Through our financial analysis certification course, acquaint yourself with benefits like unlimited access to the course video content and Excel templates for one year. Also, have any time free access to the tutorial videos by simply logging in. Additionally, with our case study on Mcdonald's and Colgate, learn how to analyze each financial line item and correlate its impact on a firm. Not just that, you also earn a certificate of completion for financial analysis training from us, which can present suitable career opportunities for you.

Accounting For Financial Analysts Course!!

Build & analyze financial statements, track cash flows & assess earnings quality | Hands-on training for bookkeeping, budgeting & financial analysis | Exclusive Bonuses Worth $300 | Master Accounting with Real-World Case StudiesFLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

Highlights

Highlights of the Course

Deep Dive into Financial Statements

Deep Dive into Financial Statements : Master income, balance sheet, and cash flow statements.Skills Top Firms Look For

Skills Top Firms Look For : Learn what drives investment banks, hedge funds, and Fortune 500s.Globally Trusted & Highly Rated

Globally Trusted & Highly Rated : Join 100K+ finance pros, analysts, and MBAs.Excel-Powered Hands-On Learning

Excel-Powered Hands-On Learning : Apply concepts with financial models, templates, and real data.Industry-Relevant & Job-Focused

Industry-Relevant & Job-Focused : Build skills in financial analysis, forecasting, and budgeting.Certification

Certification : Get certified to enhance your career.HURRY UP!

Unlock Premium Course Benefits Worth $300+!

Financial Analysis Using Real Data

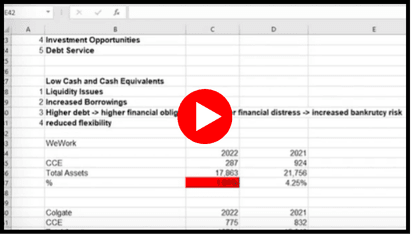

Financial Analysis Using Real Data : Break down financials from real annual reports.Hands-On Accounting in Excel

Hands-On Accounting in Excel : Build statements, reconcile, and break down key ratios.Cash Flow Statement & Earnings Quality

Cash Flow Statement & Earnings Quality : Spot red flags, cash flow risks, and earnings manipulation.EPS & Income Tax Adjustments

EPS & Income Tax Adjustments : Perform EPS calculations and understand tax impacts.Shareholder’s Equity & Consolidated Reporting

Shareholder’s Equity & Consolidated Reporting : Analyze ownership, earnings, and minority interest via case studies.Accounting For Financial Analysts Course Preview

Sample Videos

BENEFITS AND FEATURES OF ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

Explore The Advantages

There are some noteworthy benefits available to those who choose this course for financial analysts. Let us look at them.

#1 - Expertise:

This financial analysts course provides an explicit advantage over your colleagues or applicants when looking for job opportunities. It helps you easily become fluent in the language of the company’s financial statements and related information. Also, it lets you get among those desirable candidates who get financial analysis jobs.

#2 - Skills Development:

Improve your professional persona and skillset with our best financial analysis certification course and Enhance your ability to analyze, forecast, and interpret financial data.. Also, this course makes you more confident by improving your financial knowledge.

#3 - Real-World Application:

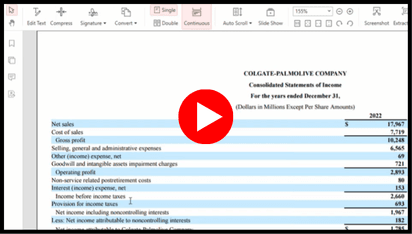

With the McDonald’s and Colgate case study provided in the financial analysis training, witness a practical application of the concept in the industry. Plus, you also get familiar with useful Excel tools and tricks that can reduce your work significantly.

#4 - Career Development:

You could soon see a promotion or upgrade in your current position after your employer learns about this recent certification. With the skills and knowledge gained through this course for financial analysts, witness a boost in your confidence as well. Also, your salary may rise by a certain amount, too!

#5 - Quick Query Resolution and Support:

As you enroll in our accounting for financial analysts training, acquire immense knowledge about accounting methods majorly used by financial analysts. That said, if you have any doubt regarding the concepts discussed, you can get your query resolved by contacting our support team by sending a mail to support@wallstreetmojo.com..

Boost your future endeavors and choices regarding career paths with our best financial analysis course today!

QUICK FACTS ABOUT ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

Industry Trend

SKILLS COVERED IN ACCOUNTING FOR FINANCIAL ANALYSTS TRAINING COURSE

What Will You Learn?

Equip your existing skillset and financial knowledge with our financial analysis online course involving the dissection of the company's financial statements and annual reports. Learn different Excel tricks and tips to present them on a spreadsheet as well. Also, gain analytical and presentation skills, which further help in communicating the details to the stakeholders. Lastly, with strategic thinking and an observational mindset, learn to make informed investment decisions on vital projects.

PROGRAM OVERVIEW FOR ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

Course Description

As renowned author Tony Robins fairly stated, “The path to success is to take massive, determined action.” Every step towards our goals is ultimately linked to its success. And if that is true, you, too, hold the potential to become a successful financial analyst!

