Below given is the comparison between A/B/C Trust vs A/B Trust.

Table Of Contents

What Is An A/B/C Trust?

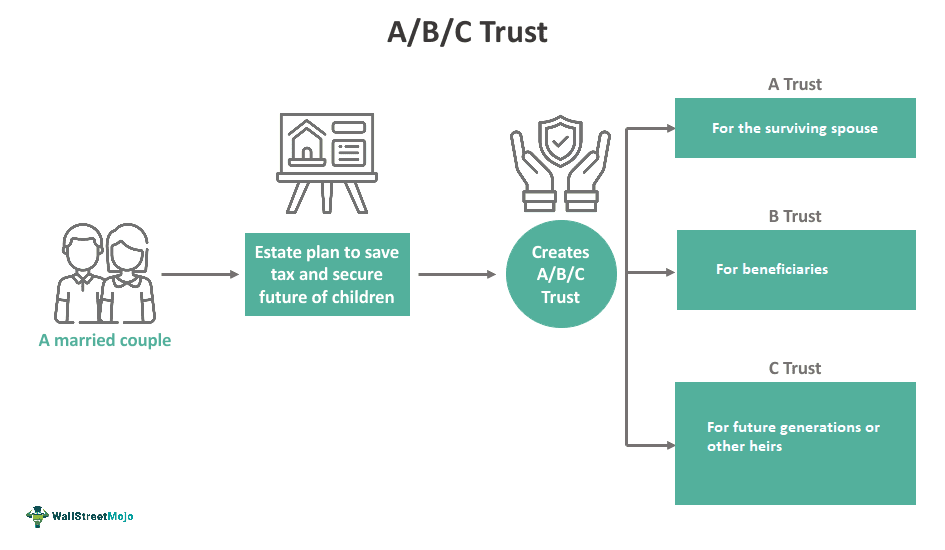

An A/B/C Trust, often called an "A-B-C or ABC Trust," is an estate planning strategy for married couples to reduce estate taxes and offer flexibility in asset distribution. It is also known as a "Marital Bypass Trust".

Estate planning involves managing the orderly transfer of assets and money to recipients. This trust distributes assets among Trust A (Survivor's Trust), Trust B (Bypass Trust), and Trust C (Qualified Terminable Interest Property Trust) following the first spouse's death. Each trust serves a unique purpose.

A/B/C Trusts are estate planning tools that aim to minimize estate taxes while providing for a surviving spouse and future generations. This structure involves dividing assets into three trusts: A (Marital Trust), B (Bypass Trust), and C (Family Trust).

A/B/C Trust Explained

An A/B/C Trust is designed to reduce estate taxes while supporting the surviving spouse and future generations, especially for couples with substantial assets.

After the first spouse passes away, the assets are divided into Trust A (Survivor's Trust), Trust B (Bypass Trust), and Trust C (Qualified Terminable Interest Property Trust). Each serves distinct purposes.

Trust A provides for the surviving spouse, allowing flexibility, while Trust B cannot be modified by the surviving spouse. Trust C's assets are included in the taxable estate of the surviving spouse.

Upon the surviving spouse's death, remaining assets are usually passed to secondary beneficiaries, like the grantor's children. One advantage of the A/B/C Trust is its ability to reduce estate taxes by utilizing both spouses' estate tax exemptions.

Assets like cash, securities, real estate, or properties can fund an A/B/C Trust. These assets are protected from creditors and unintended beneficiaries.

This topic opens up many avenues for further exploration. If you’re intrigued by these concepts, this fixed income certification course might provide additional insights and hands-on experience.

Examples

Example #1

Dan and Nina have a $10 million estate. After Dan's passing, $5 million is split between Trust A and Trust B. Trust A supports Nina, while Trust B benefits their children, bypassing Nina's estate. Trust C holds $5 million and is exempt from estate taxes until Nina's death.

Example #2

David and Rose have an $8 million estate. Upon David's death, $4 million is split between Trust A and Trust B. Trust A supports Rose, while Trust B benefits their children. After Rose remarries and has two more children, these children do not inherit from Trust C, as they are not designated heirs.

Pros and Cons

Pros

- Estate Tax Minimization: Utilizes both spouses' estate tax exclusions to reduce future tax liabilities.

- Asset Protection: Shields assets for future generations.

- Control: Provides control over asset distribution and management.

- Support for Surviving Spouse: Financial support and protection against creditors.

Cons

- Administrative Complexity: Requires ongoing management and professional assistance.

- Costs: Higher legal and administrative costs than other estate planning strategies.

A/B/C Trust vs A/B Trust

| Key Points | A/B/C Trust | A/B Trust |

|---|---|---|

| 1. Concept | Three trusts: A, B, and C. | Two trusts: A (Survivor's Trust) and B (Bypass Trust). |

| 2. Process | A Trust supports the spouse, B Trust shields assets, C Trust benefits future generations. | A Trust supports the spouse, B Trust shields assets for other beneficiaries. |

| 3. Purpose | Reduce taxes, support the spouse, protect assets for future generations. | Preserve assets, maximize estate tax exemptions, support the spouse. |