Table Of Contents

What Is An Accelerated Death Benefit (ADB)?

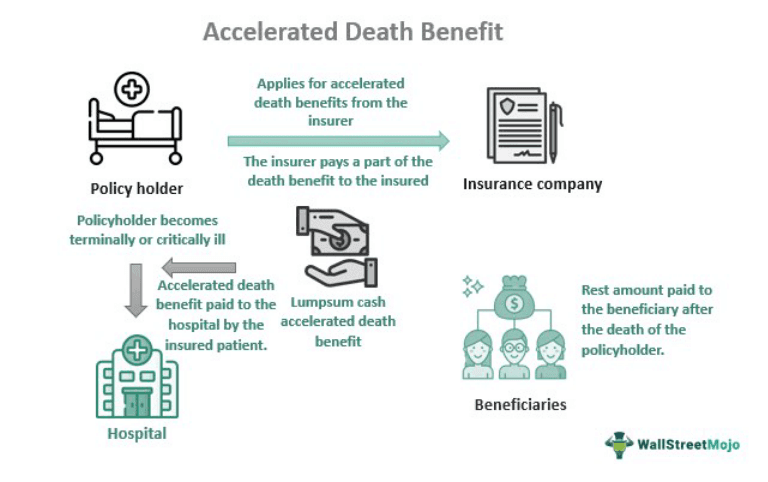

Accelerated Death Benefit rider refers to a rider in a life insurance policy that sets aside a part of the death benefit towards serious illnesses in old age or the end of a customer's policy. It primarily provides financial assistance to terminally ill seniors, prevents customers from selling their policies to third parties, and buys policies from other insurers.

It also allows policyholders to meet any expenditure during severe illnesses like AIDS. However, one has to keep paying the insurance premium during the policy redemption. Therefore, some charge extra, and some have the accelerated death benefit inbuilt into the policies. As per the American council of life Insurance, insurance companies provide twenty-five to ninety-five percent of the death benefit as ADB to the insured.

Key Takeaways

- Accelerated death benefit means a special rider attached to the life insurance policy that enables a partial withdrawal of the death benefit of a senior insured person during their lifetime for meeting their critical or terminal illness expenses.

- This death benefit prevents policyholders from selling their policy to a third party and buying other insurance products from other than the original life insurance company.

- The cash benefits derived from this benefit do not attract taxes when paid in lumpsum, but the installment-wise payment does attract taxes as per Internal Revenue Service.

- Viatical settlements have a better repayment advantage than ADB as seniors do not need to pay the premium after a Viatical settlement, unlike accelerated death benefit, which requires seniors to pay the premium while availing of the death benefit.

Accelerated Death Benefit (ADB) Rider Explained

Accelerated death benefit rider refers to a special provision in a policy agreement between the insurer and insured that allows a specific percentage of death benefits usage to meet the senior person's urgent, terminal, or chronic illness. It came into prominence during the eighties when cases of diseases like AIDS were on the rise in the United States. Insurers association came to the fore and added the life insurance accelerated death benefit rider in the policies for helping AIDS patients.

As a result, the insured suffering from AIDS can utilize the amount for their treatment and meet their family's financial needs during and after they pass. Usually, life insurance means a safety net for the insured's family after they die. But sometimes, policyholders need vast sums of money during their lifetime to fight chronic illness. In these situations, policyholders can tap into a portion of the death benefit to pay the cost of illnesses.

However, their nominee would receive a death benefit after subtracting the ADB availed. Nevertheless, ADB has some provisions and purposes before beneficiaries can avail of them. Different companies have different levels of accelerated death benefit percentages and amounts associated with their policies. Once beneficiaries avail of the accelerated death benefit pro

Provision & Purpose

Nowadays, every American life insurance provider has incorporated the provision or rider of ADB like:

- Any senior person suffering from terminal or critical illness can only afford ADB.

- The terminal illness covers - kidney failure, Lou Gehrig's disease/Amyotrophic lateral sclerosis (ALS), coma, heart attack, cancer (invasive and blood cancers), stroke, major organ transplant, and paralysis.

- Critical illnesses pose huge hindrances in performing the six essential body functions- bathing, dressing, independent movement, continence, eating, and toileting.

- A government-registered doctor must provide the policyholder's certificate of critical or terminal illness; companies will process the request for ADB only after that.

Moreover, all the above provisions act to serve the following specific purposes:

- Seniors get financial assistance immediately for treating their critical or terminal illnesses.

- Policyholders do not go shopping for policies of other companies.

- To prevent the selling of policies to a third party by the policyholders.

- To allow seniors to live fully without any problems.

Example

Let's look at an accelerated death benefit example to understand this concept. Let there be a senior citizen Alex who avails insurance from a leading life insurance company for $600000 as a death benefit. The insurance policy also contained the death benefit rider for the insured up to 50% of the death benefit.

Senior Alex found out he had developed lung cancer after availing of the insurance from the company. That forced Alex to rest without earning to meet the cancer treatment. Hence, Alex decides to avail of the death benefit rider and avails a sum of $300000 towards cancer treatment. Thus, the timely financial impetus helped them fight cancer without monetary tension. Thus the death benefit saves Alex's life, without which cancer might have ended their life.

Taxation

In the United States, cash benefits arising out of accelerated death benefits are taxable and have the following implications:

- First, ADB does not fall under federal income taxes.

- Lump sum payments of ADB to the insured do not attract taxes.

- However, death benefit payments in installments do attract taxes as they charge interest.

- Any redemption over $50000 as ADB for group life insurance comes under the income tax provision as per Internal Revenue Service.

- Policies of the insured get attached while computing the net asset value. Hence, as per law, any value of assets above 411.58 million does get taxed.

- If one withdraws more money as ADB than one pays as an insurance premium, the amount may be subject to income taxes.

Viatical Settlement vs Accelerated Death Benefit

Viatical Settlement

- It consists of an agreement between the policyholder and a viatical settlement provider for the sale of the policy in exchange for cash.

- The amount received from the sale of the policy remains lesser than the death befits amount of the policy.

- Under the viatical settlement, the third party buying the insurance pays the premium, not the policyholder.

- Only chronically ill or terminally ill policyholders get eligible for the settlement.

- Seniors may find it easier on their finances to avail of the viatical settlement.

- A terminal or chronically ill certificate must be submitted to initiate such agreements.

- A person with a terminal illness leading to death within two years gets eligible for a viatical settlement.

- An individual with chronic illness leading to more than 90 days of lost physical functioning abilities gets eligible for viatical settlement.

Accelerated Death Benefit

- This benefit is part of the policy signed between the insurer and the insured.

- ADB amount gets decided as a percentage of the total death benefit minus loans taken upon the policy.

- After availing of ADB, one has to continue the payment of insurance premiums as before

- Only senior persons with a chronic or terminal illness can claim the ADB.

- Seniors may get burdened to pay the premium after availing of the ADB as they have to continue paying it independently.

- No such thing happens, but after ADB, one can go for the viatical settlements.

- A person enjoying ADB gets debarred from taking benefits related to medical aid and other government medical benefits.

- Only senior citizens can take benefit from chronic illnesses.