Table of Contents

What Is Actuarial Valuation?

Actuarial valuation refers to an accounting practice of examining a pension fund's assets in contrast to its future liabilities, thus shaping its sustainability in the long run. Such pension plan appraisal is derived using statistical measures based on long-term economic, investment, and demographic projections.

The purpose of such valuation is to ascertain the funding ratio for an insurance or pension fund company. The investors need to ensure that the company in which they are investing is competent enough to maintain adequate pension assets to meet its liabilities in the long run. Thus, an efficient funding ratio is expected to surpass 100% or 1.

Key Takeaways

- The actuarial valuation is an accounting practice that uses statistical models to determine the adequacy of the pension fund's

- assets in comparison to the potential liabilities based on the various demographic, economic, and investment assumptions in the long run.

- The actuary performs such valuation annually, semi-annually, or quarterly to facilitate the financial reporting based on historical data and current market scenarios.

- The assumptions for assets consider factors like employer contribution and investment growth rates.

- The liabilities aspect includes employee contribution, wage growth, discount, inflation, and mortality rates along with service retirement age, disabled retirement, and interest on member accounts.

Actuarial Valuation Explained

The actuarial valuation is a statistical probability measure for accounting purposes that determines the potential cash flow of a pension or insurance plan to determine the possibility of its future occurrence. Moreover, the estimation is made for a long-term period extending up to 80 years. An actuary follows an identical process like the discounted cash flow method to determine the actuarial valuation of gratuity, pension, leave, etc.

The actuary first needs to figure out the long-term assumptions of the company's assets and liabilities to ensure that it is financially capable of meeting its future obligations. Thus, the funding ratio is evaluated, which is simply the proportion of the estimated assets to liabilities. Here, the assets are projected using the following aspects:

- Employer Contribution Rates: It is a percentage of an employee's salary that the employer additionally contributes to the Employees' Pension Scheme (EPS) and the Employees' Provident Fund.

- Investment Growth Rate: The actuarial funds are often invested in stocks and bonds; therefore, the percentage growth of the portfolio is also accounted as an asset for the company.

Another critical process is to determine the payment liability, which includes the following factors:

- Employee Contribution Rate: The percentage of deduction made from the employee's gross pay for pension or provident fund schemes.

- Wage Growth Rate: It is the annual appraisal of the employee's salary or wages.

- Discount Rate: The rate of interest charged by the Federal Reserve from the various commercial banks and financial institutions on short-term borrowings.

- Inflation Rate: It is the percentage change in a nation's general price index level annually.

- Mortality Rate: It is the ratio of the total number of deaths occurring out of certain diseases to the overall population.

- Service Retirement Age: The maximum age limit for retirement from a job, as stated by the Government.

- Disabled Retirement: It considers the person being disabled at the age of 18 years or above.

- Interest on Member Accounts: It is the interest earned on the EPF account.

Examples

Let us now discuss some instances where an actuarial valuation report serves a purpose in the decision-making and planning by the insurance companies and pension funds:

Example #1

Suppose a pension fund plan that would generate an annual pension of $6000 to a retiree over their lifespan may have a present value of $90,000 as evaluated by the actuary. Thus, it denotes the liability of the pension fund in the long run, and the stakeholders need to maintain a sufficient reserve with systematic annual contributions required to fund this obligation.

