ACA Exam - Associate Chartered Accountant Guide

Table Of Contents

ACA Exam Format

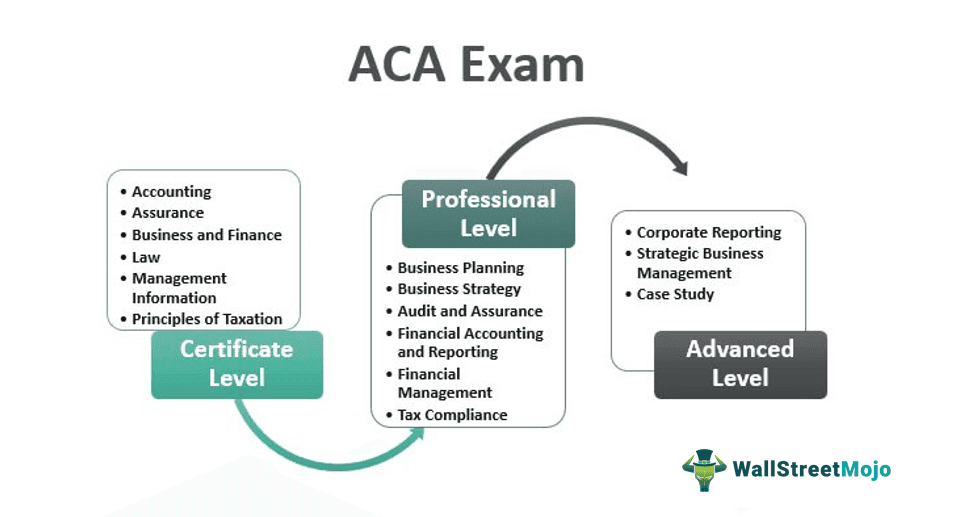

The exams are divided into three levels: certificate level, professional level, and advanced level.

A candidate is required to complete all 15 modules across three levels. Exemptions are allowed in the cases of prior study (for certificate and professional level modules).

Certificate level

The certificate level covers accounting and business essential principles:

- Accounting (40 questions)

- Assurance (50 questions)

- Business and finance (50 questions)

- Law (50 questions)

- Management information (40 questions)

- Principles of taxation (50 questions).

All the topics within this module are tested in one exam for one and half hours at any point when the student thinks he is ready. Candidates are allowed to give one level four times.

Professional level

The syllabus of the Professional level concentrates on the candidate’s ability to apply the theoretical knowledge and understanding to real-life situations:

- Business planning: taxation

- Business strategy

- Audit and assurance

- Financial accounting and reporting (3 hours)

- Financial management

- Tax compliance.

There is a three-hour exam held for each topic at this level.

Advanced level

The advanced level is an open book examination that focuses mainly on the complex scenarios of the real-time business and case study, testing each candidate’s skill and judgment in a critical time.

- Corporate reporting

- Strategic business management

- Case study.

The Advanced level has three and a half hour examinations for two modules, while the case study examination is a 4-hour long agony. There is no limit on the number of times a student appears for the examination. However, students should take the case study paper towards the end of their professional development, ethics training, and work experience to use the practical knowledge gained in the field.

ACA Exam

No one likes to be stuck in one place forever. Desire spirals the way to succeed, and the easiest shortcut to achieve professional success is working hard and taking relevant professional courses to boost your career prospects. In an industry where talent is not scarce, but jobs are, experience combined with updated knowledge of the current times gives an edge to an individual over his competitors. This article will give you the nuts and bolts of the ACA examination. The article aims to provide you with the best possible information on the ACA course to enrich your knowledge and aid you in your decision-making process. Let us help you give your growth the right direction by helping you decide on the right course. Please read ahead carefully.

Before you read on what the ACA course is all about, let us answer the question of your curious mind, Why is ACA one of the most sought-after certifications for Accounting Professionals?

- The ACA qualification is valued by corporates the world over. The course enjoys seeking the best talent and turning them into highly technical and accounting updated professionals.

- The ACA examination rigorously trains the students to be prepared for the situations in the real-world environment. They are taught to be technically sound with detailed information about the in and out of the finance industry.

- The course format and exam structure are extremely student-friendly, ensuring the best possible way for studying and ensuring their work commitments are not hampered.

The core information about the ACA exam is as follows:

About the ACA Exam

The ACA or the Associate Chartered Accountant Program is a premier course designed by the Institute of Chartered Accountants in England and Wales (ICAEW). The ACA is considered the most reputed exam to achieve the Chartered Accountant designation. This course is noted for its difficulty level and the diverse opportunities it opens up for the partaking candidates in accountancy. ICAEW is the largest body of qualified accountants. ACA is their sole focus of education, ensuring that the syllabus is regularly checked, keeping to the industry's needs.

