How Airwallex is Revolutionizing Cross-Border Payments for Businesses in 2024

Table Of Contents

Introduction

Airwallex is a global financial technology company, specializing in financial services and software in finance. To offer a small Airwallex overview, the company was founded in 2015, and just within a period close to a decade, the company has grown to appoint more than 1500+ employees in their 23 international offices spread across the globe in countries, such as the United States, Netherlands, India, Malaysia, Japan, Australia and even New Zealand.

The foundation of Airwallex came following the increasing importance of fintech, its growing scope and raised technicalities of cross-border payments. Today, fintech is completely redefining cross-border payments, offering affordable alternatives to send and receive money for businesses and personal transactions across borders. The fintech solution provider and cross-border payments platform has come a long way and became a leading fintech platform offering monetary transfers and FX conversions. Airwallex fintech solutions offer a single global business account and facilitate smooth FX transfers, borderless cards, expense management, and online payments, which have become essential services in today’s digitally-driven world.

With a valuation of $5.5 Billion, Airwallex is gaining traction in the industry not only because they have made the entire fintech experience smooth and convenient, but also cheap and unbelievably affordable.

Key Takeaways

- Airwallex is used both for individuals and businesses.

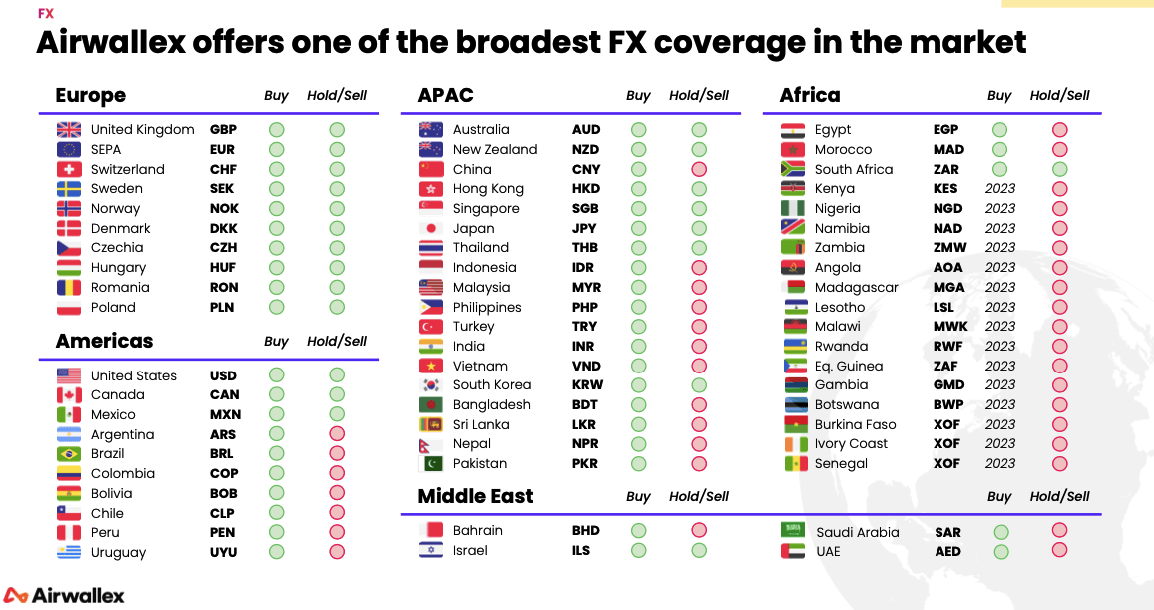

- Airwallex supports 130+ currencies in 50+ countries, parallel to localized payment options.

- Airwallex makes it safe and secure with 3DS risk engine, PCI, and DSS compliance coupled with SOC 1 and SOC 2 certifications.

- Airwallex offers integrated payment getaways for e-commerce, seamless cross-border payments, helps in setting up global bank accounts, and charging as low as zero transaction fees.

- Airwallex offers cross-border transfers, low conversion fees, and real-time foreign exchange rates, for international FX and Airwallex global payments.

- Airwallex has helped many firms with its expense management tools, charges no monthly fees, and is well-integrated with accounting software such as QuickBooks and Xero.

- For business banking, Airwallex offers virtual and physical corporate cards that offer seamless payments and integration. It is also ready to offer access to quick credit and loans based on business needs.

- Zero charges on international and domestic payments and transactions with Airwallex FX services.

- Airwallex has completely revolutionized the fintech platforms' pricing strategies with its "pay as you go" pricing policy.

What Is Airwallex?

