Accounting Trends: Predicting Business Future in 2025 and Beyond

Table Of Contents

What Are Accounting Trends?

Accounting trends are constantly evolving in response to technological advancements, regulatory changes, and shifting ways of conducting business. One distinguished trend is the acceptance of cloud-based accounting software, which offers increased accessibility, real-time data insights, and improved collaboration among stakeholders. This shift towards cloud solutions not only streamlines accounting processes but also enhances scalability and flexibility for businesses of all sizes.

Additionally, there's a growing emphasis on data analytics and automation in accounting. With the vast amount of financial data available, businesses are using analytic tools to extract valuable insights, identify trends, and make data-driven decisions. Automation of repetitive accounting tasks such as eliminating manual data entry with tools like SaasAnt Transactions, invoice processing, reconciliation, and reporting not only increases efficiency but also reduces the common risk of human error.

Another new accounting trend is the increasing focus on ESG metrics. As stakeholders demand greater transparency and accountability, businesses are integrating sustainability considerations into their financial reporting processes. This involves measuring and disclosing non-financial performance indicators related to environmental impact, social responsibility, and corporate governance practices.

Moreover, regulatory compliance remains a key focus area for accounting professionals. With the ever-changing regulatory frameworks, staying updated on accounting standards and compliance requirements is essential to make sure accurate financial reporting and avoiding risks of non-compliance.

Key Takeaways

- Accounting trends are a result of the constantly improving or evolving world of finance and business. The adoption of cloud-based accounting solutions for accessibility and efficiency is a classic example.

- The most recent one is the integration of AI and ML for data analysis and automation.

- Emphasis on sustainability reporting and environmental, social, and governance (ESG) metrics has been on the rise as well.

- Monitoring changes in tax policy and regulatory compliance to ensure adherence to statutory requirements can help with staying on top of trends.

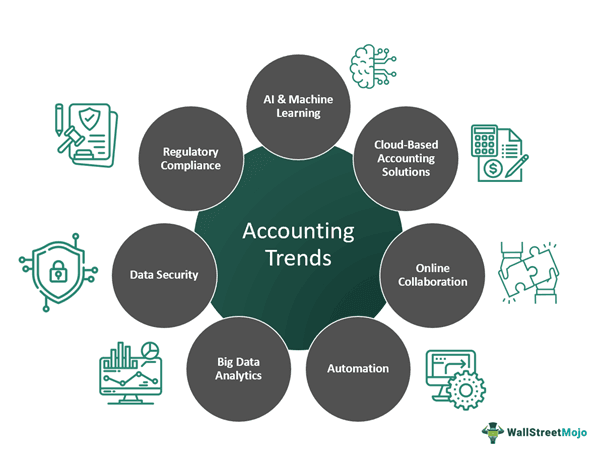

Top 10 Accounting Trends To Pay Attention To

The world of finance and business keeps growing constantly. You can either work for decades in an organization or get all the knowledge through the best accounting course online to grasp all that knowledge in one go!

A few of the most head-turning and eye-popping trends in the world of accounting are discussed below.

#1 - Artificial Intelligence & Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are part of most conversations across industries. With respect to the latest accounting trends, AI and ML are revolutionizing the accounting world by offering advanced data analysis capabilities and automating routine tasks. AI-enabled accounting software can analyze large volumes of financial data to identify patterns, detect anomalies, and provide valuable insights for decision-making. For a comprehensive understanding of e-commerce accounting practices in 2025, refer to Webgility's Ultimate Guide.

ML algorithms, on the flip side, can actively learn from past financial transactions to predict future trends, optimize resource allocation, and enhance forecasting accuracy. Moreover, AI and ML technologies enable the automation of repetitive accounting tasks such as data entry, invoice processing, and reconciliation, freeing up valuable time for accounting professionals to focus on strategic initiatives and value-added activities.

