Table Of Contents

Get in Touch with our Experts!

What Is Aave Crypto?

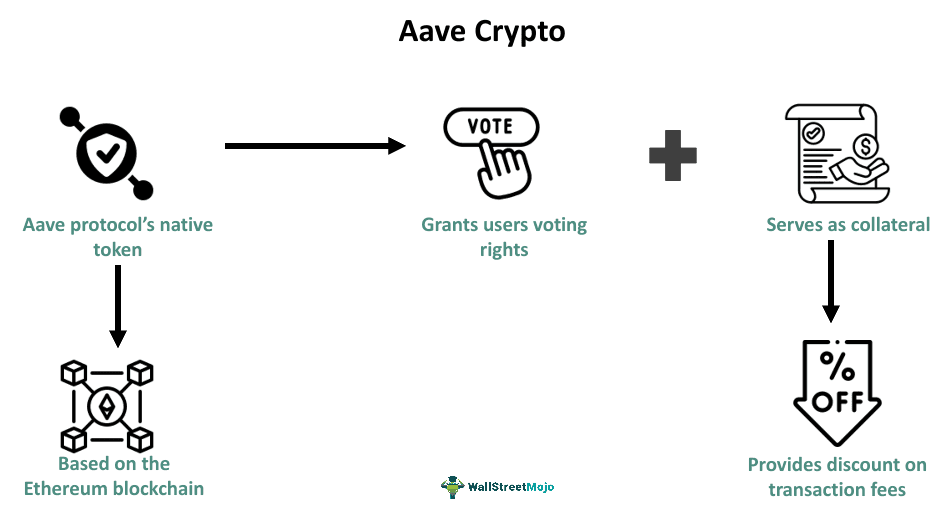

Aave crypto refers to the Aave protocol’s official governance token running on the Ethereum network. These tokens are an essential element of the Aave ecosystem as they offer users collateral, staking, and governance, helping them earn rewards. Moreover, these tokens offer users discounted trading fees for transactions.

Aave tokens are ERC-20 compatible; they have an extra snapshot feature utilized for governance balance monitoring. Moreover, they incorporate the EIP 2612 permit function, enabling one transaction transfer/approval and gas-less transactions. Users need to choose an Aave-compatible wallet, participate in crypto staking and mining pools, and sell or buy such tokens on exchanges to get going on this platform.

- Aave crypto is a digital currency of the Aave protocol that is based on the Ethereum blockchain. It mainly has three roles — staking, collateral, and governance. Since the cryptocurrency operates on the Ethereum blockchain, Aave crypto mining cannot take place.

- There are various benefits of this digital currency. For example, it has the backing of multiple credible crypto institutions and allows one to earn interest income through lending.

- Aave tokens come with certain limitations. For example, one must return these tokens via a single transaction only. Moreover, the cryptocurrency’s transaction speed is dependent on the Ethereum blockchain.

How Does Aave Crypto Work?

Aave crypto refers to a digital asset governance token that gives its users the power to decide what changes take place on the network. This cryptocurrency is a deflationary token, meaning the tokens constantly burn. Note that around 80% of the total transaction fees paid get utilized in the burning process. Burning reduces the overall tokens in circulation. This, in turn, forces the cryptocurrency’s value to rise.

The value of these tokens is related to their utility. This cryptocurrency has multiple use cases and features, making it even more valuable. Also, the Aave crypto price has a connection with the total supply, which has a maximum cap of 16 million. Besides this, the popularity of cryptocurrency also influences its value. Borrowers depositing this cryptocurrency as collateral often receive a discount on the transaction cost. Moreover, note that usually, borrowing the tokens does not involve any charges.

Besides the Aavve tokens, the Aave protocol uses another set of tokens called aTokens. Lenders receiving the latter tokens get passive income in the form of interest for providing the pool with liquidity.

Let us look at some key characteristics of the Aave protocol to understand how it functions differently from the Aave tokens clearly.

- The decentralized finance (DeFi) protocol maintains reserve funds to absorb the severe impact of market swings.

- Collaborating with Chainlink, this protocol serves as an oracle for communication with various blockchains.

- Aave offers flash loans that borrowers must repay within a block. One can utilize it to take advantage of the price discrepancies across multiple exchanges.

Features

A few noteworthy features of Aave cryptocurrency are as follows:

- Owning this cryptocurrency gives the holder the right to decide the result of different Aave Improvement Proposals (AIPs). Moreover, the token holders can vote on any modification to the protocol. As a result, the community can influence the future of Aave crypto.

