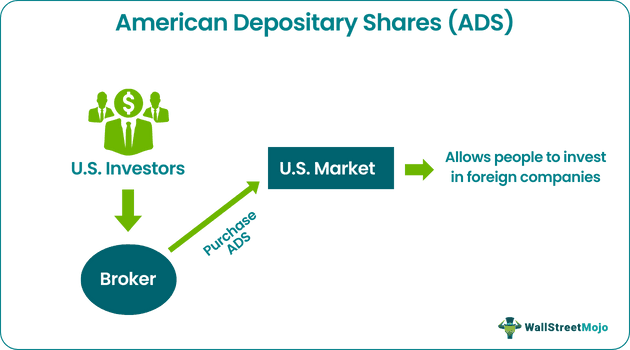

American investors can buy ADS directly as they are traded on the US financial market like any other share belonging to a domestic company. ADS are issued for the sole purpose of making shares belonging to foreign companies accessible to American investors.

Investors can approach a broker or connect with a Depositary bank representative and request ADR to ordinary stock conversion. This procedure requires submitting relevant documents—parent company's name, number of shares, CUSIP number, etc.

Yes, ADS are common stocks of a foreign company made available to the US investors, which in any other case should have been unavailable. Alternatively, if US investors were to buy shares from a stoUsing examples from China, we exchange located in another country, the procedure would and tedious.