You know, we came across many people asking us the same question again and again: what is Airwallex? When we showed them, they just couldn’t believe that global finances, expense management, and cross-border payments could be performed so swiftly. Airwallex is an end-to-end fintech solution provider. It is available as a mobile application for both iOS and Android and offers financial services, software, and APIs to international businesses. As a global payment solution, Airwallex has literally brought the entire global financial framework at your fingertips. You can open global accounts in as many as 12 currencies, make global transfers across 150+ countries, manage your multi-currency wallet, and even get paid for accepting payments with over 150+ online methods.

Airwallex’s core services include offering global accounts, facilitating online payments, providing borderless cards, enabling smooth FX transfers and conversions, proper expense management and whatnot. All you need to do is just get started with it, and overcome all your financial hassles instantly.

Airwallex history and services remind us to have a look at its rich and inspiring journey, while peeking inside the founder’s vision. In 2015, the company’s CEO, Jack Zhang and three fellow entrepreneurs started a cafe in Melbourne, Australia. Not only did they serve great coffee, but they also used the cafe as a lab to test and acquire knowledge of rising retail global trends.

The founders worked day and night to not only develop a supply chain but also remove any unnecessary costs. With perpetual efforts, the team was able to identify the problems that Airwallex would solve. The FX conversion costs were painful to their pockets, and it was highly tiring and time-consuming when it came to fund transfers. All four of them believed that this could be dealt with if worked on, and hence finally, they founded Airwallex.

With over 100,000 international clientele, Airwallex Global Payment Solutions is trusted for its software and APIs that offer them a world-class experience of global payments and financial operations. Their mission is to build a global financial infrastructure to keep businesses around the world feel empowered 24x7. Over the last nine years, Airwallex has successfully penetrated some of the core global regions and is offering its services and financial products to a huge clientele.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Key Features Of Airwallex

By now, we know that Airwallex offers one single global bank account through which you can use different services and pay for them individually. But there are many Airwallex features that you are yet to explore. Let’s check them below:

- It is used both for individuals and businesses. Airwallex has helped many SMEs, large business enterprises, and e-commerce platforms save time and money with their features, such as borderless cards, FX and transfers, software integrations, global treasury services, and international and domestic payments and transactions.

- For e-commerce platforms, Airwallex supports 130+ currencies in 50+ countries parallel to localized payment options.

- Even with e-commerce transactions, Airwallex makes it safe and secure with 3DS risk engine, PCI, and DSS compliance coupled with SOC 1 and SOC 2 certifications.

- Airwallex has primarily focused on e-commerce by offering integrated payment getaways for e-commerce, seamless cross-border payments, helping set up global bank accounts, and charging as low as zero transaction fees.

- For international FX and Airwallex global payments, it offers cross-border transfers, low conversion fees, and real-time foreign exchange rates. Airwallex maintains complete transparency with no hidden markups on FX transactions, hidden charges, or additional fees with global payment platforms.

- Numerous case studies show how Airwallex has helped many firms with its expense management tools, charges no monthly fees, and is well-integrated with accounting software such as QuickBooks and Xero.

- For business banking, Airwallex offers virtual and physical corporate cards that offer seamless payments and integration. Yes, not to forget, with multicurrency accounts, Airwallex allows you to receive and make payments in different currencies. Airwallex is ready to offer you access to quick credit and loans as they understand your business needs.

- Zero charges on international and domestic payments and transactions with Airwallex FX services are the key attractive features that sparked the success of Airwallex.

- With a "pay as you go" pricing policy, Airwallex has completely revolutionized the fintech platforms' pricing strategies. Airwallex is simple, and that is what makes it smart. You do not have to worry about searching for different plans and paying extra charges for features that you are not even using. Airwallex API integrations with accounting software help in data management and syncing customer information.

- Some key figures to note are 60+ countries to open local currency accounts over 180 countries from where Airwallex makes payment acceptance possible. 150+ countries where you can make transfers, and yes, do not worry about the payment period; 90% of the transfers done by Airwallex arrive within the same day. All of this is via one single fintech platform.

- 60+ countries are accessible with the facility to open local currency accounts.

- 180+ countries from where Airwallex makes payment acceptance possible.

- 150+ countries where you can make transfers.

- 90% of the transfers arrive within the same day.

- All of this is done via one single fintech platform.

Airwallex vs Traditional Banking Solutions

Here, let us clearly understand that Airwallex is not a bank. In many countries and jurisdictions, it seems mandatory to have a proper traditional bank account to operate your business transactions. However, for any business owner or enterprise, this is not always a viable option. This is where Airwallex comes into the picture, though it is not a bank, but abides by all the regional and foreign regulatory and compliance requirements.

A simple Airwallex vs banks comparison can help you understand how Airwallex is miles ahead and how it is also the need of the hour to ensure that modern business banking solutions are put in place.

- Banks require a proper domestic address and even citizenship details. On the other hand, Airwallex offers one single global account operated online that is swift, smart, and secure.

- Banks have a minimum balance requirement, but Airwallex does not.

