Table Of Contents

What is the Ad Valorem Tax?

Ad Valorem Tax refers to the tax levied on assets depending on their assessed monetary value. These are imposed by state and municipal governments of a region and calculated annually. Such taxes help respective administrations gather revenue and ensure it is adjusted and collected as per the spending limits of an individual.

It is different from the specified taxes, whereby individuals have to pay taxes every time a transaction occurs. Instead, the price of the property in question is evaluated first, and accordingly, an ad valorem tax rate is applied to it. Then, based on the calculation, the owners pay the tax.

Key Takeaways

- Ad Valorem tax is defined as the tax levied on a property, depending on its assessed value.

- The municipal and state governments make these taxes applicable to personal and commercial assets.

- These taxes are charged as per the spending capabilities of the buyers. This means an expensive product will have a higher tax rate than an inexpensive one.

- Property tax, sales tax, and value-added tax (VAT) are the three types of Ad Valorem Taxes.

How does Ad Valorem Tax Work?

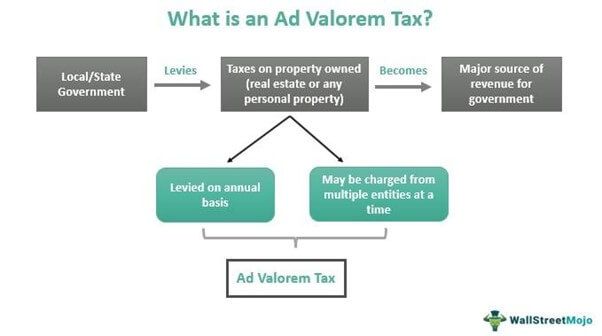

Ad Valorem Tax is derived from the Latin term "Ad Valorem," which means according to the value. This tax, therefore, is charged according to the assessed value of the property. These comprise a major source of revenue for the local and state government authorities for the properties owned by the citizens. Hence, these taxes are often addressed as property taxes.

The concerned authorities choose assessors to examine the taxable property. Based on the examination, they determine its value and decide the applicable tax rate for further tax calculation. Unlike transactional taxes, the concerned governments levy these taxes annually on the property owned.

Though these taxes are not levied frequently, these might be charged by more than one authority. For example, one might need to pay these taxes multiple times as charged by the municipality and county for a real estate asset.

Types

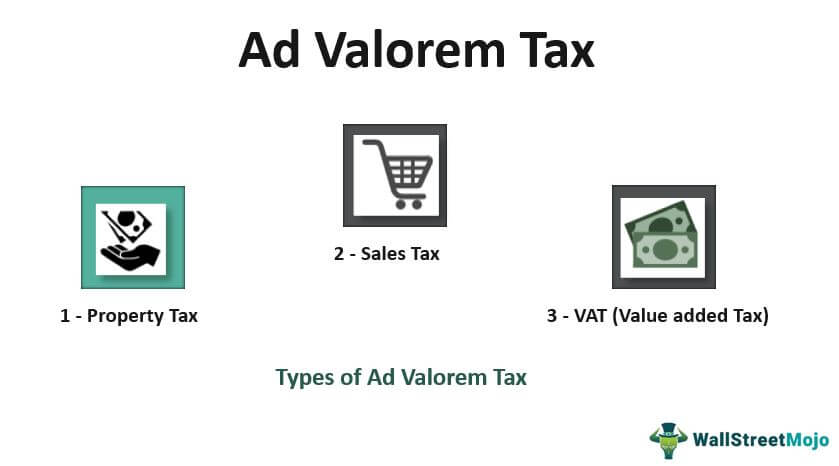

These taxes are available in various forms – Property Tax, Sales Tax, and Value Added Tax (VAT).

#1 - Property Tax

Property taxes are levied on personal and commercial property that individuals own. Once individuals or entities purchase a property, the municipal or state governments charge the tax against the property. As a result, figuring out the right value of the assets becomes an important factor. Then, the authorities choose an assessor who evaluates the property in question and accordingly charges the tax.

#2 - Sales Tax

It is the type of tax levied on every transaction one makes. In short, the sales tax is applicable whenever people buy a product or service. It is a percentage of the value of a property, and its rates vary from county to county.

#3 - VAT (Value added tax)

VAT is the tax that the authorities charge for the services that make businesses add value to the final products and services. While sales tax is charged on the full value of consumer goods, VAT is charged on the extra value added to the products/services or profits generated by businesses. So, for example, if consumers buy some goods, they will have to pay VAT for the entire production process that helps in manufacturing or producing them.

Examples of Ad Valorem Tax Calculation

Let us consider the following ad valorem tax examples to understand the concept better:

Example #1 (Simple)

Let's say Tom owns a house, and for this year, tax authorities have assessed the value of your home to be $100,000. Therefore, the property tax rate applicable in the area is 4%.

In such a scenario, the calculation will be –

- Value of House = $100,000

- Property Tax Rate = 4%

- Property Tax = 100,000*4% = $4,000

Hence, Tom had to pay $4,000 as property tax for the house.

Example #2 (Complex)

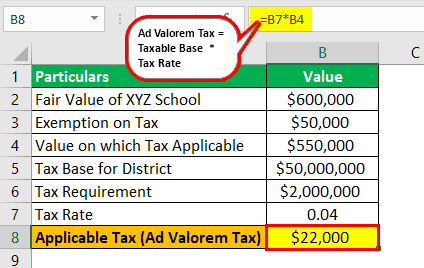

XYZ school added five more classrooms and constructed a playground this financial year. When tax authorities evaluated its value for the financial year, because of construction, they increased the value of the school from $500,000 to $600,000, though the area of the school remains the same.

The school is eligible for an exemption of $50,000. So, the total value of property eligible for Ad Valorem property tax for this financial year would be $550,000. Let us calculate the tax payable for the property.

Tax Rate = Tax Requirement / Tax Base.

The tax base for that district is $50 million, and the tax requirement is $2 million.

Tax rate = 2/50 = 0.04 = 40 mils.

The calculation of the tax for XYZ School –

Assessed Value = $600,000

Assessed Value = $600,000

Exemption = $50,000

Tax Millage rate = 40 mils

Advantages & Disadvantages

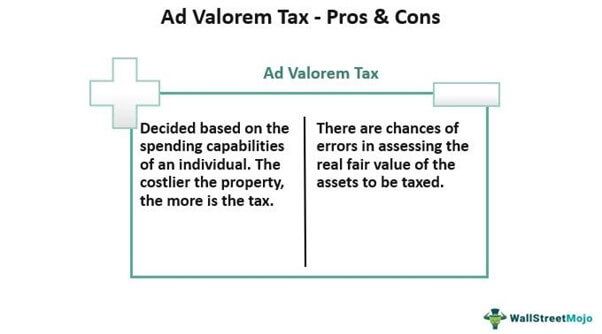

Ad Valorem Taxes increase with the increasing cost of the property, products, or services people purchase. As a result, the tax for the low-priced items is less than the tax charged for the high-priced ones. In addition, these taxes do not affect the financial stability of individuals as authorities adjust and apply the tax rates only as per their spending power.

However, these might leave room for doubts, given the accurate assessment of the actual fair price of an asset or any property is not always possible.