Let's now look at the head to head difference between Above the Line vs. Below the Line.

Table Of Contents

Above the Line vs. Below the Line Head to Head Difference

| Basis | Above the Line | Below the Line |

|---|---|---|

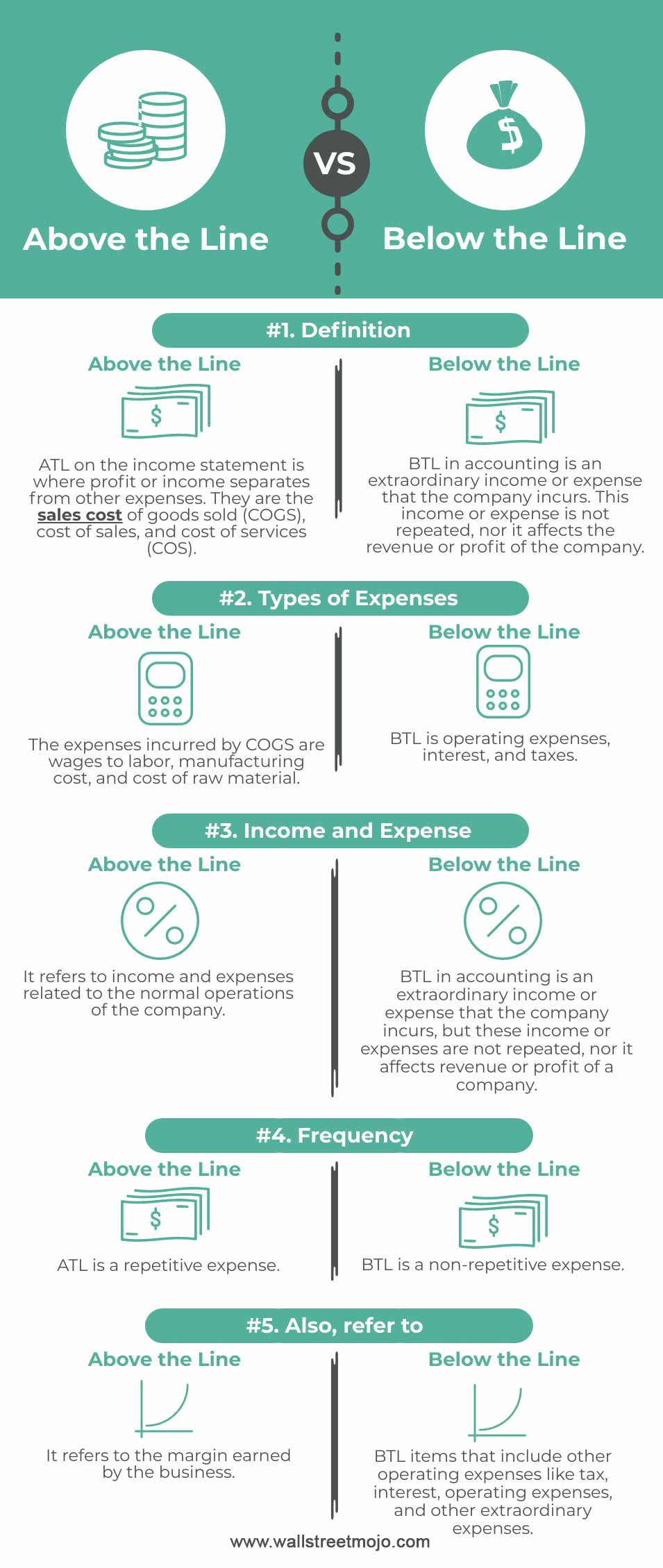

| 1. Definition | ATL on the income statement is where profit or income separates from other expenses. They are the sales cost of goods sold (COGS), cost of sales, and cost of services (COS). | BTL in accounting is an extraordinary income or expense that the company incurs. This income or expense is not repeated, nor does it affect the company's revenue or profit. |

| 2. Types of Expenses | The expenses incurred by COGS are wages to labor, manufacturing cost, and cost of raw material. | BTL is operating expenses, interest, and taxes. |

| 3. Income and Expense | It refers to income and expenses related to the company's normal operations. | BTL in accounting is an extraordinary income or expense that the company incurs. Still, these income or expenses are not repeated, nor does it affect a company's revenue or profit. |

| 4. Frequency | ATL is a repetitive expense. | BTL is a non-repetitive expense. |

| 5. Also, refer to | It refers to the margin earned by the business. | BTL items include other operating expenses like tax, interest, operating expenses, and other extraordinary expenses. |

