Table Of Contents

How To Calculate?

One can calculate the formula for absolute valuation by using the following steps: -

1. Firstly, the company's financial projections noted the projected cash flow during the year. The cash flow can be in dividend income, earnings, free cash flow, operating cash flow, etc. CFi denotes the cash flow for the ith year.

2. Next, a company's weighted average cost of capital (WACC) is usually taken as the discount rate because it denotes an investor’s expected required rate of return from investment in that company, represented by r.

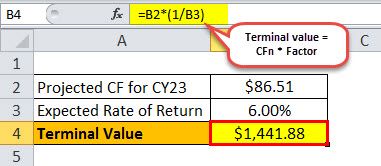

3. Next, determine the terminal value by multiplying the cash flow of the last projected year by a factor, which is usually the reciprocal of the required rate of return. The terminal value denotes the value of the assumption that the business will continue after the projected periods.

Terminal value = CFn * Factor

4. Next, calculate the present values of all the cash flows by discounting them using the discount rate.

5. Next, the equation of absolute valuation calculation for the particular company is done by adding up all the present values of the cash flows and the terminal value calculated in step 4.

6. Finally, one can calculate the absolute value of a stock by dividing the value in step 5 by the number of shares outstanding of the company.

Absolute valuation Stock = Absolute valuation Business / Number of outstanding shares

What is Absolute Valuation?

The term “absolute valuation” refers to the business valuation method that utilizes DCF analysis to determine the firm's fair value. This method helps determine a company’s financial worth based on its projected cash flows. The absolute valuation model helps determine the fair market value of a business, security, or asset.

The formula for discounted cash flow is calculated by adding up the cash flow in each period divided by one plus the discount rate, which is again raised to the power of the number of periods. The two major types of calculation are the discounted cashflow model and the dividend discount model.

Key Takeaways

- The "absolute valuation" means the business valuation method using DCF analysis to determine the firm's fair value.

- It helps to understand a company's economic value depending on the projected cash flows.

- One may calculate the discounted cash flow by adding up the cash flow in every period divided by one plus the discount rate, again raised to the power of the number of periods.

- Investors need to know the absolute valuation equation because it identifies whether a stock is overvalued or undervalued.

Absolute Valuation Explained

Absolute valuation is a financial analysis method used to determine the intrinsic value of an asset, such as a stock or a company, irrespective of market conditions or relative comparisons.

It relies on fundamental factors, including earnings, cash flows, and assets, to estimate the asset's true worth. This approach seeks to answer the question: "What is this asset worth in and of itself?"

To perform this calculation, various techniques can be applied, such as the discounted cash flow (DCF) method, where future cash flows are estimated and discounted back to their present value. Another common approach is the dividend discount model (DDM), which values a stock based on expected future dividend payments.

The absolute valuation method is considered more objective than relative valuation covered in the Valuation Course, as it doesn't rely on market trends or comparisons with other assets. However, it requires accurate data and assumptions, making it subject to potential errors if those inputs are inaccurate or unreliable.

From a value investor's perspective, it is very important to understand the concept of an absolute valuation equation because it is used to check whether a stock is over or undervalued. However, it is very challenging to forecast the cash flows with certainty the growth rate and assess how long the cash flows will continue to grow in the future. Therefore, one should use this method but with a pinch of salt.

Formula

Let us understand the formula that shall act as a basis for the calculation of this concept and our understanding of the related factors through the discussion below.

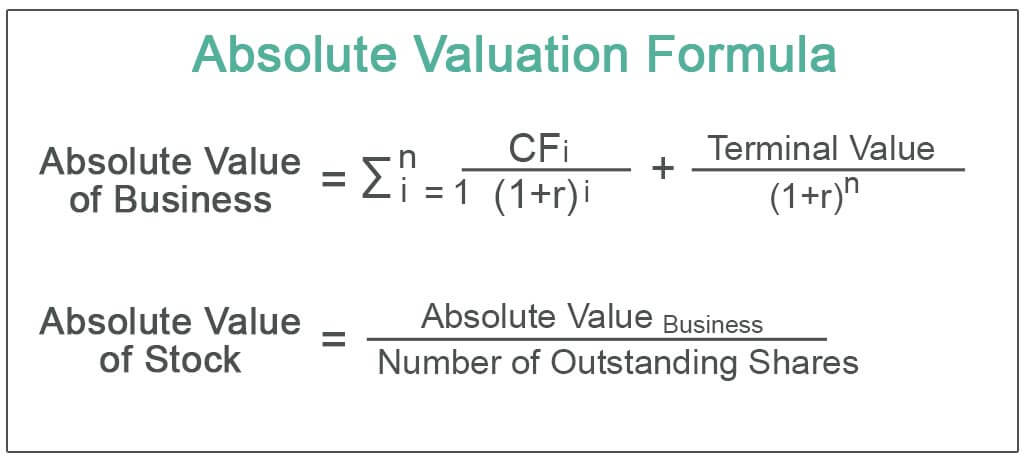

#1 –Absolute Valuation Formula of Business

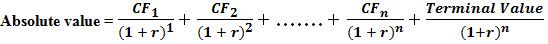

Mathematically, the absolute valuation equation can be represented as,

Absolute Value = CF1/(1+r)1 + CF2/(1+r)2 + ... + CFn/(1+r)n + Terminal Value/(1+r)n

