Table of Contents

What Is An Accounts Receivable Ledger?

The accounts receivable ledger records each customer's transactions and payment history to whom the company extends credit. The balance of each customer's account is reconciled with the general ledger's accounts receivable balance to check cash flow and maintain accounting accuracy.

The ledger contains all information regarding the credit sales, credit amount, memos, payments, invoice dates and numbers linked to the refunds, allowances, and discounts. It is also known as a subsidiary ledger or customers' ledger. The total of all invoices in the ledger for accounts receivable is also referred to as the control account. It should be equal to the total of the general ledger receivables.

Key Takeaways

- An accounts receivable ledger is an accounting ledger that records and maintains each customer's account to whom the company has given credit. Also known as a subsidiary ledger or customer's ledger.

- It is separate from the general ledger but each account's balance is time to time checked with the general ledger's account receivables balance. It should match it to validate the accuracy.

- A subsidiary ledger helps firms understand market demographics, track credit sales, prevent financial frauds, help simplify auditing processes and attain accounting accuracy.

- Although it is a time-consuming and tiresome process, corporates put all efforts into maintaining it as the subsidiary ledger overpowers its maintenance through its applications.

Accounts Receivables Ledger Explained.

The account receivable ledger is the list of all the sales credits that a company has given to different customers. Since it is used for accounting purposes, it holds a detailed record and track of individual customer payments and transactions, including their credit memos, adjustments, outstanding balances owed by customers, invoices, type, receipts, and reference numbers, along with basic information such as name and description of the purchased goods on credit.

Periodically, the firms match the accounts receivable ledger's total balance of all individual customer accounts with the general ledger's accounts receivable balance. This process is referred to as reconciliation; the balance values must be equal in both the ledgers to ensure the accuracy, correctness and completeness of the financial statements and records. The accounts receivable ledger debit or credit entries help businesses monitor the cash flow and the amount due on each customer. The company management can make further decisions based on the overdue accounts and may initiate a collection action.

The general ledger records all transactions, but with an accounts receivable ledger format, the company can choose which information is to be kept. For any company, maintaining a subsidiary ledger is a time-consuming and time-consuming process. Yet, it is managed because, on the contrary, it is quite challenging to handle the credit balance of each customer at once with all the detailed information, and this is where the accounts receivable ledger helps proactively.

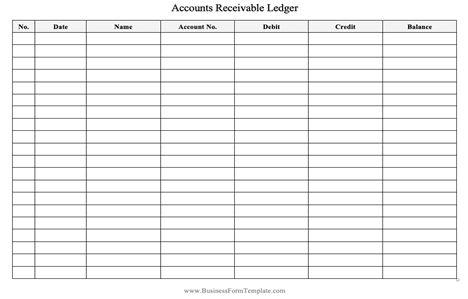

Template

Reference link - https://www.businessformtemplate.com/preview/Accounts_Receivable_Ledger

However, management can decide to add more information to the ledger to simplify the accounting procedures. The ledger's total balance must match the general ledger balance.

As provided in the template, an accounts receivables ledger typically consists of six columns depicting information regarding date, name, account number, debit, credit and balance. As payments are collected or credit sales are given, the ledger is updated to accurately track the cash flow, products or goods supplied.

Examples

Here are two examples of accounts receivable ledger -

Example #1

Suppose Ryan owns a soft drink and beverage company. Every week, tons of cold drinks and other beverages are supplied by him to his various distributors, market vendors and wholesalers that further distribute them to retailers and shopkeepers according to their orders. Since Ryan has good business relationships with most of his clients, it often happens that Ryan gives out the stock on credit, which vendors later clear.

Ryan manages a general ledger that accounts for all transactions. At the same time, he also maintains an accounts receivable ledger which records the information of all the customers to whom Ryan has given credit sales. From time to time, Ryan matches the balance of both the ledgers' accounts receivable to ensure there is no mismatch and the accounts are correct.

It is a simple example of the purpose and importance of an accounts receivable ledger. Ryan can track which customer owes how much amount, make collection efforts, more importantly Ryan can understand the customer demographics.

Example #2

In another hypothetical example, suppose Maria owns a handbag company. She had a strong reputation in the market and gave credit sales to many of her customers. Once, she went on vacation, and when she returned, she assessed the general ledger and accounts receivable ledger balance. It did not match.

This made Maria get concerned a bit about the company’s accounts. She decided to perform an audit and found out that an employee manipulated the accounts behind her back for his own interest. Maria immediately took legal action against him, rectified the books and ensured that both ledgers were correct and complete. Again, this is a good example explaining how the accounts receivable ledger helps prevent financial fraud.

Benefits

The benefits of an accounts receivable ledger are -

- Offers specific information regarding the credit sales and the company's accounts receivable.

- Using the subsidiary ledger, it becomes easy to compile information and record any particular customer's credit balance.

- Assists in eliminating and avoiding financial fraud or manipulation of company accounts.

- Helps in identifying the target market and demography.

- Aids in categorizing clients and customers based on their balance.