Table Of Contents

Get in Touch with our Experts!

Abatement Meaning

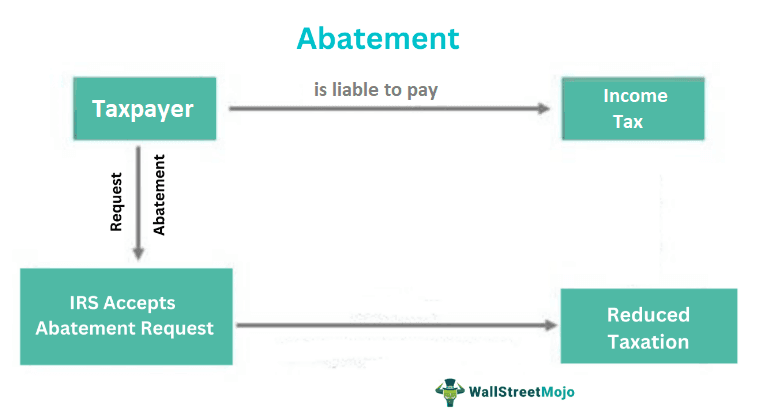

Abatement is a formal request for tax reductions and rebates. Individuals, companies, and other entities can use this provision to reduce taxation.

When a company or an individual faces unrealistic or excessive taxation, they apply for an abatement. The request is sent to the applicable tax authority.

In the US, revenue collection, tax laws, tax breaks, and tax rebates are governed by the IRS.

However, the IRS makes an exception when it is warranted; to facilitate increased economic activities in a specific area.

Usually, tax rebate orders terminate within a short period. After that, entities have to pay normal taxation levels.

- Abatement reduces taxation levels when a company or an individual is justified in seeking tax breaks. There are different types of tax reductions–rent, construction, and property tax.

- Rent abatement is a provision that allows tenants to occupy the property without paying any rent for a short duration. Usually, free occupancy is only extended for the first few months. During these months, the occupant spends on renovation.

- Construction abatement is used as a defense against a payment claim when there are defects in the construction project. When the defects are proven, the claim is adjusted—based on extra work caused by the defect.

How Does The Abatement Process Work?

Abatement is a request to reduce taxes for reasonable causes. Any company or individual can make this request—if they concur that the imposed taxation is incorrect or excessive. Further, the individual or firm has to submit a formal abatement notice. The formal notice informs the IRS about the particular reason behind the correction request.

The tax abatement meaning elucidates the formal procedure for requesting tax reduction. Rebates are granted when the tax burden is excessive—when the tax-paying entity cannot clear tax liabilities.

It is important to note that tax rebate orders only apply for a short period. Once the order terminates, taxation levels go back to normal. There are different tax reductions—decrease in taxation, removal of a specific tax, refunds, rebates, and tax penalty reductions.

Tax reduction services, tax-saving strategies for firms, and individual tax-saving techniques are overseen by the government. In addition, the government regulates economic activities to ensure easy tax payment and reduction in tax rebates. Some examples of governmental initiatives include capital equipment investment, tax incentives, and property tax exemptions.

Tax rebate is more common for property tax. Some regions and cities have separate tax reduction programs for their citizens—a specific tax rebate order that reduces property taxes for decades (in some cases). Real estate tax reduction, therefore, varies from one city to another. Nevertheless, tax reductions significantly impact the local community—they increase infrastructural investments, economic activities, and employment opportunities.

Example

Let us look at an abatement example to understand its practical application.

Chloe runs a battery manufacturing company; she is also a philanthropist. She makes it a point to lend a hand whenever she can. In addition, she is always involved in community service. She actively raises funds for local infrastructure.

When Chloe announces a new business project, the government offers a three-year tax reduction for her company. Up to a purchase of $900,000, Chloe’s company has to pay no tax.

There is a caveat, though, this reduction is applicable as long as Chloe spends on machinery and land bought for the automation of battery production. If Chloe spends on other components, her company will be taxed. The tax rebate order also mentions that Chloe is required to pay taxes only after three years.

Eventually, Chloe's manufacturing plant created many jobs for the local workers and operated at minimum pollution levels.

The region benefitted from the manufacturing plant, and in response, the government extended the tax relaxation to nine years.

While Chloe was busy with her project, she was looking for a small house near the manufacturing plant. Chloe rents a house and spends on renovation. Thus, Chloe avails rent abatement—she has lived rent-free for nine months. It was an agreement between Chloe and the landlord. Usually, landlords are supposed to pay for renovation costs, but here Chloe pays for it.

Later Chloe purchases a property and applies for a property tax rebate from the IRS (for a limited duration). The IRS accepts requests based on the conditions of a particular area, region, and demographics. Also, all the tax rebates received by Chloe are temporary. Once the relaxation terminates, she will have to pay the total tax amount, like anyone else.

IRS Penalty Abatement Letter Sample

Even when a taxpayer applies for reduction and attaches relevant documents and reasons, the IRS (or applicable tax authority) denies the request. Therefore, taxpayers are highly recommended to hire an experienced tax advisor. They know the ins and outs of the tax reduction process.

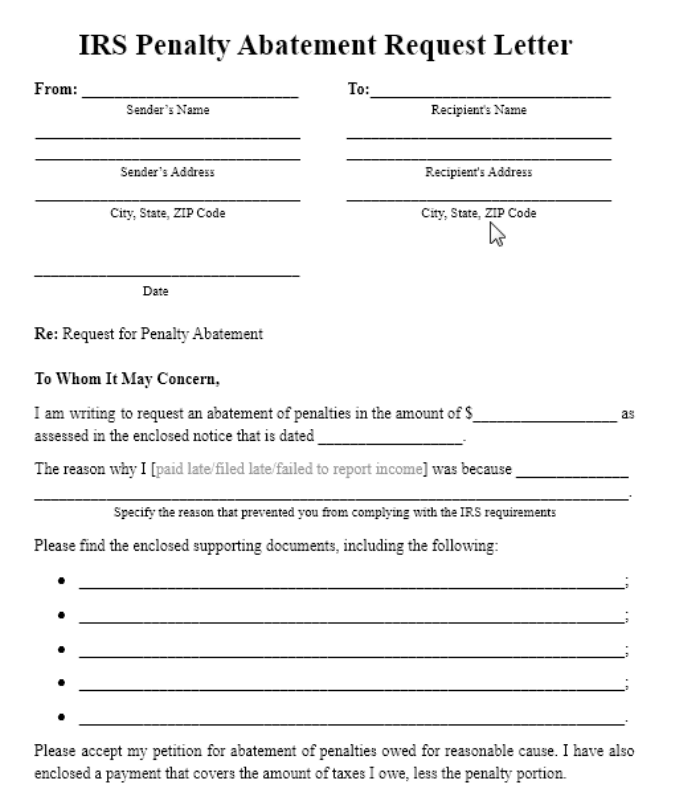

Technically, anyone can file for tax reduction with the IRS. However, taxpayers need to fill up an IRS penalty reduction request letter. The letter should be exhaustive—it should mention the specific tax penalty exemption requested by the taxpayer—along with the attached documents.

Let us look at an IRS penalty abatement letter sample.

(Source)

The main components of a Penalty Abatement Request Letter are as follows.

- Taxpayer and penalty information.

- Request for a tax rebate.

- Explanation and events based on facts.

- Details about tax reduction laws and the applicable authority.

- Discussion of reasons and action request.

- Signatures, attestations, and supporting documents.