Table Of Contents

What Is Accounts Receivable Turnover?

The accounts receivable turnover ratio indicates how effectively a business collects credit from its debtors. It calculates how frequently a company manages its average accounts receivable over a specified period. Providing a line of credit is one thing, but collecting this ‘interest-free loan’ from the debtors is another.

A higher accounts receivable turnover ratio is desirable since it indicates a shorter delay between credit sales and cash received. On the other hand, a lower turnover is detrimental to a business because it shows a longer time interval between credit sales and cash receipts. Additionally, there is always the possibility of not recovering the payment.

Key Takeaways

- The accounts receivable turnover ratio shows the business efficiency of gathering credit from the debtors. In addition, it determines how often a company can manage the average accounts receivable over a particular period.

- It is calculated by dividing the net credit sales by the average accounts receivable.

- Considering only the first and last months, one may calculate the average receivable turnover. Hence, it may give a different picture if the accounts receivables turnover varies drastically over the year.

- To overcome the drawback, one can take the average over the whole year, i.e., 12 months instead of 2.

Accounts Receivable Turnover Explained

The accounts receivable turnover or debtor’s turnover ratio is a measure of maintaining accounts which clarifies an organization’s efficiency in providing debt and collecting those debts.

In general terms, 7.8 is considered a good accounts receivable turnover ratio. This means that the company collects payments 7.8 times a year. A number higher than this could indicate that the company has a better collection skill.

As investors on the other hand, one should learn to calculate the turnover ratio. Many firms consider gross credit sales rather than net credit sales. It can be misleading if not paid attention to.

Also, it is important to understand that the average receivable turnover is calculated by considering only the first and last months. Therefore, it may not give the correct picture if the accounts receivables turnover has drastically varied over the year. To overcome this shortcoming, one can take the average over the whole year, i.e., 12 months instead of 2.

Video Explanation Of Accounts Receivable Turnover

Formula

The accounts receivable turnover ratio is calculated by dividing the net credit sales by the average accounts receivable. Net credit sales are considered instead of net sales because net sales include cash sales, but cash sales do not fall under credit sales.

Accounts Receivable Turnover Ratio Formula = (Net Credit Sales) / (Average Accounts Receivable)

In the above ratio, we have two components.

- Net Credit Sales = Gross Credit Sales - Returns (or Refunds). We must remember that we cannot take the total net sales here. We need to separate the cash sales and credit sales. And then, we need to deduct any sales return from the credit sales.

- Average accounts receivables - To find out the average accounts receivable (net), we need to consider two elements – accounts receivable (opening) and accounts receivable (closing) and find the average of the two.

How To Calculate?

In 2010, a company had a gross credit sale of $1000,000 and $200,000 worth of returns. On 1st January 2010, the accounts receivable was $300,000, and on 31st December 2010 was $500,000.

Based on the above information, let us use the accounts receivable turnover calculator to find the ratio:

- Average accounts receivable = (3,00,000 + 5,00,000) / 2 = ₹4,00,000

- Net credit sales = 10,00,000 – 2,00,000 = 8,00,000

- Receivable turnover = 8,00,000 / 4,00,000 = 2.

From the above example, the turnover ratio is 2, which means that the company can collect its receivables twice in the given year or once in 182 days (365/2).

In other words, when making a credit sale, it will take the company 182 days to collect the cash from the sale.

Example

Let us understand the concept of the accounts receivable turnover ratio through the example of one of the largest consumer goods companies in the world- Colgate.

- Now that we have seen how to calculate the asset turnover ratio, let us know the turnover ratio for Colgate.

- We have assumed that all Colgate’s income statement sales are credit sales.

- The following image shows the average receivables turnover for 2014 and 2015: -

- Colgate’s accounts receivables turnover has been high at around 10x for 5-6 years.

- Higher turnover implies a higher frequency of converting receivables into cash.

- We note that the P&G receivable turnover ratio of around 13.56x is higher than that of Colgate (~10x).

- Unilever’s receivables turnover is closer to that of Colgate.