- Banks are old-school institutions with limitations. They often require customers to visit branches for paperwork and account concerns. You will never have to worry about this with Airwallex.

- Banks have different types of accounts and demand additional fees for international payments. Again, that is not the case with Airwallex cross-border payments.

- Banks charge annual maintenance fees and card service charges, while with Airwallex, you only pay for what you use.

- With banks, there will always be a risk of accepting payments from a different currency as your bank account may not support it. Still, again, Airwallex's whole purpose is to help businesses send and receive money in multiple currencies.

When it comes to speed, cost and ease of cross-border payments, it is safe to say that the whole debate of traditional banking vs fintech solutions is old and boring. Fintech is taking over the banking system and is all set to bring a dramatic shift in how things are going to work in the next three to five years. We have already witnessed some of the key advantages that Airwallex has over banks when it comes to businesses and SMEs.

Banks have a slow processing framework, which can discourage a business owner, but with Airwallex, everything is managed within minutes, just with a few clicks. SMEs looking to expand their business internationally should never think of opening a traditional bank account. It is a tiring and time-consuming process. On the contrary, Airwallex will let you enjoy all those services online. In fact, Airwallex will do one better for your business. It has access and network to over 150+ countries for cross-border payments, something even banks don’t have.

Airwallex For Businesses

Airwallex is a one-stop shop in fintech services, not only for individuals but also for small to large enterprises and e-commerce businesses. With its expense management framework, Airwallex helps businesses resolve their expense pain points.

Airwallex for businesses offers features, like assigning expenses to the right accounting categories, which helps businesses track expenses most efficiently. There is also an option to upload and track expense receipts, which makes it easy for businesses to have full transparency and visibility of purchases, and all are streamlined in one place.

The superb integration of Airwallex with accounting software assists in syncing expense data in real time which leads to easy reconciliation and closing of books. As far as SMEs are concerned, Airwallex is committed to working with them and helping them achieve global market access. For many SMEs, the best way to become impactful is to expand their customer base, especially if it can be done globally.

How does Airwallex help SMEs, you ask?

Airwallex offers services like borderless cards, cross-border payments, and global bank accounts for different currencies. When it comes to paying local suppliers and vendors, allowing customers to pay in their local currency and making a profit out of foreign exchange and conversion fees, Airwallex is the answer you seek.

With Airwallex by your side, you don’t have to open local bank accounts. With an Airwallex global account that can be opened within minutes, you save a lot of time and effort for your business with no excessive paperwork to handle. This global account lets you collect payments from global customers in their preferred currency.

Airwallex’s FX and Transfers feature lets you access market-leading FX rates and pay suppliers in 150 countries and 45+ currencies.

The key benefits for businesses, large and small enterprises, include the following:

- The whole payment process becomes seamless.

- Cross-border payments become swift.

- Using an Airwallex global bank account is highly affordable compared to traditional banks and other fintech platforms. It is cost-saving and encourages operational efficiency.

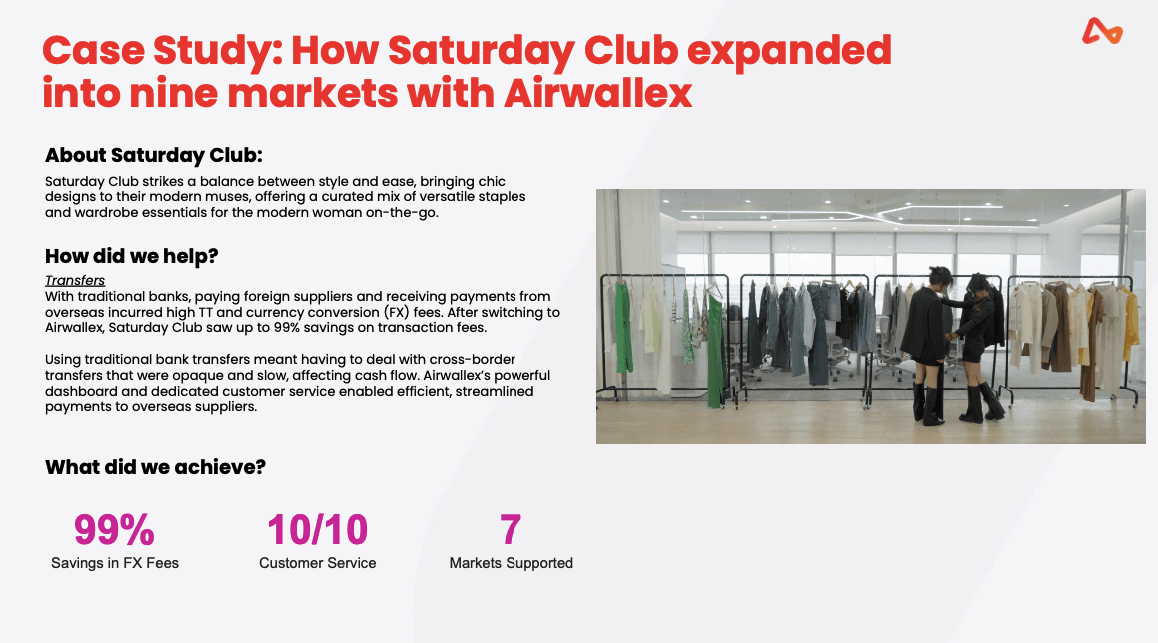

From Airwallex case studies, we have some success stories to share:

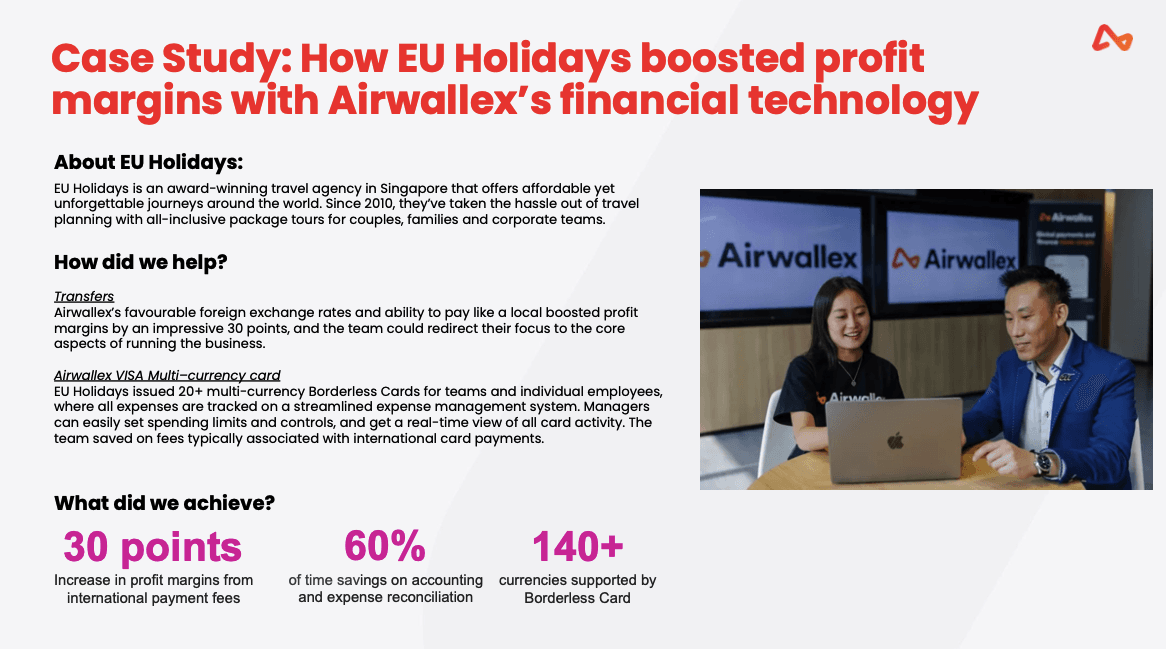

- Airwallex helped EU Holidays, an award-winning Singapore-based travel agency, boost profit margins. The business agreed to save 60% of time on accounting and expense reconciliation.

