Table Of Contents

What Is An Alternative Investment Market (AIM)?

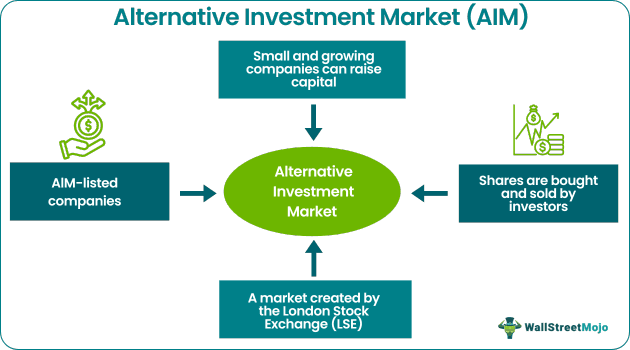

The alternative investment market (AIM) is a platform that enables small and growing businesses to raise capital by listing their shares on the London Stock Exchange (LSE). The AIM is less stringent than LSE's primary market, offering liquidity to shareholders and helping small or medium companies attract more investors.

Companies listed on the AIM enjoy more flexibility in regulatory reporting, resulting in lower expenses, easier access to financing, and greater autonomy in their business expansion strategies. Investors can diversify their portfolios and reduce overall risk by taking advantage of the various investment options available in the AIM. Some alternative investments may generate higher returns than traditional investments, making alternative investment markets attractive for investors.

Key Takeaways

- The alternative investment market (AIM) is a sub-market of the London Stock Exchange that provides a platform for smaller, growing companies to raise capital and for investors to access alternative investment opportunities.

- These markets offer diverse investment opportunities that can help investors diversify their portfolios.

- They typically have less stringent listing requirements than traditional stock exchanges, making it easier for smaller and growing businesses to access capital.

- Transparency and access to information can be a challenge in some alternative investment markets, making it difficult for investors to understand the risks associated fully.

Alternative Investment Market Explained

The alternative investment market (AIM) was launched by the London Stock Exchange (LSE) in 1995 to provide small and developing businesses with a platform to raise funds and list their shares. While the LSE has historically focused on listing and trading conventional assets like stocks and bonds, it has also contributed to the growth of the alternative investment market by establishing AIM. The traditional listing standards deemed too stringent for smaller companies were planned to be replaced by AIM.

As a sub-market of the LSE, AIM offers a stepping stone for small businesses seeking public funding and an alternative to conventional listing requirements. It attracts businesses too young or undeveloped to be eligible for a full listing on the LSE. Companies listed on AIM are subject to less strict financial, governance, and reporting rules and regulations than those listed on the LSE's primary market, which is why AIM is often considered less regulated.

AIM requires companies to designate a nominated adviser (Nomad) who must be a qualified professional and serve as a point of contact between the company and the LSE. The Nomad's responsibilities include determining if the company is suitable for listing, examining its listing documentation, and performing reporting duties for the LSE.

Once the listing is approved, the company's shares begin trading. In addition, the business must adhere to continuous reporting and regulatory obligations, such as submitting annual reports and financial statements and adhering to LSE listing requirements.

Examples

Let us look at alternative investment market examples to understand the concept better:

Example #1

The LSE has launched alternative markets and platforms for different companies and investors. One of these is LGX, a unique platform for businesses involved in sustainability, enabling them to showcase their contribution and attract investment. Renewables Infrastructure Group Limited is one of the companies listed on LGX. Octopus Renewables Infrastructure Trust plc is another investment firm focusing on renewable energy infrastructure.

These firms appeal to investors interested in supporting sustainable initiatives. Alternative investment markets allow small businesses to raise capital and list shares and investors to find opportunities aligned with their values. These markets are a significant development in the financial industry, benefiting both businesses and investors.

Example #2

Consider the company "Green Energy Inc," based in London and dedicated to developing and manufacturing sustainable energy solutions such as solar panels and wind turbines. The company has been in operation for a few years and has had some success, but it requires additional funding to expand operations and bring new products to market.

Green Energy Inc's management decides to look into alternative investment markets to raise capital. After researching their options, they list them on the London Green Exchange (LGX). The LGX is an alternative market for companies involved in sustainable or environmental causes. In addition, LGX allows the company to prove its commitment to environmental and social issues, which may attract interested investors.

The LGX approves the listing after carefully examining the company's application and confirming that it complies with all listing standards. As soon as the listing is granted, Green Energy Inc. shares start trading on the LGX, making it possible for the business to raise more money by allowing the public to buy shares.

Advantages And Disadvantages

Some advantages and disadvantages of the alternative investment market are listed below.

Advantages

- One of the primary benefits of alternative investment markets is that they provide companies access to capital that would not otherwise be available. As a result, it can be especially beneficial for small and growing businesses that may need to meet the requirements for a full listing on the London Stock Exchange's primary market.

- Alternative investment markets provide diverse investment opportunities, which can assist investors in diversifying their portfolios and lowering overall risk.

- These markets typically have less stringent listing requirements than the main market of the London Stock Exchange, making it easier for small and growing businesses to list their shares.

- They commonly have greater transparency and easier access to information, which can assist investors in making more informed decisions about the companies they invest in.

- Companies listed on alternative investment markets, such as LSE ELITE, can benefit from professional management and support facilities, which can help them scale up, improve efficiency, and gain access to new markets and customers.

Disadvantages

- These investments are typically riskier than regular investments, and in some markets, a lack of regulation may make them much riskier. In addition, the assets in the alternative investment sector, such as private equity, hedge funds, and real estate, are riskier since they are less liquid and harder to evaluate than stocks and bonds.

- Some alternative investment markets might not be as transparent as traditional markets, making it challenging for investors to comprehend the underlying assets and risks of the investments.

- These markets frequently have less control and supervision than traditional markets, making it more challenging for investors to defend themselves against fraud and other types of malpractice.

- Alternative investment market functioning can be difficult to understand and require specialist knowledge to evaluate, limiting their accessibility to small investment funds and retail investors.

Frequently Asked Questions (FAQs)

To invest in the alternative investment market (AIM), investors can open an account with a brokerage firm that offers access to the AIM market and then choose from the available investment opportunities listed on the market.

The risks include a lack of liquidity, greater volatility, potential for fraud, and higher fees than traditional investments. Investors in AIM also face the risk of investing in small and growing companies that may not have a track record of success and may be more susceptible to economic downturns or industry-specific risks.

Investors can evaluate companies by reviewing their financial statements, understanding their business models, analyzing their market competition and growth potential, and seeking advice from professionals such as financial advisors or brokers.