Table Of Contents

Amalgamation vs Merger Differences

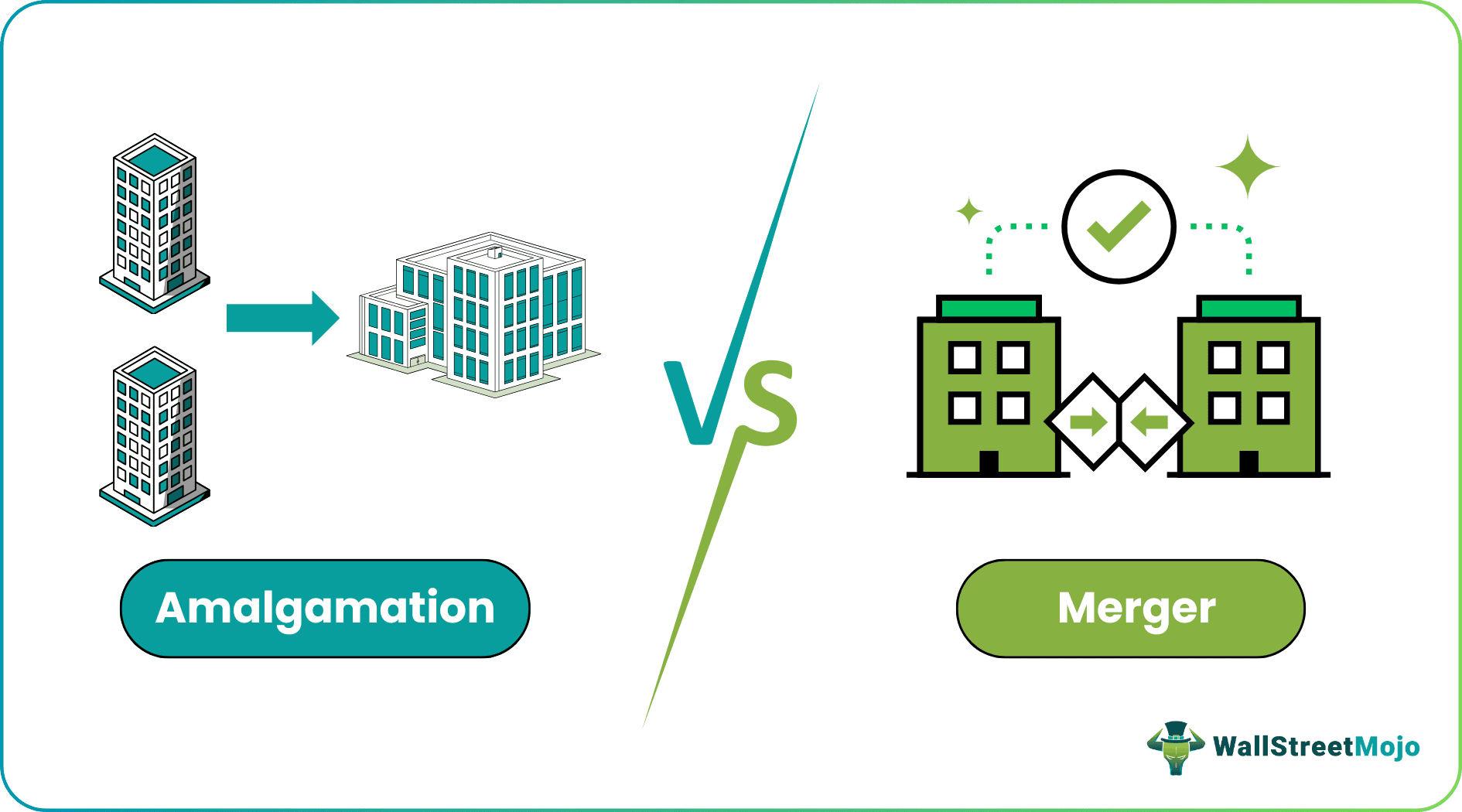

A merger is when two or more companies/entities are combined to form either a new company or an existing company absorbing the other target companies. It is a process of consolidating multiple businesses into one business entity.

The merger process may involve two possibilities in the above example: -

- A new entity, XYZ Corp., is formed to house the assets and liabilities of existing entities. Hence, the survival of ABC Corp. and PQR Corp. ceased to exist.

- On the other hand, ABC Corp. is a relatively more robust entity absorbing PQR Corp. Therefore, the resultant entity is the absorbing company, i.e., ABC Corp.

