Following are the comparison between ACA and CPA:

Table Of Contents

ACA vs CPA

Financial Accounting remains one of the most important fields in the financial industry, and there is an ever-growing demand for competent professionals in global financial institutions. To gain accreditation in accounting, it would be advisable for professionals to choose a certification program that fits in with their individual preferences, educational qualifications, and work experience, among other things. In the course of this article, we would be discussing ACA and CPA as two of the leading certifications in accounting, which have made some quality contributions to the accounting industry by validating the professional capabilities of competent individuals in this field.

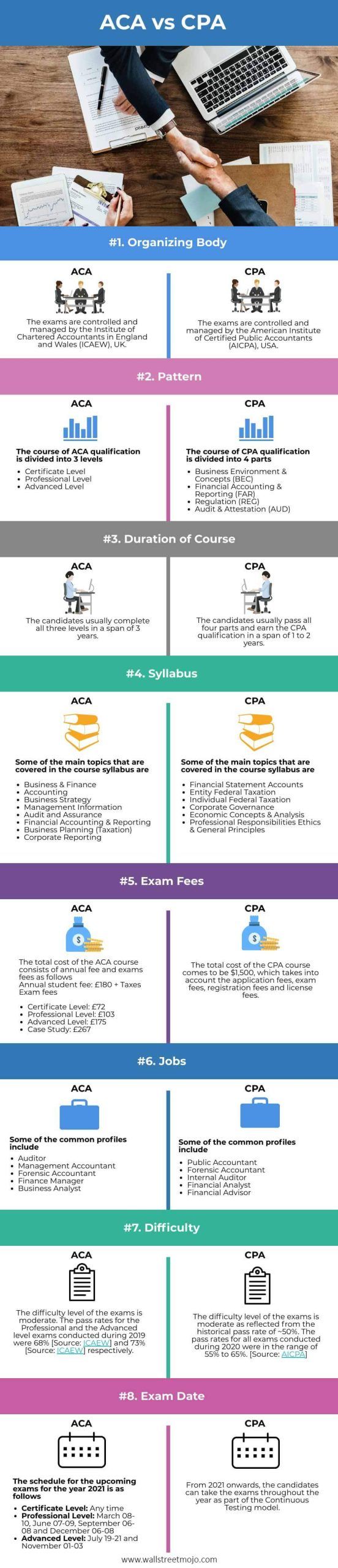

ACA vs. CPA Infographics

Let's understand the difference between these two streams with the help of this ACA vs. CPA Infographics.

ACA VS CPA Comparative Table

| Section | ACA | CPA |

|---|---|---|

| 1. Organizing Body | The exams are controlled and managed by the Institute of Chartered Accountants in England and Wales (ICAEW), UK. | The exams are controlled and managed by the American Institute of Certified Public Accountants (AICPA), USA. |

| 2. Pattern | The course of ACA qualification is divided into 3 levels

| The course of CPA qualification is divided into 4 parts

|

| 3. Duration of Course | The candidates usually complete all three levels in a span of 3 years. | The candidates usually pass all four parts and earn the CPA qualification in a span of 1 to 2 years. |

| 4. Syllabus | Some of the main topics that are covered in the course syllabus are Business & Finance | Some of the main topics that are covered in the course syllabus are Financial Statement Accounts |

| 5. Exam Fees | The total cost of the ACA course consists of the annual fee and exams fees as follows Annual student fee: £185 + VAT (if applicable)

| The total cost of the CPA course comes to be $1,500, which takes into account the application fees, exam fees, registration fees, and license fees. |

| 6. Jobs | Some of the common profiles include

| Some of the common profiles include

|

| 7. Difficulty | The difficulty level of the exams is moderate. The pass rates for the Professional and the Advanced level exams conducted during 2019 were 68% and 73% , respectively. | The difficulty level of the exams is moderate as reflected from the historical pass rate of ~50%. The pass rates for all exams conducted during 2020 were in the range of 55% to 65%. |

| 8. Exam Date | The schedule for the upcoming exams for the year 2021 is as follows

| From 2021 onwards, the candidates can take the exams throughout the year as part of the Continuous Testing model. |

What is ACA?

Associate Chartered Accountant (ACA) qualification is offered by the Institute of Chartered Accountants in England and Wales (ICAEW), a globally recognized UK-based accounting body engaged in promoting and professionally developing more than 144,000 accountants worldwide. This credential is aimed at helping individuals acquire advanced professional competencies in accounting, finance, and business. Earning this credential requires completing 3 years of technical work experience, making it one of the most rigorous qualifications in finance and accounting. ACA also introduces professionals to accepted professional and ethical standards for accounting professionals in the global arena.

What is CPA?

Certified Public Accountant (CPA) is offered by the American Institute of Certified Public Accountants (AICPA), a premier accounting body engaged in promoting globally accepted accounting standards and the development of professionals for the global accounting industry. CPA is considered nothing less than a black belt in accounting, preparing professionals to work by US GAAP and IFRS standards. As IFRS continues to emerge as the new global standard for financial reporting, this credential will gain greater relevance. With CPA, professionals can promote themselves as experts in accounting, auditing, and taxation-related work.

ACA vs. CPA Exam Requirements

ACA

Candidates can opt for ACA right after leaving school if they have earned two A2 levels and have passed 3 GCSEs or their international equivalents. Graduates with good grades can also be considered by authorized training employers and a minimum UCAS tariff score of 280 or above, including AS and A2 levels. International equivalents of these qualifications and scores might also be acceptable, or one might have to look for eligibility as defined for a specific country or region. Candidates also require at least 450 days of relevant work experience, taking up to 3-5 years to complete.

CPA

Candidates who have completed a 4-year bachelor’s degree with at least 120 semester hours are eligible for CPA. This usually includes 24 to 30 semester hours in accounting, which might be completed in a bachelor’s degree or even a master’s degree in some cases. They are also required to have at least 1-2 years of work experience with CPA.

Why Pursue ACA?

ACA qualification offers advanced technical knowledge in accounting and finance, helping professionals take their career graph and explore novel work opportunities in the global arena. There is a lot of post-qualification support as well, which works to the advantage of participants. The average salary of ACA-qualified professionals is among the most competitive in the financial industry, primarily due to the demand for technical accounting and finance skills developed as part of the ACA qualification.

Why Pursue CPA?

CPA designation can help develop a career in accounting, auditing, tax, or management consulting, among other areas. The CPA license is widely recognized as a standard of a high level of professionalism and expertise in quantitative finance. One can work as an independent auditor after completing CPA, and most of the advanced roles in accounting have CPA as a pre-requisite. They can work with some of the largest firms and are particularly well-suited for public accounting roles.

Conclusion

It would be important to understand that both of these credentials focus on accounting and auditing-related skills. However, there are more subtle differences that set them apart. Where CPA introduces professionals to US GAAP and IFRS as two of the most important reporting standards globally, ACA helps professionals acquire advanced technical accounting skills. Another major difference is that ACA is more focused on the practical application of concepts and requires a good deal of work experience. In contrast, the CPA is more focused on advanced concepts, including strategic planning and operations management, to build a deeper contextual understanding of accounting.