Table Of Contents

What Is An ABLE (Achieving A Better Life Experience) Account?

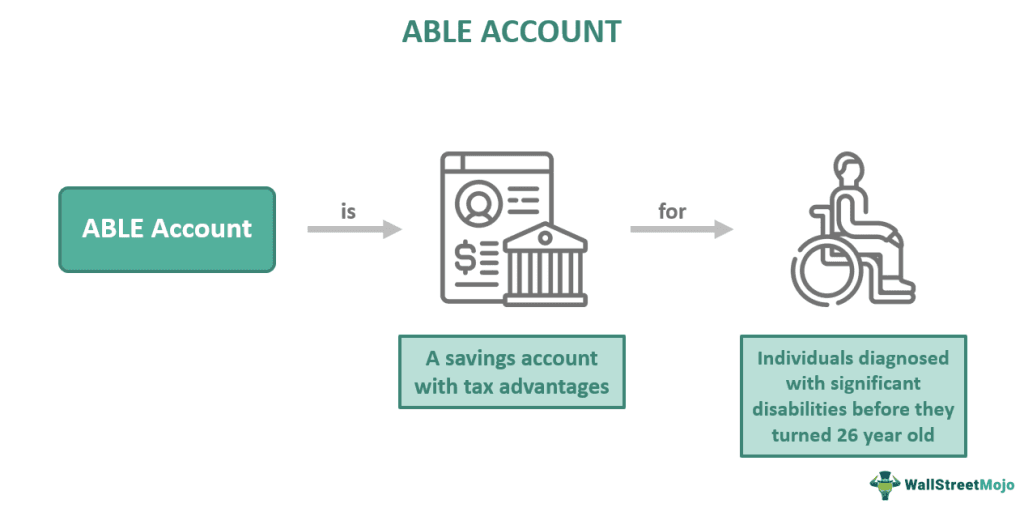

The ABLE (Achieving a Better Life Experience) Account is designed to help individuals with disabilities save and invest money. It allows them to accumulate funds without hampering their eligibility for certain government benefits. It was created in 2014 in the United States through the enactment of the ABLE Act.

The ABLE account for disability enables individuals with qualifying disabilities to save and grow funds for disability-related expenses, including healthcare, housing, education, and transportation. They also allow several tax benefits on increasing money and withdrawal for disability-related costs, providing individuals with disabilities and their families an opportunity to improve their financial security and independence while maintaining access to essential government benefits.

- The ABLE (Achieving a Better Life Experience) Account is a savings account that helps individuals with disabilities to save and invest money. It provides them with financial security without impacting their eligibility for certain government benefits.

- The account offers tax advantages where the earnings can grow tax-free, and withdrawals for qualified disability-related expenses are tax-free. It assists disabled individuals and their families manage and plan their funds, allowing them to cover disability-related costs.

- Individuals with these accounts can achieve greater financial freedom, allowing them to meet their specific needs and financial objectives.

ABLE Account Explained

The ABLE Account is a specialized savings account to assist individuals with disabilities in saving and investing money. It offers them financial stability while preserving their eligibility for certain government benefits. They aim to address the economic challenges faced by individuals with disabilities by providing them with a tool to save for disability-related expenses.

The ABLE account for disability offers a tax advantage. The contributions to these accounts are not tax-deductible. However, the account's earnings grow tax-free, and withdrawals for qualified disability-related expenses are tax-free. Additionally, the funds deposited in these accounts can help cover the costs that enhance the individual's quality of life. Furthermore, they allow individuals to achieve greater financial security and plan for the future according to their needs and goals..

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Eligibility

The ABLE account eligibility requirements are as follows:

- The individual must have experienced a significant disability that occurred before the age of 26. The onset of the disability should be established by meeting the disability criteria under the Social Security Administration's rules or through a self-certification process.

- The disability must be significant and have a substantial and long-term impact on the individual's ability to perform activities of daily living or result in severe functional limitations.

