Table of Contents

What is Disclosure?

Disclosure refers to making relevant information available to the public in a timely manner. In terms of a business, "relevant" means every fact, date, figure, procedure, and innovation that can affect investors’ investment decisions. Therefore, a reliable disclosure statement includes both the positive and negative aspects of a business.

Disclosure of companies became federally mandated as part of the measures taken through the Securities Act of 1933 and the Exchange Act of 1934. Since both these laws came into action as a response to stock market crashes, these mandates were made to safeguard the best interests of investors and ensure higher levels of transparency in the market.

Key Takeaways

- Disclosure refers to the timely disclosure of financial, operational, and other information to investors and other stakeholders.

- It helps ensure that all market players are on a level playing field and that no single party can take undue advantage of the information. Disclosure leads to more transparency in the market.

- However, the cost of communication and auditing might be a significant effort and burden on management.

- In the larger scheme of things, it prevents the market from going into economic depression or financial crisis. In fact, the disclosure aspect for companies came as a reaction to these significant financial events.

How Does Disclosure Work?

Disclosure is the act of divulging all necessary and relevant information or facts to the public within a stipulated period. While some disclosures are made to the general public and regulatory authorities, some disclosures are made within the company as well.

These disclosure agreements and mandates have been passed as a result of stock market crashes and economic depressions. Disclosing all relevant information not only increases the overall transparency in the market but also brings more accountability to the table. As a result, the investors are safeguarded against manipulation and other unethical practices.

Businesses, especially those with exposure to the securities market, must make periodic disclosures as per regulatory authorities’ direction to ensure potential and existing investors are aware of all relevant details about the company. This information is shared through a document called the disclosure statement.

However, most disclosure statements contain financial and accounting jargon that might need to be more straightforward for new investors and the general public to understand and make sense of. Moreover, the format varies from country to country based on the direction of regulatory authorities.

Nevertheless, the information, both positive and negative, is valid for multiple market players. Of course, it is helpful for investors to choose the stocks or bonds for their portfolio, reduces the uncertainty in the market, and also allows experts to curate financial reports according to these statements.

Types

There are various types of full disclosure practices for a business or an entity. A few of the most common ones are:

- Financial Disclosures: These reports provide information on a company's overall financial health, including profits, losses, revenue, and other details.

- Strategic Disclosures: These disclosures express a company's plans and strategic goals. They can pertain to the entire organization or be department-specific.

- Operations Disclosure: These statements discuss and inform company values, market share growth, purpose, and business activities.

- Risk Disclosure: Information regarding risk factors such as cybersecurity, employee retention, compliance, and sustainability are also divulged to ensure that potential investors have a complete picture of the company’s prospects.

- Narrative Disclosure: These disclosures can be understood as explanations of any of the above subsets. They tell the company’s side of the story or share their perspective on the company's happenings to give context to the happenings within the organization.

Examples

While the disclosure agreement's theoretical aspects have been established, it is equally important to understand its practical applicability through the examples below.

Example #1

ABC Enterprises had a sub-par year in terms of generating revenue and, thereby, profits. The raw materials for their products were imported from Russia, and due to an ongoing war, the prices shot up significantly. Moreover, the availability of these raw materials was inconsistent.

As usual, they disclosed all financial and operational facts to their investors and regulatory authorities. However, they also attached a narrative disclosure to these statements to help investors understand the reasons for the drop in sales and assure them that the next financial year looks more promising.

Example #2

The Securities and Exchange Commission (SEC) delayed the rule on climate disclosure because of legal action against it. However, some market participants saw this as a perfect opportunity for ISSB (International Sustainability Standards Board) to take action instead.

In fact, large corporations like Vanguard and BlackRock have also voiced their support for ISSB setting the norms for climate-related information disclosure. With the rise of ESG reporting, it will soon be a norm for companies across the globe to declare their effect on the environment and society at large.

Importance

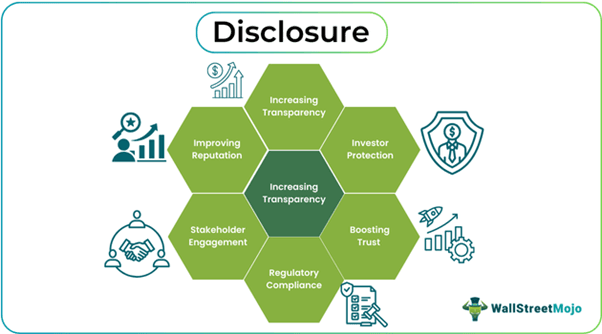

The importance of a disclosure agreement is unparalleled in business and investing because:

- Disclosure from companies and other such entities promotes transparency on the business and investment front.

- It reduces the chances of misuse of investors’ money, manipulation, and other such unethical activities.

- In the larger scheme of things, it can prevent financial crises and economic depressions, such as the 2008 financial crisis, which was the consequence of a lack of transparency in the market.

- It allows investors and other market players to make decisions based on the actual data provided by companies.

- Since all relevant information is readily available in the market, there is a level playing field for all markets. As a result, every individual or entity can only take advantage of information that is available to some, and insider trading or window dressing can be virtually eliminated.

Limitations

While these disclosure statements give multiple market players a clear understanding of the financial, operational, and overall status of a company, there are a few limitations to these declarations, too. A few of the most prominent ones are:

- One of the most common problems with these statements is the technical jargon, which is difficult for new investors and the general public to understand and make decisions based on.

- Companies often use multiple methods, such as including a multitude of items on the balance sheet and changing accounting methods, to make the report too complex to interpret.

- Sometimes, companies share incomplete or utterly false information. Regulators cannot check each statement within the declaration.

- From the company’s perspective, declaring this information costs a significant sum in terms of audit fees and communication.

- Constant changes from the regulators make it difficult for companies to curate these disclosures. Hence, managers and others who curate them must be up to date with the changes.

Disclosure Vs Disclaimer

The distinctions between full disclosure and disclaimer are:

| Basis | Disclosure | Disclaimer |

|---|---|---|

| Definition | It is a statement that reveals relevant financial and operational information in a timely manner. | A disclaimer establishes boundaries or outlines the responsibilities of service or information. |

| Purpose | Disclosure ensures transparency in the market. As a result, investors can make investing decisions based on complete information about the share or bond. | Protects the individual or entity from liability and clarifies their scope of work or limitations. |

| Focus | Fundamentally centered around comprehensive and precise financial and operational data. | It places a lot of impetus on the protection of misuse or misunderstandings. |

| Regulatory Requirement | It is typically mandatory and needs to be noticed by regulatory authorities. | Even though it is not mandatory, a voluntary disclaimer may be necessary for legal protection. |