Table Of Contents

Affiliated Companies Meaning

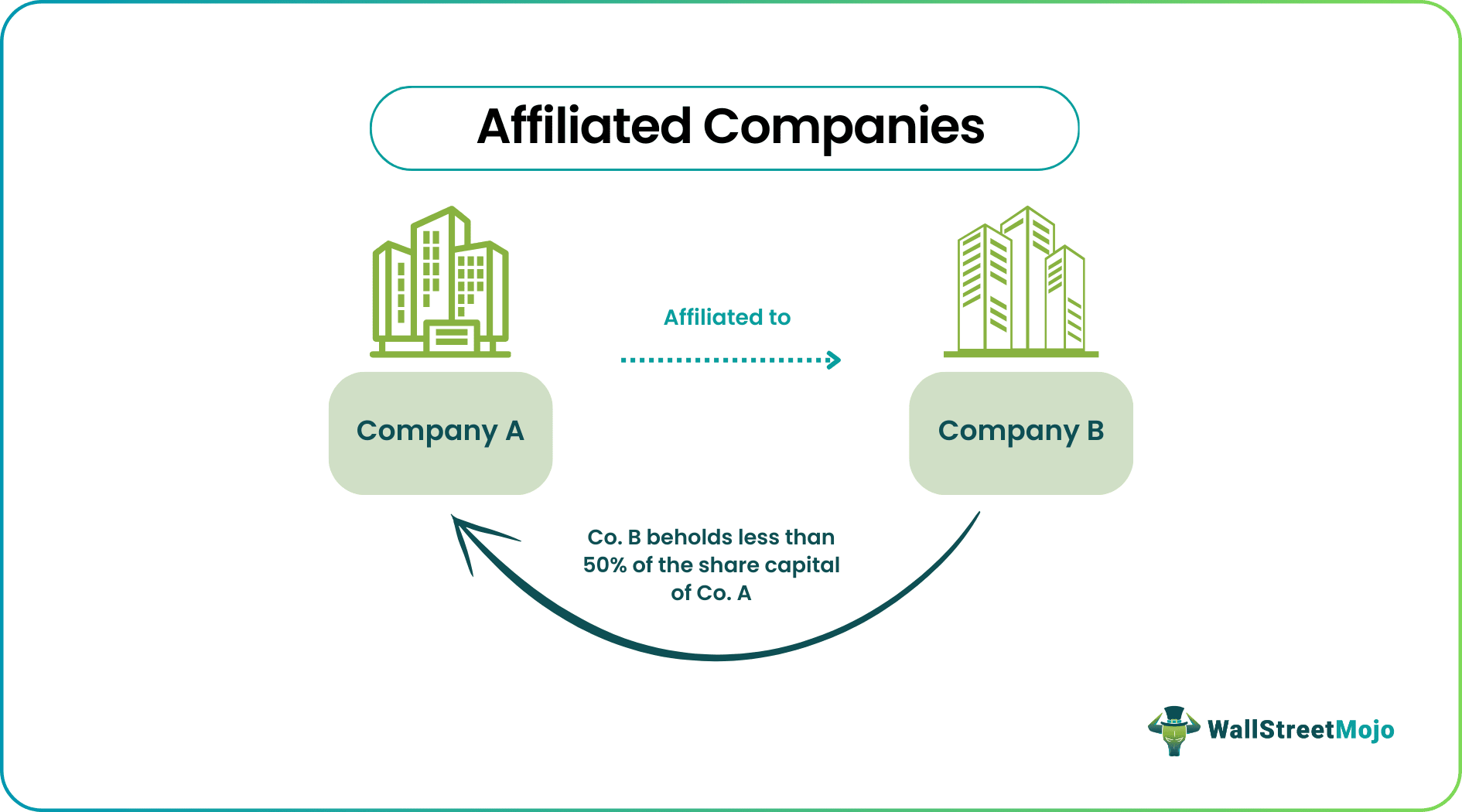

Affiliated companies can be described as an entity (company) in which another company holds less than 50% of its share capital, i.e., having a minority interest in another company. Moreover, two companies can also be affiliated if a third company has controlled both.

There may be various reasons for companies to get affiliated with each other, like for controlling the business chain, a synergy of operations due to combined operations, or for investment purposes. In the case of a subsidiary company, another company holds more than 50% of the equity share capital of that entity, which grants controlling interest to the parent company (holding company) and can affect day-to-day operations, management decisions, etc. Also, the parent company has the power to elect a board of directors of subsidiary companies.

