Table Of Contents

What Is Active Income?

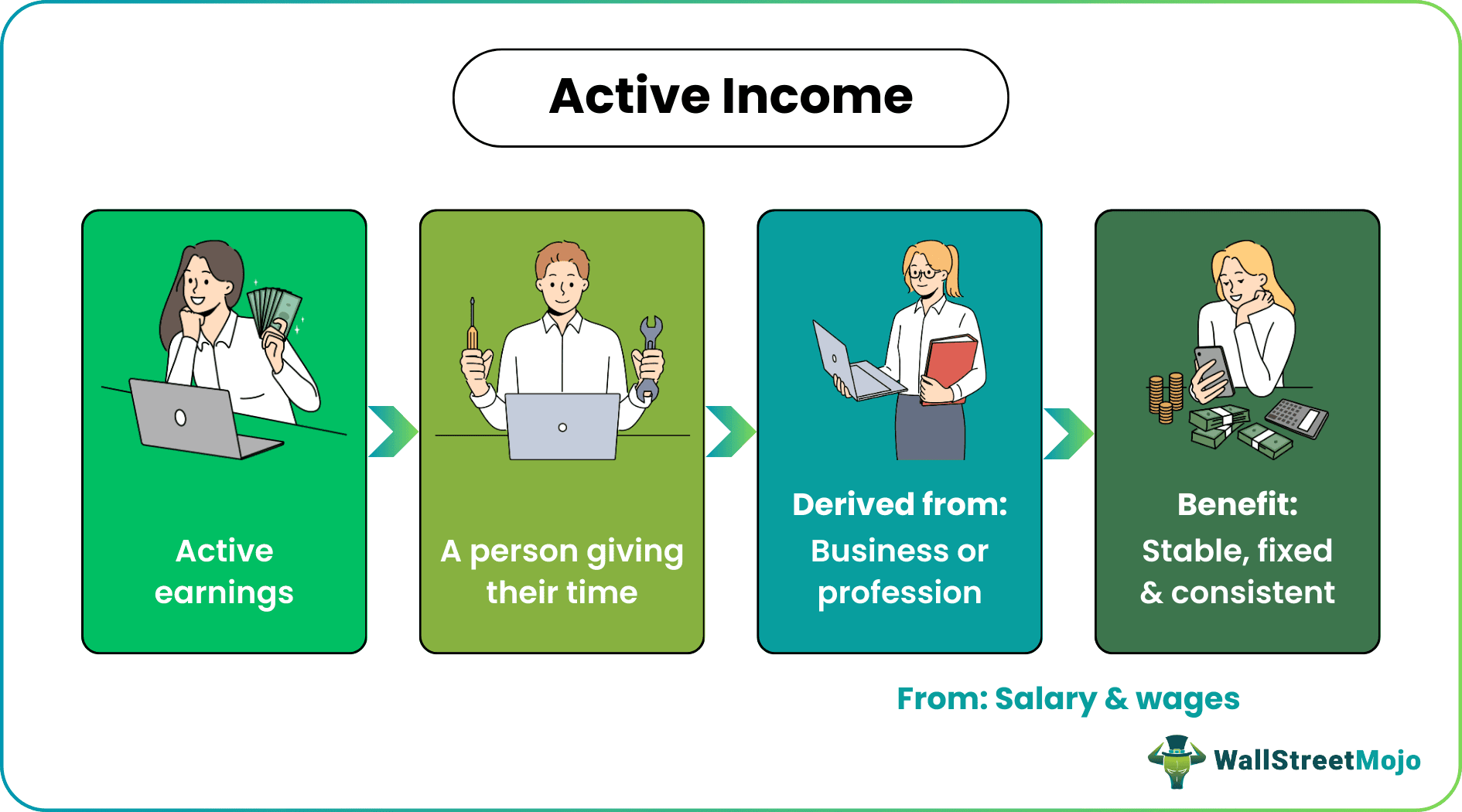

Active income in finance refers to an income type derived from a job or a business. The main purpose of this income is to serve as a fixed, stable source of monetary funds for an individual.

This income includes salaries, tips, wages, commissions, or active handling of business. It acts as a fixed source of income for an individual. As a result, there is a stable and consistent flow of money to their bank account. Besides, it also serves as a foundation for other types of income. However, other (passive) earnings cease to exist without an active income plan.

