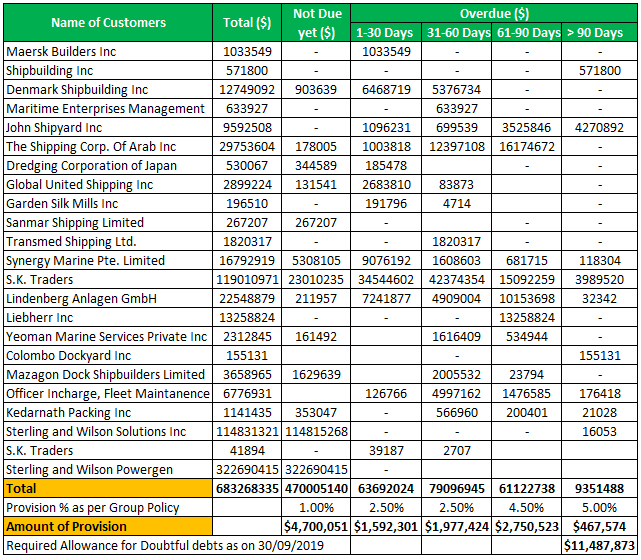

Let’s take an example of an aging accounts receivable in excel.

We can download this aging accounts receivable in excel Template here – Aging Accounts Receivables Excel Template.

A company prepared the following report on September 30, 2019.

Based on the above report, the management can decide to provide $114,87,873. The above allowance is based on corporate policy to provide for 1% as a normal allowance, 2.5% for debts outstanding within 30 days, 2.5% for debts outstanding within 60 days but beyond 30 days, 4.5% for debts outstanding within 90 days but beyond 60 days, 5.0% for debts outstanding beyond 90 days. In the future, it can revise the percentage estimates. Thus the above details clearly states the aging accounts receivable excel template.