Table Of Contents

What is Accelerated Depreciation?

Accelerated depreciation refers to those methods where the asset cost is depreciated faster than the straight-line method. This method's main purpose is to believe that assets are more productive in the early years than in later years. Therefore it leads to larger depreciation expenses in the earlier years than the later period of the asset's useful life. Declining Balance Method and Sum of Years Digit Method are the two such popular methods.

Types of Accelerated Depreciation Method

The most commonly used methods are the Declining Balance Method of Depreciation and Sum of year Digit Method of depreciation. Let us discuss each one of them in detail -

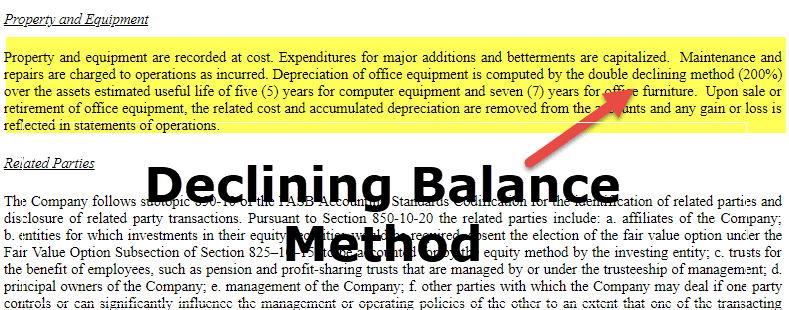

#1 - Declining Balance Method of Depreciation

Under this declining balance method, a constant rate of depreciation is applied to an asset's book value each year, which results in accelerated depreciation (higher depreciation values in the early years of the life of an asset). The most commonly used depreciation rate is 2X of the straight-line method known as a double-declining depreciation method.

The basic formula to calculate depreciation using the double-declining method is

Declining Balance Method Example

An asset worth $10,000 has a life of 5 years, and its salvage value is 0 after five years.

So as per the straight line depreciation method:

- Depreciation at every year = (Book Value of an asset- Salvage Value)/life of an asset

- Dep every year = (10000-0)/5=$2000 per year or 20% per year;

Now if we are using accelerated depreciation method with a factor of 2X i.e. 40% per year

- The depreciation expense in first year = book value* rate of dep. = 10000*40%= $4000 in year 1

- In year 2 depreciation = book value* rate of dep = 6000*40%= $2400 in year 2

- Depreciation in year 3 = 3400*40% = $1360 in year 3.

- Depreciation in year 4 = 2040*40% = $816

- In the last year, it will be fully depreciated with 0 residual value.

So we observe that in the accelerated depreciation method, we depreciate the asset heavily in the first few years and gradually decrease in further years.

Though this accelerated depreciation method has certain financial regulatory implications, it gives the firm advantages.

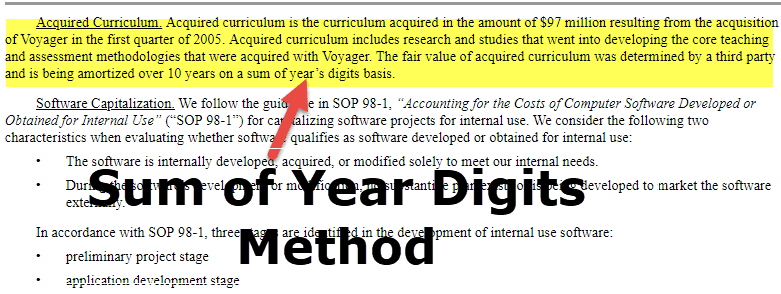

#2 - Sum of Years Digit Method

Sum of Year Digit Depreciation is an accelerated depreciation wherein the depreciation is calculated using the following formula.

Sum of year depreciation = Number of useful years remaining/sum of useful years * (Depreciable amount)

Sum of Year Depreciation Example

Let us consider the asset $10,000 with a useful life of 5 years and no residual value.

Sum of useful life = 5 + 4 + 3 + 2 + 1 = 15

The depreciation factors are as follows

- Year 1 – 5/15

- Year 2 – 4/15

- Year 3 – 3/15

- Year 4 – 2/15

- Year 5 – 1/15

Depreciation Expense for each year will be

- Depreciation in year 1 = $10,000 x 5/15 = $3333.3

- Depreciation in year 2 = $10,000 x 4/15 = $2666.7

- Depreciation in year 3 = $10,000 x 3/15 = $2000

- Depreciation in year 4 = $10,000 x 2/15 = $1333.3

- Depreciation in year 5 = $10,000 x 1/15 = $666.7

We again note that most of the depreciation expense is charged in the initial years.

