Table Of Contents

What Is Accumulated Depreciation?

The accumulated depreciation of an asset is the amount of cumulative depreciation that has been charged on the asset from its purchase date until the reporting date. It is a contra-account, which is the difference between the asset's purchase price and its carrying value on the balance sheet and is easily available as a line item under the fixed asset section on the balance sheet.

Thus, it is a concept in the accounting process that tracks the decrease in the asset value over a period, which is its useful life. The cost is allocated in such a manner so that at the end of the useful life, the owner of the asset can get a realistic view and estimation of its value, which has been subject to obsolescence or estimation over time.

How Does Accumulated Depreciation Work?

The concept of accumulated depreciation explains the total reduction in the vaue of an asset over its useful life and allocation of the same using various methods. The popular methods used for the purpose are straight line or diminishing balance.

It is clearly displayed and reported in the balance sheet of the organization, just below where the actual asset value or the opening balance of the concerned asset is mentioned. This allows the user of the financial statement to clearly understand the current value of the asset.

The concept of accumulated depreciation equation is a summation of all the depreciation amount that has been recorded for that particular ass till date. But this account has a credit balance and is recorded as a contra account. Therefore, the carrying amount it will be the value derived after deducting the accumulated amount from the cost.

Formula

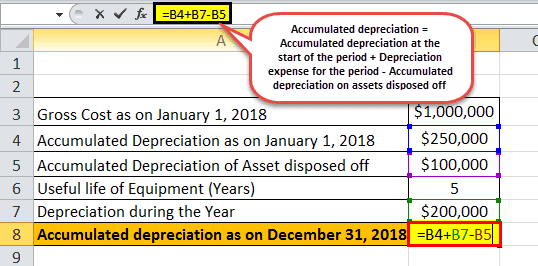

The calculation of accumulated depreciation equation is done by adding the depreciation expense charged during the current period to the depreciation at the beginning of the period while deducting the depreciation expense for a disposed asset.

Accumulated depreciation formula = Accumulated depreciation at the start of the period + Depreciation expense for the period – Accumulated depreciation on assets disposed off

In the above formula for accumulated depreciation in balance sheet we see that the depreciation value accumulated at the start of the accounting period is added to the depreciation amount of the current financial year. Here it is to be noted that any depreciation that is was existing in the financial statement related to an asset that has been sold off recently, has to be removed. Else the calculation will reveal an incorrect value.

Examples

Let’s see some simple to advanced examples to understand the calculation of accumulated depreciation in balance sheet better.

Example #1

Let us consider the example of company A which bought a piece of equipment worth $100,000 and has a useful life of 5 years. The equipment is not expected to have any salvage value at the end of its useful life. The equipment is to be depreciated on a straight-line method. Determine the accumulated depreciation at the end of 1st year and 3rd year.

Below is data for calculation of the accumulated depreciation on the balance sheet at the end of 1st year and 3rd year.

Since the company will use the equipment for the next five years, the cost of the equipment can be spread across the next five years. The annual depreciation for the equipment as per the straight-line method can be calculated as,

Annual depreciation = $100,000 / 5 = $20,000 a year over the next 5 years.

Therefore, the calculation after 1st year will be -

Accumulated depreciation formula after 1st year = Acc depreciation at the start of year 1 + Depreciation during year 1

= 0 + $20,000

= $20,000

Therefore, after 2nd year it will be -

Accumulated depreciation formula after 2nd year = Acc depreciation at the start of year 2 + Depreciation during year 2

= $20,000 + $20,000

= $40,000

Therefore, after 3rd year it will be -

Accumulated depreciation formula after 3rd year = Acc depreciation at the start of year 3 + Depreciation during year 3

= $40,000 + $20,000

= $60,000

Example #2

Let us calculate the accumulated depreciation on the balance sheet at the end of the financial year ended December 31, 2018, based on the following information:

- Gross Cost as on January 1, 2018: $1,000,000

- Acc depreciation as on January 1, 2018: $250,000

- Equipment worth $400,000 with acc depreciation of $100,000 has been disposed of on January 1, 2018

- The machinery is to be depreciated on the straight-line method over its useful life (5 years)

Below is the data for the calculation of accumulated depreciation at the end of the financial year ended December 31, 2018

As per the question, Depreciation during a year will be calculated as,

Depreciation during a year = Gross cost / Useful life

= $1,000,000 / 5

Depreciation during a year= $200,000

Therefore, calculation of Accumulated depreciation as on December 31, 2018, will be,

Accumulated depreciation as on December 31, 2018, = Acc depreciation as on January 1, 2018, + Depreciation during a year – Acc depreciation for asset disposed of

Accumulated depreciation as on December 31, 2018= $250,000 + $200,000 - $100,000

= $350,000

Purpose

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets.

- Capitalized assets provide value not only for a year but for more than one year, and accounting principles prescribe that expenses and the corresponding sales should be recognized in the same period according to the matching concept. To cater to this matching principle in the case of capitalized assets, accountants across the world use the process called depreciation.

- Depreciation expense is a portion of the total capitalized asset recognized in the income statement from the year it is purchased and for the rest of the asset's useful life. Subsequently, it is the total amount of the asset that has been depreciated from the date of its purchase to the reporting date. The amount of accumulated depreciation for an asset increases over the asset's lifetime as depreciation expense continues to be charged against the asset, which eventually decreases the carrying value of the asset. As such, it can also help an accountant to track how much useful life is remaining for an asset.

- It helps in accurately finding out the total remaining value of the asset as on the date of the balance sheet. Thus, it gives a realistic and updated picture of the financial position of the business after taking into consideration the loss of value due to depreciation.

- The financial statements are widely used by analysts and investors who take important financial decision based on the asset and liability of the company. Thus, it is important for the business to show the asset value as per the accumulated depreciation account as on the particular day so that the user of the statement is not misguided.

- The value of accumulated depreciation is used to calculate the profit or loss on sale of asset when it is disposed off. This is also used for calculation of tax amount on the profit earned, which is in turn used for the purpose of financial reporting. At the time of disposal, the actual asset book value can be determined.

- The management can do an asset replacement planning using this concept. The accumulated depreciation equipment serves as a benchmark to understand the how much funds are to be invested further to replace it and how much will be the possible fall in value within its useful life. The management can create a budget for the purpose and this helps in proper expenditure planning.

Accumulated Depreciation Vs Depreciation Expense

Both the above are highly related concepts in the field of accounting. However, there is a difference between them as given below:

- The accumulated depreciation account is a contra account that is mentioned in the balance sheet of an organization whereas the latter is not.

- The former shows the total amount of depreciation value accumulated against the particular asset since it has been acquired but the latter is the the reduction in the value over each accounting period.

- The former is listed in the balance sheet of the organization as the total depreciation expense that is accumulated against the asset. But the latter is recorded in the income statement as an expense at a particular date.

- The accumulated depreciation equipment offsets the asset cost as displayed in the balance sheet but the latter shows an operating expense that which reduces the income that is reported in profit and loss account.

However, both reflect the actual asset value at the end of the useful life, because it is subject to wear and tear and obsolescence. Both are of equal importance since it helps in portraying the financial statements in a clear and transparent manner.