Absolute Value = ∑ni=1

Where,

- CFi = Cash flow in the ith year

- n = Last year of the projection

- r = Discount rate

#2 – Absolute Valuation Formula of Stock

Finally, the absolute value of a stock equation is calculated by dividing the absolute value of the business by the number of outstanding shares of the company in the market, and the absolute value of a stock is represented as,

Absolute value Stock = Absolute value Business / Number of outstanding shares

Examples

Now that we understand the basics, formula, how to calculate, and the types of an absolute valuation method, let us apply that knowledge into practical application through the examples below.

Example #1

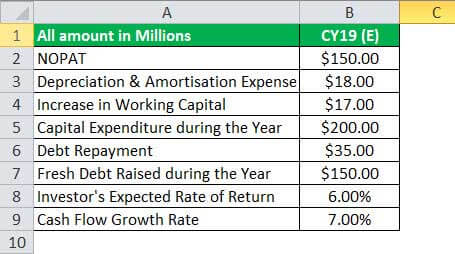

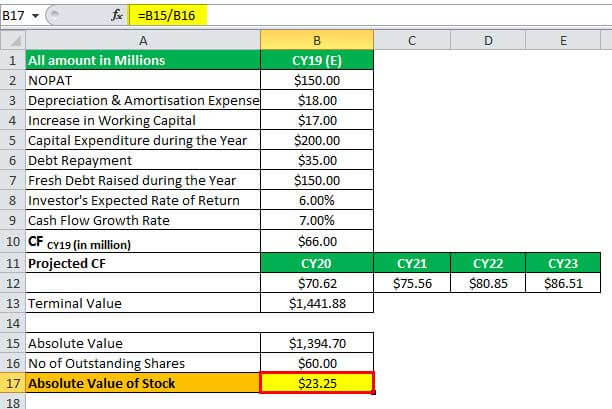

Let us take an example of ABC Ltd., and a particular analyst is interested in predicting the company's fair value based on the available financial information. The investor’s expected required rate of return in the market is 6%. On the other hand, the company has projected that the company's free cash flow will grow by 7%. Therefore, determine the absolute value of the stock based on the following financial estimates for CY19.

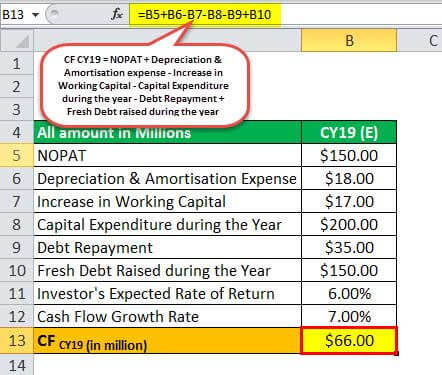

So, from the above-given data, we will first calculate the CF for CY19.

CF CY19 = NOPAT + Depreciation & Amortisation expense – Increase in Working Capital – Capital Expenditure during the year – Debt Repayment + Fresh Debt raised during the year

- $150.00 million + $18.00 million – $17.00 million – $200.00 million – $35.00 million + $150.00 million

- $66.00 million.

Now, using this CF of CY19 and CF growth rate, we will calculate the projected CF for CY20 TO CY23.

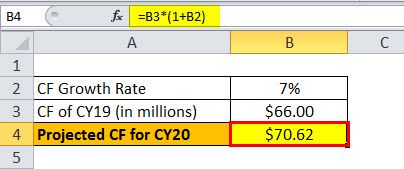

Projected CF of CY20

- Projected CF CY20 = $66.00 million * (1 + 7%) = $70.62 million.

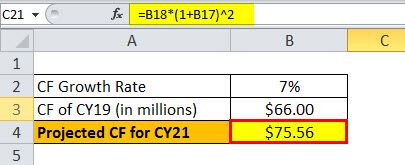

And Projected CF of CY21

- Projected CF CY21 = $66.00 million * (1 + 7%)2 = $75.56 million.