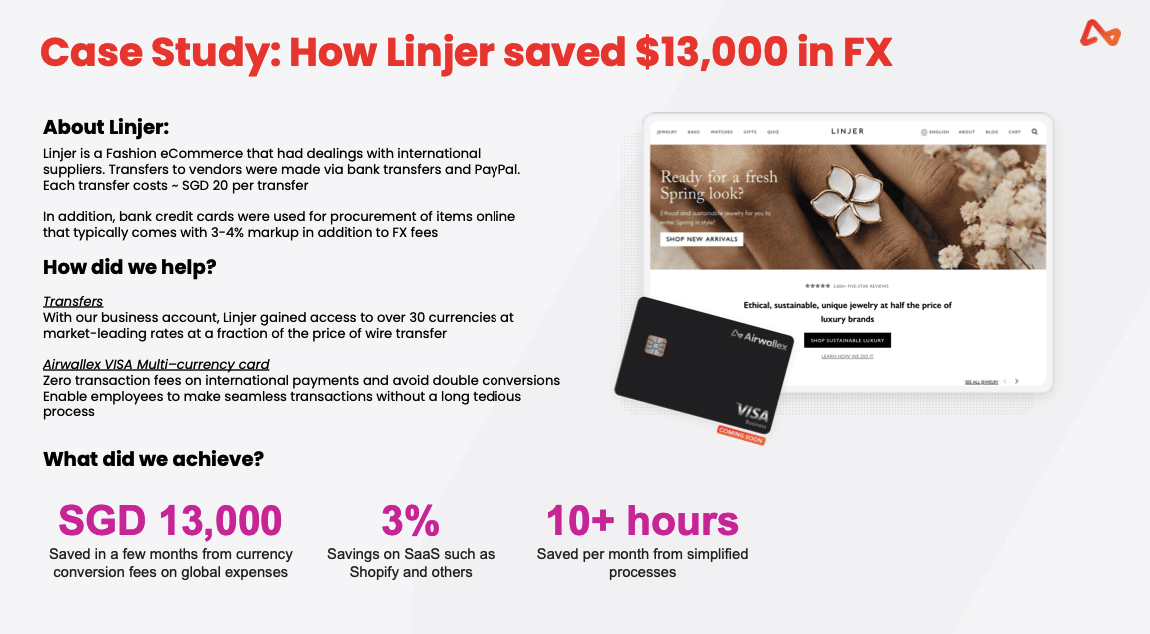

- In the second case study, Linjer, a fashion e-commerce company, saved $13,000 in FX using Airwallex business solutions.

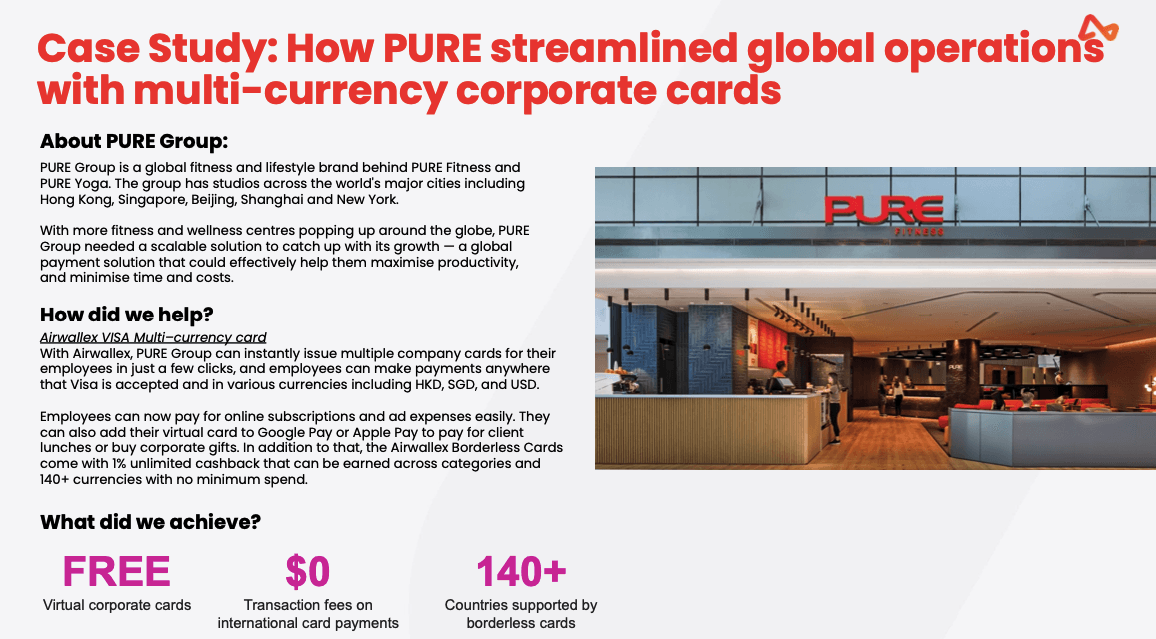

- PURE Group, a global fitness and lifestyle brand, achieved $0 in transaction fees on international card payments and 140+ countries supported by borderless cards.

- Lastly, the Saturday Club successfully saved 99% of its money in FX fees using Airwallex fintech solutions.

Security And Compliance At Airwallex

Airwallex has a strong commitment to strong security, compliance and data protection concerns. All the certifications and legal documentation can be checked on Airwallex’s trust center. Speaking of data security, all activities within the platform have restricted access and are monitored and audited by authorized personnel only. Everyday encrypted backups of voluminous data are initiated with routine recovery testing.

Airwallex only erases data from its cloud infrastructure if required with encryption-at-rest, encryption-in-transit, and physical security at its place all the time. The fintech platform complies with -

- GDPR

- PCI DSS

- SOC 1

- SOC 2

- Visa Service Provider

Airwallex security is also in process with its compliance with ISO 27001 and CSA STAR. Airwallex maintains the trust and safety of its users through comprehensive compliance with all global financial regulations. Airwallex is not a bank, yet it ensures the security and protection of customer’s money, data and personal information.

Airwallex compliance is deep and exhaustively detailed with every region they operate in. Every user must go through the KYC process, where all the information for account purposes is taken, and potential red flags are marked.

