Table Of Contents

What Is Agency Theory?

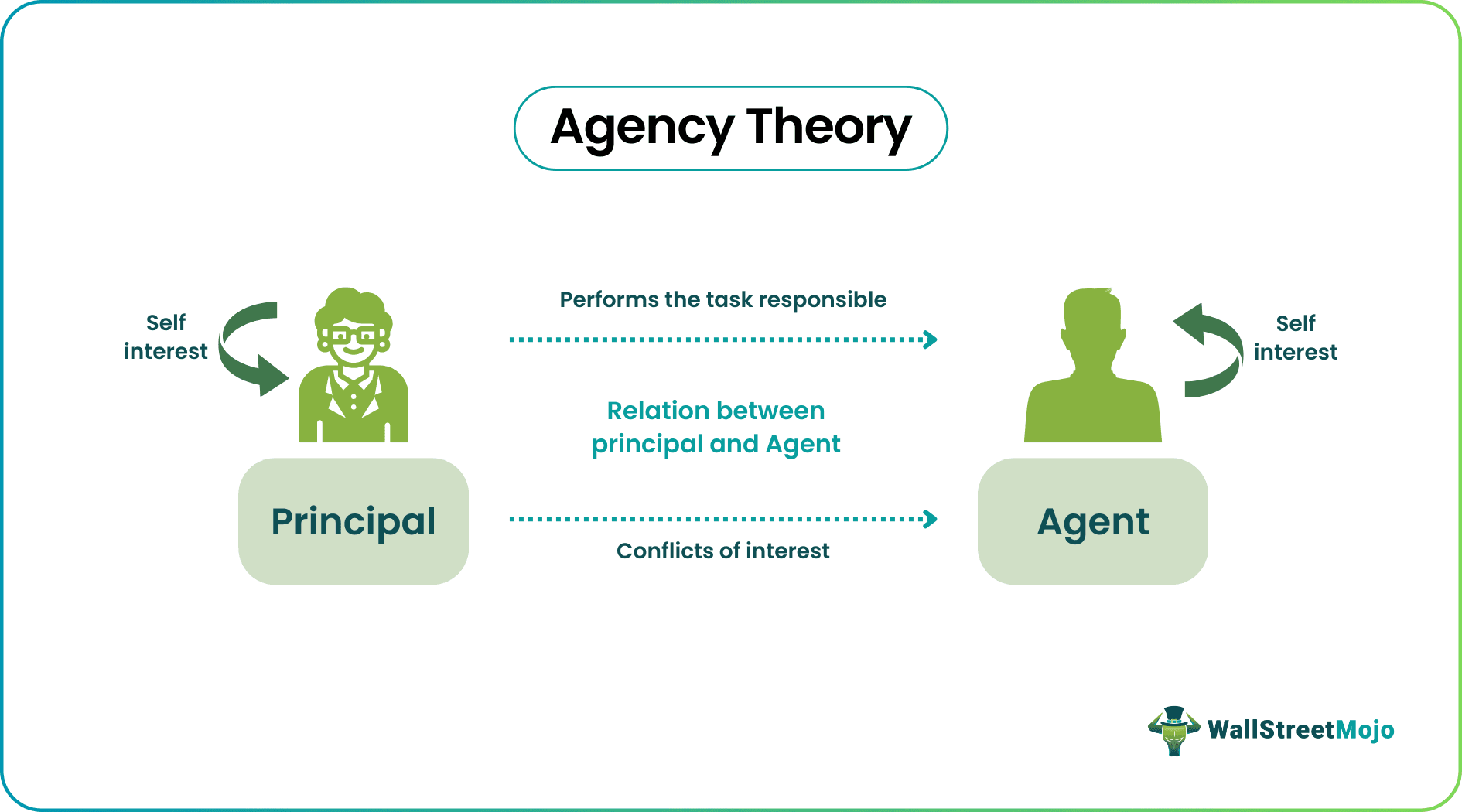

Agency theory refers to a principle that focuses on the relationship between principals and their agents. The principal is a superior entity, and they delegate work to the entity known as agents. Michael C. Jensen and William Meckling popularized the agency theory concept.

In a business scenario, shareholders are the principals, and company executives are the agents. In a political context, elected representatives are the agents, and their constituents are the principals. The theory points to the conflict of interest and priorities between principals and agents. Conflict occurs when they are engaged in achieving a specific goal and agents act on behalf of the principal.

