Table Of Contents

What Is After Hours Trading?

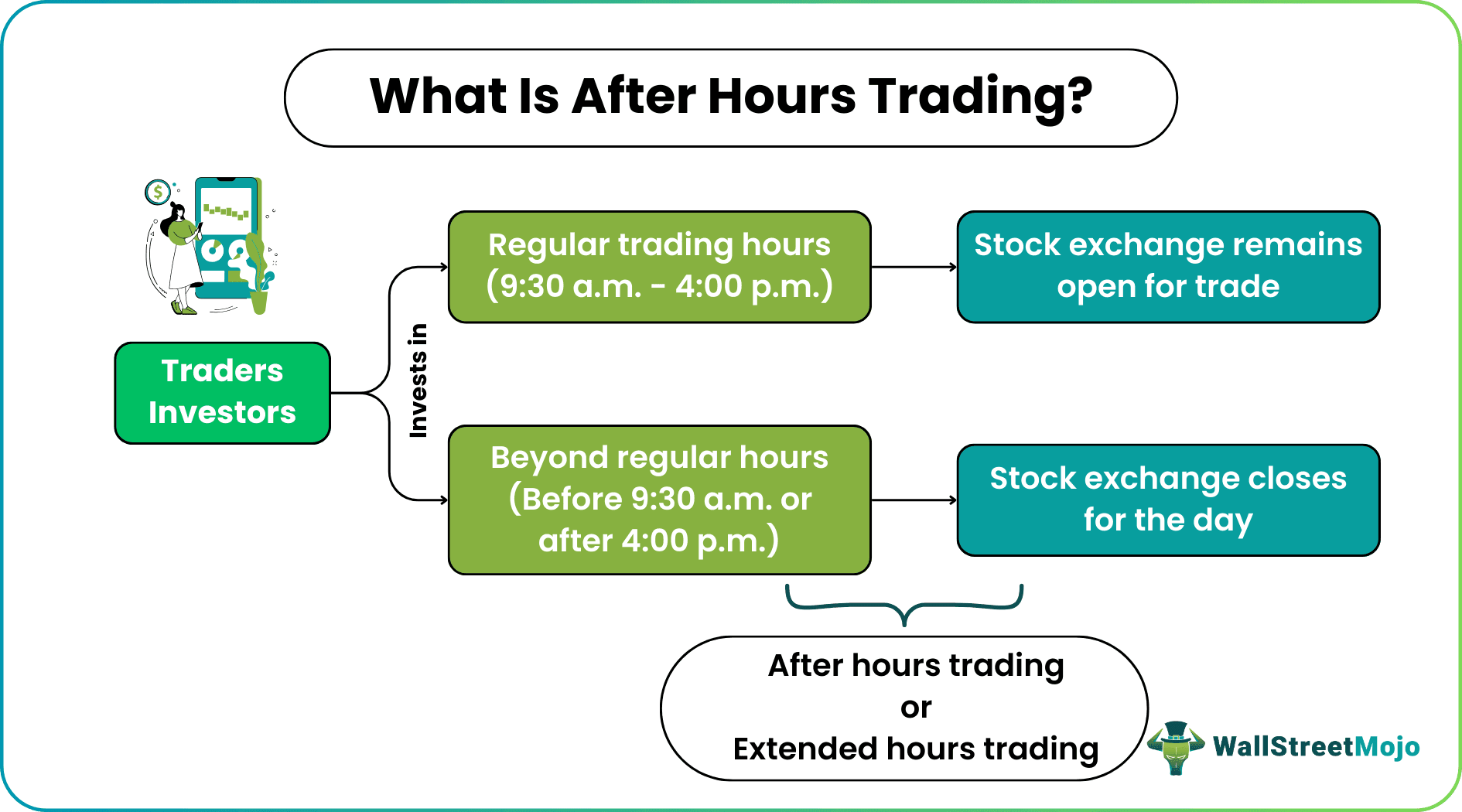

After hours trading refers to taking trades beyond regular trading hours, which is between 9.30 a.m. and 4.00 p.m. EST. Trading in stocks after official hours allows investors to buy and sell securities before and after the normal trading sessions. However, the after-hours duration differs depending on the market situation and trading venues.

Also known as extended hours trading, this option allows investors/traders to purchase and sell stocks even after the stock exchanges close. As a result, the after hours trading times witness no further price movement for the day. From the types of securities available for trade to the type of orders accepted, this trading option has a different set of guidelines that the market participants must follow.

