Table Of Contents

Meaning of Accounts Receivables

Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year.

Table of contents

Accounts Receivables Accounting

Let us take an account receivables example to see how it works. ToysforU sales and receipts from customers are shown below.

- All customers buy on credit and pay cash the following year if they are not bankrupt. Any uncollected receivables are then written off.

- Based on its experience, ToysforU books 10% of its receivables outstanding at the end of the period as an allowance for bad debts.

- There are no other costs, i.e., the cost of goods sold (COGS) is $0

- The actual write-offs differ from expectations, as shown in the table below.

Please create the Income Statement, Balance Sheet and Cash Flows at the end of Year 1 and Year 2

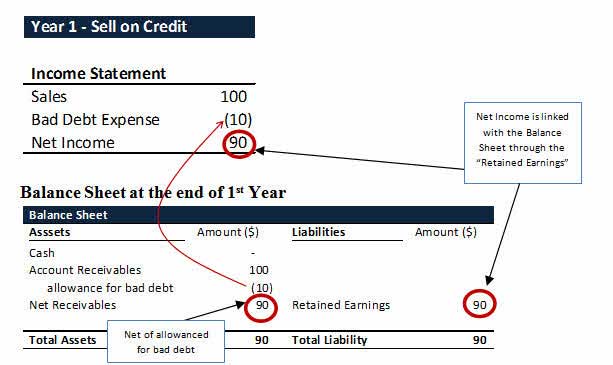

Year 1

Income Statement for the 1st Year

- $100 sales will be booked due to the "Accrual Accounting" concept (introduced in 1st chapter Kartik's case study)

- COGS is $0 as given in the case study

- Bad Debt Expense is 10% of the Sales = 10% of $100 = $10

- Net Income Reported in 1st Year is $90

Balance Sheet for the 1st Year

- Receivables is an asset and is reported as $100

- After accounting for the allowance for bad debt, Net Receivables becomes $90

Cash flow for Year 1

There is no cash received in Year 1, Cash Flow = $0

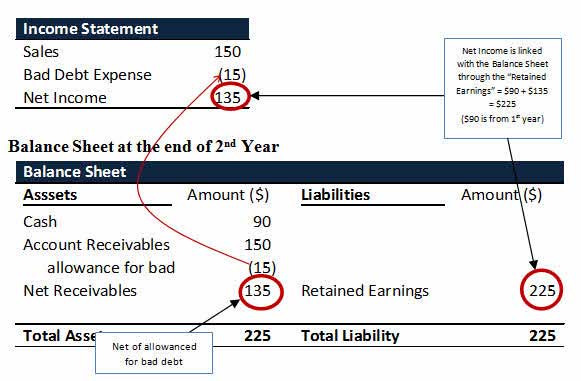

Year 2

Income Statement for the 2nd Year

- Sales will be booked due to the "Accrual Accounting" concept (introduced in 1st chapter Kartik's case study)

- COGS is $0 as given in the case study

- Bad Debt Expense is 10% of the Sales = 10% of $150 = $50

- Net Income Reported in 2nd Year is $135

Balance Sheet for the 2nd Year

- Receivables is an asset and is reported as $150

- After accounting for the allowance for bad debt, Net Receivables becomes $135

Cash flow for Year 2

The actual cash collection during the year was $90. Cash Flow = $90

Video Explanation of Accounts Receivables

Examples of Accounts Receivable

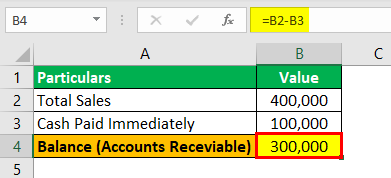

#1 - Sale of Goods

A trader Mark Inc. dealing in FMCG products sells 20,000 pieces of soap, each having a market price of $20 (total value $4,00,000) to Henry Inc. Against this purchase, Henry Inc. paid $1,00,000 in cash and agreed to pay the balance after 6 months.

