Table Of Contents

Accounting Records Definition

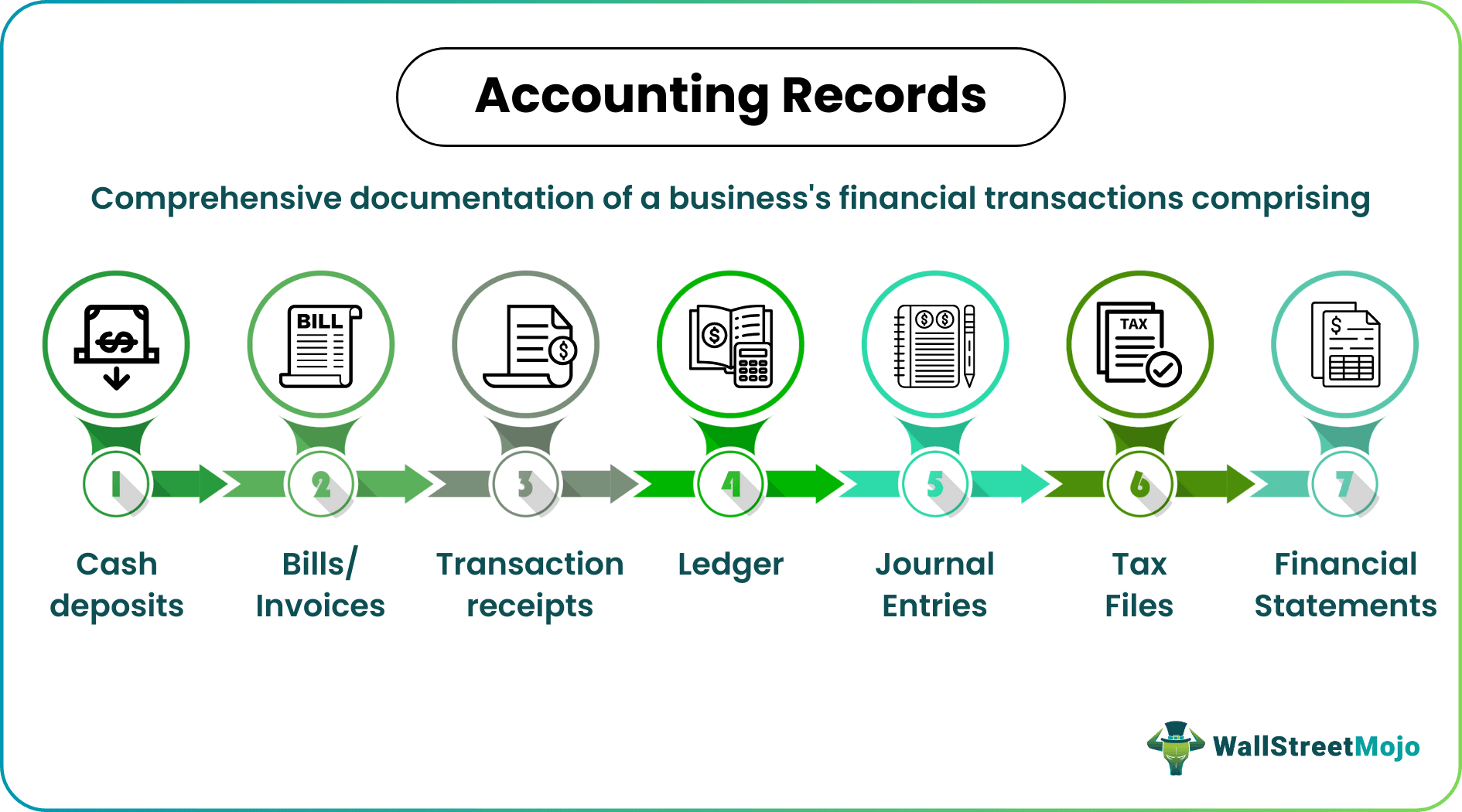

Accounting Records refer to organized and methodical documentation of a business’s financial transactions to create an audit trail and ensure compliance. An accounting system chronologically records an organization’s cash inflows and outflows for a given period. Financial statements are based on the accounting information recorded in a company’s books.

Maintaining accounting records meticulously and in line with statutory guidelines is crucial since this information is audited at regular intervals. It helps the relevant stakeholders understand if a company is well-managed and enables them to verify a company’s financial position. Incomplete accounting records hamper the preparation of financial statements and can result in loss, bad faith, and accounting manipulation.

