Table Of Contents

What are Above the Line Deductions?

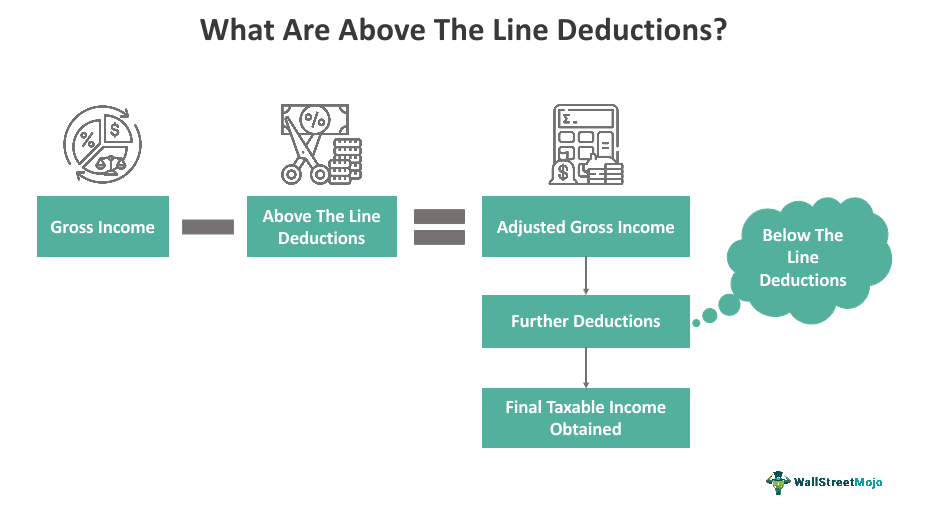

Above The Line Deductions are amount deducted from the gross income of an individual or entity, thereby helping them obtain the adjusted gross income (AGI). These deductions help grab additional tax benefits by allowing the taxpayers to limit their tax liabilities based on the AGI obtained.

This tax break allows to lower the tax burden on the taxpayers. When taxpayers fill in Form to file their taxes, they come across Part II of Schedule 1 of the form where they can claim their above the line deductions for their AGIs to be calculated with respect to which they require to pay their taxes.

Above The Line Deductions Explained

Above the line deductions, also known as adjustments to income, imply subtracting an amount from the gross income of a taxpayer, which decreases the net income or the taxable income of that individual or entity. This is what makes these deductions a significant element to be claimed for while filing for taxes in the United States.

Above the line deductions are those allowed from the individual’s total income to get the adjusted gross income of an individual tax filing and therefore reduce the tax payable by the individual. These deductions are itemized in Form 1040 (from line 23 to line 35) and filled by US taxpayers as per the guidelines of the Internal Revenue Service (IRS).

The deductions are available so one can plan their taxes accordingly. These deductions are called above the line because these are the first deductions available, which help calculate the AGI, which is the base to calculate various other deductions, and finally, calculate your tax liability.

Above the line deductions reduce the Adjusted Gross Income, which ultimately reduces the tax liability of the taxpayers. Also, certain deductions are based on your AGI. If your AGI is too high, you won’t be able to claim those deductions. For example, you can claim a deduction of the amount exceeding 10% of the AGI as your medical expense. If your medical expenses are $8,000 and the AGI is $70,000, then you can claim the deduction of only $1,000, but if your AGI is $50,000, you can claim $3,000.3

List

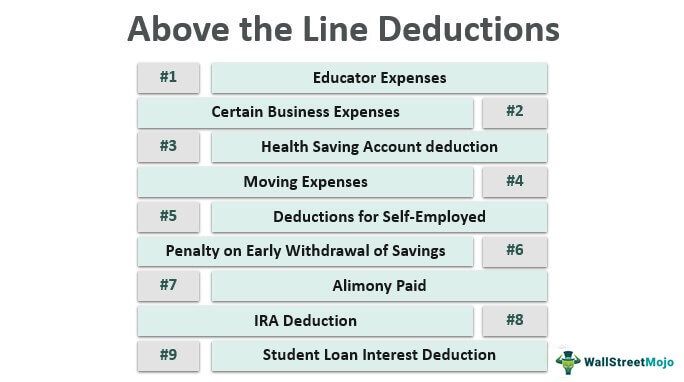

IRS above the line deductions can be claimed based on what is allowed by the tax authorities. Here are the types of such deduction that taxpayers can claim in the Form 1040 while filing for taxes. Let us have a look at them below:

#1 - Educator Expenses

Under this head, the teachers can claim a standard deduction of $250 to reimburse their school supplies and other related expenses. Only the kindergarten teachers through 12th Grade working for 900 or more hours in a year can claim this deduction.

#2 - Certain Business Expenses

A deduction was available for job-related traveling expenses, but these are no longer available.

