Table of Contents

What Is Account Maintenance Fee (AMF)?

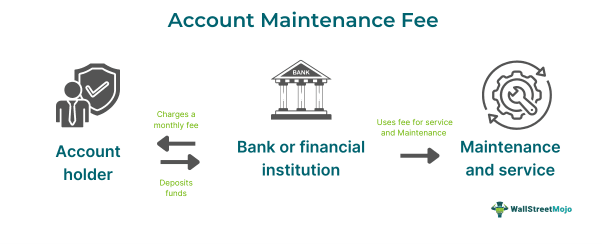

An account maintenance fee is a monthly charge imposed by banks on their account holders. This fee covers the cost of keeping the account active, open, and well-maintained in terms of deposits, withdrawals, and other services. It is charged by different banks, financial institutions, and credit unions depending on their own policies and fee structure.

It is not a universal fee; many banks or financial institutions may not charge it to their account holders. The fee varies based on the account type and geographical location. Additionally, some banks may choose to deduct an annual account maintenance fee instead of a monthly fee.

Key Takeaways

- Account maintenance fee is the monthly charge imposed by banks, credit unions, and financial institutions to keep a bank account active, open, and well-maintained.

- It is not a fixed amount and varies from one bank to another based on several factors, such as account type, services provided, limits, and restrictions.

- These charges range between $5 to $35 monthly. According to a Bankrate survey, approximately 25% of Americans pay nearly $24 every month as banking fees.

- There are multiple bank charges, such as closure fees, card fees, check fees, wire transfer fees, and negative interest rates, along with withdrawal and deposit fees.

Account Maintenance Fee Explained

Account maintenance fee is a monthly cost incurred by an account holder with an active bank account with any credit union, bank, depository, or financial institution. Each banking system has this provision and, therefore, has its own rules and regulations for it. These charges typically differ from one bank to another based on several factors such as type of services, minimum balance, account type, withdrawal limits, insufficient funds, overdrafts, debit card usage, and branch. Two people having different types of bank accounts in the same bank or branch may pay different account maintenance fees. In some countries, the bank account maintenance fee is deducted annually instead of monthly.

In the US, these charges generally range between $5 to $35 a month. At the same time, some banks or accounts have no fees at all. These fees are a crucial source of income for banks. While a few dollars here and there may seem negligible initially, they add up to a significant amount over time. For instance, an individual paying $18 a month to keep their bank account active and money deposited ends up paying $216 annually. As per a Bankrate survey, 25% of Americans pay these fees for checking accounts and other added financial services.

From an account holder’s perspective, these charges can be a concerning issue depending on their account status and durability. Fortunately, there are many ways these fees can be lowered, negotiated, or avoided. A wise account holder always looks for different ways to alter such fees and smartly handle these charges.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Monthly Maintenance Fees Charged By The Largest US Banks

When a person deposits money into their bank account, they receive interest, but various services come with the account. Therefore, even fee-free accounts have associated charges. The largest US banks typically charge the following fees:

- Monthly account maintenance fee – Checking and savings account maintenance fees are a direct charge most US banks impose. Monthly fees eventually add up to a reasonable amount a year. It is up to the bank to reduce or remove the fee if the account holder has maintained a minimum balance.

- Check fees - Banks offer a checkbook to their account holders. After the first supply is depleted, account holders can request another checkbook, for which the bank charges a fee. It also depends on the account type.

- Card fees - There are automated teller machines that banks install at different locations. An account holder is also provided with a debit card to use at these locations to withdraw cash. If account holders use an ATM outside their bank’s network, a fee is charged, typically around $4. At the same time, some banks have a limit on the times one can use the ATMs free of charge.

- Wire transfer fees - A wire transfer is used to send money almost immediately. Such service is facilitated through a fee. It is charged from the outgoing party and sometimes to the incoming wire transfer party as well. It is generally around $30 and $15 for outgoing and incoming wire transfers, respectively.

- Returned deposit fees - When a person deposits a check from another party and it gets bounced, they are charged a returned deposit fee. It is typically around $12.85. Such activities trigger an overdraft protection fee as well.

Examples

Below are two examples to understand the concept better:

Example #1

Raven, a student, opened her first bank account at a local US bank. However, she deposits some portion of her pocket money and savings in the account. The bank charges her a monthly account maintenance fee of nearly $18. Raven, at first, was reluctantly okay with it, but soon, the charges became frequent given to the added services of her bank account. Since she is a student, she never really maintains the minimum balance.

Upon research, Raven discovered that there is a rule that will waive her maintenance fee. She visits the bank, negotiates the terms with the bank manager, and tells her that she is currently studying. Her application was accepted, and the maintenance fee was waived from her bank account. It is a simple example explaining how banks charge the fee and how an account holder can avoid it or get an exemption on it.

Example #2

According to a BusinessDay article, Fidelity Bank Plc, FCMB Group Plc, and Wema Bank Plc are listed with the highest growth in account maintenance fees in 2023. They are listed in the category of midsize Nigerian banks. All the data is compiled by the BusinessDay shows. Fidelity Bank recorded a 68.8% hike in such fees, followed by Wema Bank with 43.6%, and lastly, the FCMB Group with 26.9%

There are other banks on the list as well, such as the Sterling Financial Holdings Company and Stanbic IBTC Holdings, which witnessed an increase of 18.7% and 24.2%, respectively. With N8.69 billion in account maintenance fees, FCMB had the highest value, followed by Fidelity Bank with N8.51 billion. As per the Central Bank of Nigeria, maintenance charges are only deducted from current accounts.

How To Avoid?

There are several ways to avoid this fee, including:

- Every account has a floor limit. Hence, maintaining a minimum balance in the account all the time helps in avoiding the fee.

- To meet the bank account requirements, the best way is to read, learn, and gain knowledge about the fee structure of banks and their imposition schedule.

- Enrolling for a direct deposit simply refers to the electronically depositing funds into a bank account. Banks do not charge maintenance fees on such accounts since they encourage physical and paperless transactions.

- All banks have some form of maintenance fee, but there are still some that do not charge it. An individual can properly research and go there to open a bank account.

- Requesting forgiveness on the fee. In case an account holder is tired of the maintenance fee, they can discuss it with the bank management and negotiate to go away.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.