Table Of Contents

What Is Alternative Investment Fund (AIF)?

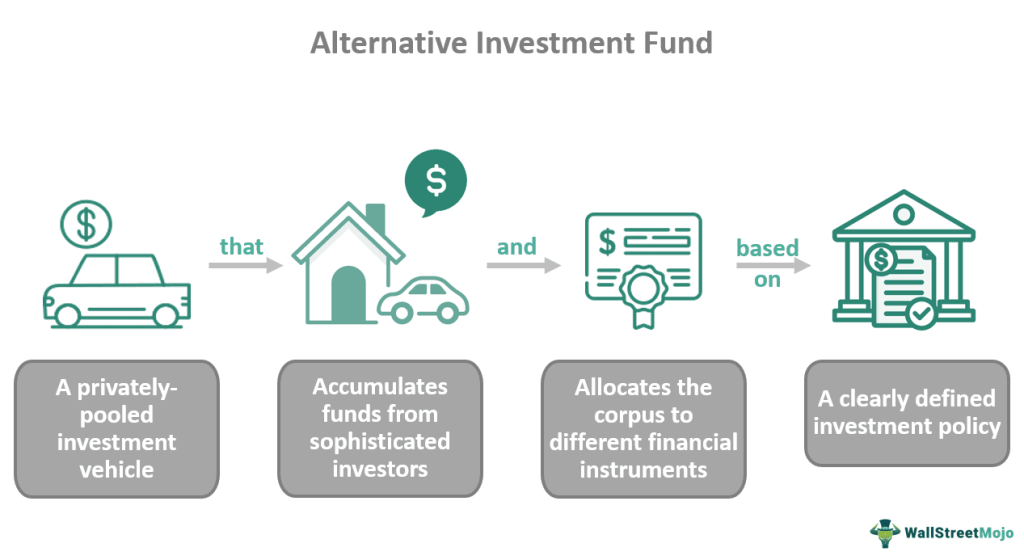

An alternative investment fund or AIF is a privately pooled investment fund established in India that collects funds from sophisticated private investors and invests the same according to a clearly stated policy. Such funds aim to generate returns for investors and help them achieve their financial goals.

Both domestic and foreign private investors can allocate their money to these investment vehicles if they fulfill the eligibility criteria. AIFs adhere to the rules and regulations of the Securities and Exchange Board of India or SEBI. They have three categories — Category I AIF, Category II AIF, and Category III AIF. These are further divided into sub-categories.

Table of contents

- Alternative investment funds meaning refers to an investment vehicle that accumulates funds from domestic and foreign investors (generally institutions and HNIs) and invests the corpus while following a preset investment policy.

- There are three types of alternative investment funds — category I, category II, and category III AIFs.

- The minimum investment amount for Individuals not working in an AIF is Rs. 1 crore. In contrast, one can start investing in mutual funds with Rs. 500.

- The two sub-categories of category III alternative investment funds are private investments in public equity and hedge funds.

Alternative Investment Fund Explained

Alternative investment fund meaning refers to investment vehicles that collect money from sophisticated investors and allocates the funds to different financial securities based on a certain investment policy. The main objective of such a fund is to diversify one's portfolio and offer adequate returns to fulfill their financial goals.

Institutional investors and high-net-worth individuals typically allocate their funds to such investment vehicles. That said, retail investors can also invest in an AIF if they can meet the eligibility criteria.

Let us look at the requirements investors must fulfill to invest in AIFs.

- The investor must be a foreign national, resident Indian, or non-resident Indian.

- One must invest a minimum of ₹1 crore. The minimum investment amount is ₹25 lakhs for AIF employees, directors, and fund managers.

- Most AIFs have a lock-in period of at least three years.

Besides the above points, one must remember that an AIF scheme (except an angel fund) cannot have over 1000 investors. In the case of angel funds, the number of angel investors cannot exceed 49.

An AIF offers the following benefits to investors:

- First, these funds help investors to diversify their portfolios.

- Second, AIFs enable investors to explore new strategies to maximize their returns.

- Third, Third, AIFs are less volatile than pure equity investments as each scheme has a well-diversified portfolio.

One can incorporate an AIF in India as a trust, corporate body, company, or limited liability partnership (LLP). Such a fund does not share any fund-related detail publicly. Moreover, since AIFs are open to limited investors because of the high investment amount and fees, these funds do not have much scope to advertise.

Types

Let us look at the different types of alternative investment funds:

#1 - Category I AIFs

These funds invest the corpus in early-stage small and medium enterprises or SMEs, startups, and new corporations that are economically viable and have significant growth potential. Their sub-categories are as follows:

- Angel Funds: Such AIFs typically invest in new companies or startups that cannot raise funds from venture capitalists.