By making use of AI and ML, businesses can improve efficiency, reduce errors, and gain a competitive edge in today's rapidly evolving digital economy.

#2 - Automation

Automation is a transformative trend in accounting, aligning processes and improving efficiency by using technology. By automating tedious and repetitive tasks like data entry, reconciliation, and reporting, accounting professionals can save time and reduce the risk of errors. Advanced accounting software and robotic process automation (RPA) tools enable businesses to automate workflows, accelerate financial close processes, and improve accuracy in financial reporting.

Additionally, automation boosts scalability, allowing businesses to handle growing volumes of transactions without significantly increasing the workforce. Ultimately, automation empowers accounting teams to focus on more critical tasks like data analysis, strategic planning, and decision-making, driving productivity and innovation in the accounting field.

#3 - Technological Advancements

Technological improvements play a critical role in sculpting accounting trends, driving innovation, and transforming traditional accounting practices. Cloud computing, for instance, has revolutionized accounting by offering secure and accessible platforms for storing financial data, facilitating remote collaboration, and enabling real-time insights.

Furthermore, AI and ML technologies are revolutionizing data analysis and automation. These technologies are also believed to curate future accounting trends and allow accounting professionals to extract valuable insights, predict trends, and automate routine tasks.

Additionally, blockchain technology is increasingly being adopted for transparent and secure transaction recording, enhancing trust and reducing fraud risks in financial transactions.

#4 - Big Data Analytics & Forecasting

Big Data Analytics and Forecasting are emerging as non-negotiable components of accounting trends by offering powerful tools for financial analysis and decision-making. With the vast amount of financial data generated by businesses, big data analytics allows accounting professionals to extract valuable insights, identify trends, and make data-based decisions.

By analyzing and examining historical data and previous market trends, businesses can develop more accurate financial forecasts and strategic plans, enabling proactive risk management and resource allocation. Additionally, big data analytics enables businesses to identify cost-saving opportunities, optimize operations, and enhance overall financial performance. Hence, the integration of big data analytics and forecasting into accounting practices gives businesses the ability to have greater visibility, agility, and control over their financial operations.

#5 - Cloud-Based Accounting Solutions

Cloud-Based Accounting Solutions represent a significant trend in modern accounting practices, offering a host of benefits for businesses of all sizes. These solutions provide a secure and accessible platform for storing financial data, enabling remote access and collaboration among stakeholders. By making use of cloud-based accounting software, businesses can streamline their financial processes, automate routine tasks, and improve overall efficiency.

Moreover, cloud solutions offer scalability, allowing businesses to gel in with changing needs swiftly and allow growth without the requirement for substantial infrastructural investments. Additionally, cloud-based accounting solutions often come with built-in data backup and security features, ensuring the integrity and confidentiality of financial information. Overall, the adoption of cloud-based accounting solutions reflects a shift towards modernization and digital transformation in the accounting industry, empowering businesses with greater flexibility, accessibility, and efficiency in financial management.

#6 - Focus on Sustainability

The focus on sustainability is increasingly becoming a prominent trend in accounting, reflecting the growing importance of environmental, social, and governance (ESG) factors in business operations. Accounting professionals who have taken up career-boosting additional courses online are integrating sustainability considerations into financial reporting practices. They use them to measure and disclose non-financial performance indicators to stakeholders. This includes metrics related to environmental impact, social responsibility, and corporate governance practices. Moreover, sustainability reporting provides transparency and accountability, enhancing stakeholder trust and confidence in the organization. Businesses are recognizing the importance of aligning financial performance with sustainable practices to mitigate risks, seize opportunities, and create long-term value.

#7 - Online Collaboration and Remote Workforce

Online collaboration and remote workforce have emerged as significant accounting trends after the pandemic. With revolutionary improvements in the world of technology and the extensive availability of online collaboration tools, accounting teams can collaborate seamlessly regardless of geographical location. This new accounting trend enables greater flexibility and accessibility for accounting professionals, allowing them to work remotely and access financial data securely from anywhere with an Internet connection.