Key Takeaways

- Agency theory definition portrays it as a principle that focuses on the relationship between principals and their agents. Michael C. Jensen and William Meckling popularized the concept.

- A company's board of directors and the CEO is an example of a principal-agent relationship where the board of directors is the principal, and the CEO is the agent.

- It can be applied to resolve disputes between principals and agents. However, it also has disadvantages like narrow focus and a limited set of presumptions.

Principal Agency Theory Explained

The agency theory analyses the issues and solutions surrounding task delegation from principals to agents. The principals appoint the agents to perform specific duties. Agents are given authority to complete the duties or work assigned. The issues arise because of conflicting interests and information asymmetry between the principal and agent. The theory discusses setting up agency relationships to minimize the likelihood of disputes and other problems between agents and principals.

The types of agency theory can be positivist and principal agency theory:

- Positivist studies have concentrated on defining scenarios in which the principal and agent are likely to have divergent aims and then detailing the governance frameworks that restrict the agent's self-serving or self-interest conduct. For example, the agent is more likely to operate in the principal's best interests when the agreement between the principal and agent is outcome-based, or the principal has information to verify the agent's actions.

- The principal-agent researchers focus on the principal-agent relationship and interaction to create the ideal contract between the principal and the agent. Also, a behavior-based contract is the most effective since the principal purchases the agent's conduct in this situation. Also, Because the agent is thought to be more risk-averse than the principal, an outcome-based contract would unduly pass the risk to the agent.

Types Of Agency Theory Relationship

Some of the important types are:

1. Shareholders and Company Executives

In this relationship, the company executives serve as the agents and the shareholders as the principal. Investors, in this case, are the shareholders who fund the companies run by company executives. Furthermore, the actions taken by the company's management will determine the potential impact on the investment. Therefore, the firm management must make wise decisions.

2. Board of Directors and CEO

The CEO (agent) serves the board of directors (principal). The board of directors would support the CEO if he can make profitable decisions. On the other side, the relationship between the board of directors and the CEO might be problematic if the choice made by the CEO hurts the company's financial situation.

3. Investor and Fund Manager

The fund manager is the agent, while the investor is the principal. The investor gives the fund manager a fee, a percentage of the fund's average assets under management (AUM). In this scenario, the fund manager allocates the money per the investor's preferences. If the fund manager can assist the investors in gaining profits above average, they can develop a close relationship. Alternatively, if the fund manager reports a loss or profits lower than expected, the relationship between the investor and the fund manager would be affected.

Examples

Let us look at the agency theory examples to understand the concept better:

Example #1

Employees are agents, while employers are the principals in agency theory. Employees are hired in a company to work toward the organization's goals. However, the increasing number of corporate scams affects employer and employee relationships. Employees violate the organization's ethics, which results in significant financial and reputational damage. Sometimes the damage done by corrupt employees is irreversible, and an organization ultimately has to wind up the business.

Example #2

The way a country's government functions is among the most prevalent examples of agency theory. The people choose political representatives to govern the nation in a way that best serves their interests. Representatives of various political parties promise voters that they will bring reforms in line with the interests of the country's citizens. However, voters feel deceived when their elected officials do not fulfill guaranteed promises. Here, the electorate serves as the principal and chooses the public servants as their agents.

Advantages & Disadvantages

Let us look at several advantages and disadvantages of the agency theory in corporate governance:

Advantages

- It resolves the disputes between the agents and the principals

- The incentives motivate the agents, reducing losses to the firm or the organization.

- Another strategy to cut agency loss is compensating agents according to performance.

- Conflict is less likely to arise if there is transparency between the principals and the agents.

Disadvantages

- Its limited behavioral presumptions and theoretical focus are one of its drawbacks. A larger spectrum of human motivations is ignored by agency theory since it primarily emphasizes self-interested and opportunistic human behavior.

- Procedures defending shareholders' interests may interfere with implementing strategic choices and limit collective activities. Hence, control mechanisms recommended based on agency theory are not only expensive but also commercially unsuccessful.

- The theory has been criticized for oversimplifying organizational conflict and for the mathematical complexity necessary to find answers to the agency problem.

Agency Theory vs Stewardship Theory vs Stakeholder Theory

- Agency theory focus on the relationship between principals and agents.

- According to the steward theory, a steward maximizes and safeguards shareholders' wealth through corporate performance.

- Stakeholder theory prioritizes the interconnected relationships between a business and its stakeholders, like customers, suppliers, employees, investors, and communities.