Table Of Contents

Amended Return Meaning

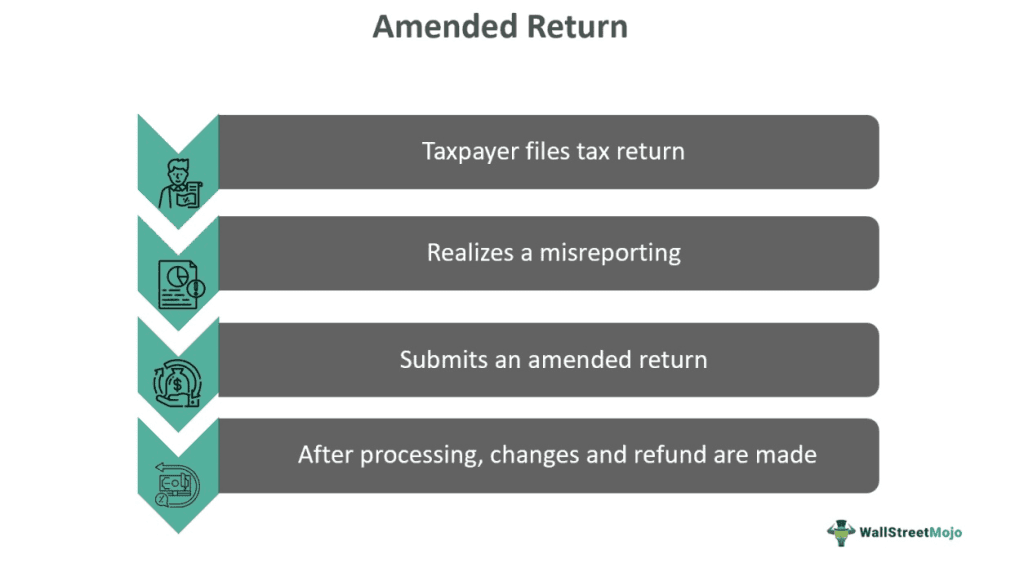

An amended return is an Internal Revenue Service (IRS) provision to let taxpayers make corrections and apparent errors and rectify misreporting in their prior year's tax return submission. It requires submitting a federal tax form 1040 X, an Amended US Individual Tax Return.

An individual should not file the amended return IRS in case of a math error or a missing form. The IRS typically takes care of a math error and notifies the taxpayer if more information is required for the tax filing. A taxpayer must not submit their original tax return with the amended one. these returns are to be filed within three years of the original filing date or within two years of tax payment, whichever is recent.

Key Takeaways

- The amended return refers to the form submitted by US taxpayers to make corrections and rectify errors after filing the tax return.

- If taxpayers amend the return for multiple years, they must file the 1040-X for each year and mail them in separate envelopes.

- In case more taxes are observed after filing amended returns. A taxpayer shall pay them as soon as possible before receiving any notice from the IRS.

- The IRS duly works to make the process more efficient and convenient for taxpayers, trying to reduce the processing time and slowdowns.

Amended Return Explained

Amended returns refer to making changes, rectifying corrections, and eliminating errors that occurred with the original tax return. In the US, even after the best tax filing practices, mistakes generally happen, and a taxpayer may realize it later. Therefore, the IRS has offered the provision of amended return tax to let the taxpayer submit a form with proper documentation and rightful information.

It signifies a tax form taxpayers can submit if they mistakenly submit a tax return with misreported earnings. It is also used to claim refunds or choose a different tax status. For multiple years, separate amended returns are to be filed, but there is an amended returns deadline, usually three years; after that, no taxpayer can submit for changes. Suppose a taxpayer filed a tax return in March 2018; then they have time till April 2022 to submit it, or else it will not be accepted.

There are certain circumstances only when a taxpayer can file for an amended return IRS -

- The taxpayer's filing status needed to be changed or entered correctly.

- In case an incorrect number of dependents is mentioned in the tax return.

- When the taxpayer realizes that deductions or credits are entered incorrectly following expenses.

- If the taxpayer believes they owe more taxes than the paid amount.

- To avoid penalties and legal notices from the IRS

Wondering where's my amended return? The amended returns status can be checked on the Internal Revenue Service's official website, and the processing can be tracked occasionally. They must be submitted on paper and mailed to the provided address as per the instructions. In addition, the taxpayers are requested to provide the reason for changes in a section provided on the back of the form 1040-X.

How To File?

To file an amended return tax, these steps must be followed:

#1- Gather Documents

A taxpayer must collect all the new documents, including the original tax return, and prepare them for amended return filing. In case of a missing claim or credit, a supporting document for the new deduction must be attached to Form 1098. In case of a mortgage interest statement or education credit, Form 1098-T is required, but for incorrect income, a taxpayer can seek a new or amended W-2 or 1099 Form.

#2- Filing The Right Forms

For every change, there is a separate form available that the IRS provides. The main form is Form 1040-X. A copy of Schedule A for the tax year is required for itemized deductions to mention a dividend income or additional interest payment. A copy of Schedule B is attached.

Schedule C and Schedule SE are for changes in revenue or expense from business, and similarly, for capital gains and losses, a taxpayer has to opt for Schedule D and Form 8949.

#3- Complete The Form 1040-X

The Form has three columns -

- Column A refers to the previously reported tax return

- Column B represents the amount that needs to be increased or decreased from the original tax return.

- Column C consists of the corrected amount, summing up the amount from Columns A and B.

In Part III, a clear explanation from the taxpayer is required.

#4- Submission

It can be done electronically by using tax software. In case of hardcopy submission, a printed copy of all the supporting documents and required information must be attached, including any notices received from the IRS.

Examples

Here are a few examples:

Example #1

Let’s say Gwen was submitting her income tax return for the first time and chose to file it alone without anyone's help. After filing the tax return, she discovered a mistake she had made while adding up her annual income.

She is distressed and is researching to rectify her mistake. She comes across the provision of amended returns. Thus, she visits the IRS official website and reads to understand what steps to follow; with the help of tax software, Gwen decides to file for an amended return electronically.

Hence, Gwen gathers all the vital information, details, and documents, carefully chooses the correct form, and submits the information. In her case, it was an amended W-2 or 1099 Form.

After she has filed and submitted the form, Gwen waits for the average expected time, but in between, she often checks for the status of her application online. Gwen may receive a refund or have to pay extra tax after changes. After nine weeks, Gwen receives a refund. It is a simple example of amended returns but a hectic and complex process in the real world.

Example #2

The IRS announced an option of direct deposit for the taxpayers electronically filing their amended returns for refund. It has been time-consuming and tiring for every taxpayer in the US regarding amended returns, even with e-filing. But now, with the option of direct deposit, they can receive their refunds more quickly.

With a lot of documentation and paperwork, taxpayers had to wait for a check and receive a refund due to delays in processing and mail slowdowns. The IRS has notified taxpayers that the normal processing time for electronic and paper returns is 20 weeks. With the new update, the IRS shall be able to reduce the time and help every taxpayer with easy refunds and settlements.

Superseding Return vs Amended Return

Here are the differences between the two:

- A superseding return is filed subsequently after the tax return with valid extensions. But amended returns can be submitted before the amended return deadline, usually within 3 or, in some cases, 2 years after paying the tax.

- Superseding returns replace the original tax return, but amended returns are submitted to make corrections and update information.

- Superseding returns are filed before the due date, but amended returns are submitted after the due date.

- An amended return is filed after superseded returns are submitted, but vice versa is not possible.