- Generally, individuals need not provide documentation of their disability during the account opening process. However, they may have to maintain relevant documentation for future reference if requested by the ABLE program or the Internal Revenue Service (IRS).

- There is no age limit for opening this account. As long as the disability onset occurred before age 26, individuals can open an account at any time.

How To Open?

Individuals may follow these steps to open an ABLE account:

- Individuals may start by researching ABLE programs available in different states. Each state has its ABLE program, and one can choose to open an account in any state's program, regardless of where they reside.

- They must ensure that they meet the eligibility requirements for opening the account. The exact criteria may vary slightly between states, so they must review the specific eligibility guidelines of the ABLE program they chose.

- Individuals may collect the necessary information and documentation for the account opening process. It may include personal identification documents, proof of disability, and other required forms or certifications.

- The individual must visit the website of the selected ABLE program or contact their customer service to obtain the account opening application. They must fill out the application form with accurate and relevant information.

- Once the application is approved, individuals may receive instructions on how to fund the account. This process usually includes making an initial contribution to start the account.

- After the individual can open an ABLE account and fund it, they can start managing their funds according to their specific needs and objectives.

Advantages And Disadvantages

Some ABLE account benefits are:

- These accounts allow individuals with disabilities to accumulate savings and assets without jeopardizing their eligibility for government benefits like Supplemental Security Income (SSI). It enables them to save for future needs and achieve greater financial security.

- The earnings within the account grow tax-free. Additionally, withdrawals used for qualified disability-related expenses are tax-free. This provides a valuable tax advantage and allows the funds to grow more effectively over time.

- Individuals may use the funds in this account for a wide range of disability-related expenses. These may include education, housing, transportation, healthcare, employment support, and other eligible costs. The flexibility in fund usage allows individuals to address their specific needs and improve their quality of life.

- The accounts empower individuals with disabilities to have more control over their financial resources. They can decide how the funds are allocated and spent, enabling them to make their own savings and investment decisions.

Some drawbacks associated with these accounts are:

- The accounts have annual contribution limits, which may be sufficient for many individuals. However, it can be restrictive for those with significant financial needs or receive more enormous contributions from family members or other sources. Contributions above the limit are not allowed, which may limit the account's growth potential.

- Each state's ABLE program sets a maximum account balance. If the account balance exceeds the established limit, individuals may risk losing eligibility for certain government benefits, like the SSI. This limitation can restrict the long-term savings potential for individuals with higher financial needs.

- These accounts offer a limited selection of investment options. It can be a disadvantage for those seeking more diverse investment strategies. The lack of investment options limits the ability to grow the funds and achieve higher returns.

ABLE Account vs Special Needs Trust

The differences are as follows:

- ABLE Account: These accounts offer individuals with disabilities more flexibility in managing their funds. The account owner has control over how the funds are allocated and spent. Contributions to such accounts grow tax-free, and withdrawals for qualified disability expenses are tax-free. This tax advantage can help the funds grow more effectively over time. This account allows contributions from the account owner, family members, friends, and even employment earnings.

- Special Needs Trust: Special Needs Trusts protect the assets of individuals with disabilities while still allowing them to access government benefits. The trust ensures the funds are appropriately managed and used for the beneficiary's needs. There are no contribution limits for the Special Needs Trusts. It makes them suitable for individuals with higher financial needs or who receive significant contributions from family members or other sources.

ABLE Account vs STABLE Account

The differences are:

- ABLE Account: They are available to individuals with significant disabilities before age 26. There are no income or asset limitations for eligibility, and they are accessible to a broader range of individuals. They have annual contribution limits. Exceeding this limit may result in tax implications or the potential loss of certain government benefits. It allows using funds for various disability-related expenses, including education, housing, transportation, and healthcare. The flexibility in fund usage will enable individuals to address their specific needs and improve their quality of life.

- STABLE Account: They are available to individuals with disabilities that occurred before the age of 26. However, they require individuals to meet the disability criteria under the Social Security Administration's rules, which are pretty stringent. These are state-based programs, implying each state sets its rules, fees, and investment options, leading to potential variations between the programs.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.