Moreover, online collaboration tools facilitate real-time communication and document sharing, enhancing efficiency and productivity among remote teams. Additionally, remote work arrangements offer benefits such as reduced overhead costs, increased employee satisfaction, and access to a broader talent pool.

#8 - Data Security

Data security is a critical concern in accounting, primarily because of the sensitive nature of financial information. Accounting professionals must prioritize safeguarding confidential data from unauthorized access, theft, or breaches. This involves implementing fool-proof security measures such as encryption, firewalls, and multi-factor authentication to protect financial data stored on servers, cloud platforms, and electronic devices.

Additionally, regular security audits and updates are essential to identify vulnerabilities and mitigate risks proactively. Moreover, training employees on data security best practices and compliance in terms of regulatory and legal requirements is crucial to maintaining a secure environment for financial information.

By prioritizing data security in a world with rising cybercrimes, accounting firms, or any organization for that matter, can build trust with clients and avoid legal and reputational risks.

#9 - Changes in Tax Policy

Changes in tax policy significantly impact accounting practices. It requires accounting professionals to stay on top of regulatory updates and adapt their strategies accordingly. Changes in tax laws, rates, deductions, and credits can affect financial reporting, tax planning, and compliance requirements for businesses and individuals. Accounting firms must closely monitor legislative developments, analyze their implications, and advise clients on potential impacts on their financial affairs.

Moreover, changes in tax policy may necessitate adjustments to accounting systems, processes, and documentation to ensure compliance with new requirements. By staying dynamic and updated about changes in tax policy, accounting professionals can help clients with complex taxation-related changes, optimize tax strategies, and mitigate risks of non-compliance or unexpected tax liabilities.

#10 - Statutory and Regulatory Compliance

Statutory and regulatory compliance is a critical aspect of accounting trends, as businesses must adhere to various laws, regulations, and standards governing financial reporting and transparency. Professionals in the accounting spectrum perform a vital role in making sure that businesses comply with statutory requirements as directed by regulatory and government bodies.

This includes adherence to accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), as well as industry-specific regulations and tax laws. Failing to follow and ensure statutory and regulatory requirements can lead to legal penalties, reputational damage, and hefty fines for businesses.

Therefore, accounting firms must stay updated on changes in regulations, implement internal controls, and provide guidance to clients to make sure applicable laws and standards are being complied with. By prioritizing statutory and regulatory compliance, accounting professionals can help businesses maintain transparency, integrity, and trustworthiness in their financial reporting practices.

Why Is It Essential To Adopt The Latest Accounting Trends?

In the ever-evolving world of business, an amateur is not someone who cannot read or write. An amateur is someone who cannot be open enough to learn. You can either read multiple columns and talk to tens of people about the latest accounting trends or enroll yourself in the most reliable courses online to be equipped with the knowledge to grasp anything new in the market.

Let us understand the variety of reasons why adopting these changes is so important through the points below.

- New accounting technologies and practices streamline processes, automate tasks, and improve overall efficiency. It allows accounting teams to work more effectively and focus on value-added activities.

- Modern accounting tools and software use advanced algorithms and data analytics to enhance accuracy in financial reporting. It limits the risk of errors and discrepancies.

- By leveraging data analytics and forecasting tools, accounting professionals can gain deeper insights into financial trends, recognize chances for growth, and devise strategic decisions.

- Staying updated on the latest accounting trends ensures compliance with evolving regulatory requirements and accounting standards. Staying updated reduces the risk of non-compliance penalties and legal issues.

- Adopting the latest accounting trends enables businesses to stay ahead of competitors by embracing innovation, optimizing financial processes, and delivering higher-quality services to clients.

- In today's dynamic business environment, adopting the latest accounting trends allows accounting professionals and businesses to adjust to evolving market conditions, advancements in the technological space, and regulatory landscapes more effectively.