Table of Contents

What Is Alternative Risk Transfer (ART)?

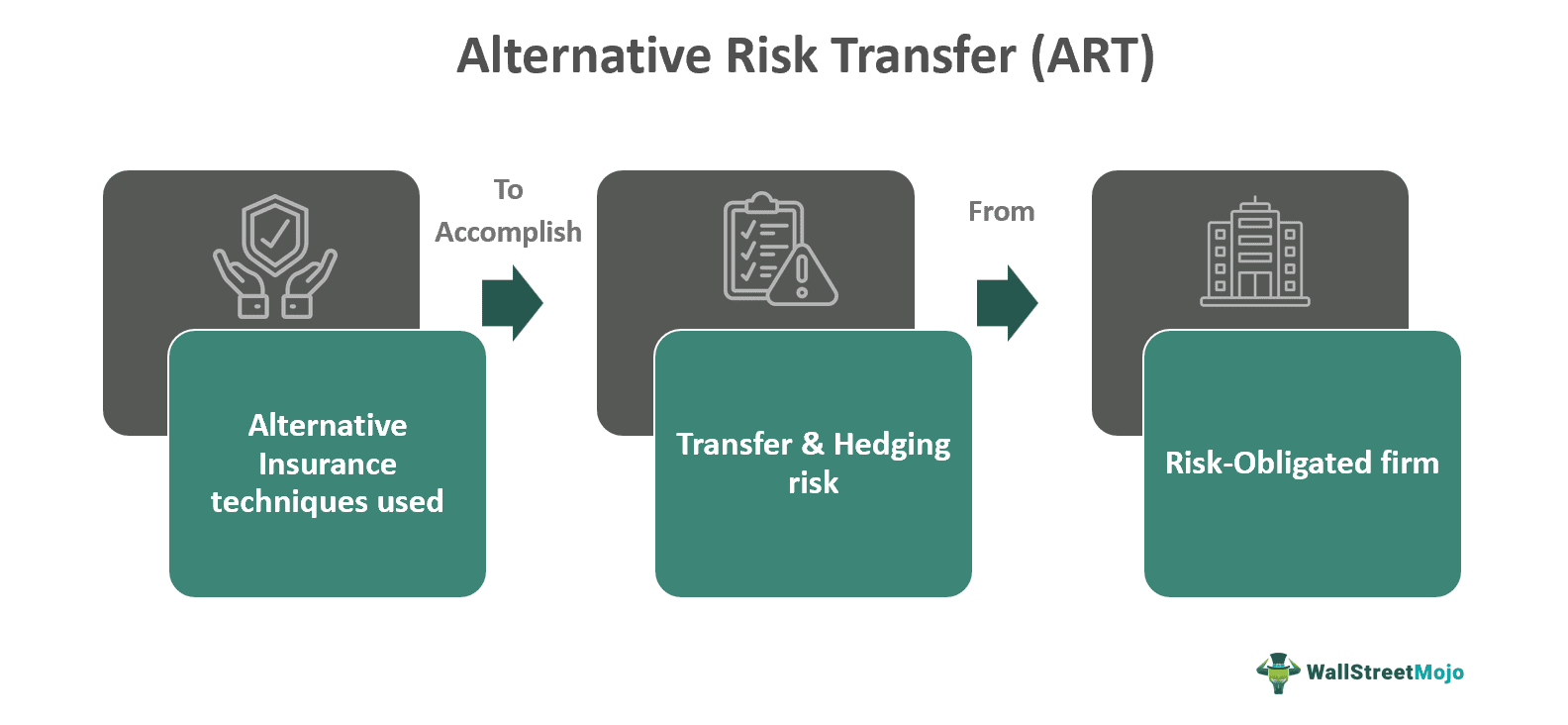

Alternative Risk Transfer (ART) refers to using alternative techniques to accomplish transfer and hedge risk from a risk-obligated firm. It goes beyond conventional reinsurance or insurance. ART facilitates firms in transferring risk to another investor in the capital market or another party. This allows them to obtain appropriate protection against specific risks for which transactions need coverage.

It helps companies finance their risks out of the conventional insurance regulation framework in a manner that safeguards simple insurance buyers. It uses different techniques, such as consolidating non-insurance methods and insurance techniques, to provide risk-averse firms with appropriate protection against risks.

Key Takeaways

- Alternative Risk Transfer (ART) represents a method that permits firms to transfer risk to another party or investor, offering appropriate safety against specific risks in transactions.

- Its strategies include parametric solutions, multi-year contracts, contingent capital, and insurance-linked securities.

- Other strategies involve reinsurance sidecars, derivatives, transformer vehicles, self-insurance, and weather-index insurance.

- Its benefits include increased control over risk management, cost savings, and capital optimization.

- Additionally, it offers reduced risk, reduced administrative costs, market stability, and easy access to profits from existing premiums.

- It has limitations like moral hazard risks, customization, counterparty risks, complex tax treatment, complexity, uncertainty, difficulty in determining prices, adoption, and initial capital.