Example #2

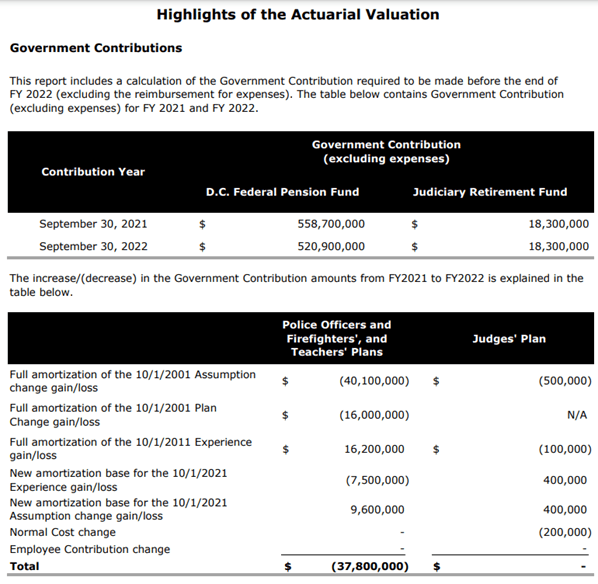

The United States Department of the Treasury District of Columbia Pensions Program released its final actuarial valuation report. The program oversaw several retirement plans in the District of Columbia, including those for police officers, firefighters, teachers, and judges. As of October 1, 2021, the report revealed an unfunded actuarial accrued liability of $3,826,284,839 for the Police Officers and Firefighters' Plan and $86,317,045 for the Teachers' Plan. It also outlined gains and losses in liabilities and assets, adjustments in actuarial assumptions, and the government contributions expected for fiscal years 2021 and 2022. The Deloitte Consulting LLP claimed that all aspects used for actuarial computations, including costs, liabilities, and interest rates, were determined based on reasonable assumptions and methodologies.

Source - https://home.treasury.gov/system/files/241/2021-Actuarial-Valuation-Report.pdf

Importance

The actuarial valuation is an indispensable part of the accounting process in the pension fund and insurance companies for the following reasons:

- Funding Needs: Such valuation primarily ascertains the funding ratio to gauge the reserve requirement of an insurance company or pension fund for meeting its future obligations.

- Financial Reporting: It is a part of the annual accounting process to determine the value of assets and liabilities presented on the balance sheet of an insurance company based on the current market conditions and historical data.

- Financial Health Assessment: Since it is used for financial reporting purposes, it aims to gauge a company's financial position by assessing its ability to fulfill potential liabilities.

- Tax Compliance: The pension fund firm's tax obligations are often based upon its actuarial valuation as per the prevailing tax laws and rules.

- Regulatory Compliance: The pension fund and insurance firms need to fulfill the relevant regulatory requirements for its assets, liabilities, and reserves, as determined through such valuation.

- Mergers and Acquisitions: At the time of various strategic alliances like mergers or acquisitions in the insurance sector, the fair valuation of an organization's pension plan is demanded using such valuation methods.

Actuarial Valuation Vs Actuarial Pricing

Actuarial valuation and pricing are two different aspects of actuarial science. They broadly differ in their purpose, evaluation, and use, as discussed below:

| Basis | Actuarial Valuation | Actuarial Pricing |

|---|---|---|

| Definition | The actuarial valuation is an annual accounting practice of determining whether the pension fund assets are sufficient for meeting long-term obligations. | Actuarial pricing refers to the process of ascertaining a competitive, effective, and profitable price for the insurance premium after analyzing the potential loss or risk involved in such policies. |

| Purpose | Evaluating the funding ratio and reserves of an insurance company or pension fund by the stakeholders, management, and investors in a certain period | Determining the insurance premium by accounting for the anticipated claim ratio, profit margin, and expense ratio |

| Assumptions | Undertakes the assumptions of long-term investments, economics, and demographics | Considers the potential claim, expense, and lapse rates for deciding the insurance premium for future customers |

| Modeling | It is usually based on the valuation models that replicate the traditional discounted cash flow methods. | It uses valuation models that gauge the potential risk involved in a policy, I.e., the company's monetary liabilities in the worst-case payout situations. |

| Method of Analysis | The actuary performs such valuation quarterly, semi-annually, and annually to maintain sufficient reserves. | The actuary determines the insurance price for each project or policy separately based on its risk and return profile. |

| Significance | Furnishes a summary of the company's financial health, ensures sustainability, facilitates financial reporting and decision-making in compliance with the regulatory norms | Fulfills the financial objectives of the insurance companies and pension funds by making them profitable and competitive in the insurance industry |