Key Takeaways

- Active income is income derived through either business, profession, or salary. The main intention of this income is to provide a stable income throughout a particular period.

- This income includes hourly wages, salaries, and business profits in which the business owner actively participates. It also includes commission, tips, and side hustle.

- Businesses must work more than 500 hours annually to become a part of these income holders. Also, contribute more working hours than the other staff workers.

- Sometimes, an active income for a person can turn out to be a passive income for others.

Active Income Explained

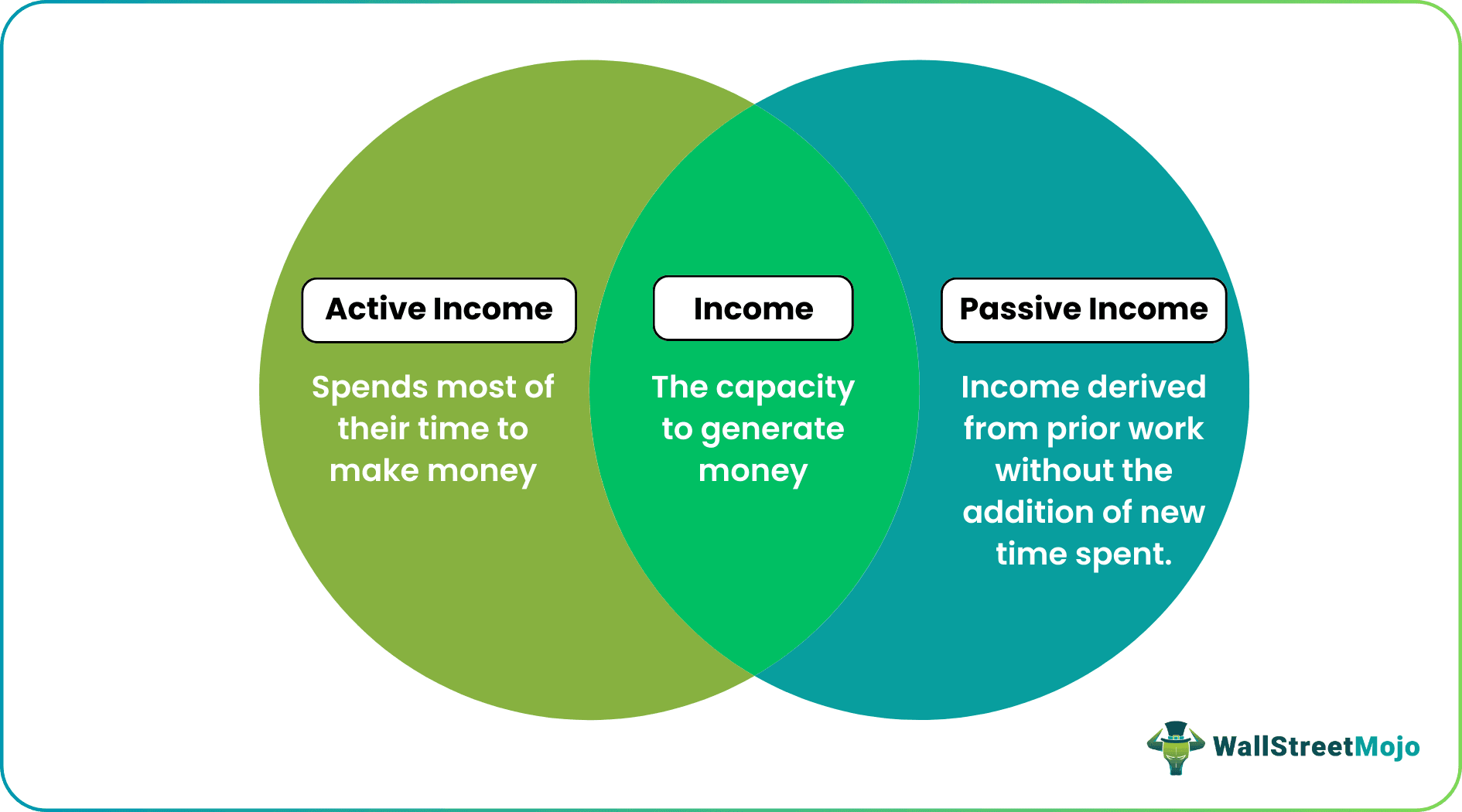

Active income serves as a significant source of earnings for any individual. Other sources of income, like passive and portfolio, arise due to this. Some examples of this income include wages, salaries, and profits from the business. The most typical example of this income is revenue which is received as a paycheck from an employer.