Airwallex is committed to working only with trusted partners who are also parallelly aligned with the compliance and regulatory requirements. Collaboration also allows Airwallex to grow and makes operations easy and swift.

Under the Airwallex data protection concerns, all employees are required to undergo security training on a yearly basis. This induces awareness and knowledge in the organization. Lastly, with automated transaction monitoring, alerts are made based on customer behavior and certain account activity.

On its legal part, Airwallex has its cyber insurance, strong privacy policy and firewall and data loss prevention executed.

Pricing And Fees Structure

You know, we believe that Airwallex has actually cracked the code of attracting customers and making them stay. The code is just keeping it simple.

The number one thing that any customer around the world for any product or service thinks about the most is how much it is going to cost them.

When it comes to paying the price, everyone is looking for a bargain, a discount, a free service, but you know what they are not looking for at all? Complexity, additional costs, and hidden charges. We think this is where Airwallex has hit a home run by just keeping it simple and transparent.

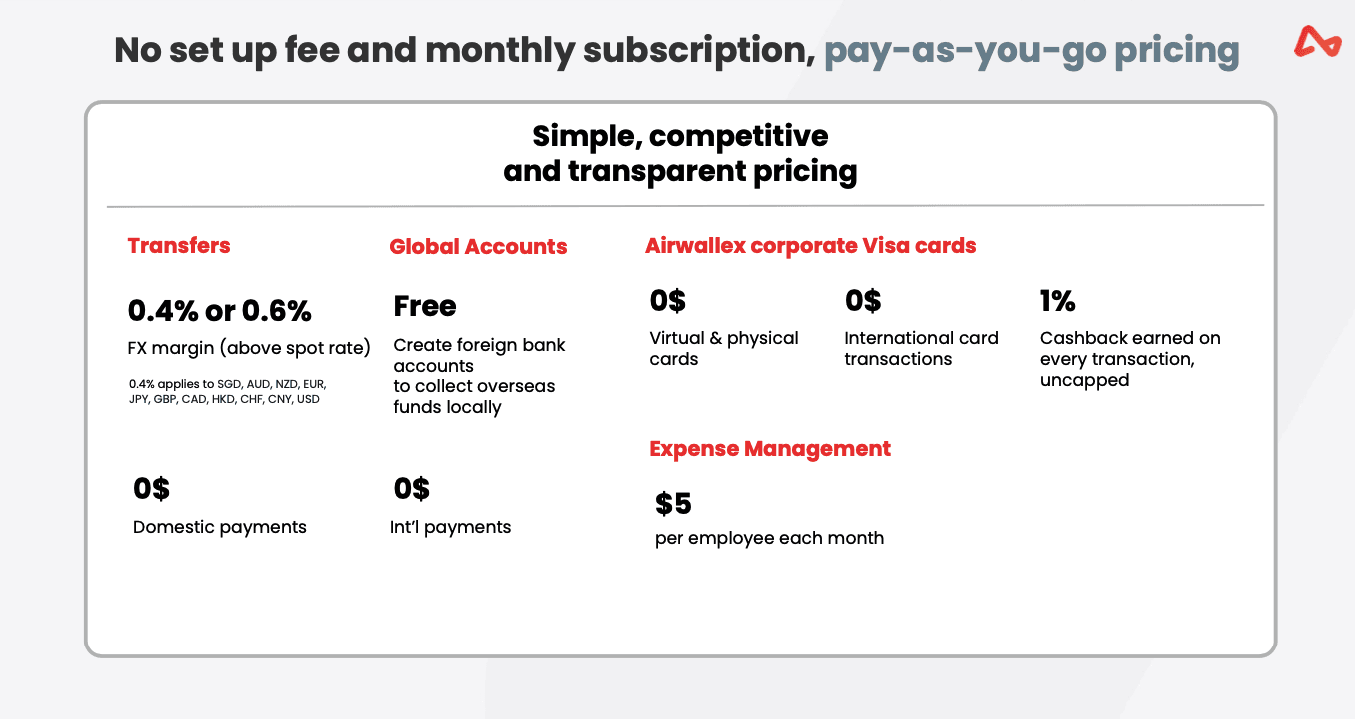

Airwallex follows a pay-as-you-go pricing model. This simply means you only pay for what you want. That’s it.

- Airwallex literally charges $0 for most of its services; you get a free foreign bank account to receive foreign funds locally.

- There is $0 charged for virtual and physical cards + $0 fee for international card transactions.

Wait, there’s more. You will receive a 1% cashback on every uncapped transaction. - Airwallex charges $0 for international and domestic payments.

- For employees’ of Airwallex, the expense management charges are $5 per employee per month.

- Airwaves charges 0.4% to 0.6% above the spot rate in FX margin transfers. The 0.4% applies to 0.4% applies to the following currencies: SGD, AUD, NZD, EUR, JPY, GBP, CAD, HKD, CHF, CNY, USD.

