Table Of Contents

How does Accelerated Buyback Work?

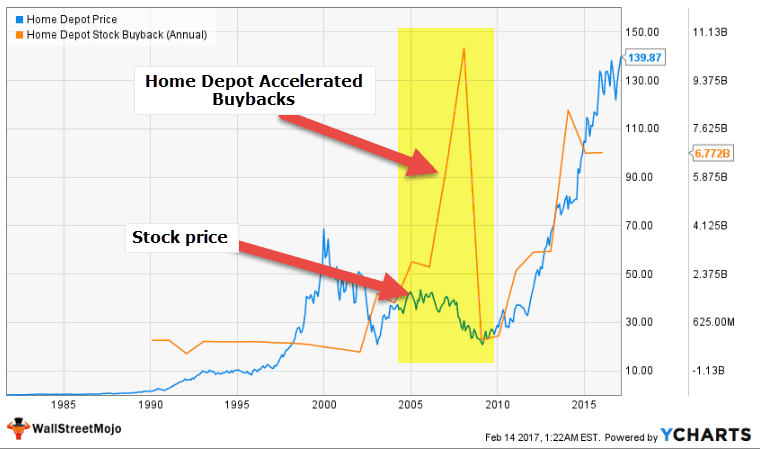

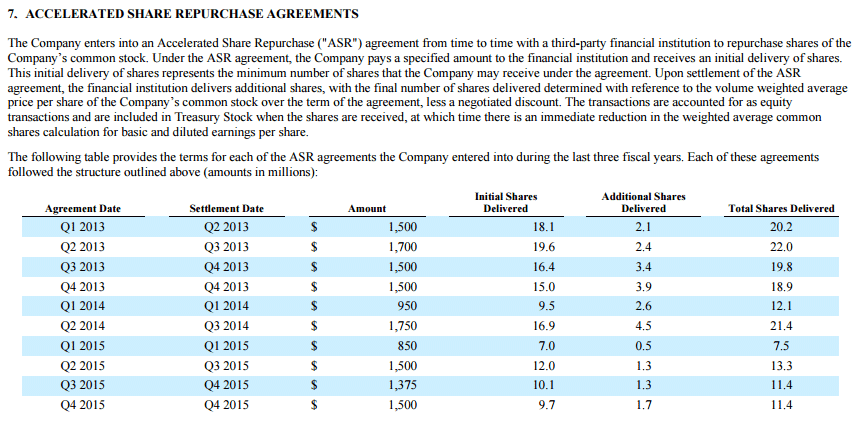

An “accelerated” buyback is also known as an accelerated share repurchase (ASR). Companies follow the practice of buying back shares of their stock from the market. Traditional buyback methods may take weeks or even months for the companies to purchase shares from the open market. But in the case of an accelerated plan, the companies ask the investment banks to short the full amount immediately. When the companies purchase the shares that the investment banks have shorted, it agrees to bear any losses on behalf of the bank. These shares, rather than being sold, are retired by the company. The buyback programs generally become a common phenomenon during the economic downturn when the stock prices fall to typically low values.

In an accelerated buyback, the company buys its shares from an investment bank, and the investment bank, in turn, borrows shares from the company’s clients. The investment banks to buy shares in the open market. Since the investment bank has sold the shares to the company to return the shares to its clients, they purchase the shares from the open market. At the end of the transaction, the company receives more shares than it initially had. While the returns on accelerated buybacks are positive, it is still less scalable compared to conventional open market repurchase operations.

The main benefit of accelerated buybacks is that it gives a big short term boost to share prices of the company. At the same time, the company’s earnings get elevated, and the profitability of the company increases on a per-share basis. The management also uses such a method to alter the earnings figure for reporting reasons and incentive remuneration. This procedure can also sometimes seem to be a strategic move by the companies to shift the risk of stock buybacks to the investment bank when the company senses that the shares are undervalued.

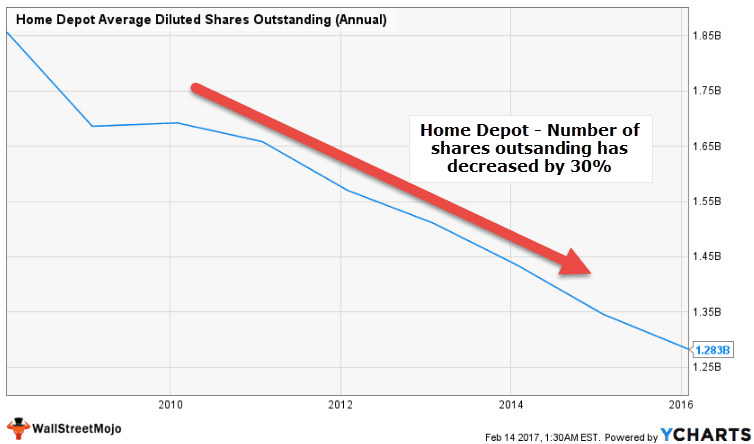

Shareholders, very often, prefer to share buyback programs, despite the risks involved because the ownership held by each investor expands when the number of outstanding shares floating in the market decreases. As a result, the company generates higher returns by making its shareholder value less dilute and spreading the same market cap over fewer shares than earlier. But realistically, in most cases, the ideal target is not achieved completely.

