Table Of Contents

Get in Touch with our Experts!

What Is The ABX Index?

The ABX index is an index representing twenty subprime residential mortgage-backed securities or RMBS. This synthetic tradable index enables market participants to gauge the performance of RMBS. Moreover, its standardization and liquidity allow investors to accurately assess market sentiments concerning the asset class and take short or long positions accordingly.

A firm named Markit was the first to create this index that uses credit default swaps or CDS on the 20 largest RMBS. A fall in the ABX index value indicates that the market associates with higher risk for subprime mortgages. The ABX, ABX.HE, or the asset-backed securities index, has six sub-indices representing different levels of credit quality among multiple RMBS tranches.

Key Takeaways

- ABX index, developed by Markit, an intelligence firm, is a tradable, synthetic index representing the twenty largest residential subprime mortgage-backed securities.

- One can look at an ABX index chart to learn about the performance of the subprime residential mortgage market.

- The Markit ABX index is the original asset-backed securities index. The Barclays Pan European ABS Benchmark and the JP Morgan ABS indices are other such indices.

- An asset-backed securities index offers various benefits. Two important ones are transparency and standardization.

- An increase in the index value signals decent market performance. On the flip side, significant declines in value indicate high risk.

ABX Index Explained

The ABX Index represents a basket of the twenty largest RMBS. It is a barometer for the investment market health in the subprime residential real-estate space. In addition, this index represents different levels of borrowers’ capacity to pay off outstanding borrowings. Markit, the firm that created the first asset-backed securities index, reconstitutes its index on 19 January and 19 July. The firm inspects all the RMBS circulated between the two six-month periods.

Various institutions, for example, Merrill, Citigroup, Bank of America, Goldman Sachs, etc., directly exchange huge chunks of properties utilized as collateral for financial assistance in the fourth market. The exchange takes place via a computer network.

Markit determines whether one should consider the credit risk exchange in the fourth market as the indicator of the repayment levels to be a part of the ABX index. The calculation of the overall ABX index value involves the use of CDS contracts. The value ranges from 50 to roughly 100, and only RMBS market subscribers can access the daily pricing. The subscribers can use the data to find out whether the dollar market is performing well or not. Significant increases in the value of the Markit ABX Index indicate favorable market transactions. In contrast, significant decreases are a sign of high risk.

To a certain extent, many subprime mortgages in the United States were responsible for the global recession in 2008. Various borrowers failed to pay off their debt, leading to a credit crisis, which in turn caused mayhem across economies worldwide.

Chart

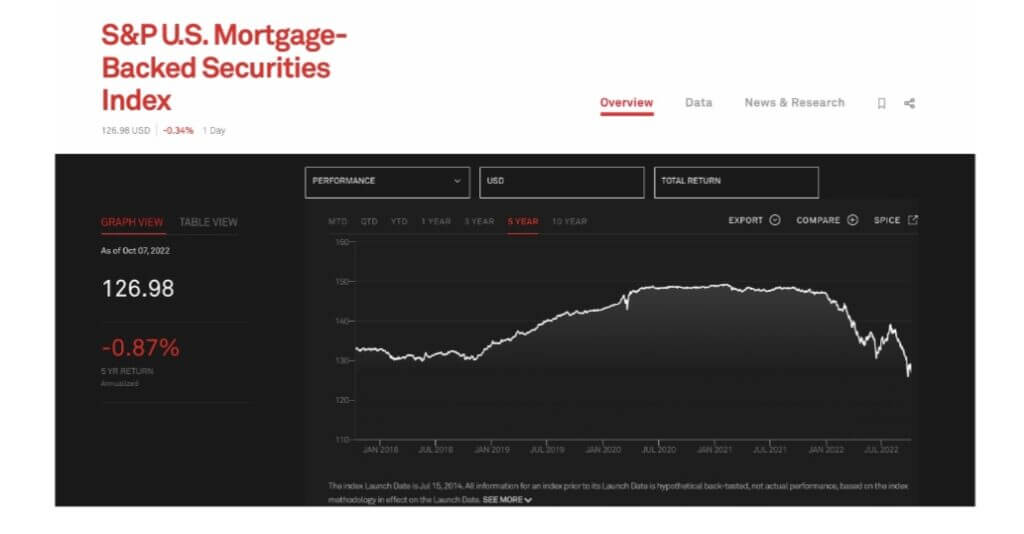

Let us look at an ABX index chart to understand the concept better.

Source: S&P Global

The above image shows that the S&P U.S. Mortgage-Backed Securities Index value dropped 0.87% over five years. As of 7 October 2022, this index’s value stood at 126.98.

Benefits

The following are the benefits of ABX Indices:

#1 - Standardization

These indices involve a standardized selection of contract documentation, reference obligations, and the availability of payment amounts with posting and monthly computation.

#2 - Transparency

Asset-backed securities indices are created based on certain objectives, a rule-based approach, and public availability of the daily closing prices.

#3 - Liquidity

Markit, now a part of S&P Global, enables individuals to better understand the transparency and liquidity concerning the index by offering a free PV calculator.

#4 - Sentiment

The daily composite levels help individuals monitor the movements in the subprime RMBS market sentiment.

Types

There are different types of asset-backed securities indices worldwide. In the U.S., asset-backed securities first entered the market in the 1980s. Hence, the market is mature enough to have multiple ABS indices. Let us look at a few examples of such indices in the U.S.

#1 - The Barclays U.S. Floating-Rate ABS Index

This index comprises asset-backed securities with a maturity period of at least one year. Moreover, it has credit cards, home loans, student loans, and auto loans as assets.

#2 - The JP Morgan ABS index

It has more than 2000 ABS instruments backed by various assets like insurance premiums, tax liens, credit cards, servicing advances, etc., in the market. This index’s objective is to capture roughly 70% of the asset-backed securities market. Moreover, it aims to have sub-indices that monitor certain sector ABS instruments.

Similarly, Europe’s market is mature enough to have various ABS indices. Some of them are as follows:

#1 - Barclays Pan European ABS Benchmark Index

This index comprises bonds backed by residential and commercial mortgages, credit cards, and auto loans with a maturity period of at least one year.

#2 - European Auto ABS Index

This index consists of auto loan-backed instruments issued by European originators.