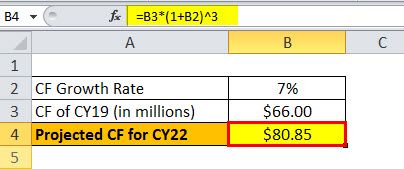

Projected CF of CY22

Projected CF CY22 = $66.00 million * (1 + 7%)3 = $80.85 million.

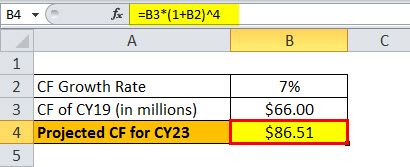

Finally, Projected CF of CY23

- Projected CF CY23 = $66.00 million * (1 + 7%)4 = $86.51 million.

We will calculate the Terminal Value.

- Terminal value = CF CY23 * (1 / Required rate of return)

- =$86.51 million * (1/6%)

- =$1,441.88 million.

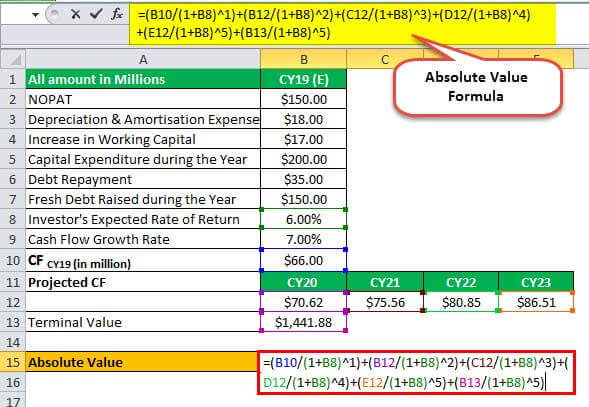

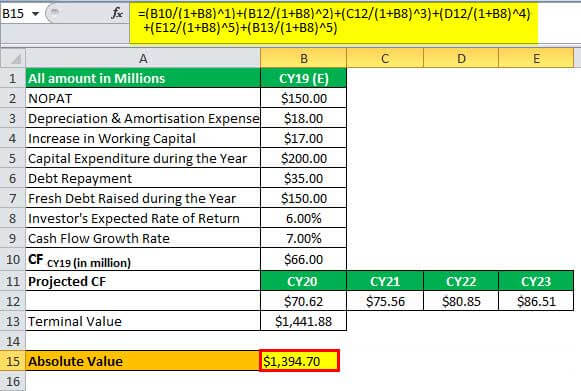

Therefore, the calculation of absolute valuation will be as follows: -

Calculation of Absolute Valuation of Company

- Absolute Value = $1,394.70 million

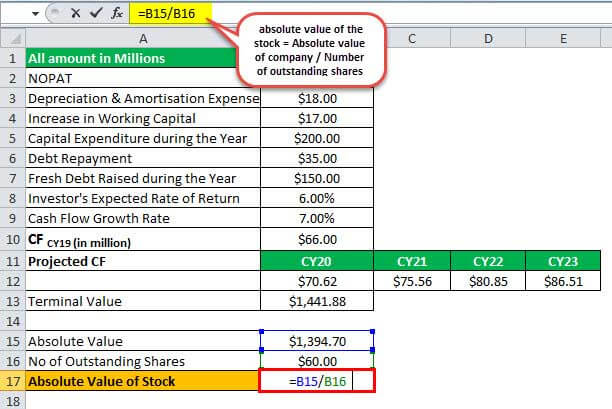

Now, we will calculate the fair value of the stock, which is as follows: -

- The Absolute Valuation of the Stock = Absolute Valuation of the Company / Number of Outstanding Shares

- = $1,394.70 million/60,000,000

Calculation of Absolute Valuation of Stock

- The Absolute Valuation of the Stock= $23.25.

Example #2

While the global markets were recovering from the fall of 2020 during the pandemic and the economic and political unrest due to the Russia-Ukraine war, late 2022 and early 2023 were periods of recovery for the markets globally.

Especially for developing economies like India and its top 50 companies, often referred to as NIFTY50, showed signs of an upcoming bull run. However, for one of the largest conglomerates in the country, the Adani group’s absolute value decline by Rs. 10.25 lakh crores or roughly 52%.

Other large companies such as HDFC Bank and ITC grew tremendously in the same period.

Absolute Valuation Vs Relative Valuation

Both these methods of valuation determine the worth of a company. However, the choice between these methods depends on the availability of data, the type of asset being valued, and the investor's time horizon and objectives. Let us understand the differences through the comparison below.

Absolute Valuation

- Absolute valuation determines the true intrinsic value of an asset based on its fundamental characteristics and financial metrics.

- It is independent of market conditions and does not rely on comparing the asset to others in the market.