#3 - Health Saving Account Deduction

There is a double benefit to taxpayers in this case. The contribution made to any health saving plan is deductible expenses. The contribution made should be from the pre-tax salary, and you get the deduction of this contribution in your tax return. The Health savings plan should be other than covered by the employer.

#4 - Moving Expenses

The Military persons moving to another place due to a change in the station can claim the moving expenses as above-the-line deductions in their return.

#5 - Deductions for Self-Employed

There are three types of self-employed tax deductions available. First, you can claim half of the self-employment tax paid as a deduction in your tax return. Second, you can claim any contributions to a self-employment retirement plan as a deduction from your income. Last, you can claim any of the premium paid for yourself and dependents only up to the amount of business income.

For claiming the last deductions, two conditions must be taken care of. Firstly, your spouse is working where you both are covered under the employer's health insurance plan, and secondly, if you are working and covered under the employer's insurance plan. You cannot claim the last deduction if you are covered under any of the above two points.

#6 - Penalty on Early Withdrawal of Savings

Suppose you invested a certain amount in Certificates of deposits, but after some time, you cashed the certificate before maturity. In this case, banks charge a certain penalty on the early maturity of deposits. This penalty charged by a bank can be claimed as a deduction of your tax return.

#7 - Alimony Paid

This deduction is available for those cases where the divorce was final before 31 Dec 2018, and an alimony decision was made. The amount of alimony you pay to your ex can be claimed as an above-the-line deduction from your income. On the other hand, the person receiving the alimony has to pay taxes on the amount received. The amount of alimony should not include child support expenses.

#8 - IRA Deduction

The amount contributed to an IRA is also eligible as a deduction from the income. There are separate rules on how much you can contribute to an IRA.

#9 - Student Loan Interest Deduction

If you are studying in a college and have taken a student loan, you can claim a deduction of $2,500 from the interest you pay on loan. You cannot claim this deduction if you are a single taxpayer and your AGI is $85,000. Also, if your AGI pre-student loan interest deduction is $70,000 or more, you cannot claim the full deduction. Certain Adjusted Gross income limits apply here to calculate the amount to be claimed.

How To Calculate?

Above the line deductions are meant to calculate the taxes payable at the end of the fiscal year by the taxpayers. There are a few steps to follow to obtain the final amount taxable to people or entities. Let us check the steps below:

- The first step is to calculate the gross income, which is derived by adding up the total income of the individual or household as generated throughout the year. The details of these sources of income are recorded on W-2s. Along with that, the amounts as dividends, social security income, retirement account distributions, etc., are also added to it. These added incomes give the final gross income figure.

- The next step is to check the above the line deductions applicable. The list above categorizes the deductions, which taxpayers may consider claiming while tax filing.

- When the gross income and the applicable above the line deductions are known, the latter is subtracted from the former to obtain the adjusted gross income.

- From the adjusted gross income, other deductions are made, which include the standard deduction.

- The final amount derived is the income of the entity or individual on which taxes are to be levied.

Examples

Example #1

Jenny files for her taxes and starts with noting down her gross income worth $100,000. She then calculates her total medical expense and obtains the figure to be $7,500. It was beyond usual bills as her hospital stay was extended because of the complications. According to the rules, the medical expense must be more than the 7.5% of the AGI. As the medical expense did not exceed the AGI, the deductions were not applicable.

On the other hand, Joseph, whose gross income and medical expense was same as Jenny’s but had an AGI of $70,000. Still, he was eligible for the deduction claims as his medical bills exceeded 7.5% of the AGI (70,000*7.5/100). Hence, he was allowed to claim for medical expenses above $5,250 or exact deduction of $2,250 ($7,500 – $5,250).

Example #2

In March 2023, a report revealed how Americans were disappointed to see the lower tax returns they received in 2023 despite expecting better return on their income than 2022. This report cited some of the aspects of the modifications observed in the taxation system the current year. The major issue the Americans faced in this respect was with the above the line deductions that weren’t extended to what was expected. It became difficult for them to claim for deductions, given the non-extended provisions.

In addition, the report also talked about the Child and Dependent Care Credit that were lowered in 2023, thereby hampering the returns in a huge way. This example reflects how above the line deductions can affect the tax returns, thereby making tax burdens difficult to bear for many.

Above The line Deductions vs Below the Line Deductions

Making deductions is important to derive the final taxable income of an individual or entity. In this context, there are two types of deductions that are seen – one is above the line and the other is below the line deductions. They differ in many aspects. Listed below are some of the differences between the two:

- While above the line deduction is the deduction made from the gross income to obtain the adjusted gross income or AGI to lead to finding the final taxable income, below the line is the further deductions made from the AGL to finally obtain the taxable income.

- The deductions above the line are so called as they are first applicable deduction to the gross income. On the contrary, below the line deductions are the next and the last one towards obtaining the final taxanle income of a taxpayer.

- When it comes to similarities, they both help in reducing the tax liability of an individual or entity.