Table Of Contents

What Is Account Analysis?

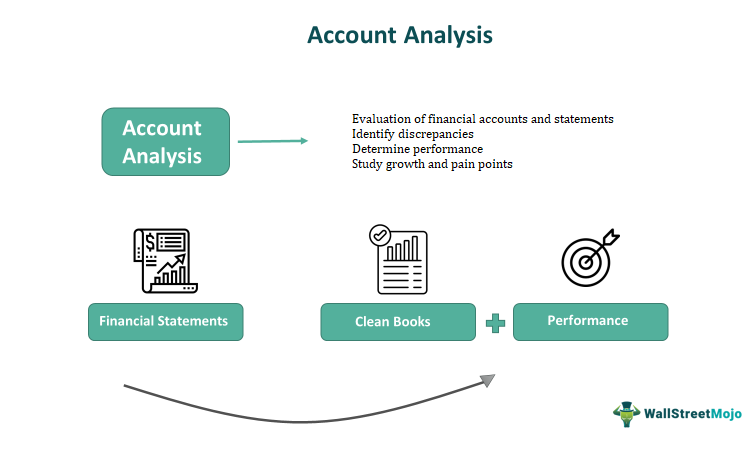

Account analysis refers to the process of evaluating and examining the important financial accounts of a business organization. The main purpose of this process is to identify any trends in the company's operations and transactions, evaluate its financial performance, or detect any suspicious transactions.

Regular account analysis is essential for businesses and can be performed by the company's accounting department or an external auditor. The analysis frequency varies depending on the size of the accounts, with monthly, quarterly, or half-yearly analyses being common. This process helps to identify any credit obligations or backlogs and provides a detailed analysis of specific accounts or departments.

Table Of Content

- Account analysis is a crucial accounting process in organizations that involves verifying the authenticity of financial statements and evaluating performance to gain insights into various business accounts.

- Regular account analysis should be conducted to resolve any issues or discrepancies that may arise and provide an immediate response with maximum efficiency.

- Bank account analysis is a similar process where the bank presents a monthly summary of transactions, bank balance, other activities, and charges incurred in that particular bank account.

Account Analysis Method Explained

Account analysis examines a company's financial accounts to identify trends, evaluate financial performance, and detect suspicious transactions. One of the important elements of the process is the account analysis statements. It is prepared by a firm's finance or accounting department. It carries information about the company's financial performance within a specific period to the most minute details.

Analyzing an account makes it possible to evaluate a firm's overall profitability and assess its growth by answering questions such as whether profits are consistent, whether there is growth in revenue or profits, and whether the growth is stable. This process can also help identify any inefficiency or financial risks requiring further attention or improvement.

A company is divided into certain departments or cost centers and profit centers. The profit and loss account analysis of these sub-units will provide an important understanding of the expenses and income made by each. This helps form an idea of the financial efficiency of the sub-units. Crucial decisions can be made based on these observations.

Types

There are two types of account analysis – horizontal and vertical.

#1 – Horizontal Analysis

Horizontal analysis compares a company's financial performance over the years or months. This accounts for seasonal changes in revenue, growth over the previous year or quarter, historical analysis, etc. Since it analyzes past trends, it is also called trend analysis.

#2 – Vertical Analysis

Vertical analysis, on the other hand, considers the financial performance at a specific time. It evaluates the financial relationships between sub-units and departments in a particular period.

Examples

Let's discuss a few examples to understand this concept better.

Example #1

Suppose Jane is an accountant in the firm EasyAccounts. She prepared the half-yearly profit and loss account analysis when she noticed a discrepancy in the sales commission entry. The firm usually pays a 5% commission. However, she found that more than 5% commission was paid over the six months under consideration. She immediately reported the discrepancy to her manager Dina. They looked into the issue by pulling out the statements from before the period under scrutiny and checking bank transactions. They discovered that the sales manager, Ron, paid more commission to his friend. The issue was then taken up with the top management.

Example #2

Suppose a firm named SuperBiz, an e-commerce company, handles over 10,000 transactions, amounting to approximately $100,000 monthly. The company relies on an account analysis system to manage the high transaction volumes. In addition, the bank provides a monthly analysis report that contains detailed information on the transactions and account balance, which helps the company to monitor and control its financial performance.

The analysis report includes information such as the total amount of transactions, the types of transactions, and the account balance. It also provides information on the fees charged by the bank, including the 0.01% fee on the total amount handled. By analyzing this information, the company can identify inefficiencies or inconsistencies in its accounts or statements and make informed decisions about cost control and budgeting.

An account analysis system is crucial for managing high transaction volumes and maintaining financial transparency and control. The monthly analysis report provided by the bank, along with the fees charged, is an essential component of this system.

Account Analysis Fee

The company's bank charges an analysis fee for its services in the form of bank account analysis. In addition, the bank provides a detailed statement highlighting its services, the charges, the account holder's transactions, etc. The fee is charged every month and is debited from the account.

Since business accounts usually handle hundreds of transactions monthly, compared to personal or individual accounts, the amount charged will be significantly greater for the former. The fee depends on the bank and the amount handled.

Also, if the firm hires an external auditor to analyze its accounts, it will have to pay a fee for the auditor too. However, the fee will not be applicable if the firm's accountants conduct the account analysis.

Advantages And Disadvantages

Here are some of the advantages and disadvantages of account analysis:

Advantages

- Helps to evaluate the financial performance of the company.

- Identifies inefficiencies or inconsistencies in accounts or statements.

- Facilitates detection of any suspicious activities or unusual expenditures.

- Helps in budgeting and decision-making.

- Crucial for stakeholder interests.

Disadvantages

- Time-consuming and resource-intensive.

- Requires skilled professionals.

- It may not capture non-financial factors.

- It may not provide a comprehensive view.

Frequently Asked Questions (FAQs)

It refers to reviewing and evaluating the transactions and balances recorded in a company's general ledger. It helps verify the accuracy and completeness of the recorded financial data and provides insights into the company's financial performance.

Cost analysis is a part of account analysis that examines the costs incurred by a business, including operating expenses, production costs, and administrative costs, to identify areas where cost-saving measures can be implemented. By analyzing cost data, a company can improve its profitability and competitiveness by reducing expenses and increasing efficiency, ultimately leading to increased revenue and profitability.

Revenue analysis is a crucial aspect of account analysis as it examines a business's income streams, including sales revenue, investment income, and other sources of income, to assess profitability and identify areas for revenue growth. Additionally, revenue analysis helps identify sales trends, assess marketing strategies' effectiveness, and determine the impact of pricing or product mix changes on overall revenue.