Table Of Contents

Acquisition Cost Meaning

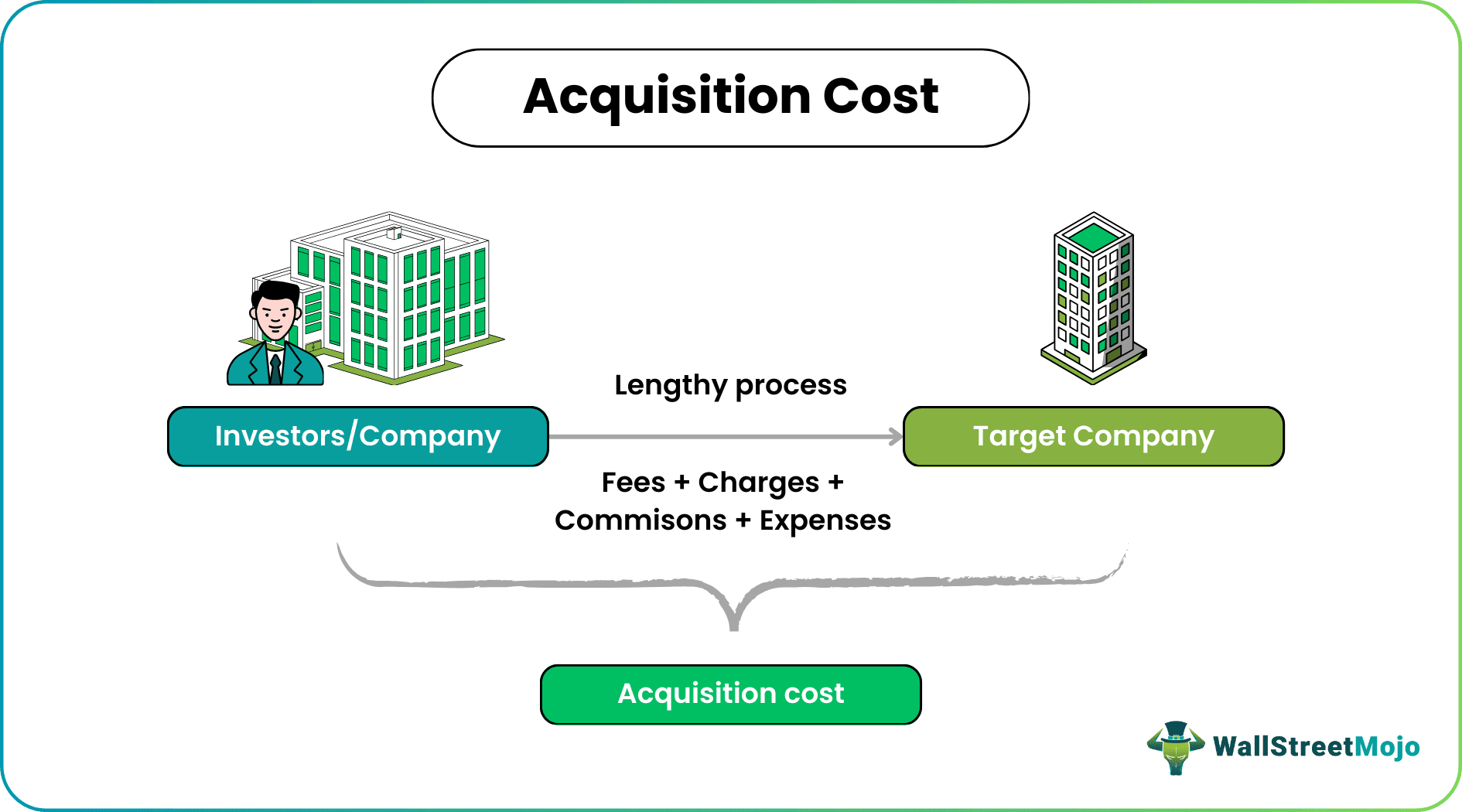

Acquisition cost refers to the expenses incurred by a company, individual, or entity to acquire something. The acquisition could be a property, company, land, or a customer. It is an important budgeting component, especially for customer acquisition. For example, acquiring new customers through advertising, marketing, and publicity is expensive.

Behind every acquisition, the buyer must complete legal procedures, documentation, and sometimes even lengthy processes. Each of those steps entails specific charges, fees, and commissions. All these personal expenses may seem small, but over time they add up; together, they constitute the acquisition cost.