Key Takeaways

- Affiliated companies are entities that share common ownership and control, typically through a parent company or a common controlling entity.

- Affiliated companies often have close business relationships and may engage in collaborative activities, such as joint ventures, shared resources, or coordinated strategies.

- Affiliated companies may have financial interdependencies, such as shared investments, loans, guarantees, or cross-ownership of stocks or bonds.

- Affiliated companies must adhere to legal and regulatory requirements, including disclosure obligations, governance standards, and potential conflicts of interest.

Affiliated Companies Explained

An affiliated company can be said as an organization in which another organization holds less than fifty percent of its equity share capital (share which grants controlling rights of an organization), i.e., another company holds a minority interest in the first company. Unlike in the case of a subsidiary company, affiliated companies clause neither have the power to control the operating, business decisions, or another company nor have the power to exercise control over management or elect the board of directors.

Two or more companies can be affiliated with each other if one of the companies holds below 50% of share capital with voting rights of another, i.e., it is not a subsidiary company of other companies. It cannot control the management and day-to-day operations of another company. It may have the power to influence the business decision but is not legally entitled to control said company. Not only by holding share capital but also if another third company controls two or more companies.

There may be different reasons and backgrounds, some of which may control the business chain. Another may increase business efficiency by creating synergy due to combined operations. Sometimes, the company may create affiliates for investment purposes. However, they do not have the power to control other companies' management and business decisions, nor elect the board of directors or exercise control over its operations.

Thus, these types of companies collaborate with each other in many ways. They may share resources, contribute and corporate on various projects or engage in business transactions with each other. Such relations and collaborations have a long-term effect on the tax related and legal matters of the company and also for financial reporting purposes. Thus, when stakeholders evaluate or assess the company conditions, it is extremely important to take into consideration the overall picture including the affiliates.

Examples

Let us understand the concept of affiliated companies clause with the help of some suitable examples.