Solution:

Calculation of Accounts Receivable can be done as follows:

Here, Mark Inc. generated an asset in the form of accounts receivable as Henry Inc. Since, a customer had paid $1,00,000 in cash and has agreed to pay rest after 6 months, Mark Inc. will show Balance of $3,00,000 as accounts Receivable in its balance sheet.

Suppose, in the above example, Henry Inc becomes insolvent after 3 months, and it is estimated that the company can recover only $1,00,000. Then, It will be reduced to $1,00,000, and the remaining $2,00,000 will be charged to profit and loss A/c as bad debts.

Note:

Similarly, all goods supply accounts receivable can be identified and accounted for.

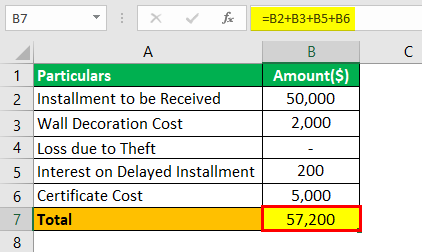

#2 - Supply of Service

Tony Builders Inc. (Construction contractor) gives the following data regarding the construction agreement of flat. Determine account receivable as on 31st March 2019:

- Total Contract Price $1,00,000

- Installment received 5 out of 10

- Additional cost incurred in Wall decoration (to be recovered from a customer)$2,000

- A loss incurred due to the theft of construction material $10,000

- Interest on delayed payment incurred on fourth installment @12%p.a. for 2 months.

- Completion Certificate legal cost to be reimbursed from customer $5,000 payable after 2 years (estimated date of completion of construction)

Solution:

It is the case of sale of service (Completion of under-construction property). To determine debtors, Mark Inc. needs to identify all expenses which can be recovered from Henry Inc.

Debtors standing in books of Tony Inc. as on 31/03/2019 will be calculated as follows:

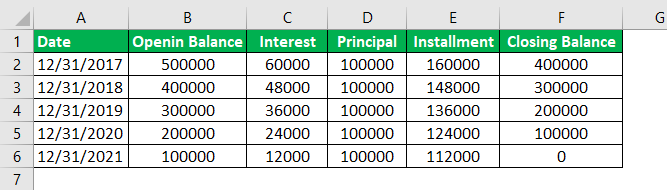

#3 - Money Lending Industry

Bank of America lent Mark Inc. $5,00,000 on 01st January 2017 for purchasing machinery to be used in business on the following conditions:

- An interest rate of 12% p.a. will be charged,

- The principle will be repaid in 5 equal annual installments,

- Loan Processing fees paid as on 01/01/2017 $ 2,000

Determine accounts receivable at the end of the Year 2017, 2018, 2019, 2020, 2021.

Solution:

It is the case of the money lending service industry like Banks, NBFCs. The primary Income of such industry is generated by Interest (charge against the use of money for a particular period). To determine debtors at each year-end, we need to prepare a loan amortization table for 5 years as follows:

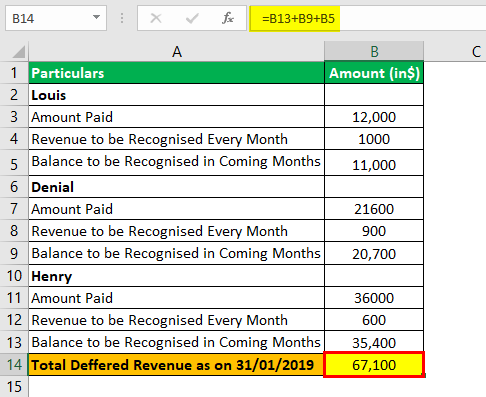

#4 - Deferred Revenue - Sale of Magazine

Mark Inc., sells a popular monthly magazine on a subscription basis on the following terms:

- One Year Subscription fees - $10,000

- Two Year Subscription Fees gets a discount of $2,000

- Five Year Subscription Fees gets a discount of $4,000

- All amounts are payable immediately

Louis, Denial, Henry opts for each option, respectively, on 01/01/2019. Identify accounts receivable for Mark Inc. as on 31/01/2019

Solution:

Selling of magazine on a fixed subscription basis becomes a case of deferred revenue since the magazine will be supplied monthly, but consideration is received in advance.

