Table Of Contents

Get in Touch with our Experts!

What Is Accounting Entry?

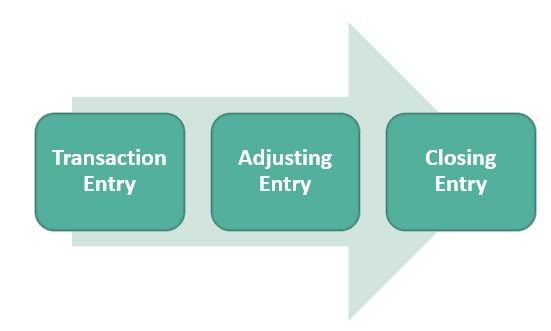

An accounting entry is the formal recording of all the transactions in the company's books of accounts where the debit and credit are generally recorded. There are three types: transaction entry, adjusting entry, and closing entry. These entries show the financial health of the company and provide the basis for filing their returns annually.

A basic accounting entry is a formal recording of transactions where debit and credit transactions are recorded into the general ledger. It is a written record of a commercial transaction. In a double-entry system of bookkeeping, a credit entry is offset by a debit entry in a general ledger. In the single-entry system, however, the duality principle is ignored, making it difficult to detect errors.

Accounting Entries Explained

Accounting entries are the documentation of a company’s accounts. They record all business-related transactions, both direct and indirect, and help the management to analyze the data.

The accounting process can be carried out through both the single-entry system of bookkeeping or the double-entry system of bookkeeping. While the former is easy to maintain, and cost efficient, it does not record the duality of transactions and cannot be reliable to find errors. However, the latter balances every credit entry with a debit entry in a ledger and makes finding errors or inconsistencies easier.

While the double-entry system allows the business to have a foolproof system of documenting transactions, it is more time-consuming in comparison to its counterpart and costlier too.

Companies are required to follow a double-entry system as it is GAAP approved and it is the norm for filing purposes as well. On a micro level, businesses also have provisional accounts for future usage. A double-entry system allows the company to create those provision accounting entries.

While it may seem like a lot of unnecessary work, it acts as the very basis for all facets of the business. From payments, tax filing, pricing, profitability, scalability, debt obligations, capital raising, and so on.

Types

There are three types of accounting journal entries which are as follow:-

#1 - Transaction Entry

Transaction entry is a basic accounting entry for any event in business. For example, bill receipt from a customer, the bill presented from a supplier for payment, cash receipt entries from a customer, and other cash payments have been done, which is an expense for the company. Transaction entry is on a cash basis and accrual basis.

#2 - Adjusting Entry

Adjusting Entry is a journal entry done at the end of an accounting period. It is based on accrual accounting. The accounting journal entry is required at the end to adjust various balances in various ledger accounts, which are done to meet the business's financial position as per accounting principles like GAAP, i.e., generally accepted accounting principle. In short, it is an aligned reported result.

#3 - Closing Entry

A closing entry is a journal entry done at the end of the accounting period. This entry type is posted to shift ending to retain the earning account from all temporary accounts like loss, gain, expense, and revenue account. This is done to transfer information to the next accounting period.

Entries for the transaction are done through software where one doing the transaction will not know he is creating an accounting entry, e.g., creating a customer invoice. They record all commercial transactions formally.

Systems

Like we discussed in brief earlier in this article, there are two systems through which basic accounting entries can be documented. Let us understand both of them in detail through the explanation below.

#1 - Single Entry

The term single entry is vaguely used to define the method of maintaining accounts that do not conform to strict principles of double entry. It is wrong to describe it as a system. The term 'single entry' does not mean that there is only one entry for each transaction. The absence of the two-fold effect of each transaction makes it impossible to prepare a trial balance; and to check the arithmetical accuracy of the books of accounts, engendering a spirit of laxity and inviting fraud and misappropriations.

Profit and loss accounts and balance sheets cannot be prepared due to the absence of nominal accounts real accounts. Hence, a single entry is not only incomplete, but the final result is also not reliable. This system typically tracks cash receipts and cash disbursements and shows only those results needed to construct an income statement.

Advantages

Let us understand the advantages of disadvantages of this system through the points below.

- The single-entry system is simple and less expensive.

- A professional person has not required the maintenance of single entry system accounting;

- It has a summary of daily transactions like income and expenses.

Disadvantages

The disadvantages of the concept are as follows:

- Lack of data may adversely affect the planning and controlling of a strategic business goal.

- There is a lack of control over the different issues which the company faces.

- In case of any loss or theft, one will not be able to find it through a single accounting system.

Example

| Date | Description | Income | Expense | Inventories | Salaries |

|---|---|---|---|---|---|

| 1- Apr-12 | Balance b/d | $50,000 | $20,000 | $10,000 | $15,000 |

| 4- Apr-12 | Raw Material Purchased | $1,000 | |||

| 5- Apr-12 | Salaries Paid | $12,000 | |||

| 20- Apr-12 | Bank Deposit | $20,000 | |||

| 22- Apr-12 | Supplies | $5,000 | |||

| 30 - Apr-12 | Balance c/d | $70,000 | $26,000 | $10,000 | $27,000 |

Here, entry singly is done for every transaction.

#2 - Double Entry Bookkeeping System

According to the book-entry system, every transaction has two elements. One is debt, i.e. when something is going, and another credit is coming in. In simple language, what comes in credit, and what goes out is debt. It is the main component of the double entry system which eventually creates a complete set of financial statements.

Advantages

Let us understand the advantages of the more elaborate form of accounting through the points below.

#1 - Complete Record

A double-entry system enables people in business to keep a complete, systematic, and accurate record of all transactions. Details of any transactions or events they can verify at any time.

#2 - Ascertainment of Profit or loss

The systematic record maintained under a double-entry system enables a business to ascertain the results of business operations for any given period. The owners can know the profitability of business operations periodically.

#3 - Knowledge of Financial Positions

With the help of Real and Personal accounts, the business's financial position can be ascertained with accuracy. It is done by preparing a balance sheet.

#4 - A check on the Accuracy of Accounts

Under the double-entry system, every debit has a corresponding credit. The arithmetical accuracy of books can be tested by preparing a trial balance statement.

#5 - No scope of fraud

The firm is saved from fraud and misappropriations since full information about all assets and liabilities will be available.

#6 - Tax Authorities

The business can satisfy the tax authorities if it maintains its accounts book properly under the double-entry system.

#7 - Amount due from Customers

The accounts book will reveal the amount due to customers. Reminders can be sent to customers who do not settle their accounts promptly.

#8 - Amount due to Suppliers

The trader can ascertain from the books of accounts the sums he owes to his creditors and make a proper arrangement to pay them promptly.

#9 - Comparative Study

Results of one year may be compared with those of previous years, and a reason for the change may be ascertained.

Disadvantages

Despite the various advantages, there are a few factors that prove to be a hassle for businesses. Let us discuss them through the points below.

- It is not suitable for small businesses, as it is complex and not advised for small businesses.

- It is expensive.

- No accuracy before making of trial balance;

Example

Example 1 - Purchase of machine by cash.

| Debit | Machine |

| Credit | Cash |

Entry on a financial statement for same will be below-

| Debit | Credit | |

|---|---|---|

| Cash | $5,000 | |

| Machine | $5,000 |

Example 2 - Interest received on a bank deposit account.

| Debit | Cash |

| Credit | Finance Income |

Entry on financial statement for same will be below:-

| Debit | Credit | |

|---|---|---|

| Cash | $10,000 | |

| Finance Income | $10,000 |

The double entry shows that the account is debited and credited, both debit and credit.