- Aave tokens act as collateral when one obtains assets from the Aave protocol. This feature enables users to avail of loans with fee discounts and substantial borrowing limits.

- Aave users can stake or deposit their tokens in the safety module. It ensures the protocol remains secure if a shortfall occurs. In return, the users get incentives and participate in the network's consensus mechanism.

How To Mine?

Aave crypto mining is impossible as the Ethereum blockchain processes all transactions involving Aave tokens. In other words, one can mine Ethereum but not Aave. That said, note that people can earn Aave tokens by purchasing them on exchanges and staking them within the safety module of the Aave protocol. Essentially, this means if depositors lose their money, they can receive compensation through the sale of the tokens

How To Trade?

Individuals can follow these steps to start trading Aave tokens:

- Visit the official website of a popular and trustworthy cryptocurrency exchange. Note that one can also download its mobile app if available.

- Initiate the application process and provide all required details, such as name, date of birth, etc., to complete the procedure.

- Transfer funds to the newly opened account to fund to buy Aave tokens. Note that one can choose any of the multiple payment methods available to perform the transfer.

- Search for AAVE tokens and place the order after reviewing the fees and payment details.

Note that every user should have a reliable crypto wallet that allows them to store the Aave tokens securely. Let us look at some factors to consider when selecting a crypto wallet for these tokens.

- The user’s preferences and needs

- Security features of the wallet

- User experience

- Compatibility with a user’s devices.

Examples

Example #1

Suppose Sam wanted to start buying and selling cryptocurrencies to fulfill his financial objectives quicker. After looking at some characteristics of Aave crypto, he believed the digital currency to have a lot of growth potential. So, he registered on a cryptocurrency exchange and opened an account to buy Aave tokens.

After transferring money into his account, Sam bought 200 AAVE tokens at $2.15 per token in September 2023. The purchase, Aave crypto price surged more than 100% over 1 month. He sold the tokens to realize the gains. It was a wise move because, over the next month, the price dropped below the $80 mark.

Example #2

In the first week of November 2023, the price and market capitalization of Aave crypto increased significantly after a crypto whale made a couple of substantial withdrawals from Binance. The two withdrawals resulted in an 8% increase initially. After that, a 16% increase followed. According to CoinMarketCap, the whale withdrew a total of 140,100 tokens. Following such developments, AAVE's market capitalization breached the $1.5 billion level. This showed how significantly large-scale transactions can impact a digital asset’s standing and value.

Pros And Cons

Let us look at the advantages and disadvantages of this cryptocurrency.

Pros

- Aave cryptocurrency has the support of various credible cryptocurrency institutions. Because of this, it becomes crypto users to trust the token.

- Individuals who use Aave tokens as collateral get a higher borrowing amount. Moreover, they have to pay a discounted borrowing fee.

- Users can lend Aave tokens and, in return, earn interest.

- Aave users can generate profits by taking advantage of the price fluctuations in the crypto market.

- One can borrow such tokens without paying any charges.

Cons

- The interest rate earned by lending Aave tokens is typically low.

- The transaction speed of this cryptocurrency is limited to and depends on the Ethereum blockchain.

- One must return the borrowed cryptocurrency through a single transaction. This can be a complicated process.

- Another disadvantage is that Aave crypto price can be highly volatile owing to the dynamic economic environment and the speculations surrounding digital assets in general.

AAVE vs AVAX (Avalanche) vs UNI (Uniswap)

People new to crypto investing often have confusion when deciding whether to invest in UNI, AAVE, or AVAX. The main reason behind this is that they do not have a clear idea regarding their key differences. If one chooses any cryptocurrency over another without knowing the meaning and purpose, there’s a high chance of losing out on gains or incurring significant losses. So, let’s find out the critical differences between AAVE, UNI, and AVAX.

| AAVE | AVAX | UNI |

|---|---|---|

| AAVE is the ticker symbol of Aave crypto. | It is the ticker symbol of the Avalanche cryptocurrency. | This is the ticker of Uniswap cryptocurrency. |

| It operates on the Ethereum blockchain. | AVAX is the native token of the Avalanche blockchain. | It is the cryptocurrency of the Uniswap platform. The Ethereum blockchain hosts the platform. |

| Its main use cases are staking and governance. | One can use AVAX to combat interoperability, scalability, and useability issues. | UNI’s primary use case is as a governance token. |