Table of Contents

What Is Alpha Decay?

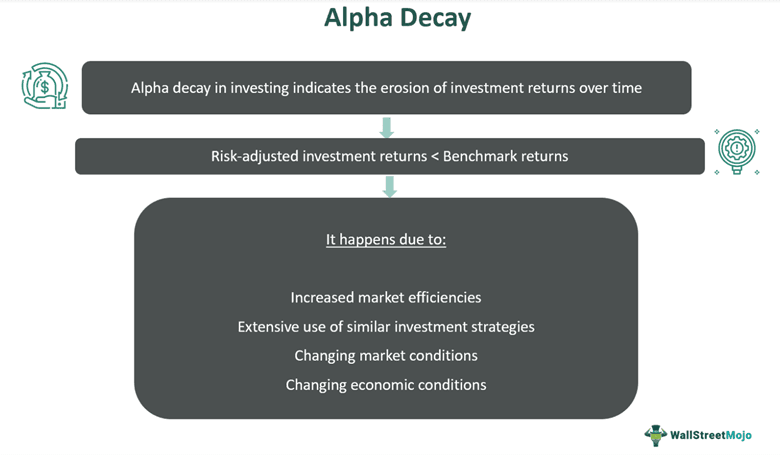

Alpha Decay shows a decline in the effectiveness of an investment strategy over time, resulting in a corresponding decline in returns when measured against a benchmark. In quantitative trading, when an alpha model is used to develop investment strategies to guide investment decisions, a decline in the effectiveness of such strategies is called alpha decay.

Typically, investors who have spent considerable time in the market experience it, as their strategy becomes ineffective and loses its predictive power, causing a reduction in its ability to generate risk-adjusted returns. In the context of alpha models, alpha indicates the “excess returns” an investment strategy can generate. Hence, when it begins to decline with time, it is called decay.

Key Takeaways

- Alpha decay in investing refers to how an investment strategy loses its effectiveness and becomes incapable of delivering risk-adjusted returns. The term is derived from nuclear physics related to a radioactive nucleus emitting alpha particles.

- Alpha means “excess returns” in the quantitative trading context. Alpha and beta are two important components that define a stock’s performance. Alpha denotes excess return, and beta reflects volatility.

- It is a gradual loss of a model’s predictive ability when measured against a benchmark. The common reasons for such decay are strategy overuse, changing markets, etc.

- Creating tough-to-replicate strategies, seeking professional assistance, and employing technology are some ways to avoid such decay.

Alpha Decay In Investing Explained

Alpha decay in finance and investing refers to a scenario where an investment strategy gradually proves ineffective over a period and is unable to help investors generate the predicted or expected returns. Therefore, the profitability quotient of such strategies declines with time. Compared to relevant benchmarks, a model’s efficiency in terms of predicting and enabling investors to produce risk-adjusted returns declines.

In quantitative trading, investment returns are categorized as alpha and beta. Beta measures the relative volatility of an investment compared to a benchmark index like Standard and Poor’s 500 (S&P 500). Alpha computes and quantifies the amount of return an investment has been able to generate compared to expected returns based on the corresponding beta. The figure or number indicated by alpha refers to excess returns. Thus, alpha can also be described as the additional return over the expected beta return.

Decay refers to slow deterioration. Hence, the term alpha decay refers to the declining returns brought on by the ineffectiveness of an investment strategy over a period of time. As the strategy continues to become fruitless, alpha returns continue to decline. Investors prefer a high alpha as it indicates that they have been able to outperform the market through effective asset selection and active portfolio management. On the other hand, a high beta is appreciated only in growth stocks because investors are willing to accept a high beta and high risks for potentially higher returns.

The alpha for any security is represented by numerical values—positive, negative, or zero. A positive alpha means the strategy or stock overperformed relative to a benchmark. On the other hand, a negative alpha means the strategy underperformed compared to the index. If the alpha is zero, it means it matches the benchmark.