Roles: An ACA cleared candidate is open to mainly working in these four sectors: public practice, business, financial services, and charity. The candidate can offer services under the designation of Chartered Accountant (ACA) or the Fellow Chartered Accountant (FCA), depending on their experience and membership with the ICAEW. An ACA qualified has the excellent opportunity to rise to the position of financial director or become partners very early in their career. The other roles open for them are business analyst, practice partner, finance director, CEO, or even running their own business.

Exam: The ACA examination has three levels with 15 modules and exams. The three levels are Certificate Level, Professional Level, and Advanced Level. Candidates are eligible for an exemption due to prior study in the Certificate and Professional Levels.

Exam Dates: The ACA exam for the Professional Level is held during March, June, September, and December, while the Advanced Level is held in July and November.

The Deal: Rewarding careers after you successfully clear the examination.

Eligibility: The minimum educational requirements needed to be eligible for the ACA program are:

- A recognized graduate degree from any of the recognized accredited Universities

- Education that is equivalent to high school

- Certificate in Finance, Accounting, and Business (ICAEW)

- Member of AAT

- Student of AAT who has achieved NVQ Level 3 Intermediate Stage

- Member of ACCA, CIMA or CIPFA

- Student of ACCA, CIMA, CIPFA, CAI or ICAS who has sat and passed all papers of every examination stage of the body concerned, up to and including the following examinations, ACCA Advanced Diploma in Accounting and Business, CIMA Certificate in Business Accounting, CIPFA Professional Certificate, CAI Proficiency II, ICAS Test of Competence, Pass in a recognized Accountancy Foundation Course

ACA Qualification Completion Criteria

The criteria to complete the program has four essential elements to be eligible for the ICAEW membership: examinations, technical work experience (TWE), initial professional development (IPD), and structured training in ethics (STE). In addition, students must complete a training program within three years and undergo regular appraisal/progress reviews with their employer. On completion of these, a copy of the completed ETWE (evidence of technical work experience) form to ICAEW needs to be provided. Then a candidate will be invited to ICAEW membership.

Recommended Study Hours: An average of 400 to 600 hours must be dedicated to clear the ACA examination successfully, though many students also rely on external support such as essay writing services to manage their workload effectively.

What do you earn? A degree that provides you with the knowledge, skill, and expertise that makes you stand out in the job market.

Why Pursue ACA Exam?

Pursuing ACA has its share of advantages, and they are sure to be concentrated. It can massively benefit your career by increasing your earning potential and making you far more visible in the job market than your peers. However, other pros also need to be considered before embarking on your journey towards achieving this certificate course.

- The ACA certificate is earned through a training contract which means that the candidates enjoy structured instructions and proper teaching for the syllabus set. Students also enjoy studying for the exams, while their books and fees are entirely paid.

- An ACA training candidate enjoys a lucrative salary, and so it speaks volumes of what a qualified ACA would achieve.

- The ACA syllabus structure is designed to ensure candidates are thoroughly prepared for each component so that they can put the theory easily into practice. The course provides a piece of detailed knowledge about the broad spectra of accountancy, finance, and business.

Jobs after pursuing ACA Qualification

Jobs are open for ACA certificate holders in public practice, business, financial services, and charity. ACAs enjoy great career growth, which is in proportion to the salary package offered. Some companies hiring ACA certificate holders are BDO LLP, Ernst & Young, KPMG, and PWC.

Work Experience Requirement

This component is essential to the candidate's training and allows the students to practice the elements of the day-to-day job. Candidates must complete 450 days of work (where 'a day' equates to seven hours) experience for the ACA. Therefore, it almost takes between three to five years (or 200 hours for the approved two-year scheme).

The practical work experience is gained from one of the ICAEW’s 2,850 approved employers in at least one area of accounting, audit and assurance, tax, financial management, insolvency, or information technology.

Key Highlights about the ACA Exam Format

The certificate level is a standalone qualification and can be completed outside of a training agreement, and most students complete this level within the first year of their training agreement.

- The certificate level can be completed at any time regularly throughout the year.

- The modules of the three levels can be taken at any time regularly throughout the year.

- The modules of each level build up the complexities of studying material for the next level.

Ethics and Professional Scepticism

This section is taught as an online training tutorial and covers the important ethical accounting practices and requirements of a working chartered accountant. The tutorial ensures the students easily understand the key principles of objectivity, integrity, professional competence and due care, confidentiality, and professional behavior.

There are six modules and a devolved assessment (30 multiple-choice questions over an hour) covering:

- An introduction to the ICAEW code of ethics

- Fundamental ethical principles

- Threats and safeguards to the fundamental ethical principles

- Conflicts of interest

- Considerations for professional accountants in practice

- Considerations for professional accountants in business.