Interpretation

Using the accounts receivable turnover calculator is one thing and understanding the data coming out of it is completely another ball game altogether. Let us understand the interpretation through the points below.

- A higher ratio means the company collects cash more frequently and/or has a good quality debtor. In turn, it means the company has a better cash position, indicating that it can pay off its bills and other obligations sooner. In addition, the accounts receivable turnover often is posted as collateral for loans, making a good turnover ratio essential.

- At the same time, a high turnover ratio may also mean that the company transacts mainly in cash or has a strict credit policy.

- A lower ratio may mean that either the company is less efficient in collecting the creditor, has a lenient credit policy, or has a poor-quality debtor.

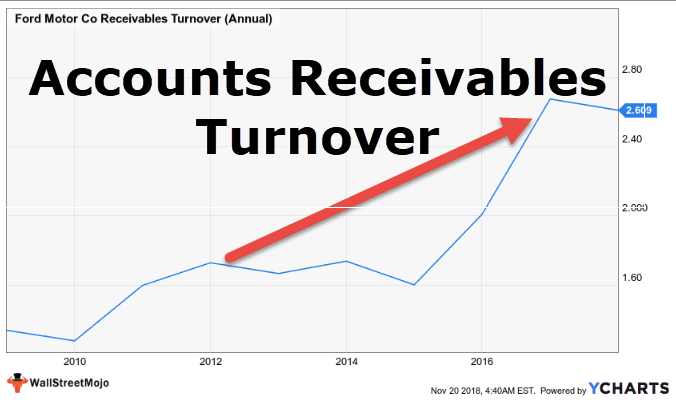

- The number (turnover ratio) does not give the complete picture. It is better to check for the turnover ratio trends over the years to assess the true collecting efficiency of the companies. In addition, many prudent analysts analyze if the company’s ratio affects its earnings. Comparing the turnover ratios of two companies in the same industry is also useful.

For individuals looking to develop a practical understanding of accounting ratios, including the receivables turnover ratio, enrolling in the Financial Planning & Analysis Program can be a wise move. This is because the instructor of the course explains each of these important ratios in detail with the help of examples to provide comprehensive knowledge.

An added advantage is that this course is self-paced. So, you can learn at your own pace and revisit lessons in case you forget a key step or want to strengthen your understanding.

Benefits

Some noteworthy advantages of this ratio are as follows:

- This ratio offers key insights into the debt collection efficiency of an organization.

- It can help in internal benchmarking.

- This ratio assists companies in tracking cash flow. Moreover, it helps identify opportunities to improve collection practices.

Limitations

Let us look at some of the accounts receivable turnover ratio disadvantages.

- Comparing this ratio of companies across industries is a challenge because of varying customer credit policies and standards.

- Organizations can inflate this ratio by utilizing total sales instead of using the net sales when computing.

- Seasonal fluctuations might have an impact on this ratio, thus requiring individuals to carry out analysis over longer durations, for example, 12 months.

- Every company does not disclose net sales and related information. This makes it challenging for individuals to make accurate comparisons.

How To Increase Accounts Receivable Turnover Ratio?

One can consider the following tips to improve the receivables turnover ratio:

- Invoice accurately and on a regular basis to receive payments on time.

- Outline the terms of payment clearly in invoices and contracts to ensure the efficient management of customer expectations.

- Offer discounts for encouraging prepayments or cash payments. This incentivizes prompt invoice settlement.

- Provide different payment methods to suit the varying preferences of customers.

- Utilize automated reminders so that debtors remember to make timely payments.

Accounts Receivable Turnover Ratio vs. Asset Turnover Ratio

Individuals learning about financial ratios should remember that receivables turnover and asset turnover are two separate metrics. If individuals have confusion about their meaning, they can take a look at their main difference below to clear all doubts.

| Accounts Receivable Turnover Ratio | Asset Turnover Ratio |

|---|---|

| It measures how efficiently a company is able to collect outstanding payments. | This ratio gauges the efficiency with which a company can utilize its assets to earn revenue. |