The share repurchase programs boost the earnings per share of the company and boost stock prices as well. Apart from boosting earnings per share, the buyback program reduces the value of the assets on the balance sheet. As a result, the shareholders’ funds, the return on assets, return on equity increase because the balance sheet has to remain balanced. Mostly, the repurchase programs target the short-sighted investors.

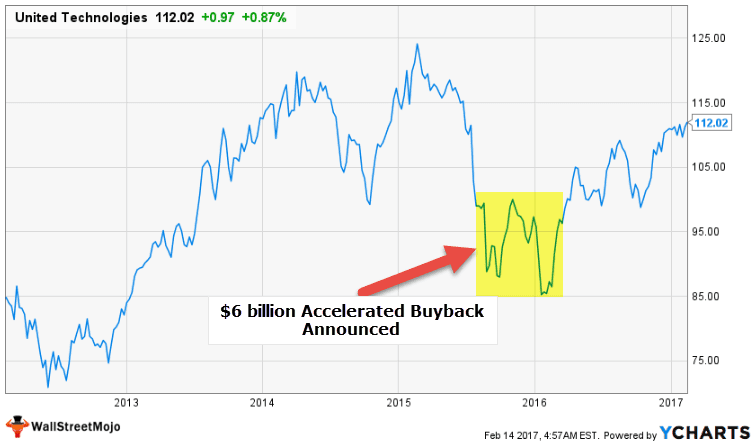

United Technology Accelerated Buyback

At the end of 2015, United Technologies entered into accelerated share buyback agreements with Deutsche Bank AG and J.P.Morgan Chase, each delivering $3 billion worth of stock under this program.

source: ycharts

This accelerated buyback was a part of the $ 10 billion repurchases planned for 2016. As per Chief Executive Greg Hayes, this buyback takes advantage of the “big disconnect” between the company’s value and share price.

Disadvantages of Accelerated Buy Backs

- Any share repurchase program serves as an easy cover-up for the poor financial status of the company. The investors get a false impression about the company's financial situation as the statistics improve drastically.

- Often, it has been observed that the company insiders take advantage of the stock exchange programs while not diluting the actual EPS number, which is reported in the company's books.

- During the accelerated programs, the share repurchases are often unable to be completed. It becomes difficult to know the real impact of the repurchase on the market price.

- When companies buy their stock, it also creates a negative reputation for the company in the market.

- The buying of its stock from the market also leads to poor utilization of the company’s capital because the company could as well employ the same dollars to fuel its business growth.

- Sometimes, buying the stock in the open market turns out to be a poor option for the companies. Because of flotation in the stock market, the repurchase doesn’t prove to be a good use of capital.

Accounting & legal requirements

In item 703 of Regulation S-K, it is stated that for all repurchases of equity-related securities, the following information must be reported by the company in the form of tables:

- Several shares are repurchased.

- The average share price paid for repurchasing;

- The number of shares whose repurchase has been completed under the publicly announced program;

- The maximum number of shares (or the approximate dollar value) that are remaining to be repurchased under the program;

Further, the company must disclose the above information for each month of the preceding fiscal quarter in the report of the next reporting period.

Additionally, for publicly announced programs, the SEC requires disclosure (in footnotes to the table mentioned above) of the following information:

- The announcement date.

- The approved number of shares or the amount by the board of directors;

- The date of the expiry of the program if any;

- Whether any program has expired during the last fiscal quarter;

- Whether there is any program has been terminated before expiration or which the issuer does not intend to continue.

Generally, these disclosures are also included in the liquidity and capital resource section of the companies’ “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is an integral part of their annual and quarterly reports. Generally, these disclosures are also included in the liquidity and capital resource section of the companies’ “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is an integral part of their annual and quarterly reports.

A company considering the share repurchase plan should consult outside counsel and other investment advisors. When carrying out the accelerated buyback programs, the companies should review the limitations or restrictions on repurchasing the shares, some of which are listed below:

- Tax and accounting statistics related to sharing repurchase

- Any application requirement related to the stock exchange on which the shares are listed

- Organizational documents, including certificate of incorporation and bylaws

- Relevant laws related to a state of incorporation

- Any agreements that may limit the ability to repurchase the company’s securities

Conclusion

Many companies will continue to face critical choices regarding how to best allocate their surplus cash. An increasing number of companies, over the years, have chosen to repurchase shares of their stock.

It is also important for a company to critically analyze the implications of share repurchases from a legal point of view, as discussed above in this article, so it can make an informed decision. Suppose a company elects to implement a repurchase program. In that case, it should take great care to ensure that the individuals and the institutions, who are tasked with implementing the program, understand the relevant contractual restrictions and statutory requirements as well as the necessary processes required to ensure compliance.