Table Of Contents

What is Accumulated Amortization?

Accumulated amortization is an aggregated value of the amortization expense that has been recorded for an intangible asset based on the cost, lifetime, and usefulness that has been allocated to the asset in producing the units, often viewed as the repayment that the firm would have to do to own the underlying intangible asset.

Key Takeaways

- Accumulated amortization is an amortization expense aggregated value recorded for an intangible asset based on the cost, lifetime, and usefulness allocated to the investment in producing the units.

- It is confused with depreciation. Still, the difference between the two is that amortization can be used for intangible assets, while depreciation for tangible assets. However, both are similar in how they are accumulated and evaluated.

- It is a helpful tool to determine intangible assets' value and usefulness to the firm. Nevertheless, not all intangible assets can be amortized.

Accumulated Amortization Formula

Accumulated Amortization is an aggregated value and hence can be expressed mathematically as:

Accumulated Amortization = ∑ Amortized Value of the Asset Each Year

Example of Accumulated Amortization

Accumulated amortization is used to realize the value of intangible assets. Examples of these type of assets are:

- Patents

- Exclusive contract

- Licensing agreement

An important point to note is that these values do diminish in value and eventually get to zero.

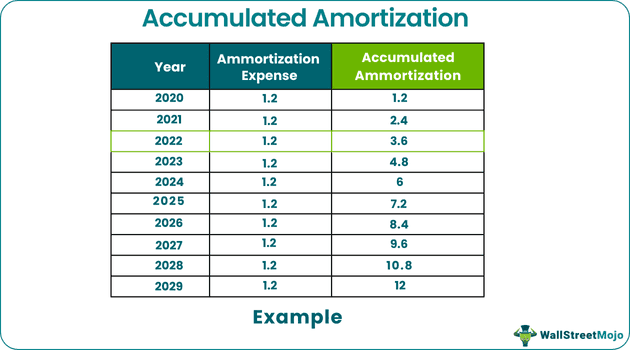

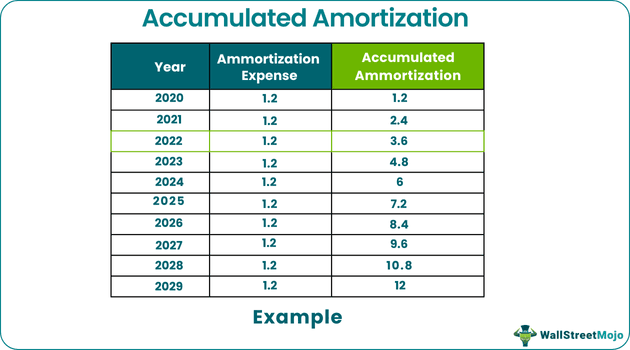

Consider the example of a patent. Let’s consider a major pharma firm ABC Healthcare headquartered in New York, the US, which spends a good amount of money on its Research and development wing and comes up with a breakthrough drug that can help a deadly disease like cancer. This breakthrough has resulted from years of research by its R & D department.

The firm files a patent for this drug and holds exclusive rights for the next ten years for 12 million dollars. During these seven years, other firms and competitors are not allowed to produce this drug, although they can develop a partnership with our firm but only at their discretion. However, the patent will expire and should be realized in the financials.

- Life of patent: 10 Years

- Total Value: $ 12 million

- Per Year Amortization: 12/10 = $ 1.2 million

Considering ABC healthcare follows a straight-line amortization mechanism, let's design the cash flow for this expense.

| Year | Amortization Expense | Accumulated Amortization |

|---|---|---|

| 2020 | 1.2 | 1.2 |

| 2021 | 1.2 | 2.4 |

| 2022 | 1.2 | 3.6 |

| 2023 | 1.2 | 4.8 |

| 2024 | 1.2 | 6 |

| 2025 | 1.2 | 7.2 |

| 2026 | 1.2 | 8.4 |

| 2027 | 1.2 | 9.6 |

| 2028 | 1.2 | 10.8 |

| 2029 | 1.2 | 12 |

This expense will continue to be part of the balance sheet till 2029 post, which is completely amortized.

Refer to the given above excel sheet for detailed calculation.

Important Points to Note About Accumulated Amortization

- Often accumulated amortization is confused with depreciation. However, that’s not the case, as the basic fundamental difference between the two is that amortization is used for intangible assets, while depreciation is used for tangible assets. Although the two are quite similar in how they are being accumulated and calculated.

- Amortization calculations directly affect the firm's financial statements, especially the bottom line. Hence, the investors keenly watch it to evaluate the firm's financial health.

- As per current accounting principles guidelines, a firm must evaluate its intangible assets at their current valuation at least once a year and record them as accumulated amortization. Advised by GAAP (Generally accepted accounting principles), it is one of the ways through which the company adjusts its intangible assets to the fair value on the balance sheet as per the current market value.

- Accumulated amortization is similar to depreciation, with the only difference arising from what assets have been applied. These accounting methods want to discount the value of assets that they possess in the company's financial statements steadily and regularly, keeping the minimum effect on the short-term and long-term profits. On the one hand, depreciation is a mechanism to realize these values for tangible assets, accumulated amortization, on the other hand, is a mechanism to realize these values for intangible assets like licensing agreements, patents owned by the firm, list of customers to name a few.

- Accumulated amortization affects the net income as it reduces the retained earnings acquired. To illustrate, a 50 million $ amortized value will reduce the revalue of retained earnings by the same amount.

- Amortization draws many parallels from depreciation. There can be three different methods through which amortization can be calculated. One of those is how these can be calculated and recorded on the financial statements. Irrespective of the methods used, it is imperative to understand the usefulness of the intangible asset, its residual value, and its impact on actual production and distribution costs.

- Straight-line Method: Similar to the straight-line method of depreciation, it calculates the total amortization cost and divides it by the time horizon. Thus, providing a gradual and even decay of the intangible asset.

- Accelerated Method: This method follows a weighted average approach and provides more value in earlier years and reduces with each passing year. It is based on the economic principle of the law of diminishing marginal utility, as with each year, gains realized are less than what was achieved last year.

- Units of Production Method – This method allocates the cost in the ratio in which this intangible asset helped produce the actual units.

- Often accumulated amortization is presented as a separate item on the balance sheet as a common industry practice. Another way of looking at it can be realizing it as a contra asset account.

Conclusion

Accumulated amortization is a useful mechanism to evaluate the value of intangible assets and their usefulness to the firm. However, the point to note is that not all intangible assets can be amortized. Consider the case of patents and licensing agreements. These methods help evaluate the competitive edge that a firm gains compared to its peers and how it can use it to present its financials in a better way to its shareholders.

Now consider the case of another intangible asset, Goodwill. Goodwill, as we know, is a measure of the synergy capacity that the firm has acquired over a time frame as a result of acquisitions. Hence goodwill should never be amortized as this value should always increase. Much like land, which is never depreciated, it should be reviewed once a year to provide a better and current view of the underlying asset. One should see it as having an indefinite life and always adding value to its finances.