Table Of Contents

What Are Accounts Payable Journal Entries?

Accounts Payable Journal Entries refer to the accounting entries related to amount payable in the company’s books of creditors for the purchase of goods or services. They are reported under the head of current liabilities on the balance sheet, and this account is debited whenever any payment has been made.

The business must record the entries in order to maintain transparency and accountability and later use them for making financial statements and generating reports, highlighting the good financial health of the company. These payment entries ensure the payables are cleared on time and the business maintains good relations with its vendors since a consistent fund management system is followed.

Accounts Payable Journal Entries Explained

Whenever there is any transaction related to the purchase of goods or services on the account, there arises the liability known as accounts payable liability. It is to be created and recorded in the books of accounts by the company. The amount is measured using the seller's invoice to document the journal entries for accounts payable. It usually contains information regarding the amount that the buyer has to pay and the due date.

The accounts payable general journal entry is made following the standard accounting system of recording journal entries, where there will be a debit side and a credit side, and the accountant has to ensure that every cash outflow-related transaction is diligently recorded in order to avoid errors and mismanagement of funds within the business. To streamline this process and ensure accuracy, many businesses today are turning to online accounting and bookkeeping services, which offer real-time tracking, automated entries, and easier compliance.

Such entries help in keeping a continuous record of the money or cash that remains with the business after meeting all current obligations, which may be utilized for purposes within the business operations.

Depending on the nature and size of the business, the accountants may follow some variations in approaches of recording these transactions, but the basic method of debit and credit entry remains the same. After the vendor sends the purchase order invoice, they are cross-checked internally with the order details related to the type of good or service, price, quantity of the same, taxes and transportation charges to be paid, and so on. If these values are in order and match with the respective documents, the accounts payable general journal entry is passed into the books of accounts, and payment is made to ensure the cash balance reflects the actual cash outflow.

Below are some common situations wherein the accounts payable journal entries are to be maintained. We will learn them in details and gain valuable insight into the accounting system of payment made by companies.

Explanation of Accounts Payable in Video

How To Record?

Here we get a thorough insight into how the journal entries of accounts payable are passed related to different payments the business has to make and what rules are to be kept in mind while recording the transactions.

#1 - Purchase of the merchandise inventory on account:

When there is a purchase of the merchandise inventory on account, by using the following journal entry, the liability relating to the accounts payable journal entries will be created:

The journal entry passed above for recording the accounts payable liability will be made under the periodic inventory system. However, if the company uses the perpetual inventory system, the debt part would be replaced by the "inventory account" instead of the "purchases account." The entry, in that case, will be as follows:

#2 - Damaged or undesirable inventory returned to the supplier:

In case the part of inventory or whole of the inventory purchased on the account is found by the buyer to be damaged or undesirable. He may either return the same to the seller; or ask for the allowance as a reduction in prices. If the seller approves the return or the allowance, then the buyer will reduce the accounts payable liability by that amount in his books of accounts. In such cases, the journal entry that will pass for reducing the liability of the accounts payable is as follows:

Note: The entry for the return of goods or allowance will not be recorded in the general journal as mentioned above in case of a separate Purchase return. If the buyer maintains an allowance journal and then returns, an allowance will be recorded in that purchase return and allowance journal.

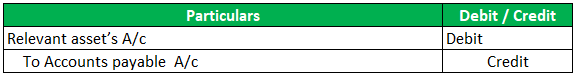

#3 - Entry when there is the purchase of assets other than the merchandise inventory on account:

In case there is the purchase of assets other than the merchandise inventory on accounts like the plant, furniture, equipment, tools, or other fixed assets. The journal entries of accounts payable to record accounts payable liability is as follows:

#4 - Entry when the expenses incurred on account of the services purchased on account:

When any person acquires any professional services like financial consultancy, legal services, etc., or incurs the expenses for which the payment is to be done on any future date, then in that case.

Suppose some professional services (such as market and legal services, etc.) are acquired, or expenses are incurred, and the payment is to be made in the future. In that case, the accounts payable liability comes into existence. The entry to record accounts payable liability is as follows:

#5 - Entry when the payment is made to the creditor or to payable:

After the creation and recording of the accounts payable liability, when the payment is made to the creditor or to payable, then there will be a reduction in the accounts payable liability, and the same will be recorded by making a journal entry as follows:

Examples

The Journal Entries that are typically used to record the accounts payable are as follows:

Accounts Payable Journal Entries - Example #1

On 5th February 2019, Sports international ltd purchased the raw material worth $5,000 from smart international ltd on the account and promised to pay for the same in cash on 25th February 2019. Prepare the necessary journal entries to record the transactions.

Solution:

Entries to record the transactions are as follows:

Accounts Payable Journal Entries - Example #2

In February 2019, the Mid-term international ltd. Did the transactions, as mentioned below. The company uses the periodic inventory system to account for the discounts using the gross method.

- Feb 02: Company purchased the inventory worth $ 50,000 with terms 2/10, n/30, FOB shipping point. For this, the freight expenses came to $ 500.

- Feb 04: It was found that out of the purchases, damaged goods were received worth $ 10,000, so it was returned to the supplier, and credit was received.

- Feb 10: Paid the cash for the purchases made on Feb 02 to the creditors.

Prepare the necessary journal entries to record the transactions:

Solution:

Entries to record the transactions are as follows:

Accounts Payable Journal Entries Vs Accounts Receivable Journal Entries

As an individual who wants to learn more about payables and their journal entries recorded in a business, it is important to also compare it with the entries made against receivables. This will enhance the understanding level and make it easy to identify them correctly and use them for the next level of accounting process. Let us differentiate them.

- In case of the accounts payable journal entries general ledger, the entries are meant for money that is leaving the business. But in case of the latter, the entries are meant for the money that is coming into the business.

- In the balance sheet, the former is entered as a current liability that has to be paid off within a short time span in the future. But for the latter, in the balance sheet, it is recorded as a current asset that will be received within a short period.

- The entries passed related to the former are identified as liability till the business pays them off to the creditor, whereas the latter remain or is identified as asset except when it is not received at all.

- The entry made related to the former is typically meant for the client who are purchasing goods for their purpose, where the entry made related to the latter is typically for the vendor’s business, who sell goods and services and collect payment for the same.

- Auditors look for different aspects of both types of entries while auditing the books. For the accounts payable journal entries general ledger, the auditors look for any entry where the current payment amount has been shifted to a later date or added to some other unrelated expenses, failure to record payment details, changing assumptions during accounting, etc. But in case of the latter, the auditors should ideally look for instances where fictitious revenue is recorded, entry made before service is complete, replacing asset sale with revenue earned to show more profits, etc.

Thus, we see form the above points that there are many differences between both types of entries, and it is essential to understand them clearly.

Recommended Articles

This article has been a guide to what are Accounts Payable Journal Entries. We explain the differences with accounts receivable journal entries with examples. You can learn more about accounting from the following articles –