Example#1

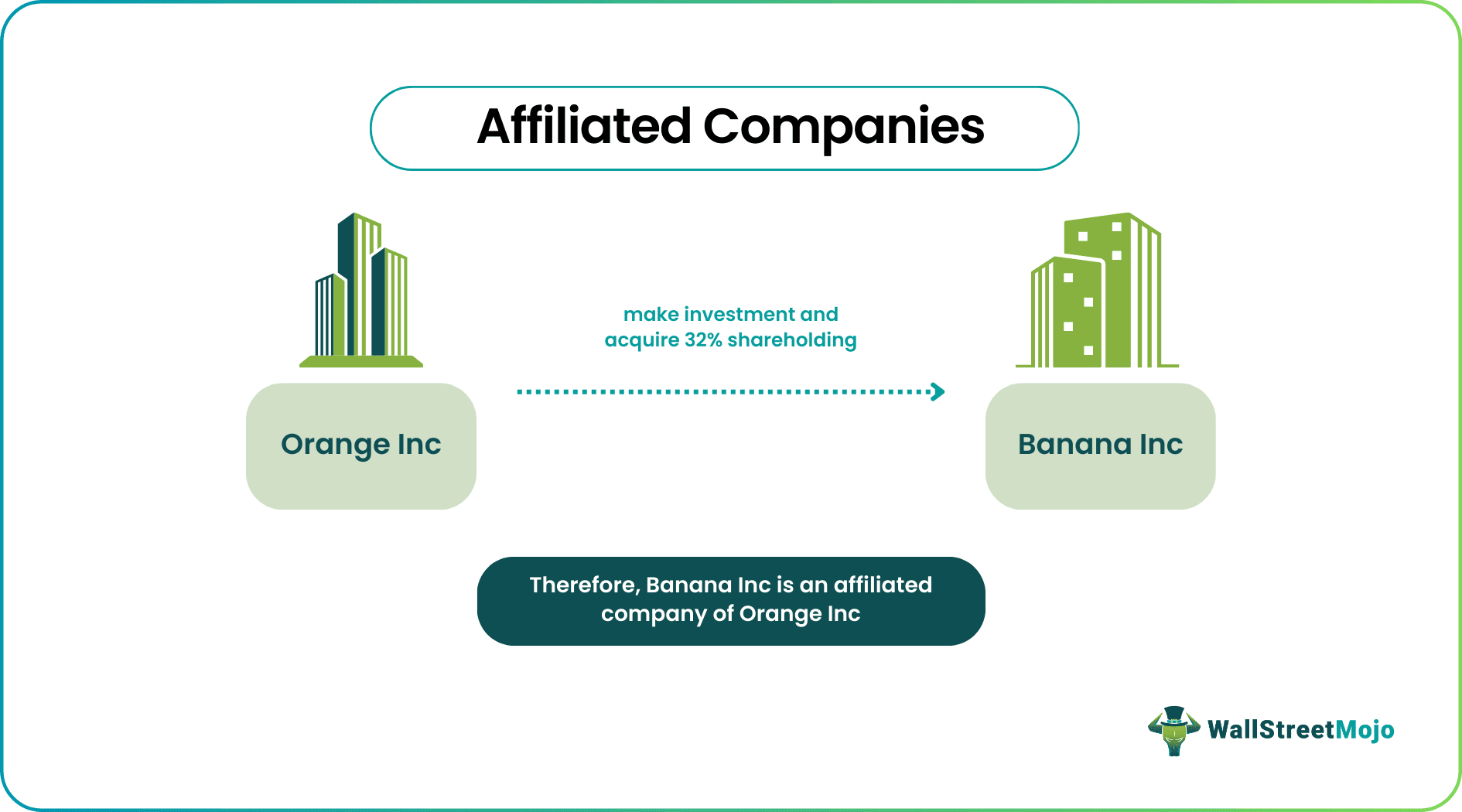

- Say, a company Orange Inc. makes investment and acquires a 32% stake (shareholding) of Banana Inc. with the motive of earning capital benefits keeping in view the growth potential of Banana Inc. Here Banana Inc. will be declared as an affiliated company of Orange Inc. since 32% of its shares are held by Orange ltd. (Motive of making such a company here was Investment purpose).

- Say, a car manufacturer company, Hyundai, acquires 19% shares of Bridgestone tires to reduce cost by making a joint agreement to provide tires at a lesser cost. Both companies will be said to affiliate with each other (the motive of affiliation here is to increase business efficiency by reducing the cost of material).

Example #2

- Hyundai Motors own approx. 33% of the share capital of Kia Motors, making both affiliated to each other.

Thus, the above examples clearly show the features of affiliated companies, how to identify them and how they operate. We also get a real life example of enterprise affiliated companies for better understanding.

Affiliated Companies Vs Subsidiary Companies

Both the above are two different types of organisations operating in the market. They are the two business contexts showing various kinds of industry relationships. Even though there are some common characteristics and connections, there are a lot of differences too. Let us study the same in detail.

- Affiliated companies can be described as an organisation (company) in which another company holds less than 50% of its share capital, i.e., a minority interest in another company. Two companies can also be affiliates if a third company owns both. They do not have the power to control other companies' management and business decisions, elect a board of directors or exercise control over their operations. There may be different reasons and backgrounds for making any company affiliated, some of which may be to control the business chain; another enterprise affiliated companies may increase business efficiency by creating synergy due to combined operations; also, sometimes, the company may develop such entities for investment purposes. They are also sometimes referred to as associate companies.

- The subsidiary company can be said as the form of organization where one company holds not less than 50% equity share capital of another company and becomes the owner of the second company. It exercises control over day-to-day business operations, management, and control over the business. A company that holds share capital is termed as parent/holding company, and the one whose shares are acquired is a subsidiary company. The basic aim of these forms of organization is to create an ownership stake in other companies leading to the increased synergy of business operations. Under this form of organization, the parent company can elect a board of directors of the subsidiary company.

Thus, we can summarize the differences through the fact that the level of control and ownership is different for both. We cannot call all affiliated companies as subsidiaries but all subsidiary companies are definitely affiliates. The relationship goes beyond subsidiaries, and includes associates, joint ventures, or any other type of companies that are somehow related or connected to each other through their businesses.

Tax Implications

It remains an option with the affiliate companies to either file their income tax return individually or file a consolidated return with its holding company. Their certain reliefs have been granted and benefits which can be availed by these company in case it files a consolidated return. However, there may be certain limits and restrictions on the maximum amount of tax credit or deductions which can be availed by affiliates in case of joint filing, or in some cases, it may also be restricted to certain companies only. Under different laws like the Affordable Care Act of the USA, there are certain provisions that require all affiliate companies to aggregate their individual workforces in order to determine the total workforce of the organization.