The Growing Risk of AI-Generated Fakes in Financial Documents

Table of Contents

Introduction

The introduction of generative artificial intelligence or AI tools has the potential to have a significant impact on financial systems across the world. While there are many positive effects of these technological innovations, there are growing concerns related to the use of AI tools for fraud involving financial documents.

According to a 2024 report published by the Association of Certified Fraud Examiners or ACFE, organizations are losing roughly 5% of their revenue on account of fraud every year. What is worrying is that scammers and fraudsters mainly conceal their crimes by altering files or via the creation of AI-generated financial document fakes, and these are now simple processes because of AI tools.

Indeed, people can now utilize AI-generated financial document fakes, for example, fabricated receipts and invoices, fake identity documents, etc., to commit fraud. Awareness is key if you want to avoid losing your money because of such illicit practices. Hence, in this article, we will be discussing how fraudsters use different AI tools to fabricate financial documents and what measures you can take to avoid losing your money to illicit activities

You Can't Trust Your Eyes Anymore

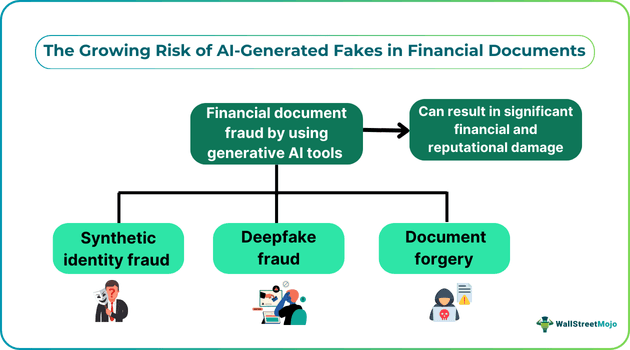

Financial document fraud via the misuse of AI technologies can involve utilizing counterfeit or fake content. The content manipulates systems or deceives or manipulates people and systems, bypassing security measures. Broadly speaking, some common variations of fraud using AI are as follows:

- Synthetic Identity Fraud: This involves combining stolen data with false information to create fake identity documents. The purpose of using such documents is to perform unauthorized financial transactions, open bank accounts, avail of financial assistance from lending institutions, etc. One may also engage in such activities to pose as the founder or the chief executive officer of a company and commit fraud through AI-generated financial document fakes.

- Deepfake Fraud: Deepfake risks in finance are a matter of serious concern. According to a report published by Entrust Cybersecurity Institute, digital document manipulation utilizing deepfakes is one of the growing threats in the financial services space. Fraudsters often utilize this technology to make people believe fake financial information in documents, which leads them to carry out fraudulent transactions.

- Document Forgery: This type of financial document fraud may involve the use of generative AI tools to make changes to key financial statements, financial records, tax returns, or important reports. As a result of this fraud, a business may suffer substantial losses. Moreover, the leadership team may even lose the trust of key stakeholders, and when trust breaks down, the company may fail to achieve its predetermined objectives.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Fake Documents, Real Consequences

Generative AI is allowing fraudsters to create fake documents at scale, and organizations are finding it extremely challenging to spot them until it is too late. While these documents are fake, the repercussions are real. AI-generated financial document fakes can cause irreparable damage to the reputation of individuals and the organization. Moreover, the victim may suffer substantial financial losses, from which it might be extremely challenging to recover.

Hence, it is important for businesses as well as individuals to be aware of document forgery, synthetic identity, and deepfake risks in finance. They must ensure that effective security measures are in place when sharing data with other parties via financial documents, including receipts, invoices, bank statements, loan applications, agreements, tax returns, etc. Keep in mind that for companies, failing to have proper security measures to protect key stakeholders may lead to legal consequences.

Human Checks Aren’t Enough Anymore

With generative AI tools getting better with time, you shouldn’t believe whatever you see. Indeed, manual checks are simply not enough anymore to identify AI-generated financial document fakes. The ability of AI tools to create realistic documents is forcing businesses to change the way they approach financial document verification.

The conventional way of visually inspecting invoices, receipts, and other financial documents is becoming outdated quickly. Organizations need to consider validating using security technology like multi-factor authentication. They can also integrate improved security features into financial documents. A popular example of such features is encrypted quick-response or QR codes. Using a QR code in a document can help organizations or individuals verify whether the content is original or human-generated.

In addition, it is vital to remain informed regarding the evolving generative artificial intelligence frauds. For that, individuals may consider collaborating with security providers, organizations, and service providers that specialize in assisting entities to keep up with the latest fraud tactics and the ways to prevent or nullify them.

What Else Can You Do?

In addition to taking the above measures, businesses may consider using AI in financial security. AI-based fraud detection measures involve executing machine learning or ML algorithms to analyze documents and identify anomalies, for example, layout inconsistencies, font discrepancies, and more irregularities.

Such systems set up normal baselines that allow flagging documents that feature deviations from anticipated patterns. Moreover, these systems compare the documents with databases comprising legitimate and verified documents to spot manipulation signs. There are readily available online tools, like the Undetectable AI image detector, that individuals and organizations can utilize to identify fake documents.

Individuals can understand how AI in financial security with regard to documents works better by going through the following points:

- Optical character recognition, or OCR, converts scanned PDFs or images into text that is machine-readable. Businesses and individuals can even use reliable online image to text converters to quickly extract text from questionable documents before running additional AI-based validation. After that, AI improves the low-quality images in the financial documents and extracts vital data for the purpose of analysis.

- Artificial intelligence and machine learning algorithms compare the details of the document against the normal baseline established by the system to spot inconsistencies, for example, altered photos, names, figures, etc.

- Some advanced AI systems may integrate fingerprint matching and facial recognition to spot AI-generated financial document fakes.

Lastly, the system will assign risk scores to the documents based on the in-depth analysis. Based on that, individuals may consider further investigation.

The Pressure Is Not Going Away

AI technologies are becoming more and more advanced with time on account of continuous innovations. Hence, the pressure on companies and individuals to keep up with the latest developments does not appear to be ceasing to exist anytime soon.

Newer versions of AI tools are being launched with capabilities to create more realistic fake documents that can evade security AI-detection systems. These tools and software are putting businesses and individuals at significant reputational and financial risk. This is because they might end up authorizing payments unknowingly to fraudsters.

Additionally, they might even end up disclosing confidential financial information by mistake. This, in turn, can have serious repercussions. Hence, it is vital to avail of relevant services and solutions that can safeguard them from AI-based document fraud.

Final Thoughts

With AI-generated financial document fakes becoming a growing concern for companies and individuals around the world, it is imperative to be aware of the potential dangers. Moreover, entities must take the necessary precautions and establish systems that can detect and neutralize such threats. Failing to do so can cause irreparable damage from both financial and reputational standpoints. Additionally, since AI technology is improving rapidly, it becomes vital for people to continue upgrading their fraud prevention and detection strategies to steer clear of fraud.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.