Under this, the amount is received in advance for supplying goods, i.e., magazine over a period of time. Here, accounts receivable will be calculated as follows:

You can refer to the given above excel template for a detailed calculation of accounts receivable.

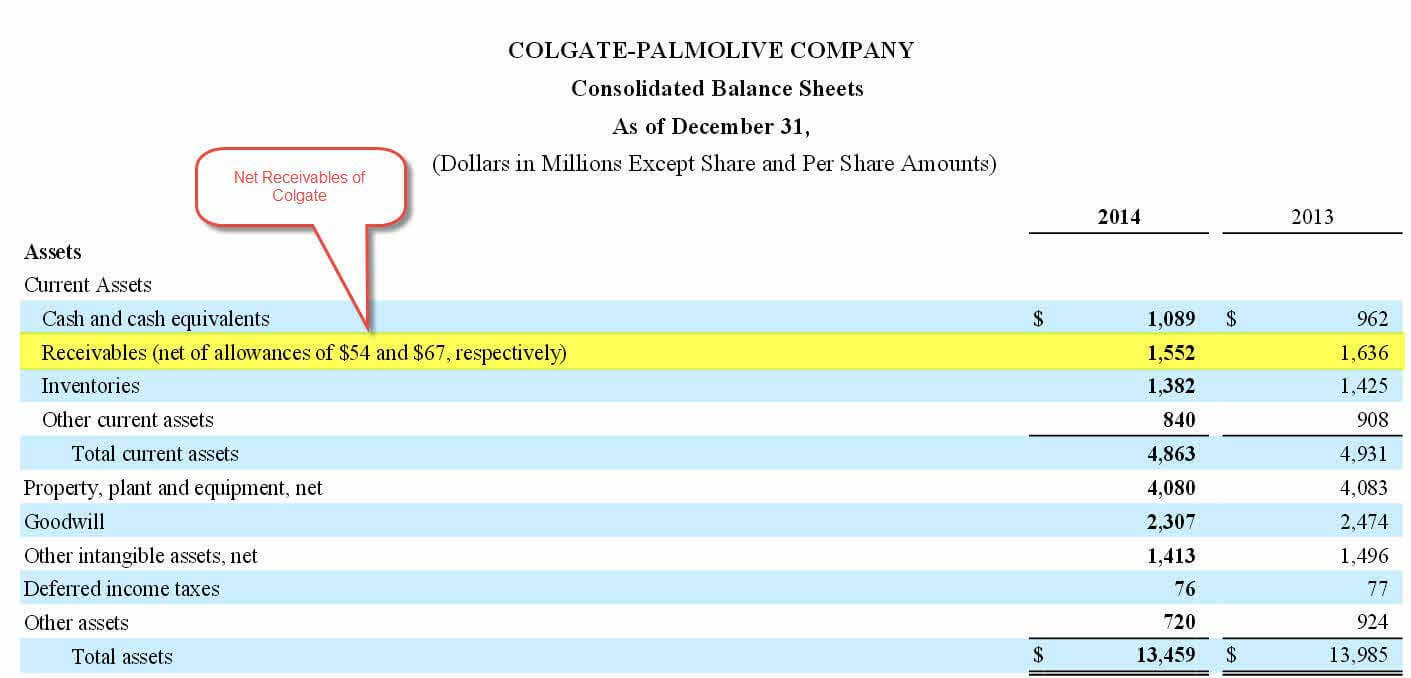

Gross vs Net Accounts Receivables?

- Gross receivables are the total receivables (open invoices) that are due to the company. This does not take into account a scenario where the customer may default.

- Net Receivables, on the other hand, takes into account the probability of default from the customers. To prepare for some nonpayments, the company estimates that a proportion of its credit sales will go bad. This term is usually called "allowance for doubtful accounts".

- The estimate shows up on the income statement as a bad debt expense. This expense is usually charged to SG&A in the income statement.