Key Takeaways

- After hours trading refers to the stock trade that occurs beyond the regular trading hours, giving people an option to trade in the securities once the market closes and there is no further price movement.

- The normal trading occurs between 9.30 a.m. and 4.00 p.m. EST every business day.

- It provides comfort to the investors who miss an opportunity to trade during normal market hours and want to execute a trade after the market hours.

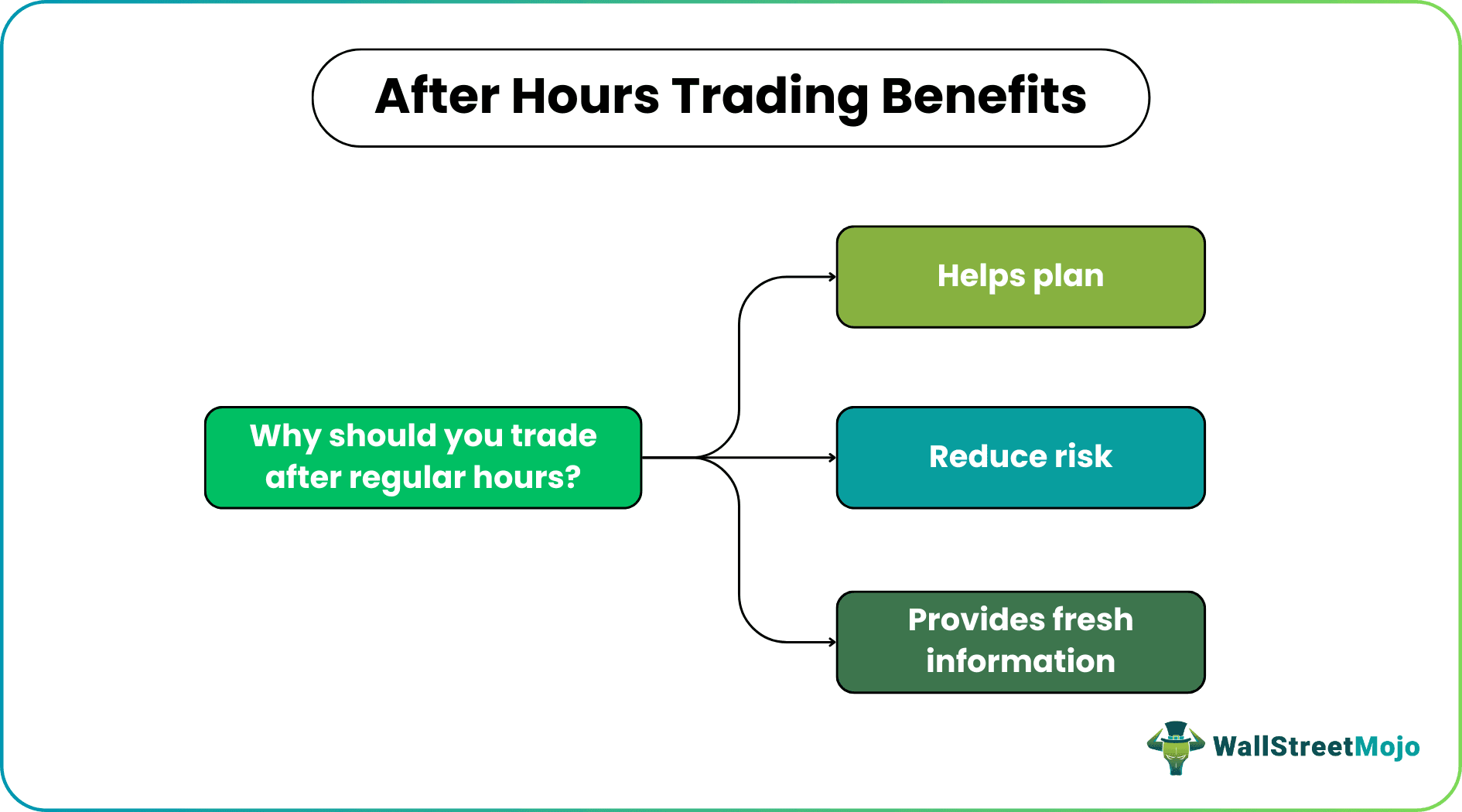

- Getting a chance to plan a trade, reduce possible risks, and make a well-informed investment decision based on fresh information are some benefits of trading in extended hours.