Alternative Risk Transfer Explained

Alternative risk transfer (ART) refers to solutions utilized in transferring risk entirely to the financial markets. It became widely popular in the markets during the 90s when issues of insurance capacity steered reinsurers and insurers to find new mediums to transfer their insurance risk to another third party. Its major areas consist of risk securitization using:

Catastrophe bonds

- Insurance-derived securities

- Reinsurance sidecars

- Deploying industry-loss warranties for risk trading

- Contracts derived from weather

- Using transformer vehicles to transform capital markets as reinsurance

All the above methods facilitate firms in collecting their resources, accessing coverage, and sharing risks. These methods are particularly useful for risks deemed to be exorbitantly costly and uninsurable.

It offers multiple implications, such as benefits like tighter control of risk exposures, potential cost savings, and reduced volatility. Additionally, it offers easy access to coverage for organizations facing risks that appear to be uninsurable. This approach provides greater predictability and financial stability.

Its nature of coverage has helped multinational companies have a higher degree of risk profiles stemming from operations in regions prone to conflicts, political chaos, or the healthcare sector full of risk of medical malpractices. Likewise, other firms need to decrease their dependency on conventional insurance providers and obtain greater control over their risk management planning.

Moreover, it has had a positive impact on financial markets by forming fresh risk markets and thinning the lines between financial markets and insurance. It has resulted in information on newer risk transfer mechanisms through catastrophe bonds or insurance-derived securities. All these have made ATRs like Allianz alternative risk transfer & old mutual alternative risk transfer limited popular amongst institutional investors.

Common Strategies

Let us explore the most common strategies for ART:

- Risk Retention Groups (RRGs): Collect resources related to similar risks to provide insurance protection.

- Captive Insurance Companies: Forms in-house insurance firms to coordinate globally.

- Insurance Pools: Group businesses have similar risks to give them insurance coverage.

- Parametric Solutions: In case of occurrence of financial loss or non-damage operations interruption, immediate capital is infused.

- Multi-Year Contracts: Different classes of insurance, like casualty and property risk, are combined to give capacity, coverage, and stability.

- Contingent Capital: Provides capital for losses in pre-agreed situations like high-severity losses.

- Insurance-Linked Securities (ILS): Bonds are issued to raise capital to cover obligations while giving interest to bondholders to diversify risk resolutions.

- Reinsurance Sidecars: Transferring risk to separate entities assuming a part of insurers risk at a certain charge.

- Derivatives: Risk trading using derivatives like weather derivative contracts to handle particular risks.

- Transformer Vehicles: Using specialized entities to transfer risk from capital markets into reinsurance.

- Self-Insurance: Providing coverage to losses from one's funds without the use of a reinsurer.

- Integrated Risk Programs: Multi-year risk and multi-line risk transfer frameworks to access market capacity effectively aligned with risk tolerance.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that a big energy company in Yorker City called GlobalPower has to face multiple risks from natural calamities. Hence, they approached a reinsurer called ABC for a partnership. Since the reinsurer has an innovative approach, it forms a calamity bond for GlobalPower. As a result, GlobalPower issues $200 million as cat bonds to their investors with a guaranteed annual return of 6%.

Therefore, if any devastating hurricane hits Old York in the next 5 years, then GlobalPower can use it to cover the losses with the investors losing their principal. Further, the chief risk officer of ABC modeled their hurricane probability at 3% annually. Nevertheless, the ATR strategy permits GlobalPower to reduce financial exposure and offer investors a high-reward and high-risk opportunity.

Example #2

An online article published on 14 June 2024 discusses the hiking capacity related to the risk transfer market and parametric insurance as recorded by the WTW broking group. Hence, it underscores the excess demand concerning alternative risk transfer solutions, which has made parametric insurance quite popular. WTW experienced continuous growth in this sector across 2024, steered by the power to resolve challenging risk folio and insurance gaps.

Generally, parametric insurance has been used for natural disasters, but now it has been used to offer coverage for cyber and pandemic risks. Moreover, it works to augment property placements, aid lender funding, and government projects. It has been observed that the insurance-related securities market increased in capacity from 6.5% catastrophic bond risk capital made in 2024.

Benefits

It offers numerous benefits like:

- Alternative Risk Transfer (ART) represents a method that permits firms to transfer risk to another party or investor, offering appropriate safety against specific risks in transactions.

- Its strategies include parametric solutions, multi-year contracts, contingent capital, and insurance-linked securities. Other strategies involve reinsurance sidecars, derivatives, transformer vehicles, self-insurance, and weather-index insurance.

- Its benefits include increased control over risk management, cost savings, and capital optimization. Additionally, it offers reduced risk, reduced administrative costs, market stability, and easy access to profits from existing premiums.

- It has limitations like moral hazard risks, customization, counterparty risks, complex tax treatment, complexity, uncertainty, difficulty in determining prices, adoption, and initial capital.

Limitations

ATR comes with certain limitations, including:

- It has complexity and uncertainty related to its burdening amount and historical backing.

- It becomes difficult to gauge and quote the correct price and the justness of agreement terms as they are not stringently regulated.

- It requires complete adoption by employees and companies concerning the basics to the topmost implementation of the ART system and having an expert view aligned with a separate perspective.

- It needs a lot of initial capital and start-up expenses before a captive can be set up and work, acting as a potential deterrent for businesses.

- It has a lot of moral hazard risks.