Each module is designed to help students develop ethics and professional skepticism skills from an accountants’ perspective.

Candidates are expected to review their understanding of ethics in their field with their employer at six-monthly intervals and apply their learning during their practical work experience.

ACA Exam Topics Breakdown

Certificate Level

Accounting (covers the topics of double-entry accounting and how to apply its principles)

- maintaining financial records

- adjustments to accounting records and financial statements

- preparing financial statements

Assurance covers the assurance process and fundamental principles of ethics

- concept, process, and need for assurance

- internal controls

- gathering evidence on an assurance engagement

- professional ethics

Business and finance covers how businesses operate and how finance and accounting functions support businesses

- business objectives and functions

- business and organizational structures

- the role of finance and the accountancy profession

- governance, sustainability, corporate responsibility, and ethics

- the external environment

The law covers the principles of law

- impact of civil and criminal law on business and professional services

- company and insolvency law

- impact of law in the professional context

Management Information covers how to prepare essential financial information for the management of a business

- costing and pricing

- budgeting and forecasting

- performance management

- management decision-making

Principles of Taxation covers the general objectives and types of tax

- objectives, types of tax, and ethics

- administration of taxation

- income tax and national insurance contributions

- capital gains tax and chargeable gains for companies

- corporation tax

- VAT

Professional Level

Audit and Assurance cover critical aspects of managing an assurance engagement, including:

- legal and other professional regulations, ethics, and current issues

- accepting and managing engagements

- planning engagements

- concluding and reporting on engagements

Financial Accounting and Reporting covers the preparation of single complete entity and consolidated financial statements and extracts from those statements

- accounting and reporting concepts and ethics

- single company financial statements

- consolidated financial statements

Financial management covers how to recommend relevant options for financing a business, recognize and manage financial risks and make appropriate investment decisions

- financial options

- managing financial risk

- investment decisions and valuation

Tax Compliance covers how to prepare tax computations for individuals and companies

- ethics and law

- capital gains, income, inheritance, and corporation tax

- national insurance contributions

- VAT and stamp taxes

Business Planning: Taxation covers how to identify and resolve tax issues that arise in the context to prepare tax computations and advising on tax-efficient strategies for businesses and individuals

- ethics and law

- taxation of corporate entities and unincorporated businesses, including partnerships

- personal taxation

Business Strategy covers how businesses develop and implement strategy, including:

- strategic analysis

- strategic choice

- implementation and monitoring of strategy

Advanced Level

Corporate Reporting

Module covers:

- auditing services, preparing and evaluating corporate reports

- determine alternative solutions to corporate reporting issues, considering client and stakeholder needs

Strategic Business Management

Module covers:

Case Study

Module covers:

- tests professional skills in the context of a specific business issue

- development of conclusions and recommendations required

- relates to how students will be expected to work

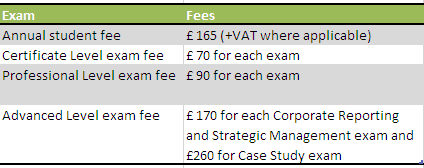

ACA Examination Fees

The costs for applying for credit for prior learning, where applicable, will be:

£70 for each Certificate Level module and £90 for each Professional Level module.

ACA Results and Passing Rates

The results of the ACA exams are published on the ICAEW website, and the results in letters are later posted to the students.

In 2019, the cumulative pass percentage of ACA was above 70%.

ACA Study Resources

The ICAEW provides learning material that the examiners design. ICAEW's study resources comprise a study manual that explains the topics on which the student will be tested. The study resources help understand the broad outline of topics the students shall be tested. In addition, an online study guide guides the student towards the approach and skills tested for each module, interactive self-test question materials at the end of the chapter, and a question bank containing questions for revision and practice before the exams.

ACA Exam Strategy

During your tutorial, make your notes clear and easy to re-use. It will save you time in the long run.

- Practice the past papers as it will benefit you in revising the concepts learned.

- Get yourself acquainted with the answering pattern as the examiner looks for something similar.

- Do not avoid the narrative answers-instead to make use of them because they can be rotted and produced.

- The mark allocation is not specified in the question paper; hence use your intelligence. Words like briefly explain and explain in detail should be the beacon of light.

Conclusion

Studying the materials is important, but the major battle is won if you concentrate on getting hands-on experience on the concepts learned in the class to be practiced on the field. All the Best!

Professional Development

The Professional Development training enables a student to improvise and strengthen key areas in the career of an accountant, which includes:

- Communication

- Team working

- Decision making

- Consideration

- Adding value

- Problem-solving

- Technical competence.

Professional development training is completed through the ICAEW Professional Development Scheme or the employer's organization scheme (if accredited).

Get in Touch with our Experts!