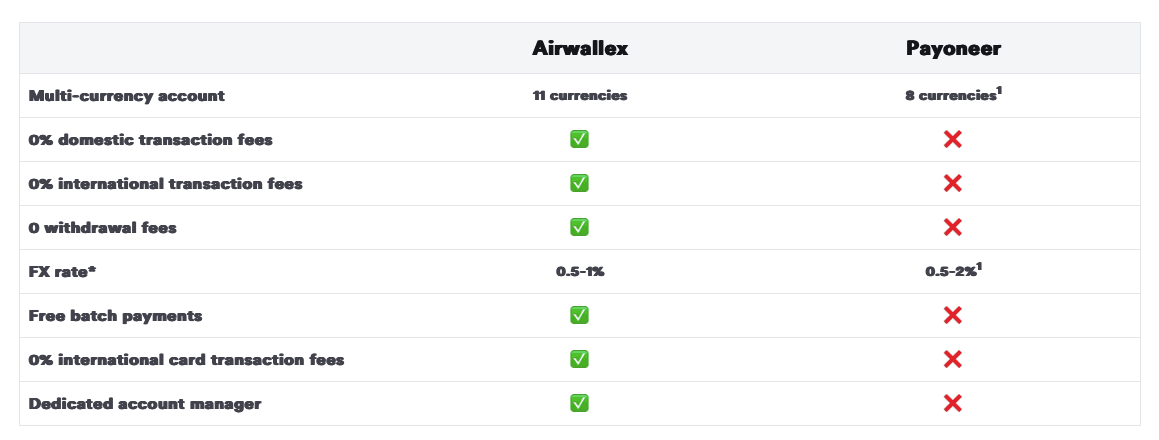

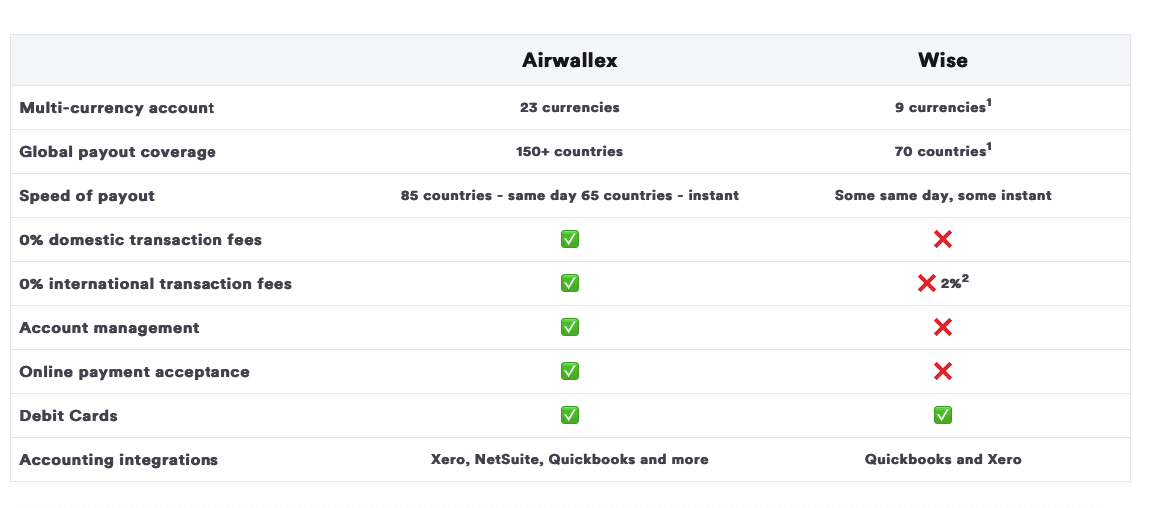

Now, to make it more obvious for you, we have here two tables where we have compared the Airwallex pricing with two of its competitors, Payoneer and Wise.

It is easily noticeable that Airwallex fees are much more convenient and have a better scope of services. The most interesting part is that both Wise and Payoneer charge a fee for international and domestic transactions, but again, Airwallex charges none.

This Airwallex cost comparison paints a truer picture of how other platforms are expensive and offer limited service.

Pros And Cons Of Using Airwallex

We especially added this section because we wanted you to have a clear understanding of what to expect and what not out of Airwallex. Below, we have drafted some of the key pointers that will draw a clear picture of the pros and cons of Airwallex in front of you. We never said that there are no drawbacks of the online finance platform but we are sure that the pros will severely outweigh the cons in this list.

Pros:

- The benefit that keeps most of the Airwallex clientele happy is the lower cost for cross-border payments with fast local transfers. Try and see yourself as you leverage Airwallex's proprietary local network to deliver funds swiftly and with no transaction fees at all.