Table of contents

- Accounting Records Definition

- Accounting records, including financial statements, balance sheets, ledgers, and journal entries, give internal and external stakeholders a picture of a company's cash flow, highlighting its income and expenses.

- Records are primarily maintained in the single-entry and double-entry bookkeeping systems. Other types may be used by companies to support specific functions within a firm.

- Without accounting records, there is no proof of transactions, cash flows, expenses, or incomes. Maintaining these records is mandatory since internal controls and statutory compliance depend on them.

- It is important to record, maintain, and retain records to enable tax filing, prevent financial fraud and misappropriation, and build a reputation for reliability in the market.

Accounting Records Explained

Accounting records include every document and paperwork that supports transactions and keeps track of a company’s income and expenses. When a company, irrespective of its size or nature, operates and actively participates in business activities and market operations, a series of financial transactions take place.

These records include securing credit, buying stock, selling products or services, dealing with suppliers, filing taxes, making investments, and so on. They form a paper trail of transactions between the company and other parties. Journals, ledgers, invoices, receipts, checks, contracts, etc., are the various source documents that help build accounting records. They form the basis of balance sheets, income statements, and cash flow statements in companies.

Maintaining accounting records is not only important but mandatory. A company without proper accounting information and financial statements opens itself up to speculation about fraudulent activities and unethical practices. Without accounting records, no company can follow tax regulations, file tax returns, and provide proof of their earnings. For instance, cost accounting records not only help companies control their expenses but also make relevant internal changes and sound financial decisions that help increase their profits and revenue.

With technological progress, companies have started using accounting software to record transactions. It is easy and convenient, especially because the entire process becomes paperless. Vendors and suppliers also prefer to share digital copies of invoices, receipts, and bills. More data can be stored for a longer period in accounting software compared to physical copies of accounting records. Digital backups and cloud storage ensure data security, boost accessibility and collaboration, and mitigate risks.

Types

The types of accounting records have been discussed in this section.

- Single-entry accounting system: In a single-entry accounting system, all transactions are recorded as affecting a single company account, typically the cash account. The cash book serves as the primary record, documenting all cash receipts and payments. This system is considered easy to maintain as no additional ledgers are used, and nominal and real accounts are not recognized.

- Double-entry accounting system: In this system, every transaction affects two ledger accounts. It uses debits and credits to ensure a balanced recording of each financial transaction in line with the double-entry recording principle. The double-entry accounting system is more complex than the single-entry system.

Some other systems that enable companies to conduct business and record transactions include:

- Financial and Managerial Accounting: Financial accounting records facilitate external reporting, while managerial accounting is used for internal decision-making and policy formulation.

- Historical and Projected Records: Companies may refer to historical records of accounting before making crucial business decisions. Projected records refer to estimations; they also help companies make decisions. For instance, capital budgeting involves decision-making based on estimated numbers.

Components

The key components and facilitators of bookkeeping are:

- Transactions: Economic events affecting a company, like selling goods, purchasing supplies, or equipment depreciation, form the initial entry in any accounting record system.

- Journals: Every financial transaction is documented in chronological order in companies. At times, these are recorded in separate journals if different departments are involved. This ensures proper tracking for complete and verifiable record-keeping.

- General ledgers: General ledgers allow businesses to categorize their transactions under specific heads for proper recording. They enable the preparation of financial statements. Journal entries are moved to the general ledger based on their type and characteristics.

- Trial balances: Trial balances ensure the integrity of financial records. By listing all debit and credit balances from the general ledger, they show whether total debits equal total credits. This helps companies assess recording accuracy. Any discrepancy at this stage may indicate financial mismanagement. Though a balanced trial balance is reassuring, it does not eliminate the possibility of errors or fraud. In case of doubts, further analysis is required to derive a comprehensive and reliable financial picture.

- Financial statements: Financial statements support transparency since they present a comprehensive picture of a company's financial health in a given period. These documents are published and shared with regulatory bodies for audits. They are also made available to the public. Stakeholders and investors understand an organization's performance, solvency, and prospects through these statements.

Examples

Here are two examples that explain the process of keeping accounting records.

Example #1

Suppose Haley runs a textile company. Her company goes public with an IPO and gets listed on the stock exchange. As it grew, she started paying off her debts. She also begins expanding her business. After three months, she issued a reasonable dividend to the company’s shareholders.

