Table of Contents

What Is Access To Capital?

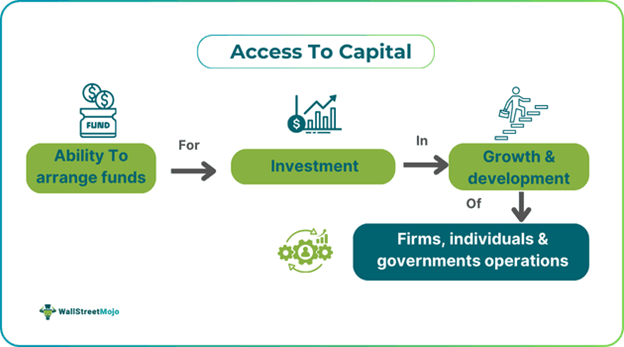

Access to capital refers to the capability of people or entities, especially small businesses, to raise funds for different purposes, like business expansion, investment, or operations. It helps entrepreneurs finance new projects, improve infrastructure, innovate, and grow by capturing avenues and successfully countering financial obstacles.

It can be achieved through various means, such as grants, loans, crowdfunding, and equity financing. All these help businesses manage operating expenses and invest in future growth. Equity financing also plays a vital role in fostering the competitiveness and economic development of entities, individuals, and nations as a whole.

Key Takeaways

- Access to capital represents the capacity of individuals or organizations, particularly small enterprises, to raise money for various activities like operations, investment, or company development.

- It enables business owners to seize opportunities and effectively navigate financial challenges by funding their new initiatives, development of infrastructure, innovation, and expansion.

- Entrepreneurs can access it through various channels, including credit unions, small business administrations, angel investors, crowdfunding platforms, government funds, and firm business credit profiles.

- It’s crucial for entrepreneurs and small businesses as it aids in operations, expansion, cash flow management, innovation, and competitiveness. Additionally, it empowers diverse business owners and creates jobs.

Access To Capital Explained

Access to capital means the capacity of governments, businesses, and individuals to arrange necessary funds for investment development and growth in their operations. Such access has been essential to stimulate economic activity, especially in emerging markets having limited funding because of factors such as high-risk perception from investors and instability in the economy. It can operate through various means, including crowdfunding, equity, loans, and grants. The Small Business Administration (SBA) has a vital role in making capital easily accessible through the 7(a) loan program that gives long-term working capital to smaller businesses.

These financial resources help businesses manage operations, invest in new technologies, and expand their market presence. However, the ease of getting capital access depends on market conditions and the creditworthiness of entities. Access to capital for small businesses has a profound impact on entrepreneurial success and the stability of the economy. If capital access is limited, then it can lead to stifled innovation and growth, especially for small companies and startups.

Moreover, it can also create barriers to trade in securing funding. Access to capital for entrepreneurs has been applied in almost all fields of business to transform quickly as per market demands. Entrepreneurs and startups use capital access to grab new profitable opportunities, mitigate risks, and manage their operations effectively. The federal government facilitates access using initiatives such as mortgage guarantees and benchmarked mechanisms for harnessing private capital. In the financial realm, it allows liquidity maintenance and investment management.

For investors, it offers new investment opportunities with a great scope of returns. Hence, equal accessibility of capital is important for promoting economic growth and ensuring business sustainability in rival markets.

How To Get?

An entrepreneur can get it through the following means:

- Small firms apply for loans from credit unions or traditional banks offering competitive interest rates for eligible borrowers.

- Small Business Administration (SBA) offers different loan programs formulated to support small companies, like disaster relief loans and microloans.

- Businesses can even approach angel investors and venture capitalists for capital in exchange for equity shares in potential startups.

- They can also approach crowdfunding platforms to raise funds for their business needs.

- Government agencies or private foundations also give non-repayable funds to particular projects in underdeveloped communities, increasing capital access.

- Lastly, by creating a strong business credit profile, one can expect to have higher chances of securing loans at favorable terms from lenders.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that Moglio, a retail startup in Old York City, struggles to obtain funding in spite of the favorable market trend of low interest rates at 4%. The firm, led by its CEO A and CFO B, is trying to raise $20 million related to its series B round to expand its AI-steered shopping platform. Despite Moglio's unique offerings showing growth potential, investors like BridgeWave Capital remain cautious because of the market recession.

Its senior analyst observes that although smaller series A funding rounds attract many, larger funding rounds face stricter, tighter scrutiny. Moglio's financial expert explains that Moglio has strengths in skilled engineering approaches and innovative sales methods. However, the expert signaled the need to achieve revenue targets to secure long-term funding consistently.

Example #2

An online article published on 22 October 2024discusses the opportunities and challenges the space firms face in accessing capital. Investors observed during the Satellite Innovation conference that despite recent low interest rates to 4.75-5% ordered by the U.S. Federal Reserve, space companies still find it challenging to obtain funding. It happens particularly during series A funding rounds. B. Riley securities' John stack brought to the fore the challenging environment.

Mike Collett of Pomus Ventures stated that valuation resets are a needed trend. Bank of America's Ronald Epstein blamed various factors, like post-COVID economic issues and uncertain markets, for the funding crunch. However, S. Sita of AlixPartners stressed the significance of cross-functional engineering skills and a strong sales team to gain funds. She cited SpaceX's success as an instance of faster project milestones and reduced costs.

Importance

Its importance to entrepreneurs and small businesses is discussed below:

- It becomes crucial to set up operations by buying inventory and equipment to help businesses start and grow.

- It aids businesses in expanding their business by foraying into new markets, adding new employees, and leading to long-term sustainability and growth.

- Business gets better cash flow to manage and easily navigate recession or sudden costs without harming operations.

- It also facilitates innovation in the development of new products, services, and technologies to meet customers' expectations and remain competitive in the market.

- It also enhances the competitive edge of entities investing in newer technologies, marketing, and domains, helping smaller companies compete effectively with bigger corporations.

- Finally, equal access to capital contributes to a nation's economic development by empowering numerous and diverse business people and creating new jobs in local communities.