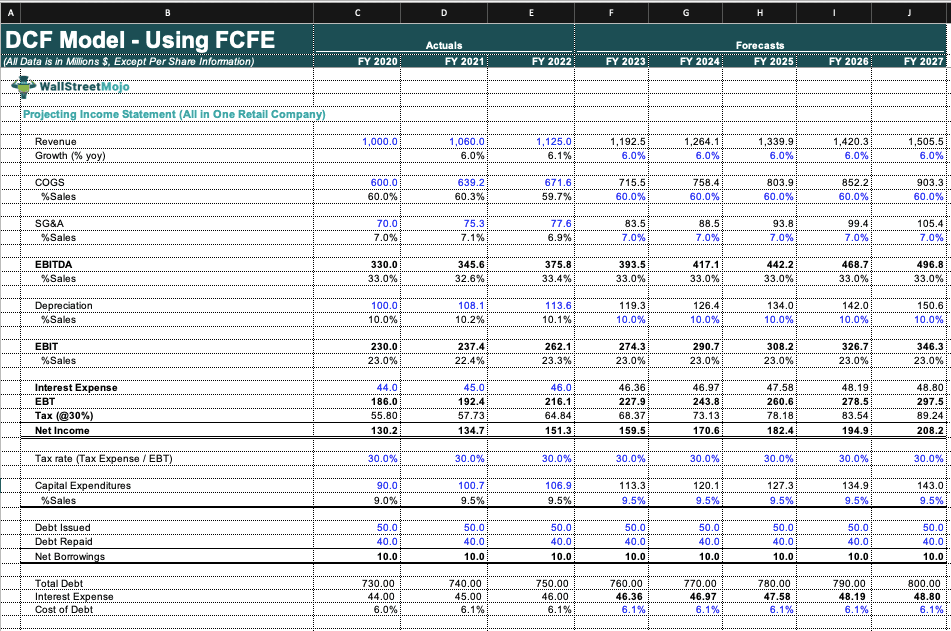

- Common absolute valuation methods include DCF analysis, DDM, earnings-based models, asset-based valuation, and replacement cost valuation.

Image Source: Valuation Course

- It provides a long-term perspective by considering an asset's expected future cash flows, earnings, or assets.

- It is considered more objective, as it relies on concrete data and financial fundamentals, reducing the influence of market sentiment.

- Absolute valuation is often preferred for valuing assets like stocks, bonds, and private companies where market comparables may be limited or less relevant.

Relative Valuation

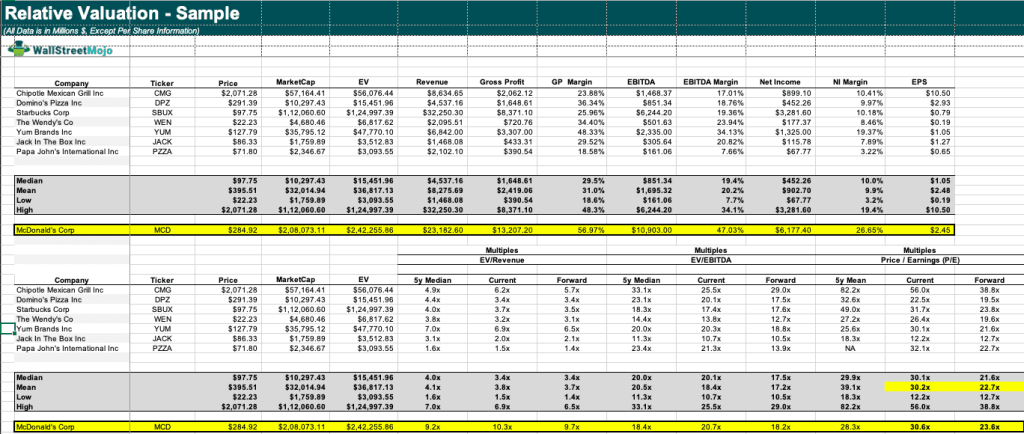

- Relative valuation assesses an asset's value by comparing it to similar assets in the market, typically using multiples like P/E ratios, P/S ratios, or EV/EBITDA.

- It is influenced by market trends, investor sentiment, and the performance of comparable assets.

- Common relative valuation methods include the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book (P/B) ratio.

Image Source: Financial Modeling and Valuation Course Bundle

- Relative valuation often provides a short-term view as it focuses on current market conditions and sentiment.

- It can be subjective as it relies on market perceptions and the choice of comparable assets, leading to potential valuation disparities.

- Relative valuation is commonly used for publicly traded assets where comparable companies are readily available. It helps investors gauge whether an asset is overvalued or undervalued relative to its peers.