Table Of Contents

Acting In Concert Meaning

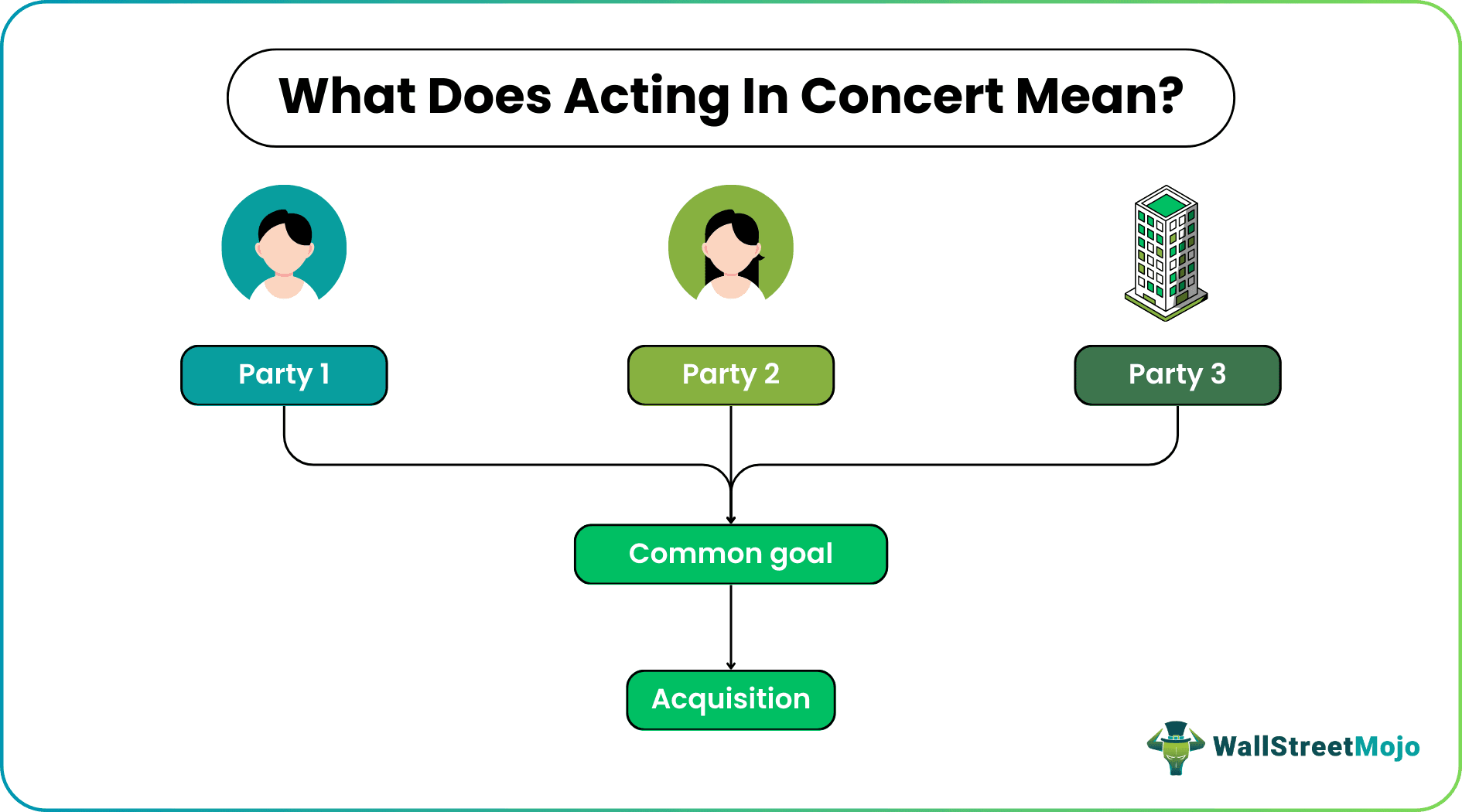

Acting in concert refers to a situation where two or more people, mostly parties to a contract or any other joint activity, agree to pursue a common goal and cooperate throughout its acquisition. The concept is mostly used in a legal context. However, it is prominent in trade finance too.