Passive income is what a person earns through a business in which they are not actively involved. Income from assets, such as capital gains and dividends, is referred to as portfolio income. What seems to be an active source of earning for one cannot be the same for others.

Depending on the law in effect at the time, these various forms of income may be taxed differently. For instance, since 2022, active earnings have been taxed more heavily than portfolio income.

Income from business activities is regarded as active for the self-employed or anybody with an ownership stake in a company if it satisfies the Internal Revenue Service's (IRS) qualification of material participation.

The active income test is a critical assessment conducted by the IRS (Internal Revenue Service). According to them, if a business owner or taxpayer fails to qualify for any conditions, the income declared will turn void. Here are some active income tax rules:

- A taxpayer must work for 500 hours or more during the year.

- They must be actively involved in the core business.

- To qualify for an active income test, no worker must work more than the taxpayer. Therefore, the maximum time allotted to them is 100 hours.

History

The history and concept of this income date back to 10,000 to 60,000 BC (Before Christ). During the Neolithic Revolution, village laborers were the first to receive an active income plan. Then, in 3100 BCE, an inscribed tablet showed evidence of the beer-making workers in Mesopotamia. At that time, salt was the exchange medium. Previously, employers paid salaries through metals and coins; now, they transfer them to bank accounts.

In contrast, individuals derived active income ideas through business in 17,000 BC. In New Guinea, locals earned their first active earnings by selling obsidian stone for other goods. As a result, this tradition continued, and people started earning income through wages and salaries.

Revenue vs Income Explained in Video

Sources of Active Income

Let us look at the sources of these earnings that are essential for an individual:

#1 Business Profits

A person owning a business can also have active earnings. As discussed above, if they devote more than 500 hours, their income will qualify for the test. As a result, they will be able to attract deductions on the active income tax.

#2 Bonus or Tips

Bonuses also play a vital role in household income. Although a salaried person might receive it once, a server gets it daily. For example, when a server serves food at a restaurant, the customers provide a tip for their service. Therefore, the more customers, the incline toward this income.

#3 Salary or Wage

It is the second most significant source of this income. As individuals spend 60% of their time at work earning money. According to a report, a person spends 1,801 hours at work. In other words, the more time they work, the more money they earn. As a result, it adds equal importance to household income.

#4 Side Hustle

A side hustle can include commissions, short-term profits, and others. For example, a person doing day trading or short-term investment will fall under the category of this income holder. However, long-term stock or passive investments falls under passive income as the investor does not spend much time fundamentally and technically analyzing them. For example, suppose a person has no other form of business and is solely day trading and making maximum income; then, it will be an active earning.

Examples

Let us look at the examples of active income to understand the concept better:

Example #1

Suppose Shane and Michael are college mates studying at Texas University. While Shane comes from a wealthy family, the latter faces some cash crunches. So, Michael decides to work at Subway as a part-time worker. In contrast, Shane invests some money in the company's stocks where Michael works. By the end of the year, they receive respective income for their work.

In the first case, Michael worked as a part-time worker. For him, it served as a significant income since he relied on it. However, Shane did not have any such crisis. He had invested his income to earn an extra income. Thus, it falls under passive income. In contrast, if he had decided to trade full-time, it would have been an active income idea.

Example #2

According to Elliott Frost, Investment Manager of Lumin Wealth, an individual must have both active and passive income portfolios. While it seems challenging to overlook, these income managers have successfully surpassed passive ones. Thus, making it a vital option for investors.

Frequently Asked Questions

Following are the ways of making active earnings:

- Following the lead passion or hobby

- Being self-employed and freelancing.

- Doing a part-time job or side hustle

In business, active revenue is derived purely from business operations. Therefore, it does not include income from dividends, interests, and others.

There are many pros and cons of both active and passive income. While the former acts as a significant, fixed, stable source of income, the latter does the opposite. In contrast, passive income is a side income that does not include a massive dedication.

Following are the ways to increase the active earnings of an individual:

- Asking the employer for a raise in the wage or salary

- Improving the efficiency and performance of work

- Expanding the business and increasing the operations.