Interestingly, the term alpha decay comes from nuclear physics. In nuclear physics, it signifies a radioactive process where an unstable atomic nucleus expels alpha particles to become more stable with each emission. A similar decay occurs over time in financial markets.

Reasons

In this section, let us study some reasons for such decay in the context of investing.

- Strategy replication corrects the market: When more and more investors, traders, and market participants replicate or use the same investment strategies to time or beat the market, the market corrects itself. The opportunities for exploiting the market decline when many investors, including retail investors, employ the same strategies. As the market dynamics begin to shift, a given strategy or strategies slowly lose accuracy, and at equilibrium, the alpha goes down to zero.

- Increase in slippage: Every strategy has specific requirements and constraints, so some may work only within limited options, volume, and features, particularly with a capital allocation limit. When firms, fund managers, and hedge funds allocate more and more capital to such strategies, they may lose accuracy. Hence, alpha decay increases due to hiked slippage.

- Changes in market conditions: Market conditions do not remain the same. When a market shifts despite having stayed stable for a considerable period, existing or tried and tested investment strategies can become irrelevant. Market efficiencies, as discussed above, play a key role in retaining the effectiveness of an investment strategy.

- Alpha model overfitting: If overfitting occurs when a quantitative trading model is being developed and optimized based on past market data, decay may set in since it will likely lose its predictive capabilities. This happens because an overfitted model is unable to absorb and interpret changing market dynamics or conditions.

- Other factors: Market sentiment and global events can have an impact on countries and their financial markets, affecting investment returns in the process. Also, changes in regulations and economic conditions can trigger decay.

Examples

To delve further into this topic, let us see a few examples.

Example #1

Suppose Susan is new to both financial markets and investing. After conducting considerable research and seeking guidance from fellow investors, she developed her investment strategy. With the help of her friend, Gemma, who works as a fund manager with a reputable company in Texas, Susan developed an alpha model to guide her investment decisions. This strategy proved fruitful at first and generated alpha (excess returns) for the next nine months.

After a while, Susan noticed that the returns began to decline. Gemma told her that the market was likely correcting itself since many investors, fund managers, and other market participants had begun to employ more or less similar strategies to earn higher returns than usual. Gemma also told her that the capital allocation of larger or institutional participants is much more significant than that of retail investors like Susan. She also introduced Susan to the concept of alpha decay, and Susan understood that her strategy might stop giving satisfactory results in the coming months.

Under Gemma’s guidance, Susan decided to change her investment strategy and ensure active management of her investments to earn adequate returns.

Example #2

A February 2024 Forbes article explained the connection between alpha decay and past returns. It also threw light on how predictability can be impacted or modified when market dynamics change with the adoption of the same or similar investment strategies. Julien Penasse, Associate Professor of Finance at the University of Luxembourg, answered a question about alpha decay on a popular online platform, and her observations have been highlighted in this article.

The write-up also talks about a perceived alpha, an interesting concept, which states that excess returns are a myth in the first place. It further highlights a point we have discussed in the previous sections—crowding—indicating that too many investors employ these strategies, reducing their effectiveness. Another pertinent aspect of such decay discussed in the article includes the effect of inherent risks and market volatility on investment performance.

How To Avoid?

While avoiding alpha decay entirely is challenging, certain measures can be taken to reduce its occurrence and impact.

- Investments with structural advantages: Adopt investments with structural advantages, making it challenging for others to replicate the corresponding investment strategies.

- Professional assistance: Seeking professional guidance from fund managers with a proven track record of generating alpha (excess returns) over a long period is recommended.

- Confidentiality: Keeping returns-generating strategies confidential is recommended. As knowledge of a specific strategy becomes widespread, the chances of slippage increase.

- Technology: Investment management firms and brokers may use Artificial Intelligence (AI) and other software to develop new trading strategies to identify new techniques for alpha (excess returns) generation.