Parties acting in concert, or concert party agreements, are significant in any endeavor for maximum coordination and control over operations. For example, parties should agree to complete the process with minimum hassles in legal takeovers. In finance, it refers to multiple traders investing in the same investment.

Key Takeaways

- Acting in concert can be referred to as a state of mutual agreement between all the participants of a particular joint activity.

- For any undertaking involving equally interested parties, coordination and cooperation are necessary for its success.

- The agreement of all parties is deemed significant in takeovers to the extent that the government demands. This is because it ensures equal and fair treatment to the companies involved as well as the shareholders.

- Though largely a legal concept, it is also applicable in finance.

Acting In Concert Explained

Acting in concert is one of the foremost important requisites of any agreement. Acceptance is often the very essence of a legally binding contract. Hence, this necessity is apparent in many economic activities. The people involved in acting in concert are called concert parties. For instance, consider the example of David, who offers Sharon to buy her car for $6000, and Sharon agrees to sell her car for the same amount. Here, David and Sharon are parties acting in concert. They have the same goal and work with mutual agreement.

Similarly, such an understanding is visible in business and finance, especially when it comes to companies. For example, suppose company A decides to acquire company X. Here, the consensus of the majority of voters in companies A and X is a requirement. Otherwise, it would be a forceful takeover, which is illegal on many grounds. After such an acquisition, concerns like shareholding, etc., should be taken care of responsibly and equitably to avoid issues. The same applies if two or more companies plan to acquire a single company together.

Finally, the situation of acting in concert arises in trade finance too. When two or more investors are interested in the same investment, it is only fair to provide them equitable treatment by dividing the security proceeds proportionately based on their investment.

Consider the example of two equity stockholders of company Z. They are both interested in buying a second stock, which was recently available. Suppose the stock price is $100; the management can decide to sell the stock to both for an equal price. Therefore, each would pay $50 to buy their share of the stock. The profit and other proceeds or benefits would be divided equally, provided they act in concert with each other and the company.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Acting In Concert And Takeover Code

The City Code on Takeover and Mergers, or the Takeover Code, is a set of rules and regulations that govern listed companies in the United Kingdom. The main objective of the code is to ensure that shareholders, too, benefit from an acquisition or merger. Another aim is to guarantee that shareholders of the same class get equal treatment and preference during takeover bids.

According to the Takeover Code, "persons acting in concert comprise persons who, under an agreement or understanding (whether formal or informal), cooperate in obtaining or consolidating control of a company or in frustrating the successful outcome of an offer for a company."

In May 2022, the Takeover Panel proposed amendments to the ‘acting in concert’ definition. They published the Public Consultation Paper 2022/1, in which a few additions have been made. Apart from the definition, the panel now defines nine categories of persons who might be presumed to act in concert with the company Code.

According to the Panel, the nine categories of persons are:

- A company, its parent company, subsidiaries, and associated companies.

- Directors of the company (any close relatives or trusts thereof).

- A company with its pension schemes and other associated companies, subsidiaries, etc.

- A fund manager or unit trust managing the company’s investments.

- A person and their close relatives (and any related trusts).

- Close relatives of the company’s founder(s).

- A connected adviser, acting in concert with the offeror or offeree company.

- Directors of a company subject to an offer or imminent offer.

- Shareholders in a private company.

This presumption applies equally to equity share capital and shares carrying voting rights. Concerning this addition, the panel has also decided to increase the threshold for ‘associated company’ status from 20% to 30%.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Hannah Arendt, a German philosopher, defined politics as acting in concert. She explains the need for democratic participation in civil affairs to check totalitarianism and authoritarianism.

A person acting in concert agrees to cooperate in a joint endeavor in such a way as to merit the party/ parties they represent. Usually, this is a person with sufficient interest in the subject, and their consensus is legally mandatory.

Yes. To act in concert is a legal compulsion in matters of joint interest. Here, interest can be ownership, legal rights, or any stake. In such a case, the agreement of everyone with interest in the subject is essential. However, the concept is found in finance too. It refers to a situation where multiple parties partake in a single investment. Consequently, the stake or the purchase is proportionately split between the parties.