Above the Line vs. Below the Line Differences

The key difference between above and below the line is that Above the Line represents items that are shown above the value of the gross profit of the company in its statement of income during the period under consideration, whereas, Below the Line represents items that are shown below the value of the gross profit of the company in its statement of income during the period under consideration.

Above the Line vs. Below the Line – “Above the Line” refer to the income and expenses that a company incurs due to normal operations. It is also the gross margin that a business earns. Whereas below the line is operating expenses, interest, and taxes.

This article looks at the top differences between Above the Line and Below the Line.

What is Above the line?

- It refers to costs above the line that separates operating income from other expenses. It also refers to the costs above the line that separate gross profit from other operating expenses.

- The expenses incurred by COGS are wages to labor, manufacturing cost, cost of raw material, and all expenses other than interest, tax, and operating expenses.

- Companies in the service industry and utility companies consider expenses above the operating income line above the Line cost. We can call it a cost before operating expenses incurred while manufacturing.

- Anything above the operating income line is ATL cost. It is COGS or equivalent accounts that we subtract from sales done by the company to compute profit.

What is Below the Line?

- Below the Line does not affect profit and loss accountof the company; hence it tells about the real financial health of the company without artificial inflating.

- Below the Line in accounting terms describes items other than the dividend paid or received by the company and retained profit of the company. It describes items like operating expenses, interest, and tax.

Above the Line vs. Below the Line Infographics

Here we provide you with the top 5 difference between Above the Line vs. Below the Line.

Above the Line vs. Below the Line – Key Differences

The critical differences between Above the Line vs. Below the Line are as follows –

- Above the Line (ATL) on the income statement is profit or income separated from other expenses. They are sales COGS cost of sales, and cost of services (COS). Whereas Below the Line in accounting is an extraordinary income or expenses the company incurs. However, these income or expenses do not repeat, nor does it affect the company's revenue or profit.

- ATL expenses incurred by COGS are wages to labor, manufacturing cost, and cost of raw materials, whereas BTL is operating expenses, interest, and taxes.

- It refers to income and expenses related to the company's normal operations. Whereas, Below the Line in accounting is an extraordinary income or expenses that the company incurs. Still, these income or expenses do not repeat, nor does it affect the company's revenue or profit.

- It refers to the gross margin earned by the business. In contrast, the item below the gross profit is Below the Line items that include other operating expenses like tax, interest, operating expenses, and other extraordinary expenses.

Final Thought

Above the Line and Below the Line is a jargon we use to manage the resources available in the company to deliver a surplus result. Above the Line tells about income and expenses related to a company's normal operations. ATL on the income statement is profit or income separated from other expenses. They are the sales cost of goods sold (COGS), cost of sales, and cost of services (COS). Whereas Below the Line in accounting is an extraordinary income or expenses that the company incurred.

However, these income or expenses are not repeated, nor it affects the revenue or profit of the company. Above the Line tells about income and expenses that are related tis profit or income separated from other expenses. They are the sales cost of goods sold (COGS), cost of sales, and cost of services (COS). Whereas Below the Line in accounting is an extraordinary income or expenses that the company incurred. However, these income or expenses are not repeated, nor does it affect the company's revenue or profit. Here, we calculate the profit by subtracting expenses from revenue. If the revenue exceeds the cost, the company has booked a profit. If the cost exceeds the revenue, the company has booked a loss during an accounting period.

Get in Touch with our Experts!