In this comprehensive guide on "Accounting For Financial Analysts Course," learn the basic fundamental principles of accounting folowed by financial analysts for financial reporting. Explore the different line items and the correlation between them. Additionally, through the case studies involving McDonald's and Colgate, dive deep into the different forecasting techniques and financial statement aalysis. Not only that, but you also get familiar with circular references and the preparation of consolidated financial statements with our best financial analysis course.

Through our financial analysis training course, you have access to multiple Excel templates concerning the case studies. You can download them whenever needed and gain insights from the financial model developed. Also, learn to forecast each line item (revenue, costs, debt, shareholder’s equity, depreciation and amortization, income taxes, working capital, and lease) and interpret its meaning.

Moreover, get comfortable with the different financial ratios discussed and populate historical data of income statements, balance sheets, and cash flow statements smoothly in Excel format. Learn to calculate margins on profit-related items in the income statement. However, the benefits do not end here; you are still left with more!

ROLES FOR SKILLS GATHERED FROM ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

Career Options

#1 - Financial Analyst:

A financial analyst is a finance professional who usually creates financial models and forecasts the financial statements of a company. They employ financial analysis tools and methods to interpret SEC filings. Technically, they are hired more by well-known companies like JPMorgan Chase, WellFargo, Amazon, Deloitte, and similar organizations.

In fact, many companies like Google, Microsoft, Tesla, Apple, and other large organizations hire financial analysts. For the position offered, the financial analyst's salary is between $60,885 and $73,500 annually as of June 27, 2024, depending on the seniority level. Individuals who have completed a certificate course for financial analysts may have scope to negotiate a higher salary.

#2 - Equity Research Analyst:

Equity research analysts mainly analyze financial information along with the different trends of the various organizations and industries and later give an opinion in their equity research report based on the analysis conducted. Additionally, they give suggestions to clients regarding their investment decisions.

Some of the popular hiring companies include Goldman Sachs, MorningStar, Barclays, CRISIL, and others. They earn $109,417 per year on average, plus some additional benefits as of June 27, 2024.

#3 - Private Equity Analyst:

It is just a sub-category of equity analysts that is more connected with private firms. It means analysts here conduct research, forecast the performance of private firms (not listed on the stock exchange), do ratio analysis, and give interpretations on private companies. Among financial analysis jobs, private equity analyst looks at undervalued companies so that an investor can buy the companyand earn profits.

They are mostly hired by Goldman Sachs, Blackstone, General Atlantic, and other private equity firms. The average salary is $94,303 as of June 27, 2024, on an annual basis. A financial analysis certification can help one get a high salary.

#4 - Credit Analyst:

Individuals choosing this financial analysis career path facilitate credit risk management by measuring the creditworthiness of the individual or a firm. Banks, credit card companies, rating agencies, and investment companies generally employ them.

Some popular banks that hire credit analysts include CitiGroup, American Express, Barclays, HSBC, and others. In this case, the salary ranges between $52,979 and $65,732 annually.

#5 - Actuarial Analyst:

In general, actuarial analysts are professionals who use statistical models to evaluate and assess risk in many industries, including insurance, healthcare, and finance. They use this analysis further to design and price insurance policies. They get paid $80,200 annually as of June 27, 2024, for the responsibility fulfilled. Such professionals are mostly hired by giants like EY, Accenture, Mercer, Aon, Swiss Re, and a few others.

#6 - FP&A Analyst:

A Financial Planning & Analysis (FP&A) analyst is responsible for analyzing the various parts of the corporate industry for projecting the future financials and cash flow of the business industry. They work closely with the executive teams and help in strategic decision-making for the board of directors, which includes the CFO & CEO, etc.

In normal circumstances, the average salary per year of a beginner choosing this financial analysis career path ranges between $61,399 and $74,116 as of June 27, 2024. However, with more years of experience and skills gained through programs like this financial analysis certification, it can rise further annually. Generally, companies like JPMorgan Chase, Amazon, Wells Fargo, and Deloitte are a few of them.

WHAT WILL YOU GAIN FROM THIS ACCOUNTING FOR FINANCIAL ANALYSTS COURSE?

Course Curriculum

Introduction to Annual Report of a Company

Income Statement

Balance Sheet

Consolidated Statement of Comprehensive Income

Throughout the financial analysis online course, delve into a step-by-step approach to analyzing financial statements in Excel from scratch. Learn about the three vital financial statements and how to forecast each line item in . Also, gain insights into financial items, assets, depreciation and amortization, in addition to liabilities and financial ratios.

Through this course, learn to conduct financial statement analysis, assess risks concerning long-term debt and cash flow projections, know about linkage of financial items across spreadsheets.

Got questions?

Still have a question? Get in Touch with our Experts

CERTIFICATION FOR ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

Earn A Certificate On Completion

Upon the successful completion of the modules and exercises, attempt the final assessment, and you will receive a certificate of completion once you pass the exam. This certificate evidences your sufficient knowledge of the subject matter of the “Accounting for Financial Analysts Course.” Also, gain unlimited access to the course content, Excel templates, and related resources with 1-year validity.

PREREQUISITES TO LEARN ACCOUNTING FOR FINANCIAL ANALYSTS COURSE

What Will You Need?

The accounting for financial analysts training comes with a couple of prerequisites. The first one is that one needs to have MS Excel installed on their device and the other one is they require a f

- Access to MS Excel

- A secure internet connection