When the financial year ended, she published the company’s annual financial report. Retail investors studied the statements, which helped them understand where the business was headed. Haley appointed an auditor to perform financial audits as mandated by law.

Additionally, Haley’s accounting records enabled tax return filing. Since she made her company’s financial statements available to the public, the Securities Exchange Commission (SEC) had access and could verify the company’s transactions.

This illustrates the usefulness of accounting records.

Example #2

Suppose Adam, who owns a paper company, follows the double-entry bookkeeping system. At the end of the business cycle, he reviewed the balance sheet and found that the numbers did not add up. He rechecked to confirm. However, the discrepancies persisted. He tried to locate errors in the records, but there seemed to be none.

Adam suspected foul play, convinced that someone had manipulated the books and committed internal fraud. He hired an auditor to perform a comprehensive audit, and the auditor checked every bill, invoice, check, deposit, debt, and expense the company made in the past year. After a complete audit, the culprits were identified, and Adam initiated legal action against them.

This shows that a company’s management must be vigilant and prevent financial misconduct at all costs to ensure transparency and build goodwill and trust in the market.

Accounting Records Retention

According to the Internal Revenue Service (IRS), a company must retain records that prove and support their income, deductions, and debt or credit seen in their tax returns. Not keeping records can also create problems in succession planning, increase the risk of litigation, and bring complexity into the accounting function.

Most professionals, including lawyers, accountants, and bookkeeping experts, recommend keeping the original records for at least seven years. This timeframe helps address potential claims, tax audits, and lawsuits. However, specific industries may have longer retention periods. Hence, it is important to check the latest laws and regulations pertaining to record-keeping.

As part of accounting records, a company must maintain and retain the following documents:

- Current employee files: These should be retained for at least seven years after the employee leaves or retires. If an employee meets with a work-related accident, the company must keep records for at least a decade.

- Payroll tax records: Records such as wages, tax deposits, timesheets, pension payments, and other benefits must be maintained for at least four years after the taxes are paid.

- Job applicant information: Even when a company does not hire an applicant, they should maintain their records for at least three years.

- Operational records: These are general documents such as credit card statements, canceled checks, cash receipts, and bank statements and fall under the seven-year rule category.

- Accounting services records: These include budgets, cashbooks, check registers, profit and loss (P&L) statements, and general ledgers and should be kept for a minimum of seven years.

- Business tax returns: A company is required to keep tax returns for at least three years after filing. If the IRS suspects a substantial error, the tax return documents should be kept for six years.

- Ownership records: These are original documents of property, deeds, contracts, agreements, by-laws, stock ledgers, and other formal documents that should be retained permanently.

Importance

Let us discuss the importance of accounting records in this section.

- Tracking and maintaining records of expenses, income, assets, and liabilities is both essential and mandatory for companies.

- Accounting records play a crucial role in simplifying business operations, ensuring tax compliance, and facilitating the preparation of tax return filings.

- Using the information documented via accounting records, a company can make policy amendments, implement operational changes, and make important decisions for business growth.

- Investors benefit from these records since they provide insights into the company's growth and performance across specific periods.

Through the accounting process, controlling cash flows, reducing costs, and monitoring a company's overall financial stability becomes convenient for management.

Frequently Asked Questions (FAQs)

Both financial statements and accounting records are part of the financial reporting process. However, they serve different purposes. Accounting records document every transaction, providing raw data for the preparation of financial statements. Financial statements summarize and categorize this data into standardized formats like the balance sheet, income statement, and cash flow statement. This condensed presentation helps stakeholders interpret the company's financial position and profitability.

Bank statements reflect a company’s recorded transactions and facilitate financial management. However, they are external documents and are not used as direct sources for accounting data entry. For instance, if a vendor has been paid their dues, the bank statement will show the amount paid, but it will not prove how the company arrived at the said figure. For this, auditors will be required to review contracts and inventory records. Hence, bank statements support accounting reconciliation and verification, but they cannot be classified as accounting records.

Accounting records offer critical information to various entities, including the government, the public, investors, stakeholders, owners, creditors, and auditors. Each entity uses it for specific purposes. For instance, investors assess a company’s growth through such documentation, auditors use them for audits, or the taxation department uses them for charging taxes.

Recommended Articles

This has been a guide to Accounting Records and its definition. Here, we explain the concept along with its examples, types, retention, & importance. You can learn more about financing from the following articles –