How Accelerated Depreciation Method lower the tax outgo?

Let’s take an example to demonstrate how the accelerated depreciation method results in lower tax outgo in the initial years. Here we will prepare an income statement for tax purposes.

Below are the steps of using the accelerated depreciation method –

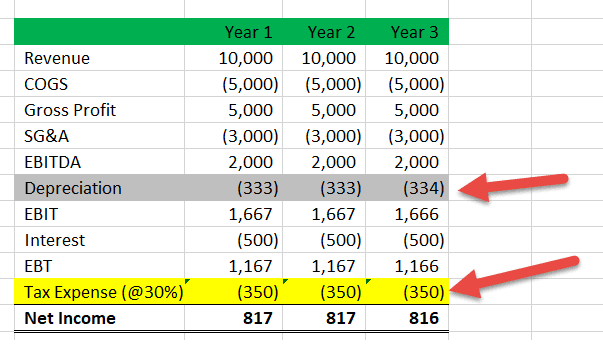

1. Tax Income Statement with the Straight Line Method of Depreciation

Here we assumed that the Asset is worth $1,000 with a useful life of 3 years and is depreciated using the straight-line depreciation method year one at $333, year two at $333, and year three at $334.

We note that the Tax Expense is $350 for all three years.

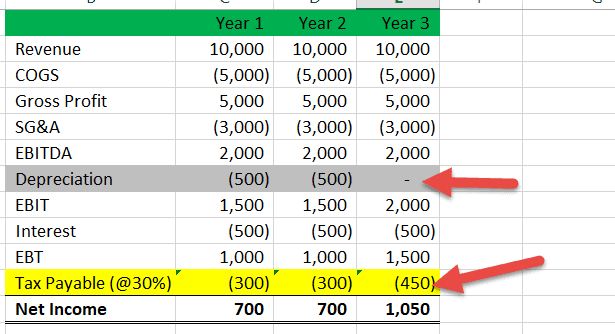

2. Tax Income Statement as per the Accelerated Depreciation Method

- Let us now assume that for tax reporting purposes, the company uses an accelerated method of depreciation. The depreciation profile is like this year 1 $500, year 2 $500, and year 3 $0.

We note that the Tax Payable for Year 1 is $300, Year 2 is $300, and Year 3 is $450.

Here we observe that the tax payment is lower in starting years if we use the accelerated depreciation method instead of the straight-line method. Due to this, we will have higher net income and cash in hand in the initial years.

Also, have a look at what is deferred tax liability?

Also, have a look at what is deferred tax liability?

Advantages

#1 - Reduction in start-up business deductions:

This method allows to report higher expenses in the initial years as the depreciation cost is charged higher in the beginning years; if this method is used in accounting, this leads to the higher expense and which will bring down the net income on paper( on paper because depreciation is a non-cash expense, funds do not flow out of the organization). So these firms have to pay lower taxes in the initial years, and they can utilize this fund in their core business activities.

#2 - Higher upfront deduction

Another huge advantage of the accelerated depreciation method is that it will allow organizations to make higher deductions in starting years. It will save their current year tax that will directly help when your business is new and you have short-term cash flow problems.

#3 - Tax Deferral Mechanism

The biggest and one of the reasons corporates use accelerated depreciation methods in their accounting is the tax deferral, i.e., if you are using this method, then you will be able to defer a part of the tax to future years as it will create a provision of deferred tax liability (DTL) in books of accounts and by this organization can take this as their advantage in deferring the tax and paying it later when they expect future years will be more profitable for them. That time easily, they can pay and bring this DTL to 0.

Disadvantages

#1 - Preferential Treatment

This method allows the business to deduct their expenses faster/quicker than the asset worn out, leading to decision biases like when to invest and how much to invest.

#2 - Future deduction a problem for growing business

The accelerated method only allows higher deductions in the early years. Still, it does not create a huge tax deduction in real terms, and this deferring amount can pose a huge problem for growing businesses as, with time, their income increases, and they will fall into a higher tax bracket and have to pay a higher amount.

#3 - Recaptured Deprecation Risk

Under this method, you can sell the asset once full depreciation is shown on papers. But in reality, the asset still has a useful life as it is not completely worn out. It still possesses economic value.

In such scenarios, the income tax department will take back the deductions as it was not a fully depreciated asset, which will become a loss-making scenario.