How Does After Hours Trading Work?

After hours trading, as the name implies, is making investments or trading beyond the normal trading hours. Here, investors/traders get a chance to participate in stock trading when the major stock exchanges and the market close for the day. The procedures, the guidelines, and the functioning differ from what the market players observe in the case of regular trading hours. For example, NASDAQ after hours trading would have enhanced limitations compared to the NASDAQ normal hours trading.

While trading in normal hours is all about keeping a check on the exchanges that list the stocks for trade for the day, extended hours trading is when investors have to place orders on an electronic communication network (ECN), which directly connects sellers and buyers. Earlier, this trading type was open to only institutional investors and high-net-worth individuals (HNWIs). However, technological advancements have made it easier for even average investors or traders to participate.

Though after hours trading has its own set of advantages, there are a few restrictions that users must know of. The limitations could be observed in the way orders are placed, the types of financial instruments available for trade, and the platforms making the securities accessible beyond regular trading hours.

Moreover, it is not mandatory for trading platforms or markets to provide this after hours trading facility. They may or may not offer investors the opportunity to trade before and after the regular trading hours. Hence, connecting with brokerage firms to know if the markets are offering extended hours trading facilities is a must. In addition, there are no fixed hours for trading beyond the regular trading period. The duration of the trading session, in this case, would depend on the market and the trading venues.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Reasons To Take Trades After Hours

While the entire world waits for those six-and-a-half hours to invest in stocks, there is a group that looks forward to getting lucky with one chance of after hours trading. Though the regular trading hours are standard choices for traders, the extended hours trade allows investors to plan.

As the stock exchanges close before the extended hours of trading execution, investors get the whole day to plan their trade with respect to their market analysis. The day's price movements are one of the most efficient parameters to study to determine which trade to take after the exchange closes. The best part is that once the regular trading hours are over, no further price movement is recorded.

Thus, based on the prices of the securities and their behavior throughout the day, investors can decide where to invest and how much. Then, traders proceed based on the planning done through the day's observations. As the steps are pre-planned based on the best possible market and stock analysis, the chances of losses or risks get reduced.

Though the traders keep a watch on the prices of the securities throughout the day, they also get a chance to have new information readily available to them after the closure of the exchanges. This, in turn, adds to the factors that help them decide whether to invest in after hours trading stocks or wait for the next time.

After Hours Trading Video Explanation

Examples

Let us consider the following examples to understand how news and announcements affect after hours trading:

Example 1 – Synopsis After Hours Trading

Synopsis' software stock prices increased 4% in the extended trading hours as soon as the company reported its earnings details. As soon as the company announced its adjusted quarterly profit of $2.50 per share, there was a significant increase in the number of trades during the after hours market.

Example 2 – Tesla After Hours Trading

Recently, Tesla announced its second stock split in less than two years. In its June 10 filing, the company revealed that Oracle's co-founder Larry Ellison has decided to quit the company's board, but the tech giant is not looking for a replacement. Instead, the company would reduce the number of seats to seven.

As soon as this news started doing rounds, the prices of stocks that decreased to 42% earlier this year suddenly jumped significantly up to 1.3% during the extended trading hours. The rise in the value made up for the 3% loss recorded that day.