Let us see an example of Colgate to understand the difference between the two.

In Colgate, we note the following -

- 2014 - Net receivables is $1,552 mn, allowance is $54 mn; This implies Gross Receivables are $1,552 + $54 = $1,606 mn

- 2013 - Net receivables is $1,636 mn, allowance is $67 mn; This implies Gross Receivables are $1,636 + $67 = $1,703 mn

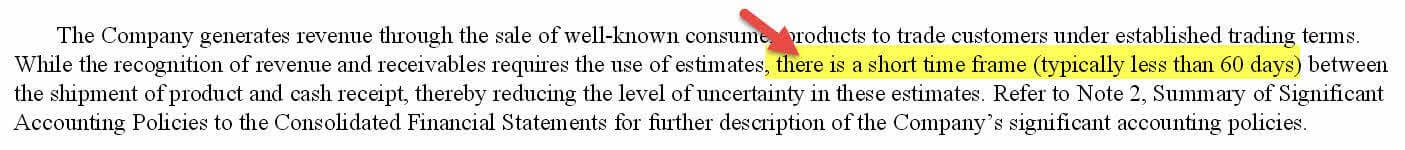

Below is the Colgate receivables policy suggests a shorter credit policy of less than 60 days

Accounts Receivables by Industry

Let us now have a look at the industry average receivables.

| Rank | Industry | Receivables (Days) |

| 1 | Banks | 331.9 |

| 2 | Machinery | 109.93 |

| 3 | Construction | 107.88 |

| 4 | Metal Products | 103.36 |

| 5 | Chemicals | 98.27 |

| 6 | Glass & Ceramics Products | 97.9 |

| 7 | Precision Instruments | 97.8 |

| 8 | Electric Appliances | 96.46 |

| 9 | Rubber Products | 92.09 |

| 10 | Other Services | 89.74 |

| 11 | Pulp & Paper | 85.73 |

| 12 | Nonferrous Metals Products | 85.13 |

| 13 | Other Products | 83.87 |

| 14 | Iron & Steel | 81.3 |

| 15 | Wood & Wood products | 75.7 |

| 16 | Communication | 74.19 |

| 17 | Wholesale Trade | 73.78 |

| 18 | Transportation Equipment | 70.65 |

| 19 | Textiles & Apparels | 69.34 |

| 20 | Leather Products | 69.23 |

| 21 | Air Transportation | 68.22 |

| 22 | Publishing & Printing | 67.31 |

| 23 | Agriculture | 61.59 |

| 24 | Oil & Gas Mining | 60.29 |

| 25 | Other Transportation | 58.85 |

| 26 | Insurance | 56.89 |

| 27 | Foods | 55.44 |

| 28 | Oil & Coal Products | 54.99 |

| 29 | Forestry | 54.38 |

| 30 | Coal Mining | 48.24 |

| 31 | Fishery | 42.81 |

| 32 | Metal Mining | 41.66 |

| 33 | Gas | 36.26 |

| 34 | Movie | 33.49 |

| 35 | Road Transportation | 32.41 |

| 36 | Retail Trade | 28.23 |

| 37 | Hotel | 27.47 |

| 38 | Electric Power | 27.28 |

| 39 | Railway | 24.68 |

| 40 | Warehousing | 23.81 |

| 41 | Marine Transportation | 23.72 |

| 42 | Amusement | 18.78 |

| 43 | Real Estate | 10.64 |

| 44 | Securities | 6.86 |

source: ediunet

As you can see from above, industries like Banks have a very long receivables period (in excess of 300 days), however, for capital goods and heavy asset industries like machinery, construction, metals, etc., it is around 100 days.

Conclusion

Accounts receivables are the amount that is due to the company by its customers. It is important to consider the default probability of the customer and therefore look at the Net Receivables numbers. Each industry has a different set of credit policy and hence, account receivable days differ by wide measures.

Recommended Articles

This has been a guide to Accounts Receivables and their meaning. Here we discuss accounting for Accounts Receivables along with Industry examples. You may also have a look at these following articles to learn more about accounting.