Key Takeaways

- Acquisition cost refers to expenses incurred by a company, individual, or entity to acquire assets, customers, or property. It could be the cost associated with a takeover or merger as well.

- Cost to acquire comprises legal costs, commissions, and charges. This metric is used to determine a property's total price or asset.

- Customer retention budgets are low as customers are already familiar with the product. On the other hand, customer acquisition requires a hefty budget. As a result, businesses run massive ad campaigns to lure early adopters.

Acquisition Cost Explained

Acquisition cost refers to expenses incurred to achieve something, apart from the actual cost paid for its possession. A structured procedure must be followed whenever a process is designed to accomplish something. But these formalities can cost a lot; the expenses, charges, and fees paid to professionals are called the acquisition cost.

There are various acquisition cost formulas; the acquisition could be a merger, takeover, property, or customer acquisition cost. For example, when companies undertake takeovers or mergers, the cost to acquire another firm is substantial. This inflated cost includes legal commissions, legal fees, processing charges, and other small expenses.

Similarly, even when an individual sells a property, they accrue considerable expenses—brokerage commission, open-house expenses, lawyer fees, legal document processing fees, etc.

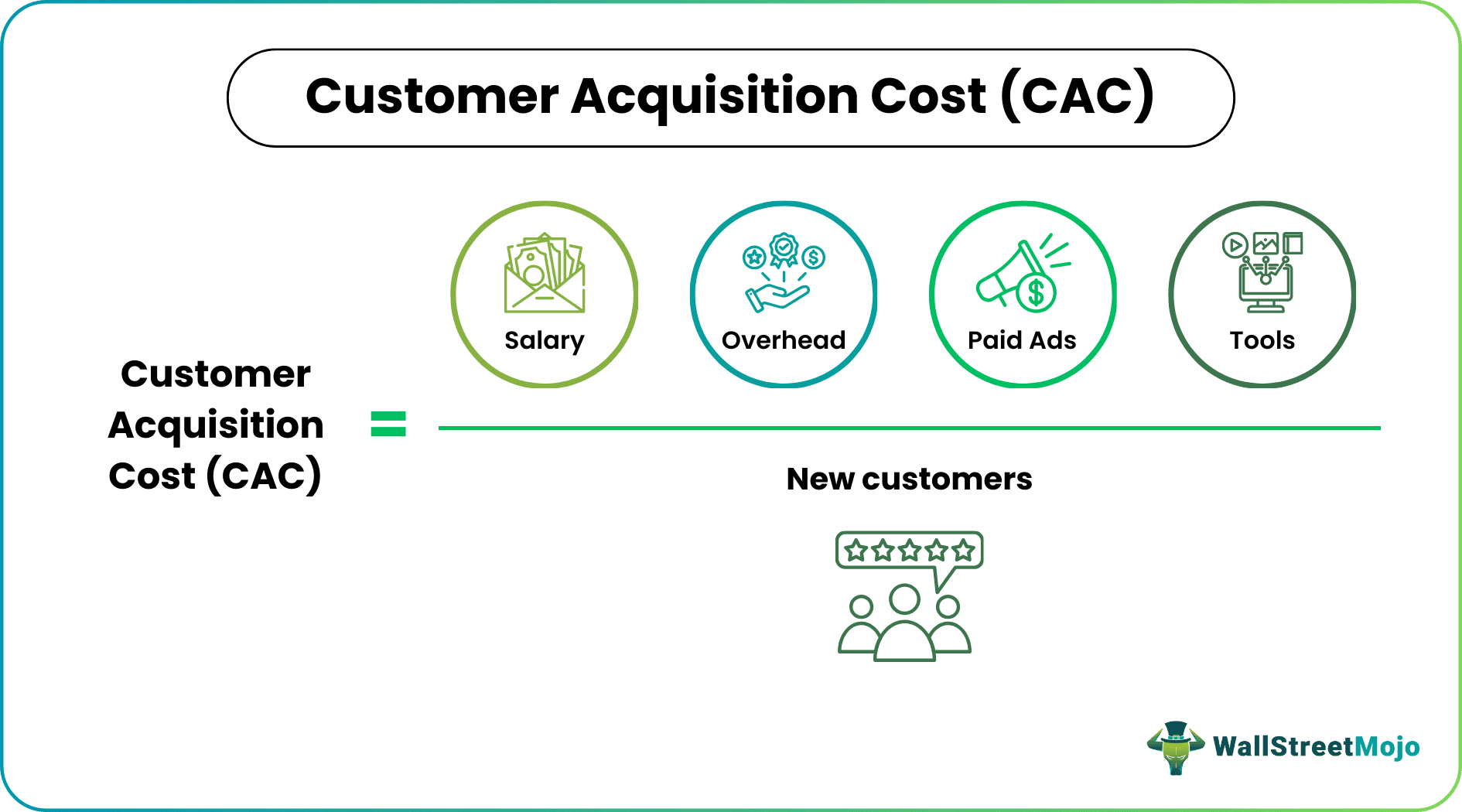

Businesses need to know the cost of acquiring customers beforehand—it is a crucial budgeting component. A company's board of directors decides how much funds they need to allocate towards acquiring new customers. This budget is then spent judiciously on marketing campaigns, advertising techniques, and strategies that can create brand awareness.

Of course, budgeting is done beforehand. Therefore, the cost to acquire customer figures is just a projection. And yes, projections can be inaccurate. However, the company can work on average acquisition costs based on the chosen publicity mode. The last minor details can be tweaked based on live feedback without altering the assigned budget.

There is also an accounting technique called deferred acquisition cost; it is applied in the insurance industry. This way, insurance companies defer some of the sales cost spent on acquiring new customers.

Formula

Formulas vary depending on the applications.

- The acquisition cost formula is as follows:

Here CAC is the customer acquisition cost.

- To determine the cost of acquiring property, the following formula is used:

Here, CII is the cost inflation index.

Calculation example

Let us look at some acquisition cost examples to grasp it better.

Example #1

The cost to acquire differs from one asset to another depending on how much is spent on customer acquisition.