- Airwallex has one of the best user-friendly APIs. You can never go wrong with its user interface; it's that simple. Airwallex is available for both Android and iOS.

- The fintech platform has a wide coverage. You can transfer to 90+ countries using their local clearing system with instant payout support from 60 other nations.

- Airwallex offers a wide range of financial services, from expense management, multi-currency wallet, FX transfer and conversions, global business accounts, borderless cards and cross-border payments.

- One of the best benefits is using batch transfers. You can send funds to multiple recipients around the world in one go, each with a different amount.

- There are a series of authentic Airwallex reviews that you can check out to understand how well-integrated the Airwallex framework is.

Cons:

Now let us move to some of the drawbacks that Airwallex has -

- Only a few limitations are experienced by some users in personal payment services, which are negligible from a business perspective.

- Although they have a strong network and services linked to so many nations, there is limited availability when it comes to certain nations.

We believe that the list says it all, there are many pros of using Airwallex but only a few cons that the company should already be working on. So, now if anyone asks, is Airwallex worth it? You can unhesitatingly tell them, it surely is.

How To Get Started With Airwallex

Unlike other fintech platforms, Airwallex does not complicate processes and plans. It only has one main business account with a full range of services and features, and you only pay for what you use. Here is a step-by-step guide to the Airwallex sign-up process -

- Visit the Airwallex website

- Click on “Get Started”

- Select the country location and business type

- Fill in your personal and contact details

- Choose a password

- Simply follow the instructions that appear on the screen to create your account.

- When asked, upload the required documents

- Confirm and wait for an email confirmation

If you have a big business, Airwallex does offer custom pricing plans as well.

Many people ask the same question: how to use Airwallex and how long does it take to get an Airwallex business account ready?

You may need to wait for at least one to three business days. This is the time required for identity verification and documentation processing. It is highly advised to avoid any delays to have all the important documents and paperwork ready with you.

Double-check the information you are entering on the website. Make sure that you comply with all the requirements of the account application. A few documents and procedures may take time, but getting started with Airwallex is easy. It has a user-friendly interface, and you can find almost everything that you are looking for just right there.

Airwallex Alternatives

Like any other industry or product, there are always big or small competitors present in the market offering similar services. The same goes for Airwallex. Transferwise, Revolut and Payoneer are considered some of the best Airwallex alternatives and competitors.

Transferwise

Founded in 2011, Transferwise is headquartered in London. It is formally known as Wise after their subproduct. Although opening a regular account with it is free, it charges a 1.36% minimum on sending money.

Payoneer

Founded in 2005, it is headquartered in New York, US. Just like Transferwise, this platform is also known for charging a fee for both domestic and international payments and transactions.

Revolut

It is again a London-based fintech company offering similar services to Airwallex. This company was started in 2015. So, it shares the same business age as Airwallex.

As you have already seen, we have compared the pricing and fee models of Payoneer and Wise. It is safe to say that Airwallex offers some of the best financial services at low or zero cost, and it is the same reason why it is successful in making its mark and leaving behind other players in the market who were already in the business before it.

In a nutshell:

Although Revolut, Payoneer, and Wise are all the best Airwallex competitors, Airwallex still managed to give them strong competition because of its simple and easy pricing. The company has better reach across nations and has well-established offices with a workforce of around 1500 employees. Even if the competitors can match that, they can never match Airwallex's pricing policy, which is based on the "pay-as-you-go" model.

When it comes to Airwallex vs Payoneer vs Transferwise, the number one reason that we have already underlined why you might choose Airwallex over its competitors is $0 charges on physical and virtual cards, free business account opening and $0 charges on domestic and international transactions. Not to forget, Airwallex is known for its surprisingly low FX rates also.

Conclusion

Started by four entrepreneurs from a small cafe in Melbourne, today Airwallex houses almost 1500 employees across their 23 international offices. The company currently stands at a valuation of $5.5 billion. There is a series of authentic Airwallex reviews and case studies to show how Airwallex has helped clients with business and fintech solutions.

Airwallex is known for its easy-to-use APIs, borderless cards, global business accounts, competitive FX rates, and conversion services, cross-border payments, digital wallet, and business banking facilities. Since its inception in 2015, Airwallex has completely changed the way people look at fintech and international payments. Airwallex for businesses has successfully garnered more than 100,000+ clients from different parts of the world. Not only has it made its mark in the fintech industry, but it is working relentlessly to offer more and more services to its customers compared to its competitors. With its easy pricing, simple plans, and competitive FX rates, Airwallex has revolutionized the financial services’ and SaaS market.

It is safe to say that if you are someone who is looking for fintech solutions and a one-stop solution for all your international payments, expense management, currency-based accounts, FX conversions, and borderless cards, Airwallex is just the right platform for you.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.