Accumulated Depreciation – An Asset or Liability

Table Of Contents

Is Accumulated Depreciation an asset or a liability?

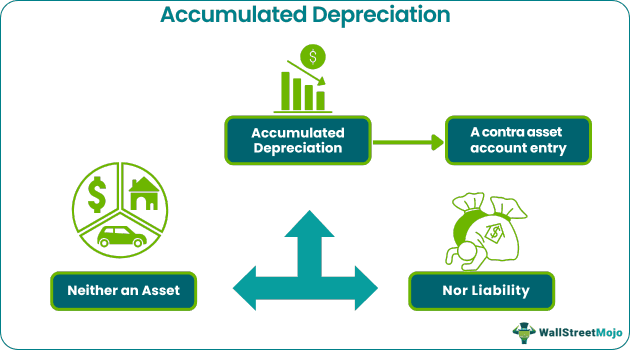

Accumulated depreciation, being the total depreciation that is reduced from the asset’s value, is neither an asset nor a liability. It is recorded on the credit side to offset the balance of the asset. It is treated as a long-term contra asset classified under the heading property, plant, and equipment as a credit balance.

Accumulated depreciation gives an account of depreciation cost allocated for assets when it is put to use. However, many experts argue that it is a liability as it does not represent something that produces economic value.

Accumulated Depreciation – An Asset or Liability Explained

Accumulated depreciation is the total amount of wear and tear that an asset has undergone. This records the repair or replacement cost a company is expected to bear for that particular asset. To know if this depreciation cost is a liability or an asset, let us first understand how these costs are and how are they recorded.

Depreciation is normal wear and tear in the asset's value as the asset value gets depreciated with the usage and passage of time. Accumulated depreciation is total wear and tear in the value of assets to date. Accumulated depreciation is to be reduced from the asset's book value to represent the true value of the asset.

This amount is not an asset in any way, but the cost associated with dealing with the deteriorating condition of that asset. Hence, it does not fall under the asset category. So far as considering this depreciation as a liability is concerned, this expense is not a direct liability, but a cost associated with the asset’s condition. However, there are critics who consider these expenses as a liability.

Accumulated depreciation, which neither fits into the definitions of an asset and liability completely, therefore, becomes the long-term contra asset as with the usage of assets, the depreciation is applied, and usage of assets contributed to the progress of entity and producing the economic value. But some view depreciation as a liability because it contains the credit balance, and depreciation is applied even when the asset is not used due to the passage of time and the introduction of new technology, the value gets depreciated. Hence the value of accumulated depreciation does not represent something that produced economic value, whether in the past or the future. Hence it is not an asset nor a liability.

Reasons

Accumulated depreciation is the total amount of wear and tear in the value of assets. It is levied due to the continuous usage of assets or devaluation of assets due to the passage of time or the introduction of new technologies. There are mixed views about the classification of accumulated depreciation as an asset or liability. But the industry experts and experienced professionals concluded that accumulated depreciation is neither an asset nor a liability, as it does not produce economic benefit; hence cannot be treated as an asset, nor it is not an obligation towards a third party; hence it cannot be classified as a liability. Hence accumulated depreciation is treated as a contra asset that offsets the balance of the asset. Accumulated depreciation is also shown separately from assets and liabilities as accumulated depreciation in long-term assets against the reduction from the book value of the asset.

Accumulated Depreciation is neither an asset nor a liability because of the following reasons:

- Accumulated depreciation is not considered an asset because assets represent something that will produce economic value to the enterprise over the past. And accumulated depreciation does not produce the organization's economic value as accumulated depreciation itself shows the credit balance.

- Accumulated depreciation is not considered a liability because liability represents the obligation to pay, and accumulated depreciation is not a payment obligation to the entity. Instead, it is created for internal and valuation purposes.

- Suppose we have to select the classification of accumulated depreciation as an asset or liability. In that case, we will choose it to represent an asset as if we represent it as a liability. It will create an impression that it is obligated to pay the third party, which is not a fact. Hence accumulated depreciation is treated as a contra asset, which means it contains a negative balance used to offset the asset. Hence it is classified separately from a normal asset or liability account.

Example

Let us consider the following example to understand the recording of the accumulated depreciation as a contra asset in the financial statement:

A Ltd has several long-term assets. The classification of long-term assets and depreciation details are given below:

The business started operations on 01-04-2015. Land purchased on 01-07-2015. Office premises were on rent at the time of the start of business. It was purchased on 01-04-2016. Plant, machinery, and furniture were purchased when incorporating a business, i.e., 01-04-2015. Vehicles were purchased on 01-04-2017 for business operations like pick and drop facilities for managers and other staff members.

Show the classification of the asset as per generally accepted accounting principles and also state at what value the assets will be shown in the balance sheet and treatment of depreciation and the accumulated depreciation, whether it is treated as an asset or liability. State the values as of 31-03-2020.

Solution:

As the value of land is appreciating; hence land is not a depreciable asset.

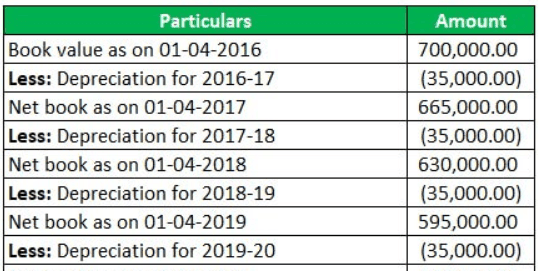

Calculation of Net Book Value of Office Building:

Calculation of Net book value of Plant and Machinery:

Calculation of Net book value of Furniture & Fixtures

Calculation of Net book value of Vehicles

Presentation of Asset in Balance Sheet

Accumulated depreciation is neither shown as an asset nor as a liability. Instead, it is separately deducted from the asset's value, and it is treated as a contra asset as it offsets the balance of the asset. Every year depreciation is treated as an expense and debited to the profit and loss account.