Table Of Contents

What Is Adjusted Working Capital?

Adjusted Working Capital refers to measuring the business’s operating working capital. It considers only the operational aspect and removes the liquid and non-operational items in the business, which are considered while measuring the working capital using the traditional measure.

Key Takeaways

- Adjusted working capital, meaning refers to a measure of an organization’s liquidity in the short term. This metric offers insights into a business’s ability to pay off its short-term liabilities and manage working capital with efficiency.

- Adjusted working capital, meaning refers to a measure of an organization’s liquidity in the short term. This metric offers insights into a business’s ability to pay off its short-term liabilities and manage working capital with efficiency.

- Individuals can calculate adjusted working capital by computing the sum of inventory and accounts receivable and then subtracting accrued operating liabilities and accounts payable from the result.

- The use of this metric can result in misleading results for an organization’s management team.

Explanation

In the traditional method of calculating the working capital, all the current assets and current liabilities of the company are considered, be it the operational or non- operational. Still, it does not provide the correct insight into the business operations. It fails to provide the exact working status of its operational aspect and how well it is being operated. For this, adjusted working capital is used to provide the result considering only operational aspects. It does not consider non-operational and liquid aspects. It highlights how well the management of the operations in the company is taking place.

Working Capital Formula Video with Explanation

Formula

The formula is given below:

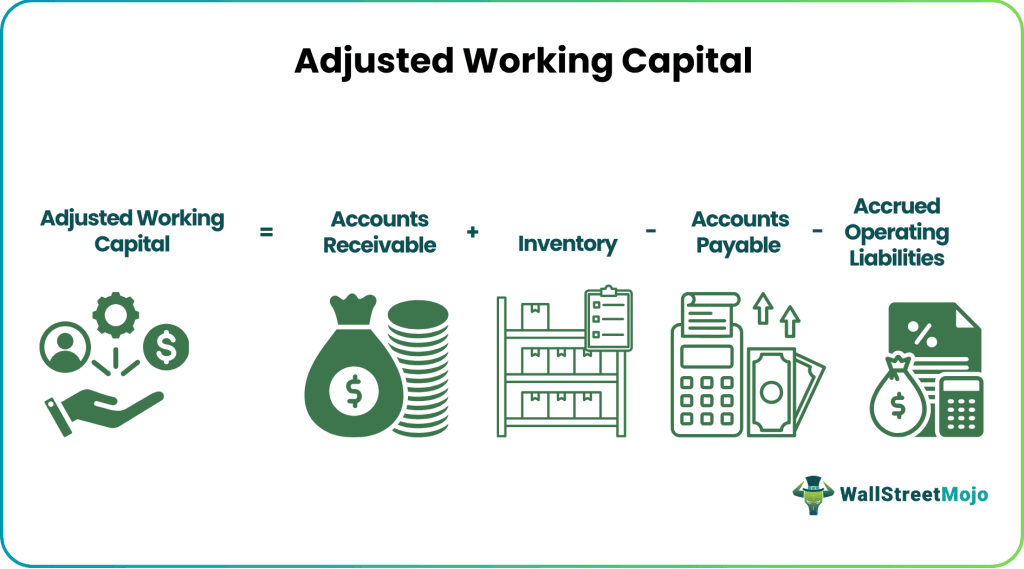

Adjusted Working Capital = Accounts Receivable + Inventory - Accounts Payable - Accrued Operating Liabilities

Here,

- Accounts receivable are the amount that is due to be received by a business entity from its customers (debtors) in return for the goods & services provided to them.

- Inventory is the goods owned by the company on the given date for further processing (Raw material and Work in progress) or sale (finished goods).

- Accounts payable are the amount that the entity owes to its suppliers (creditors) for the goods & services.

- Accrued operating liabilities are the business expenses that have been incurred but are yet to be paid in cash.

It is to be noticed that while calculating the adjusted working capital, cash and cash equivalents or marketable securities, current maturities like notes payable, a debt payable, etc. are not included.

This is a key component of financial planning and analysis, or FP&A, because of its application in assessing the financial health of a company and mergers and acquisitions. If you wish to learn some other important concepts, techniques, or formulas associated with FP&A, you can consider enrolling in this Financial Planning & Analysis Course.

The instructor of the program covers an extensive range of topics, including financial modeling, financial ratios, and more, to help one enhance their financial knowledge and gain specialized skills needed to boost career growth.

Example

At the end of financial 2019-20, Amity Incorporation had accounts receivable of $ 100,000, inventory at $50,000, Accounts payable were $60,000, Accrued operating liabilities were $40,000, and cash and cash equivalents were $70,000. Calculate the adjusted working capital of the company for the mentioned period?

Solution:

Adjusted Working Capital = $ 100,000 + $50,000 - $60,000 - $40,000 = $ 50,000

Here, cash and cash equivalents will not be included in the calculation.

Interpretation

It highlights how short-term assets and the liabilities in the company are being utilized to run its operations. The higher the value of the adjusted working capital, the better the utilization of the short-term assets and the liabilities.

Also, it can be analyzed with the help of calculating the trend with the proportion of sales. In case there is a decline in the proportion over the period. It indicates that operations are being managed properly. With that trend, we conclude that investment in the inventory and the receivables is kept low concerning the proportion to its sales.

Advantages

- It helps in analyzing the trend concerning the proportion of sales. With the help of this, management can know various aspects of the business, such as how much investment in the inventory and the receivables are kept to the proportion of its sales, whether there is a high diversion in the trend during any period with the reason for the same, etc.

- This measurement throws light on the utilization of the short-term assets and liabilities of the business.

- This ratio is highly important and useful in companies earning good profits and retaining the same as cash or investment. This is so because if the company does not use adjusted working capital; rather, it uses the traditional method of calculating the working capital where all the current assets and liabilities are included. Profit retained as cash or investment will increase the value of the company’s working capital, and the number will also be too high when calculated as the sales ratio. This will not show the correct status of the management of the assets and liabilities in the company. Instead, if the adjusted working capital is used, it will show a better picture of the company’s ability to manage its assets and liabilities.

Disadvantages

- There are chances that the measurement may give misleading results to the company's management. For example, after seeing the market condition prevailing, management decided to increase its customers’ credit period. With this decision, the company’s overall profitability increased, but this will decrease the ratio of adjusted working capital concerning sales in the company, thereby giving a misleading result while analyzing the ratio of adjusted working capital for sales.

Conclusion

Adjusted Working Capital is a measurement that is different from the traditional way of calculating the working capital as it does not include cash and cash equivalents and the current maturities in the business, such as debt payable, note payable, etc. So, this measurement relates purely to operational aspects of the business and strips away working capital elements that are not related directly to the company's operations, thereby showing how well the utilization of short-term assets and the liabilities are there in the business.