Table Of Contents

Account Ownership Meaning

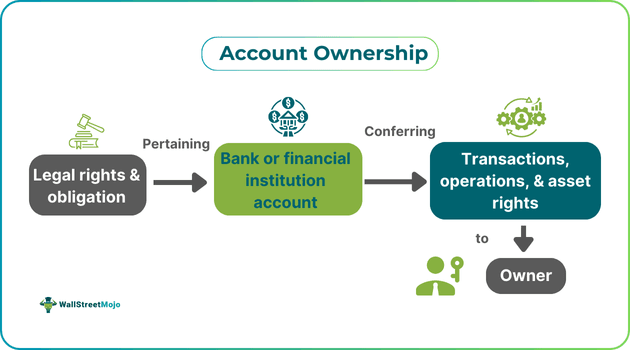

Account Ownership refers to legal responsibilities and rights conferred to customers, giving them control over their bank accounts or accounts opened with financial institutions. It safeguards the assets, acts as a barrier of usage for the owner only, facilitates the transactions, offers fund access, and makes customers eligible to grab all account benefits.

It has wide applications in both personal banking and corporate finance as it demarcates accountability for funds in financial dealings. It ensures proper management and clear accountability of assets. The ownership exposes structures dealing with tax implications, legal protection and operational control.

Key Takeaways

Account Ownership Explained

Account ownership makes an operator legally responsible for a bank or financial account, thereby giving them full control. Ownership can either be joint accounts, organization-managed accounts or single accounts. The Federal Deposit Insurance Corporation (FDIC) insures these account holders' assets after putting them under the FDIC account ownership category.

The ownership of an account has different forms per the needs and uses of individuals. At the time of account opening by entities, governments, or individuals, they have to specify the type of account to be created, their roles, and the benefits they want to decide on the nature and type of accounts, which determines:

- the operational permissibility,

- limit of funds that can be kept,

- limit on the amount and number of transactions per day, month, quarterly or yearly basis,

- decision-making person of the account

- deposit mode and withdrawal level

- Passing of account funds to the nominated persons or through probate

Account ownership impacts access rights and tax responsibilities. Businesses use the features embedded in the bank account ownership to delegate decision-making powers to authorized officials while adhering to corporate governance regulations.

The ownership structure enhances transparency, reduces dispute risks, and streamlines operations. Moreover, an authorized account operator also helps curtail money laundering, fraud and transaction disputes. After the account holder's death, it allows the transfer of funds to the nominee easily or through probate, making it easier for the near ones to have their right to funds. In case of transfer dismissal or resignation of company officials, ownership of the account can be transferred to the next person in line of authority.

Hence, understanding different bank account ownership types becomes essential in effectively planning and managing finances in the complex financial world.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Categories

Every bank and credit union has certain types of ownership of accounts. Some of these include:

- Single or individual account: It is operated by a single person who has full control over all the account functions and transactions. If it has a nominee or is payable on death (POD), its funds are easily passed on to the nominee. If not, the probate process applies to the transfer of funds to the estate.

- Joint accounts: It can be shared with two or more accounts under various ownership structures like:

- Either or survivor, where any joint account holders may operate the account on their own, and after the death of any one holder, its ownership is retained by the other account holder/s.

- Anyone or survivor allows all the parties to manage the account easily.

- Joint ones facilitate the joint operation of the account together without allowing any single account holder to run the account on its own.

- Trust accounts have to be managed by trusts on behalf of the beneficiaries having accounts of a revocable or irrevocable nature, which affects asset distribution after the owner's demise.

- Revocable trust account allows change of beneficiaries after death.

- An irrevocable trust account does not permit a change of beneficiaries after death.

- Organizations and businesses run business accounts.

- Government bodies or public entities operate a government account to manage public funds. They have account-specific regulations governing their management and usage.

Examples

Let us use a few examples to understand the topic.

Example #1

An online research paper published in 2021 discusses the ownership of accounts in the Philippines. As per the report, in 2017, 22.65 adults had a regular bank account, which saw an increase of 6% by 2019 and reached 28.6%. Moreover, the percentage of adults having bank accounts rose slightly to 12.2% from 11.5%. On the other hand, it experienced a surge in e-money to 8.0% from 1.3%, representing a major increase of 6.7%.

Also, its accounts in microfinance institutions increased to 12.1% from 7.1% at a rate of 4% growth. Meanwhile, one noted a significant decline in cooperative accounts to 1.7% from 2.9%. Subsequently, on the whole, the article highlighted that formal ownership of accounts amongst working adults inclined to 39.0% from 28.1%. Therefore, the Philippines has shown a positive trend in financial inclusion and accessibility.

Example #2

Let us assume that a resident of Old York City - Joanna, opens a checking account for her grooming business at American XYZ Bank. The account has the bees listed as the sole owner, having exclusive rights over her deposits, writing checks, and permit transactions. The bank documents her account ownership to adhere to local banking regulations.

Besides, Joanna also notifies her manager, Manig, as an authorized person to perform some of the transactions without having any right to ownership of the account. To expand her business, she partners with Jake as he provides the funds for the business. In that case, she modifies her account status to a joint account with Jake. Hence, all transactions and operations need major financial decisions now, giving her shared accountability and control.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.