Table of Contents

What Is An Acquisition Planning?

Acquisition planning refers to a strategic function of identifying, evaluating, and curating a series of actions that lead to a business acquiring another business entity. It is an elaborate process where target companies are screened, evaluated, negotiated, and taken over. An efficient acquisition planning guide minimizes risks and maximizes value addition to the acquiring company.

Conducting extensive planning concerning taking over another entity facilitates seamless integration of both entities, mitigates significant risks, and aligns the strategies of both companies. As a result, the growth prospects increase multifold. However, there are considerable disadvantages as well, such as massive costs, overestimation, and cultural differences. Therefore, businesses must conduct thorough due diligence before making conclusive decisions.

Key Takeaways

- Acquisition planning is the extensive effort carried out by a company that wants to acquire another entity as part of its overall growth.

- Before acquiring a target company, the acquiring company conducts due diligence.

- They conduct market research and investigate the operations, finances, and legalities before making further decisions.

- The planning phase allows the company to allocate resources efficiently and helps with risk mitigation.

- However, the time and resources invested in this stage are significant and can disrupt the existing business's daily activities.

Acquisition Planning Explained

Acquisition planning is an extensive process that curates the framework of a merger & acquisition (M&A) transaction. It is an essential step, regardless of whether the company is acquiring it.

An efficient asset acquisition planning phase must cover everything from the rationale for investing or indulging in such an investment to how it will be the catalyst of value addition. Naturally, all details of the entities' natures, integration or acquisition specifications, and projected performance must be explored in the planning phase itself.

When any business is expanded through internal or external means, it must ensure that the management has thoroughly reviewed the proposition and explored all possible positive and negative outcomes. If they do so, the probability of being taken by surprise by an unforeseen event dwindles as they are prepared for such circumstances.

It is also vital to remember that planning an acquisition is a multifaceted process. It requires a unique combination of financial, risk, and integration analysis. These steps help the acquiring company calculate the return on Investment (ROI).

One of the most common mistakes businesses make is ignoring or overlooking market research during the planning phase. Because the market's trends and long-term prospects play such a vital role in ROI and overall integration, it is crucial to keep that aspect in mind.

Process

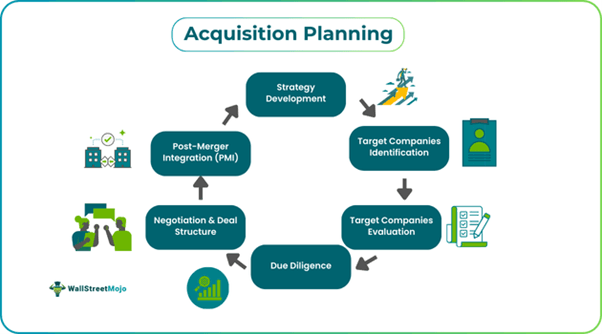

While there might be minor changes from business to business, acquisition planning steps are generally similar regardless of the industry or the nature of the business. The process is explained below.

- Strategy Development: Management must revisit the company’s long-term plans, how it plans to achieve those goals, and the Key Performance Indicators (KPIs) that will get it there. Therefore, they will be able to determine whether an acquisition is the best option for this scheme of things.

- Target Companies Identification: After determining that acquisition is conducive to the company’s growth, management must start looking for companies that align with the financial goals and are overall compatible.

- Target Companies Evaluation: Drawing valuations and comparing them with market rates, the evaluation of their compatibility with the acquiring company must be practical and realistic.

- Due Diligence: During evaluation, management most often learns in-depth details about the target company. Using this information, further analysis and overall due diligence are conducted. This can help them significantly during the negotiation process.

- Negotiation & Deal Structure: The data found during due diligence is gold dust at this stage of the acquisition, as it helps finalize a more favorable deal. However, various market outcomes must also be considered while finalizing a deal structure.

- Post-Merger Integration (PMI): Most businesses mistake the previous step for the conclusion of the process. However, this cannot be further from the truth. This step is mostly where value generation or losing investment is determined. A seamless integration is most often the catalyst for an enhanced income statement.

Examples

Now that the theoretical aspects of an acquisition planning guide are well-established, it is time to explore the concept's practical applicability through the examples below.

Example #1

ABC & Sons is a watch spare parts manufacturing company that operates across Asia. It produces critical spare parts for watches for the biggest brands in the world and has been wanting to expand its operations to newer geographical boundaries.

They got to know about a company in Vietnam that had a state-of-the-art production plant. However, since the owner faced an untimely death, it was up for sale. ABC decided to conduct due diligence. They found that the machinery would be a handful for them to produce spare parts for leading brands for the next decade. They negotiated a favorable deal for all parties involved and acquired the company later the same year.

Example #2

2023-24 had been a challenging phase for the India-based Adani Conglomerate due to various allegations and scandals. However, towards the end of 2024, the Adani group prepared to conduct strategic acquisitions in some key industries, such as defense, cement, airports, and consumer goods.

They plan to invest between $5 and 7 billion in acquiring these companies. In the decade between 2014 and 24, the conglomerate has acquired over 65 companies across industries and plans to continue to do so with companies that align with their long-term strategies.

How To Improve?

Irrespective of how efficient a business or asset acquisition planning is, there is always scope for improvement. A few of the most prominent ways to improve the planning process include:

- The foremost way to ensure the quality of planning is to ensure a thorough legal, operational, and financial analysis while conducting due diligence. It shall bring any hidden costs, compatibility issues, or potential risks involved.

- As mentioned, acquiring a business is a multifaceted process. Therefore, it is only natural that multiple teams must be involved while planning. The HR, finance, and accounting teams can provide insights that will be more than handy.

- A clear understanding of the financial goals of the acquiring company and target company can make acquisition and integration seamless.

- Acquisition is usually the first step of the ever-flowing process. Therefore, it is pivotal to induce systems and processes that make monitoring easier.

- An established channel of communication and chain of command must be charted to ensure clear communication and reporting standards.

Importance

The importance of using an acquisition planning guide to ensure that the target company is compatible with the acquiring company is unparalleled. A few specific points are as follows:

- A clear-cut vision of the acquisition's growth prospects allows management to curate long-term plans accordingly. Therefore, there is a sense of direction across all levels of the organization.

- An in-depth understanding of the target company also allows the acquiring company to plan its resource management to ensure a seamless transition and integration.

- The value addition that an acquisition brings can only be maximized by understanding all possible outcomes and creating contingency plans for them.

- Financial and operational risks are inevitable in any business. Thorough planning ensures that these risks can be mitigated efficiently without hindering daily activities.

- If the integration process is seamless, it becomes almost inevitable that profit maximization can be attained.

- The risks of acquiring a new business can be mitigated if management conducts proper due diligence during the planning phase.

Challenges

Despite following all acquisition planning steps, management must address significant challenges. A few of the most common ones are:

- Finding a target company that fits not only with the nature of the business but also with the style of operations is a significant challenge. Even if this aspect is covered, it is equally important to find a company that will add value to the larger scheme of things.

- The data provided by the target company may only be partially accurate in some cases. Therefore, entirely relying on those numbers to make an investment decision might not be the brightest idea.

- The uncertain nature of business and the market at large is a significant threat. Risk mitigation tactics might only partially rule out existing risks.

- Once the growth and compatibility aspect is sorted, the negotiation process is another challenge that the acquiring company must consider carefully. They would not want to pay extra for a company that is worth less than the finalized amount.

- The time and resources that the planning phase takes can disrupt the daily activities of the existing business.

- Retaining employees of either company after the acquisition might be challenging, as they might perceive the change of ownership as a sign of uncertainty.