- Venture Capital Funds: These funds mainly invest in emerging businesses and startups with high growth potential and require substantial capital. One with a high-risk appetite and an aim to generate maximum portfolio returns often allocates money to such schemes.

- Social Venture Schemes: These AIF schemes invest in organizations participating in philanthropic activities.

- Infrastructure Funds: Such funds primarily invest in infrastructure projects.

Lastly, an SME fund is a sub-category of a category I AIF. It invests in unlisted or listed micro, medium, and small enterprises, for example, water, railways, renewable energy, municipal solid waste, etc.

#2 - Category II AIFs

According to SEBI, category II AIFs are the funds that are not part of categories I and III and which do not opt for borrowing and leverage other than to fulfill day-to-day requirements.

The sub-categories of category II are as follows:

- Funds Of Funds: These AIF schemes allocate their funds to other AIFs.

- Private Equity Funds: These funds use the accumulated money to invest in unlisted private companies that are challenging to raise capital by issuing equity and debt instruments.

Another sub-category of category II AIF is debt funds. This type of AIF invests in fixed-income securities of unlisted or listed investee companies that follow decent government models and possess good growth potential.

#3 - Category III AIF

Category III alternative investment funds use various trading techniques and leverage by allocating their corpus to unlisted and listed derivatives. These AIFs can be open-ended or close-ended. Let us look at their different types.

The different types of category III AIFs are as follows:

- Private Investment In Public Equity Fund: These AIFs invest in public firms by purchasing their shares at a discounted price.

- Hedge Funds: Hedge funds accumulate funds from corporations and investors to invest in equity and debt markets both on international and domestic levels. Such schemes use a high-risk investment strategy to generate returns for the investors. Hence, such funds are suitable for investors with a high risk appetite.

Examples

Let us look at alternative investment fund examples to understand the concept better.

Example #1

One of India's leading asset management companies (AMCs), HDFC Mutual Fund, introduced its first AIF, HDFC Select AIF FOF – I. This is a category II alternative investment fund (fund of funds); it will invest in private equity and venture capital AIFs without any predetermined sector focus.

This scheme allows investors to get exposure to multiple AIFs without investing significantly for each fund. The scheme aimed to collect ₹1,500 crore along with an option to raise an additional ₹1,500 crore via the Greenshoe option.

Example #2

Let us say that Sam Jones was a high-net-worth individual looking to earn high returns to fulfill his financial goals. After considering the various investment options, he decided to invest in a hedge fund as the fund's investment policy aligned with his risk appetite and financial objective. The scheme's fund manager used a highly-aggressive investment strategy and managed to generate a 5-year return of 41%. This helped Sam fulfill his financial goals.

Difference Between Alternative Investment Fund And Mutual Fund

The concepts of AIFs and mutual funds can confuse individuals new to investments. Indeed, although both are investment vehicles accumulating funds from different investors, they have certain differences. To eliminate any confusion, one must know their distinct features. So, let us look at them.

| Alternative Investment Funds | Mutual Funds |

|---|---|

| The minimum investment amount for AIFs is Rs. 1 crore. The ceiling is Rs. 25 lakhs for AIF employees, fund managers, and directors. | One can start investing in mutual funds with an amount as low as Rs. 500. |

| Most AIFs come with a lock-in period of three years. | Only equity-linked savings schemes and close-ended mutual funds have a lock-in period. |

| AIFs do not adhere to SEBI’s mutual fund regulations. | Mutual funds adhere to the SEBI mutual fund regulations. |

Frequently Asked Questions (FAQs)

One can start an AIF by following these steps:

1. Individuals must apply in Form A of the Securities and Exchange Board of India Regulations, 2012, with a business plan and the necessary documents.

2. They must submit an authorization letter if they authorized an officer, director, or promoter to be an authorized signatory.

3. One must provide a cover letter if necessary.

4. Individuals must apply and pay the application fee.

5. SEBI will scrutinize the application and approve the same within a few weeks after successful verification.

6. The regulatory body will grant the AIF registration certificate.

AIF managers manage a scheme's portfolio; they take buy-and-sell decisions based on a clearly defined investment policy to benefit investors.

Category I and II AIFs do not have to pay any tax under Section 10(23FBA) of the Income Tax Act. That said, the investors earning returns from such funds must pay capital gains tax to the government. One must remember that category III AIF is subject to taxation at the fund and investor levels.

Recommended Articles

This has been a guide to what is Alternative Investment Fund. Here, we explain its types, differences with mutual fund, and examples. You can learn more about from the following articles –