Table Of Contents

Contribution Calculator for 401k

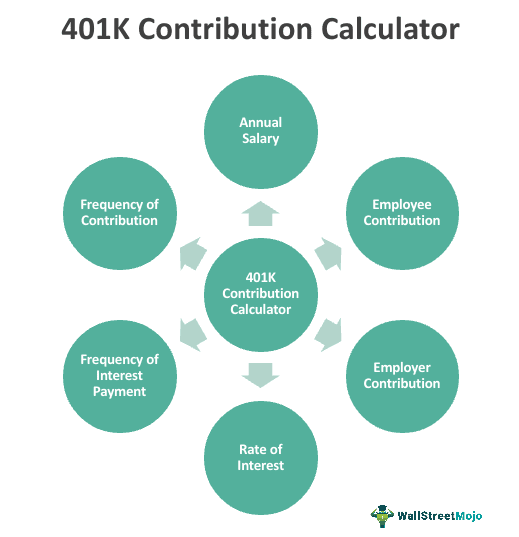

A 401(k) Contribution calculator will help one calculate the contribution that will be made by the individual and the employer as well, depending upon the limits. A solo 401(k) Contribution calculator, is a type of calculator wherein an individual can calculate the amount they can invest in a 401(k) plan and what amount their employer will contribute.

This calculator is significant as it empowers individuals to plan for retirement effectively. Estimating the impact of varying contribution amounts helps users optimize their savings strategy. This tool provides clarity on future retirement funds, aiding in informed financial decision-making and ensuring individuals contribute an amount aligned with their retirement goals and financial capabilities.

401K Contribution Calculator Explained

A 401(k) contribution calculator holds substantial significance as a pivotal tool for individuals planning their retirement savings. This calculator allows users to make informed decisions about their 401(k) contributions by providing a detailed projection of the future value of their retirement fund based on different contribution scenarios.

This tool typically takes into account variables such as the current age of the individual, expected retirement age, current 401(k) balance, and the rate of return on investments. Users can experiment with varying contribution amounts to see how adjustments impact their retirement savings over time.

The solo or self-employed 401(k) contribution calculator plays a crucial role in financial planning by enabling them to:

- Optimize Contributions: Users can determine the ideal contribution level to meet their retirement goals. The calculator assists in finding the balance between saving enough for a comfortable retirement and maintaining current financial stability.

- Forecast Retirement Income: By providing a future value projection, the calculator offers users a glimpse into their potential retirement income, aiding in realistic retirement expectations and lifestyle planning.

- Evaluate Impact of Time: The calculator underscores the importance of starting contributions early. It demonstrates how the compounding effect over time can significantly enhance retirement savings.

- Facilitate Goal Setting: Individuals can set specific savings goals and track progress toward those goals using the calculator, fostering disciplined and purposeful retirement planning.

Therefore, the 401(k) contribution calculator empowers individuals to take control of their financial future, make strategic decisions, and align their savings efforts with their unique retirement aspirations.

Formula

The formula for calculating 401(k) Contribution as per below:

Contribution to 401(k) ;

Periodical 401(k) Contribution is made then calculation:

In case the investment is made at the beginning of the period:

Wherein,

- S is the Annual Salary

- C is the contribution of the employee

- E is the Employer’s contribution

- O is the starting account balance

- I is the periodically fixed amount invested at regular intervals

- i is the rate of interest

- F is the frequency of interest paid

- n is the number of periods for which a 401(k) Contribution shall be made.

* The maximum amount would be $19,000 per year for 2019** Employer contribution will be subject to any ceiling limits decided by the employer.

401(k) contribution calculator is a subset of 401(k) wherein first, we shall calculate the employee contribution amount, which cannot exceed $19,000. Further, the employer contribution will also be calculated subject to limits decided by the individual's employer. 401(k) has certain limits as one is already taking deductions on the contributions made and is deferring the payment of taxes; hence is considered one of the best alternate plans for retirement since the employer will also be contributing to the retirement benefits of their employee.

How to Calculate?