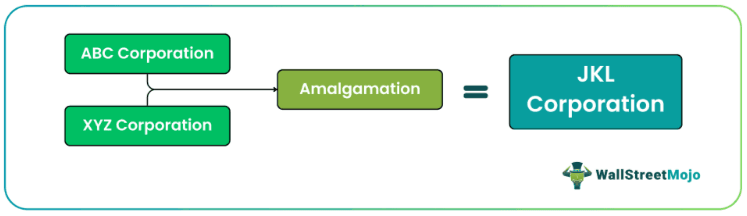

Amalgamation is a merger process in which two or more companies combine their businesses to form an entirely new entity/company. Amalgamation is an appropriate arrangement wherein two or more companies operate in the same industry. Thus, amalgamation helps reduce operational costs due to functional synergy.

ABC and XYZ Corp. will cease to exist after the amalgamation process resulting in a new entity, JKL Corp.

Table of Contents

Amalgamation vs. Merger in Video

Amalgamation vs. Merger Infographics

Key Differences Between Amalgamation and Merger

- There is a very subtle difference as both processes are a way to consolidate multiple companies.

- Amalgamation is a type of consolidation process used under a merger.

- Amalgamation results in the formation of an entirely new company. However, a merger is a consolidation process wherein the resultant company may be a new or existing company.

- A minimum of two companies are involved in a merger. However, a minimum of three companies are required for the amalgamation process.

- The size of the companies involved in the amalgamation process is of a comparable level. However, the size of companies in the merger process is different as an absorbing company is expected to be relatively larger than the size of an absorbed company.

- Assets and liabilities of the existing entities in the amalgamation process are transferred to an entirely new entity. However, the assets and liabilities of the absorbed entity in the merger process are consolidated into the absorbing entity.

- Shares of the absorbed company are given to shareholders of the absorbed company in the merger process. However, shares of the new entity formed in the process are given to the shareholders of the existing entities in the amalgamation process.

Comparative Table

| Basis | Merger | Amalgamation |

|---|---|---|

| Definition | Two or more companies are combined to form either a new or existing company absorbing the other target companies. A merger is a process of consolidating multiple businesses into one business entity. All the amalgamations are part of the merger. | It is a merger process in which two or more companies combine to form a new entity. All the mergers are not amalgamations. |

| Number of Entities Required | A minimum of two companies is required as one absorbing company will survive after absorbing the target company. | A minimum of three companies are required as an amalgamation of two companies results in a new entity. |

| Size of the Companies | The size of the absorbing company is relatively larger than the absorbing company. | The size of the target companies is comparable. |

| Resultant Entity | One existing company may absorb the target company for a merger, retaining its identity. | Existing companies lose their identity, and a new company is formed. |

| Impact on Shareholders | Shareholders of the absorbing entity retain their ownership. However, shareholders of the absorbed entity gain ownership of the absorbing company. | All the shareholders in the existing entities become shareholders in the new entity. |

| Impact on Shares | Shares of the absorbing company are given to shareholders of the absorbed company. | Shares of the new entity formed in the process are given to the shareholders of the existing entities. |

| Driver for Consolidation | The absorbing company mostly drives mergers. | The amalgamation process is initiated by both companies interested in the amalgamation process. |

| Accounting Treatment | Assets and liabilities of the absorbed/acquired company are consolidating. | Assets and liabilities of the existing entities are housed and transferred into the balance sheet of the newly formed entity. |

| Examples | The consolidation of two entities, Tata Steel and UK-based Corus Group, resulted in Tata Steel. Corus Group lost its identity in the process. | The consolidation of two entities, Mittal Steel and Arcelor, resulted in the new entity named ArcelorMittal. Both Mittal Steel and Arcelor Group lost their identity in the process. |

Why Do Companies Go for Amalgamation and Merger?

- Diversification into multiple industries without going through hurdles of starting afresh.

- To achieve economies of scale for cost optimization, access to a larger market, effective utilization of resources, etc.

- To achieve operational synergy by targeting companies in the same industry/similar product lines.

- To achieve growth targets in less time.

- The advantage of taxation is combining a loss-making company with a profit-making company, thereby reducing the tax liabilities.

- Reduced competition in a specific industry by combining two entities.

- To achieve effective financial planning with a resultant entity with a bigger balance sheet and utilize financial resources effectively.

- Increased control over the value chain in a specific industry by the forward integration and backward integration

Conclusion

Both are the processes of consolidation of two or more companies into a new entity or an existing entity absorbing the target entity. A resulting entity may be a new or existing entity in the process. Amalgamation is a type of consolidation process under a merger.

In the amalgamation process, two companies combine to form a new entity. And, merger helps companies achieve their goals such as growth, increase in shareholders’ value, an increased economy of scale, synergy, access to larger market/new geographies, entry into a new industry, etc.