Let us assume that a company introduces a new washing powder product. The management decided to organize a seminar and invite people to it. Here, the marketing and advertising departments aim to attract new customers to the seminar.

At the seminar, the company will demonstrate the washing powder. In addition, the manufacturer is trying to use a seminar platform to launch its new product.

The cost of sales and marketing is aggregated to $18,000. Two hundred people attended the seminar—90 invitees signed up for the product and decided to buy it.

Using the given data, let us apply the acquisition cost formula:

- CAC = Sales and marketing cost / Number of new customers acquired

- CAC = 18000 / 90 = $200

Thus, the company accrued a cost of $200 for acquiring one customer.

Example #2

Property and land cost of acquisition comprises an indexed acquisition cost and other factors. The total cost depends on the cost inflation index for the transfer year and the year of sale.

Let us assume Bernard sold his property for $90000 in 2020. Bernard originally bought the property in 2015 by spending $72000. If Bernard is in the 20% income tax bracket, the CII of 2015 is 180, and the CII of 2020 is 270.

Applying the values to the formula, we get:

Indexed acquisition cost = 90000 x 270 / 180

= $135,000

The CII is always available on the income tax department’s official website.

Customer Retention vs Acquisition Cost

- Customer retention refers to strategies that ensure repeat customers. For example, businesses use these strategies to ensure first-time customers do not purchase a substitute the next time. In contrast, the cost refers to funds spent on acquiring new customers—marketing, advertising, and publicity.

- Customer retention budgets are low as customers are already familiar with the product. On the other hand, customer acquisition requires a hefty budget. As a result, businesses run massive ad campaigns to lure early adopters.

- If a company is new, customer retention follows customer acquisition. But for established businesses, both strategies run parallel.

- The research and study required for customer retention are limited; companies already possess customer data. In contrast, customer acquisition requires extensive research.

Frequently Asked Questions (FAQs)

Whenever a campaign is run for publicity or advertising purposes, the entire marketing expenditure is divided by the number of customers acquired. The following formula is used to calculate CAC.

“Cost to Acquire Customer = Sales and marketing cost / Number of new customers acquired.”

It is associated with property and real estate assets. It is calculated by multiplying the property's purchase price by the Cost inflation index of the year the property was sold and then divided by the cost inflation index of the purchase year of the property.

Following are common strategies for reducing CAC:

- Retargeting of customers.

- Introducing market automation.

- Focusing more on customer retention.

- Improving the sales funnel.

- Trying cheaper advertisement mediums.