One needs to follow the below steps to calculate the maturity amount for the employee or solo 401(k) Contribution calculator.

Step #1 – Determine the initial balance of the account, if any. Also, a fixed periodical amount will be invested in the 401(k) Contribution, which would be a maximum of $19,000 per year.

Step #2 – Figure out the rate of interest that would be earned on the 401(k) Contribution.

Step #3 – Now, determine the duration left from the current age until retirement.

Step #4 – Divide the interest rate by the number of periods the interest or the 401(k) Contribution income is paid. For example, if the rate paid is 9% and compounds annually, the interest rate would be 9%/1, which is 9.00%.

Step #5 – Determine whether the contributions are made at the start or the end of the period.

Step #6 – Determine whether an employer is contributing to match the individual's contribution. That figure plus the value in step 1 will be the total contribution in the 401(k) Contribution account.

Step #7 – Use the formula discussed above to calculate the maturity amount of the 401(k) Contribution, which is made at regular intervals.

Step #8 – The resultant figure will be the maturity amount, including the 401(k) Contribution income plus the amount contributed.

Step #9 – There would be tax liability at the time of retirement for the entire amount since the contributions are pre-tax, and deductions are taken for the contributed amount.

Examples

Now that we understand the basics, formula, and how to calculate a solo or self-employed 401k contribution calculator, let us understand its practical application through the examples below.

Example #1

Mr. HNK is working in a multinational firm, and he has been investing in a 401(k) Contribution account and has accumulated $2,900, and he earns $140,000 early, and he wants to contribute 25% of his annual salary. Further, the employer also contributes 30% of his contribution and limits the same up to 7% of the annual salary. Mr. M wants to invest for the next 25 years. The rate of interest that he will earn will be 5% per annum, which will be compounded annually. The contribution will be made at the start of the year.

You must calculate the amount accumulated at maturity based on the given information.

Solution:

We are given the below details:

- The annual salary of Mr. HNK is: $140,000

- Contribution of Mr. HNK towards 401(k): 25%

- Employer Contribution: 30% of the contribution

- Maximum employer contribution: 7% of the annual salary

- Maximum employer contribution: $9,800 (140,000 x 7%)

Contribution to 401(k) = ( S x C )* + { ( S x C)* x E }**

- = ($140,000 * 25%) + (($140,000 * 25%) * 30%))

- = $45,500

Now here, an individual's contribution cannot exceed $19,000, and hence the maximum amount that can be invested, including both, will be $19,000.

- O = $0

- I = $19,000

- i = Rate of interest, which is 5.00% and is compounded annually

- F = Frequency which is annually here; hence it will be 1

- n = number of years the proposed 401(k) Contribution will be 25 years.

Now, we can use the below formula to calculate the maturity value.

401(k) = O * (1+i)F*n + I * (((1+i)F*n – 1) * (1+i) / i )

- = 0 * (1 + 5.00% )1 *25 + $19,000 * ((1+5.00%)1*25 – 1 * (1+5.00%) / 5.00%)

- = $952,155.62

When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken.

Example #2

Mr. A has been employed with ABC company for five years. Since he has completed five years in the firm, as per the firm's policy, the company will invest 50% of his annual contribution, subject to a maximum of 8% of the annual salary. Mr. A is contributing 10% of his annual salary and is willing to do so for the next 30 years. He has been earning $30,000 a year, which is paid semi-annually.

Based on the given information, you are required to calculate the contribution amount that will be made by Mr. A and his employer.

Solution:

We are given the below details:

- Annual salary of Mr. A is $30,000

- Contribution of Mr. A towards 401(k): 10%

- Employer Contribution: 50% of the contribution

- Maximum employer contribution: 8% of the annual salary

- Maximum employer contribution: $2,400

Contribution to 401(k) = ( S x C )* + ( ( S x C)* x E )**

- = ($30,000 * 10%) + (($30,000 * 10%) * 50%))

- = $4,500

Since an employer's contribution is below 2,400 maximum limits, we can take $1,500.