Risks

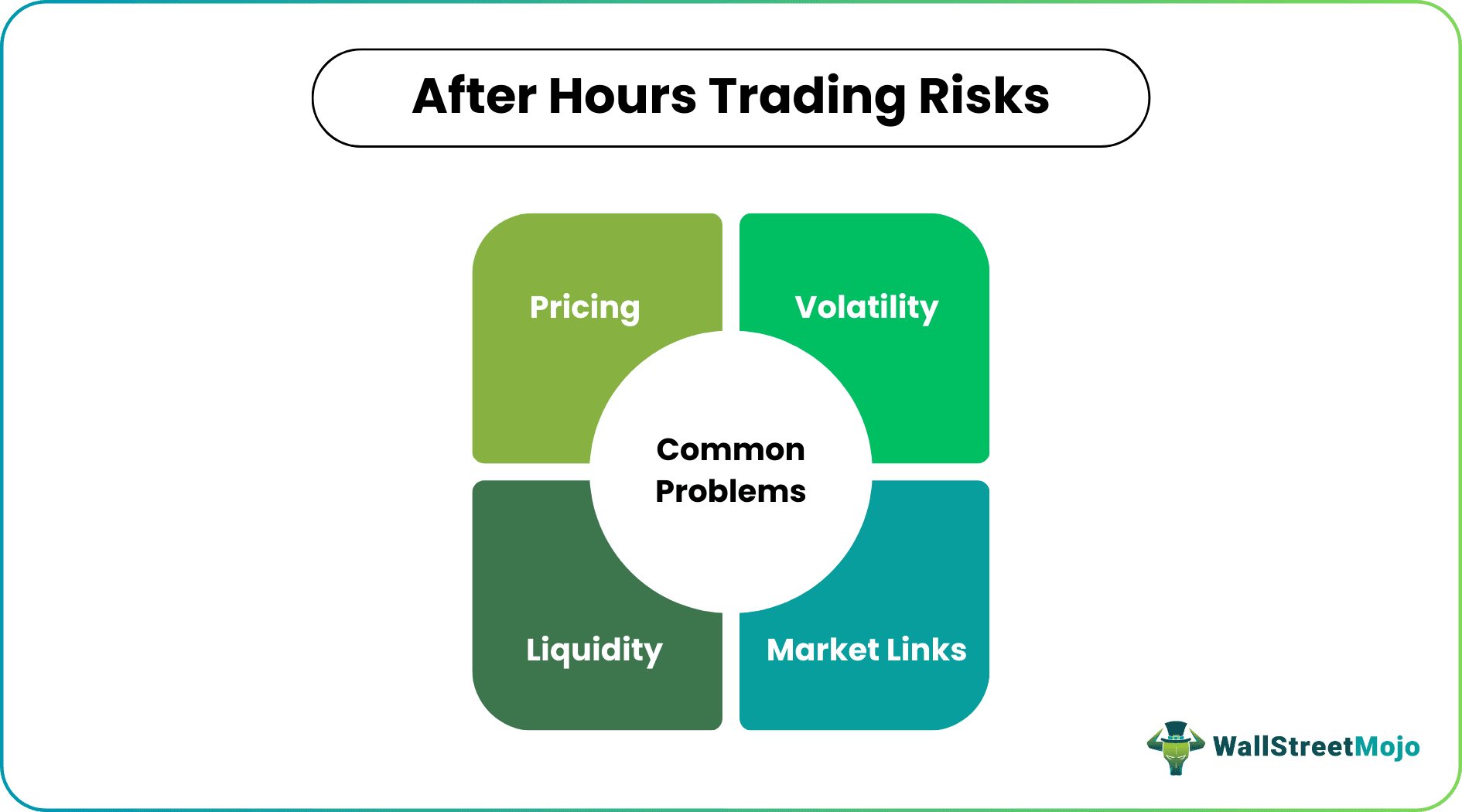

Trading beyond regular hours could be fruitful, but it simultaneously poses a few risks to traders.

The number of traders available for after hours trading is less than that for normal hours trading. As a result, there is less competition as fewer interested traders are involved. Thus, the market liquidity is deteriorates, affecting the ability of the investors to trade in stocks. This lack of liquidity makes companies decide not to make stocks available for trade beyond the regular trading hours.

As fewer interested traders are during the extended hours, the market seems more volatile than during normal trading hours. As a result of the market volatility, prices fluctuate beyond expectations, especially for stocks with limited trading activity.

Next is the pricing issue. The stock prices for after hours execution might not be the same as the prices during the normal trading hours. In short, it might vary at the end of a normal trading session or even when the regular trading session begins for the day.

Normally, this difference in the pricing arises because of the missing links between the after hours trading markets. The stock price displayed on one trading system at one time may not reflect the same pricing for the same stock on another trading system at the same time.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The type of trading occurs and gets executed after the market closes. In the United States, such trades fall under this category when investors or traders take trades beyond 9.30 a.m. to 4.00 p.m., which marks the regular trading hours.

No, after hours trading is not considered a day trading as the orders are meant for that session only. In case the limit order remains unexecuted, the same holds canceled. Investors/Traders would need to place a new order for the next day's trading session.

The trading done in the after-hours session will impact the stock's opening price since the traders consider the latest news and events concerning the stock and the trading done in the stock. For example, if there is news out on the internet that there is a trade war between the Middle East and the US, traders may take sell positions in the stock in the after hours session, expecting the market to go down the next morning to earn profits.